IN THE HIGH COURT OF PUNJAB AND HARYANA AT CHANDIGARH

Neena Aggarwal ….Appellant.

Versus

Commissioner of Income Tax, Panchkula …Respondent

ITA No. 368 of 2015

Date of Decision: 17.11.2015

Facts of the case

The assessee had derived income from running a boutique. She filed return under Section 44AF of the Act and no books of account were maintained.

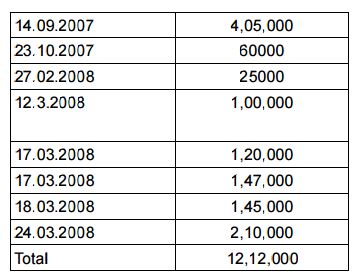

Cash Deposited in to the bank account by the Assessee as follow

The Assessing Officer asked the appellant to explain the source of cash deposits of ` 12,12,000/- to which she submitted that the said amount was out of the sale proceeds as she had sold a piece of land in Sector 9, Ambala for a sum of ` 10 lacs (Rs.9 lacs from encashment of two cheques and Rs.1 lakh in cash ) in September, 2007 and also from the business of boutique where sales amounting to ` 14.50 lacs were made resulting in profit of ` 1,54,690/-.

HELD

If the assessee has cash of Rs.10 lacs on 14.09.2007 i.e. Rs.9 lacs from encashment of two cheques and Rs.1 lakh as cash payment, then why only Rs.4.05 lacs was deposited and then money has been deposited in various installments as stated above. No explanation was given for this discrepancy.