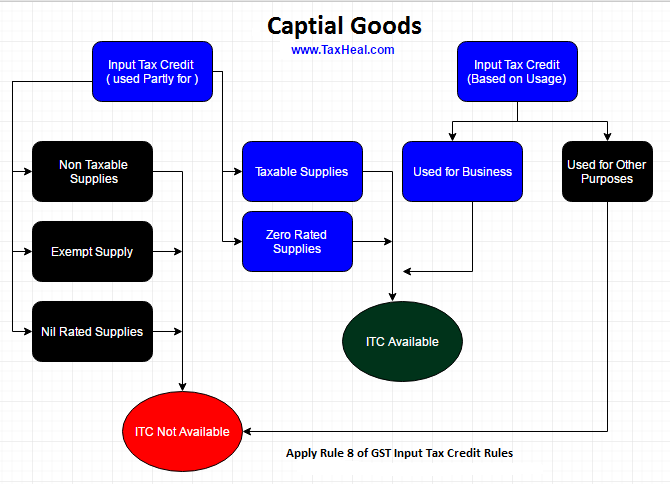

Input Tax Credit on Capital Goods Partly used for Business and partly for other purposes

Input tax credit in respect of capital goods, which attract the provisions of sub-sections (1) and (2) of section 17, being

i) Partly used for the purposes of business and partly for other purposes, or

ii) Partly used for effecting taxable supplies including zero rated supplies and partly for effecting exempt supplies,

Example on Rule 8 of GST Input Tax Credit Rules

Amount of input tax credit, at the beginning of a tax period, on all common capital goods whose useful life remains during the tax period (August 2017) – Annexre A

| Sr No | Particulars | Reference | Rs |

| For August 2017 | |||

| 1 | Machinery No 1 Purchased (Inward Supply) i.e Common Capital Goods used partly for Business and Partly for Exempt Supplies | 750000 | |

| IGST @ 12% | Tc1 | 90000 | |

| Invoice Value | 840000 | ||

| Date of Inward Supply | 12/07/2017 | ||

| Useful Life of Capital Goods for GST Purpose is 5 years from date of Invoice of such Goods (in Months ) | 60 | ||

| Amount of input tax credit attributable to a tax period (August 2017 i.e one month ) on common capital goods | Tm1 = Tc1 /60 | 1500 | |

| 2 | Machinery No 2 Purchased (Inward Supply) i.e Common Capital Goods used partly for Business and Partly for exempt supplies | 1000000 | |

| IGST @ 12% | Tc2 | 120000 | |

| Invoice Value | 1120000 | ||

| Date of Inward Supply | 20/08/2017 | ||

| Useful Life of Capital Goods for GST Purpose is 5 years from date of Invoice of such Goods (in Months ) | 60 | ||

| Amount of input tax credit attributable to a tax period (August 2017 i.e one month ) on common capital goods | Tm2 = Tc2 /60 | 2000 | |

| Aggregate of ITC on common Capital Goods for Tax Period (August 2017) | Tr = Tm1+ Tm2 | 3500 |

Calculation of Input Tax Credit on Common Capital Goods Attributable to exempt supplies

| Sr No | Particulars | Reference | Rs |

| 1 | ITC on capital goods used exclusively for nonbusiness purposes (Note 1) [Not to be credited to Electronic Credit Ledger ] | T1 | 20000 |

| 2 | ITC on capital goods used exclusively for effecting exempt supplies (Note 1)[Not to be credited to Electronic Credit Ledger ] | T2 | 20000 |

| Total | 40000 | ||

| 3 | ITC on capital goods used exclusively for taxable supplies (including zero-rated supplies) (Note 1) [ To be Credited to Electronic Credit Ledger ] | T3 | 100000 |

| 4 | ITC on common capital goods (other than T1, T2 and T3) – Refer Annexure -A [ To be Credited to Electronic Credit Ledger ] | A= Tc1+Tc2 | 210000 |

| 5 | ITC on common Capital goods whose useful life remains in beginning of Tax Period (August 2017) | Tr = Tm1+ Tm2 | 3500 |

| 6 | Aggregate value of Exempt Supplies for the Tax Period (August 2017) – [Note 2 and 3 ] | E | 1250000 |

| 7 | Total Turnover of the registered person for the tax period (August 2017) | F | 5000000 |

| Input Tax Credit on Common Capital Goods Attributable to exempt supplies – (IGST)-( Note : -the amount Te along with applicable interest shall, during every tax period of the useful life of the concerned capital goods, be added to the output tax liability of the person making such claim of credit. ) ( Note 4) | Te= (E/F)*Tr | 875 |

Note 1: T1, T2 and T3 should be declared in Form GSTR-2. T3 alone will be credited to the electronic credit ledger

Note 2: If the registered person does not have any turnover for August 2017, then the value of E and F shall be considered for the last tax period for which such details are available

Note 3: Aggregate value excludes taxes

Note 4: The amount Te shall be computed separately for central tax, State tax, Union territory tax and integrated tax.

Relevant Extract of Rule 8 of GST Input Tax Credit Rules :-

Manner of determination of input tax credit in respect of capital goods and reversal thereof in certain cases

(1) Subject to the provisions of sub-section (3) of section 16, the input tax credit in respect of capital goods, which attract the provisions of sub-sections (1) and (2) of section 17, being partly used for the purposes of business and partly for other purposes, or partly used for effecting taxable supplies including zero rated supplies and partly for effecting exempt supplies, shall be attributed to the purposes of business or for effecting taxable supplies in the following manner, namely,-

(a) the amount of input tax in respect of capital goods used or intended to be used exclusively for non-business purposes or used or intended to be used exclusively for effecting exempt supplies shall be indicated in FORM GSTR-2 and shall not be credited to his electronic credit ledger;

(b) the amount of input tax in respect of capital goods used or intended to be used exclusively for effecting supplies other than exempted supplies but including zero-rated supplies shall be indicated in FORM GSTR-2 and shall be credited to the electronic credit ledger;

(c) the amount of input tax in respect of capital goods not covered under clauses (a) and (b), denoted as ‘A’, shall be credited to the electronic credit ledger and the useful life of such goods shall be taken as five years from the date of invoice for such goods:

Provided that where any capital goods earlier covered under clause (a) is subsequently covered under this clause, the value of ‘A’ shall be arrived at by reducing the input tax at the rate of five percentage points for every quarter or part thereof and the amount ‘A’ shall be credited to the electronic credit ledger;

Explanation: An item of capital goods declared under clause (a) on its receipt shall not attract the provisions of sub-section (4) of section 18 if it is subsequently covered under this clause.

(d) the aggregate of the amounts of ‘A’ credited to the electronic credit ledger under clause (c), to be denoted as ‘Tc’, shall be the common credit in respect of capital goods for a tax period:

Provided that where any capital goods earlier covered under clause (b) is subsequently covered under clause (c), the value of ‘A’ arrived at by reducing the input tax at the rate of five percentage points for every quarter or part thereof shall be added to the aggregate value ‘Tc’;

(e) the amount of input tax credit attributable to a tax period on common capital goods during their useful life, be denoted as ‘Tm’ and calculated as:-

Tm= Tc÷60

(f) the amount of input tax credit, at the beginning of a tax period, on all common capital goods whose useful life remains during the tax period, be denoted as ‘Tr’ and shall be the aggregate of ‘Tm’ for all such capital goods.

(g) the amount of common credit attributable towards exempted supplies, be denoted as ‘Te’, and calculated as:

Te= (E÷ F) x Tr

where,

‘E’ is the aggregate value of exempt supplies, made, during the tax period, and

‘F’ is the total turnover of the registered person during the tax period:

Provided that where the registered person does not have any turnover during the said tax period or the aforesaid information is not available, the value of ‘E/F’ shall be calculated by taking values of ‘E’ and ‘F’ of the last tax period for which details of such turnover are available, previous to the month during which the said value of ‘E/F’ is to calculated;

Explanation: For the purposes of this clause, the aggregate value of exempt supplies and total turnover shall exclude the amount of any duty or tax levied under entry 84 of List I of the Seventh Schedule to the Constitution and entry 51 and 54 of List II of the said Schedule;

(h) the amount Te along with applicable interest shall, during every tax period of the useful life of the concerned capital goods, be added to the output tax liability of the person making such claim of credit.

(2) The amount Te shall be computed separately for central tax, State tax, Union territory tax and integrated tax