5 Key Points about GST Registration in India

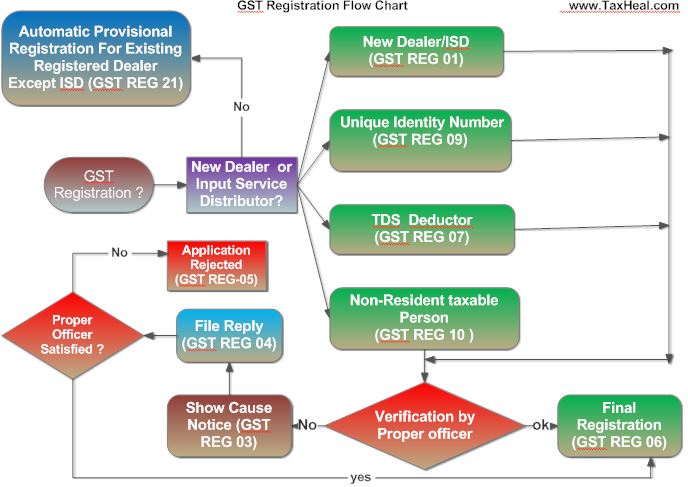

- The application for GST registration will be made online either directly on the GSTN Portal or through Facilitation Centres.

- The proper officer will examine registration application and grant registration within 3 common working days.

- If the application is found deficient, then applicant will be intimated within 3 common working days. Thereafter, applicant has to furnish information or documents sought within 7 working days electronically. If the proper officer is satisfied with such details, then he will grant registration within 7 common working days from date of receipt of such details.

- The person obtaining registration as casual dealer is required to make advance deposit for estimated tax liability for the period for which registration is sought.

- The registration certificate must be displayed at principal place of business and at every additional place of business. GSTIN (i.e. registration number) must be displayed in the name board at the entry point of business premises.

Read :- Flow Chart for GST Registration in India

GST Registration:- Forms

26 Forms for Registration prescribed-26 Forms for Registration have been prescribed (Form GST REG-01 to Form GST REG-26), namely-GST REG 01, GST REG 02, GST REG 03, GST REG 04, GST REG 05, GST REG 06, GST REG 07, GST REG 08, GST REG 09, GST REG 10, GST REG 11, GST REG 12, GST REG 13, GST REG 14, GST REG 15, GST REG 16, GST REG 17, GST REG 18, GST REG 19, GST REG 20, GST REG 21, GST REG 22, GST REG 23, GST REG 24, GST REG 25,

| Sr. No | Form Number | Content |

| 1 | GST REG 01 | Application for Registration under Section 19(1) of Goods and Services Tax Act, 20– |

| 2 | GST REG 02 | Acknowledgement |

| 3 | GST REG 03 | Notice for Seeking Additional Information/ Clarification/ Documents relating to Application for<<Registration/Amendment/Cancellation>> |

| 4 | GST REG 04 | Application for filing clarification/additional information/ document for <<Registration/Amendment/Cancellation/ Revocation of Cancellation>> |

| 5 | GST REG 05 | Order of Rejection of Application for <<Registration /Amendment / Cancellation/ Revocation of Cancellation>> |

| 6 | GST REG 06 | Registration Certificate issued under Section 19(8A) of the Goods and Services Tax Act, 20– |

| 7 | GST REG 07 | Application for Registration as Tax Deductor or Tax Collector at Source under Section 19(1) of the Goods and Service Tax Act, 20– |

| 8 | GST REG 08 | Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source under Section 21 of the Goods and Service Tax Act, 20–. |

| 9 | GST REG 09 | Application for Allotment of Unique ID to UN Bodies/Embassies /any other person under Section 19(6) of the Goods and Service Tax Act, 20–. |

| 10 | GST REG 10 | Application for Registration for Non Resident Taxable Person. |

| 11 | GST REG 11 | Application for Amendment in Particulars subsequent to Registration |

| 12 | GST REG 12 | Order of Amendment of existing Registration |

| 13 | GST REG 13 | Order of Allotment of Temporary Registration/ Suo Moto Registration |

| 14 | GST REG 14 | Application for Cancellation of Registration under Goods and Services Tax Act, 20–. |

| 15 | GST REG 15 | Show Cause Notice for Cancellation of Registration |

| 16 | GST REG 16 | Order for Cancellation of Registration |

| 17 | GST REG 17 | Application for Revocation of Cancelled Registration under Goods and Services Act, 20–. |

| 18 | GST REG 18 | Order for Approval of Application for Revocation of Cancelled Registration |

| 19 | GST REG 19 | Notice for Seeking Clarification/Documents relating to Application for << Revocation of Cancellation>> |

| 20 | GST REG 20 | Application for Enrolment of Existing Taxpayer |

| 21 | GST REG 21 | Provisional Registration Certificate to existing taxpayer |

| 22 | GST REG 22 | Order of cancellation of provisional certificate |

| 23 | GST REG 23 | Intimation of discrepancies in Application for Enrolment of existing taxpayer |

| 24 | GST REG 24 | Application for Cancellation of Registration for the Migrated Taxpayers not liable for registration under Goods and Services Tax Act 20– |

| 25 | GST REG 25 | Application for extension of registration period by Casual / Non-Resident taxable person. |

| 26 | GST REG 26 | Form for Field Visit Report |

Download GST REG 01

Download GST REG 02

Download GST REG 03

Download GST REG 04

Download GST REG 05

Download GST REG 06

Download GST REG 07

Download GST REG 08

Download GST REG 09

Download GST REG 10

Download GST REG 11

Download GST REG 12

Download GST REG 13

Download GST REG 14

Download GST REG 15

Download GST REG 16

Download GST REG 17

Download GST REG 18

Download GST REG 19

Download GST REG 20

Download GST REG 21

Download GST REG 22

Download GST REG 23

Download GST REG 24

Download GST REG 25

Download GST REG 26

Download GST -Draft Registration formats released by CBEC

Download GST -Draft Registration Rules Released by CBEC

Free Education Guide on Goods & Service Tax (GST)