CARO 2016 Applicability

CARO 2016 Applicability

CARO-2016 has been issued by the Central Government in pursuance with the provisions of sub-section (11) of Section 143 as an additional matters to be included in the Report of Auditors. Therefore, CARO-2016 should be complied by the Statutory Auditor of every company to which it applies. Further, every report made by the Auditor in pursuance with the provisions of Section 143 of the Companies Act, 2013 for Financial Year commencing on or after first day of April, 2015 should include CARO-2016. Hence, the Companies (Auditor’s Report) Order, 2016 is applicable w.e.f. F.Y. 2015-16 and the matters specified therein shall be included in each report made by Auditor under Section 143 on the accounts of every company to which CARO-2016 applies.

As per Companies (Auditor’s Report) Order 2016 Notified on 29.03.2016 CARO 2016 Applicability Conditions are as follow :-

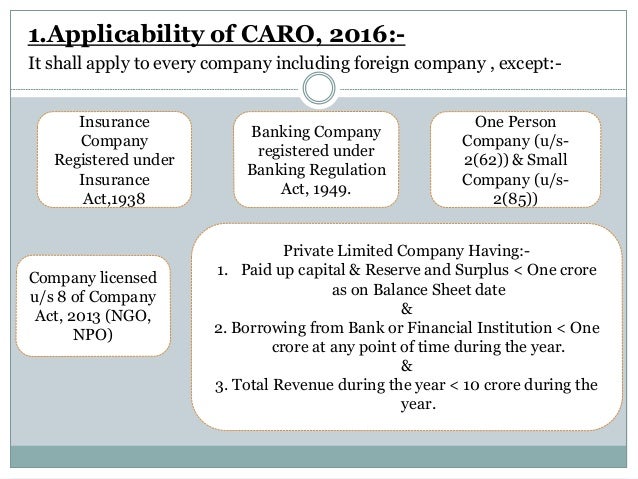

It shall apply to every company including a foreign company as defined in clause (42) of section 2 of the Companies Act, 2013 (18 of 2013) [hereinafter referred to as the Companies Act], except–

(i) a banking company as defined in clause (c) of section 5 of the Banking Regulation Act, 1949 (10 of 1949);

(ii) an insurance company as defined under the Insurance Act,1938 (4 of 1938);

(iii) a company licensed to operate under section 8 of the Companies Act;

(iv) a One Person Company as defined under clause (62) of section 2 of the Companies Act and a small company as defined under clause (85) of section 2 of the Companies Act; and

(v) a private limited company, not being a subsidiary or holding company of a public company, having a paid up capital and reserves and surplus not more than rupees one crore as on the balance sheet date and which does not have total borrowings exceeding rupees one crore from any bank or financial institution at any point of time during the financial year and which does not have a total revenue as disclosed in Scheduled III to the Companies Act, 2013 (including revenue from discontinuing operations) exceeding rupees ten crore during the financial year as per the financial statements.

CARO 2016 Applicability on Foreign company

CARO 2016 shall apply to every company including a foreign company as defined in clause (42) of section 2 of the Companies Act, 2013 (18 of 2013)

Foreign company means any company or body corporate incorporated outside India which

(a) has a place of business in India whether by itself or through an agent, physically or through electronic mode; and

(b) conducts any business activity in India in any other manner

CARO 2016 Applicability : Analysis of Exclusions

The following are the class of companies whose auditors are not required to comment on matters specified in CARO-2016.

| (a) | Banking Company [Under Section 5(c) of the Banking Regulation Act, 1049] | |

| (b) | Insurance Company [Defined under the Insurance Act, 1938] | |

| (c) | Companies registered with Charitable Objects.[ Incorporated and licensed to operate under Section 8 of the Companies Act, 2013] | |

| (d) | One Person Company [Under Clause (62) of Section 2 of the Companies Act, 2013] | |

| (e) | Small Company—According to Section 2(85) of the Companies Act, 2013, small company means a company, other than a public company— (i) paid up share capital of which does not exceed Rs. 50 lakhs or such higher amount as may be prescribed which shall not be more than Rs. 5 crore : and (ii) Turnover of which as per its last profit and loss account does not exceed Rs. 2 crore or such higher amount as may be prescribed which shall not be more than Rs. 20 crore: It is to be noted that the definition of Small Company has been amended vide the Companies (Removal of Difficulties) Order, 2015 [ S.O. 504(E)] w.e.f. 13th February, 2015. However, the following companies will not qualify as a Small Company:- |

| (A) | A holding company or a subsidiary company; | |

| (B) | A company registered under Section 8; or | |

| (C) | A company or body corporate governed by any Special Act. |

| (f) | Private Company – The Statutory Auditors of the following private limited companies are not required to comment on the matters prescribed under the CARO-2016 |

| (a) | Holding /subsidiary of Public company—A private company which is not a subsidiary or holding company of a public company and | |

| (b) | A private company having a paid up capital and reserves and surplus not more than Rs. 1 crore as on the Balance Sheet Date; and | |

| (c) | Such private company does not have total borrowings exceeding Rs. 1 crore from any bank or financial institution at any point of time during the financial year | |

| (d) | Such private company does not have a total revenue exceeding Rs. 10 crore during the financial year as per the financial statements. [Such revenue means revenue as disclosed in Schedule III to the Companies Act, 2013 and includes revenue from discontinuing operations] |

Also, the CARO-2016 shall also not apply to the Auditor’s Report on Consolidated Financial Statements (CFS) of the Company.

CARO 2016 Applicability : Companies Covered

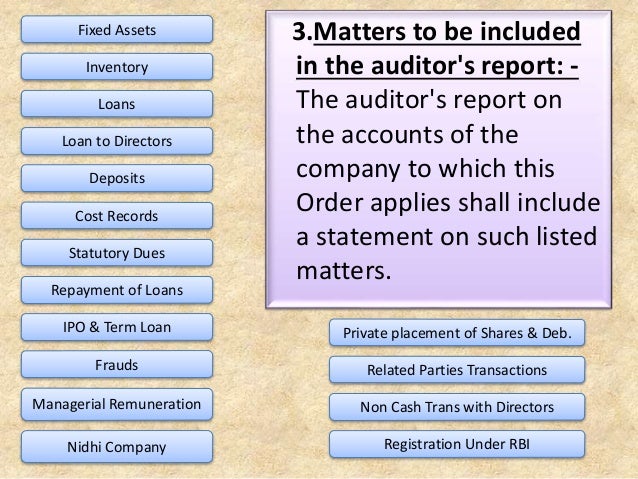

CARO 2016 Applicability and Matters to be included in Auditor Report : Read 16 Points to be reported by Auditor as per CARO 2016 in Audit Report

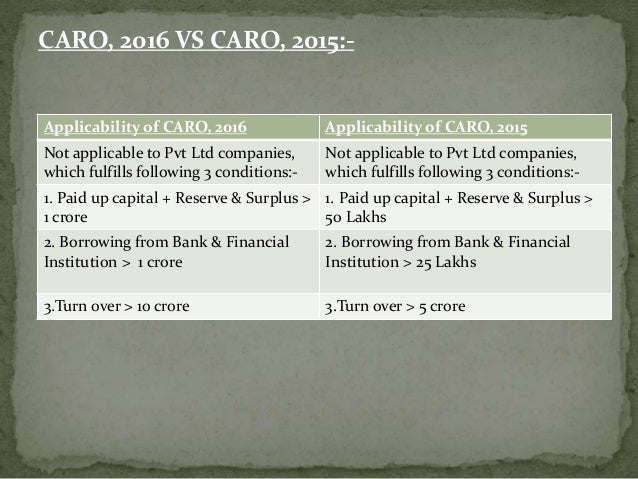

CARO 2016 Applicability and CARO 2015 Applicability : Difference

Also Read :

- Companies (Auditor’s Report) Order 2016 Notified

- ICAI Guidance Note on CARO 2016

- CARO 2016 Analysis

- Book on CARO 2016 [ june 2016 Edition}

- 16 Points to be reported by Auditor as per CARO 2016 in Audit Report

- Auditor Duties and Reporting under Companies Act 2013

- Guidance Note on Accounting for Real Estate Transactions

- Guidance Note on Reporting on Fraud u/s 143(12) of Companies Act 2013

- Guidance Note on Audit of Banks 2016 edition released by ICAI

- ICAI released Guidance Note on Accounting for Depreciation as per Schedule II to the Companies Act, 2013

- ICSI GUIDANCE NOTE ON GENERAL MEETINGS

- Guidance Note on SS1 and SS2 ( Meetings of Board of Directors)

- CBDT Guidance Note on Foreign Account Tax Compliance Act

- Guidance Note on Reporting on Fraud under Section 143(12) of the Companies Act, 2013

- 5 Guidance Notes Withdrawn by ICAI

- SEBI Guidance note on Insider Trading

- Guidance Note on CSR (Corporate Social Responsibility )