Composition Scheme under GST

Key Points about Composition Scheme under GST

- [ Read Composition Scheme under GST Analysis after CGST act 2017 ]

- Coverage : Section 8 of Model GST Law cover Composition Scheme.

- Eligibility :- Composition Scheme under GST can be availed by

- Registered taxable person and

- Does not effects inter-State supply (i.e both, output & input purchase/sale should be within state] and

- Aggregate turnover in a financial year does not exceed fifty lakh of rupees.Section 2(6) of the CGST / SGST Act, 2016 ‘aggregate turnover’ means ‘Value of all (taxable and non-taxable supplies + Exempt supplies + Exports) – (Taxes + Value of inward supplies + Value of supplies taxable under reverse charge) of a person having the same PAN [Clarity is missing in the section whether said turnover limit refers to previous/preceding year or it refers to expected turnover in the current financial year]

- Persons not Eligible :-Composition Scheme under GST can not be availed by a taxable person

- who effects any inter-State supplies of goods and/or services. or

- Who is not registered under GST

- Eligibility for both Goods and /Or Services:-Composition scheme may be opted for by taxable persons, for supply of goods and / or services.

- PAN Based :Composition Scheme under GST is PAN based, i.e., all the units having same PAN shall assess under this scheme, that is, if any one of the units wishes to assess under regular scheme not under this scheme then all other units would be ineligible for composition scheme.Thus It must be noted that a taxable person cannot opt for payment of taxes under composition scheme say for supply of goods and opt for regular scheme of payment of taxes for supply of services.For example: A taxable person has the following business verticals separately registered:

- Sale of Shoes

Sale of Furniture

Franchisee of PizzaHut

In the above scenario, the composition scheme would be applicable for all the 3

business verticals. Taxable person will not be eligible to opt for composition scheme say

for sale of Shoes and sale of Furniture and opt to pay taxes under the regular scheme

for franchisee of PizzaHut.

- Sale of Shoes

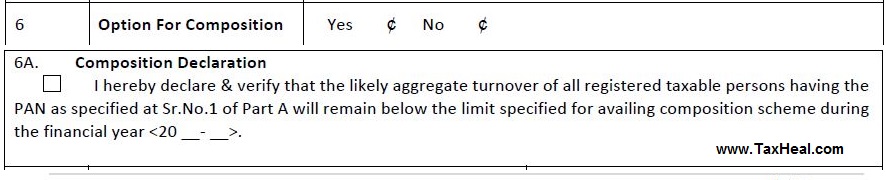

- Registration Form :- Application for Registration under Section 19(1) of Goods and Services Tax Act, can be made in GST REG 01. For availing Composition Scheme under GST following declaration has to be made in GST REG 01

- Recommendation of GST Council : Composition Scheme under GST is based on recommendations of the GST Council and is subject to prescribed conditions and restrictions (to be prescribed)

- Amount payable in case of Switching to Composition Scheme.Where a taxable person who has carried forward the amount of eligible credit in a return, furnished under the earlier law, in respect of the period ending with the day immediately preceding the appointed day, switches over to the composition scheme under section 8, he shall pay an amount, by way of debit in the electronic credit ledger or electronic cash ledger, equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date of such switch over: However after payment of such amount, the balance of input tax credit, if any lying in his electronic credit ledger shall lapse.

- Rate of GST :-on the recommendation of the Council, the proper officer of the

Central or a State Government may, subject to such conditions and restrictions as may be prescribed, permit a registered taxable person rupees to pay, in lieu of the tax payable by him, an amount calculated at such rate as may be prescribed, but not less than one percent of the turnover during the year[The exact rate will be prescribed ,may be by way of notification/rules)] - Amount payable on Turnover:-Under GST Composition Scheme ,Tax rate shall be applied on turnover. Section simply refers to ‘turnover’ and not to the ‘taxable turnover’. Because of this GST may have to be paid under this scheme even on non-taxable supplies.[ Clarity required]

- No Input Tax Credit :-A taxable person covered under the Composition Scheme of GST shall not be entitled to any credit of input tax .Consequently, recipient will not get any credit of tax paid by supplier under this scheme .

- Collection of GST not permitted :– A taxable person covered under the Composition Scheme of GST can not collect any tax from the recipient on supplies made by him.

- Return and Tax period : Under GST Composition Scheme return has to be filed Quarterly.The due date for payment of tax & filing of return is 18th of month succeeding the particular quarter. For example, for the quarter ending 30th June 2017 (Apr-Jun 2017) due date is 18th July 2017

- Return Form :– GSTR-4 has been prescribed for filing return under Composition Scheme

- Reverse Charge liability:- In addition to payment of tax under Composition Scheme , liability of registered taxable person under reverse charge may exist . This is because scheme overrides all provisions of law, except reverse charge that is levied under section 7(3) of the GST law.

- Penalty for wrong availment :-If the proper officer has reasons to believe that a taxable person was not eligible to pay tax such person shall, in addition to any tax that may be payable by him under other provisions of this Act, be liable to a penalty equivalent to the amount of tax payable .

However no penalty shall be imposed without giving a notice to show cause and without affording a reasonable opportunity of being heard to the person proceeded against. - Credit of Input tax on Switching over :Credit of eligible duties and taxes on inputs held in stock is allowed to a taxable person switching over from composition scheme under GST

Free Education Guide on Goods & Service Tax (GST)