e-File u/s 119(2)(b)/92CD

Introduction

e-File u/s 119(2)(b): Assessees after obtaining the condonation of delay u/s 119(2)(b) of the Income Tax Act, 1961 will be able to e-File the ITR as per Rule 12 of the Income-Tax Rules, 1962.

[ Relevant Extract of Section 119(2)(b) of Income tax Act : The Board may, if it considers it desirable or expedient so to do for avoiding genuine hardship in any case or class of cases, by general or special order, authorise [any income-tax authority, not being a Commissioner (Appeals)] to admit an application or claim for any exemption, deduction, refund or any other relief under this Act after the expiry of the period specified by or under this Act for making such application or claim and deal with the same on merits in accordance with law; ]

e-File u/s 92CD: To file a Modified Return to give effect to the advance pricing agreement u/s 92CD of the Income Tax Act, 1961.

Pre-Requisites

The assessee should be registered in e-Filing portal. If not registered, the assessee should register themselves in e-Filing portal. To register, the following mandatory details are required:

Valid PAN

Valid Mobile Number

Valid Email Address, preferable belonging to self

Filing Process

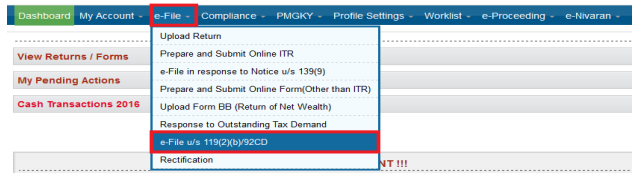

Step 1: Login to e-Filing, Go to “e-File” Click “e-File u/s 119(2)(b)/92CD”.

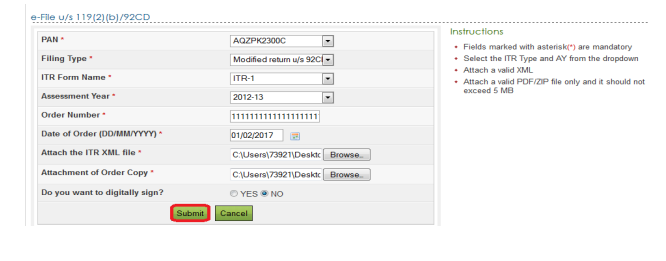

Step 2: Select “Filing Type”, “ITR Form Name”, “Assessment Year”, from the drop down and enter “Order Number”, “Date of order”. Browse and attach the “ITR XML file” and “Order copy” and click on submit.

Step 3: In order to upload Modified Return select Filing Type as “Modified return u/s 92CD”, select “ITR Form Name”, “Assessment Year” and enter “Order Number”, “Date of order”. Browse and attach the “ITR XML file” and “Order copy” and click on submit

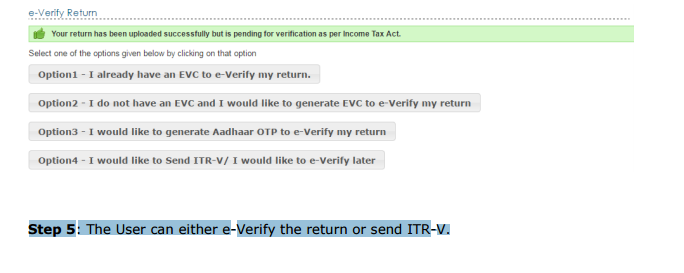

Step 4: On Successful Validation, success message is displayed on the screen.

Step 5: The User can either e-Verify the return or send ITR-V.

Income Tax Return : Free Study Material

Delay in Filing Income Tax Return : Study Material

How to request for condonation of Delay in submitting ITR V/ Verification

IDS 2016- Condonation of delay in Payment of Tax

Financial inability to pay is Sufficient cause to seek condonation of delay: HC

condonation of delay in filing board resolution

ITR Acknowledgement (ITR V) not submitted ? apply for condonation of delay

High Court can’t direct CIT(A) to condone the delay beyond condonation power of CIT(A)

Delay in filing ITR due to not getting NOC from erstwhile auditor condoned : HC

Delay in filing return condoned due to Assessee under severe financial crises

Delay in uploading return due to Technical snag on website valid excuse : HC

No penalty for delay in filing TDS return as it was first year of e-TDS return

Delay in claiming refund should be condoned when there are huge losses

HC condone the delay of 76 days on payment of Rs 2000

Delay of one day in filing Income tax return

IDS 2016 Payment Default ; CBDT to condone delay in genuine cases

Condonation of delay in making IDS payment : CIT to dispose of application

What is “Order Number”, “Date of order” and ‘Order copy.’Where can we find these details.