Clubbing of minor Child income if Parents Died

Summary : Till date there was the confusion as how to do Clubbing of minor Child income if Parents Died and who should file Income Tax Return of minor child if he/she has Interest income from Fixed Deposits etc . But as per the following notification dated 29.05.2017 , CBDT has clarified that in cases of minors whose both the parents have deceased (died) , TDS deductors/Banks were clubbing the interest income accrued to the minor in the hand of grandparents and issuing TDS certificates to the grandparents, which is not in accordance with the law as the Income-tax Act envisages clubbing of minor’s income with that of the parents only and not any other relative. Ideally in such type of situations, the income should be assessed in the hands of the minor and the income-tax returns be filed by the minor through his/her guardian.

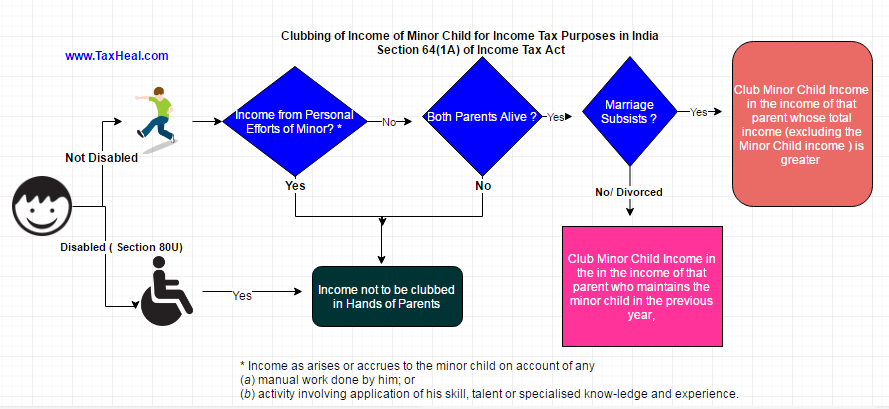

Info graphics on Clubbing Income of Minor Child – Section 64(1A)

Related Post

No Clubbing of Income if Trust created for minor after Divorce

clubbing of income of minor child – Gross income or Net Income ?

Clubbing of income and Income Tax Provisions

Notification on Clubbing of minor Child income if Parents Died

F.No. DGIT(S)/CPC(TDS)/NOTIFICATION/2017-18

Government of India

Ministry of Finance

Central Board of Direct Taxes

Directorate of Income-tax(Systems)

New Delhi.

Notification No. 5/2017

New Delhi, 29 May, 2017

Subject: – TDS and filing of ITR in case both the parents are dead of minor –reg.–

It has been brought to the notice of CBDT that in cases of minors whose both the parents have deceased, TDS deductors/Banks are clubbing the interest income accrued to the minor in the hand of grandparents and issuing TDS certificates to the grandparents, which is not in accordance with the law as the Income-tax Act envisages clubbing of minor’s income with that of the parents only and not any other relative. Ideally in such type of situations, the income should be assessed in the hands of the minor and the income-tax returns be filed by the minor through his/her guardian.

2. Under sub-rule (5) of Rule 31A of the Income-tax Rules, 1962, the Director General of Income-tax (Systems) is authorized to specify the procedures, formats and standards for the purposes of furnishing and verification of the statements or claim for refund in Form 26B and shall be responsible for the day-to-day administration in relation to furnishing and verification of the statements or claim for refund in Form 26B in the manner so specified.

3. In exercise of the powers delegated by the Central Board of Direct Taxes (Board) under sub-rule (5) of Rule 31A of the Income-tax Rules, 1962, the Principal Director General of Income-tax (Systems) hereby specifies that in case of minors where both the parents have deceased, TDS on the interest income accrued to the minor is required to be deducted and reported against PAN of the minor child unless a declaration is filed under sub-rule(2) of Rule 37BA of the I.T. Rules, 1962 to that effect.

4. This issues with the approval of the Principal Director General of Income-tax (Systems).

(P.S. Thuingaleng)

Dy. Commissioner of Income-tax (CPC-TDS),

O/o the Pr. Director General of Income-tax (Systems),

New Delhi