Steps and Flow Chart for GST Registration in India

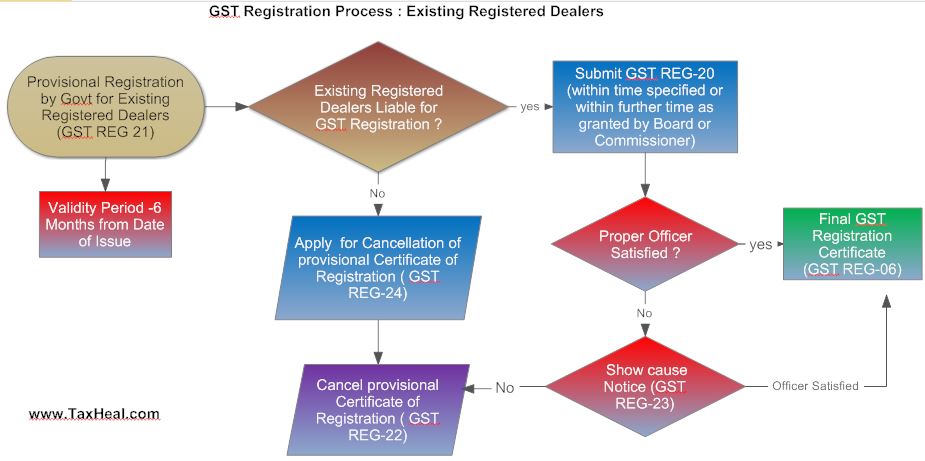

GST Registration Steps for Existing Dealer

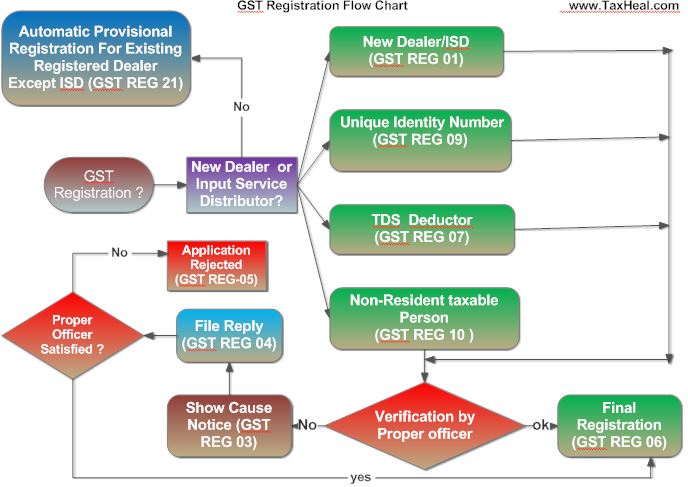

GST Registration Steps for New Dealer /Input Service Distributor

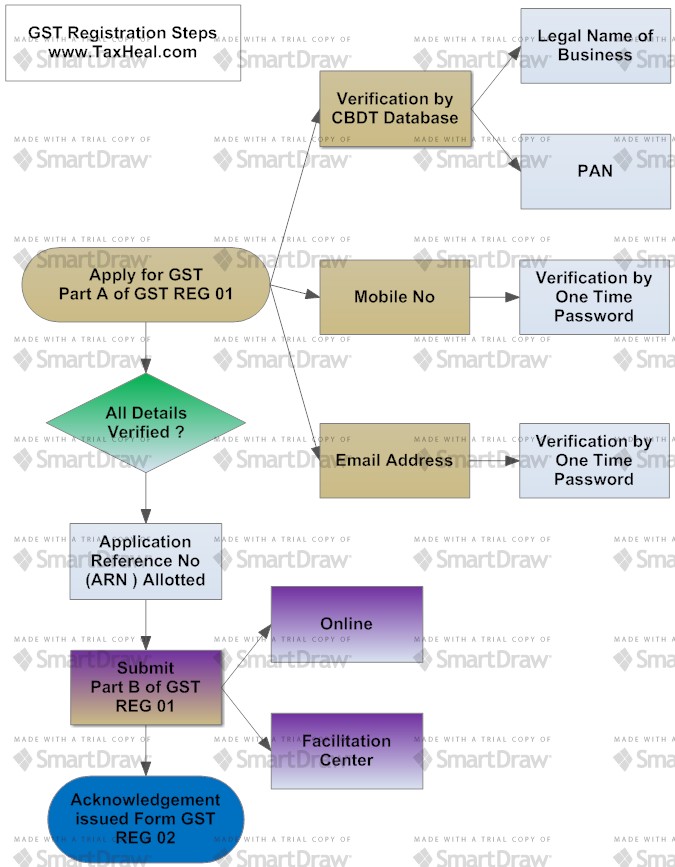

Steps for GST Registration Application

- Every person, other than a non-resident taxable person who wants to register under GST must provide his Permanent Account Number (PAN), mobile number and e-mail address in Part A of FORM GST REG-01.

- The PAN shall be validated online via the Common Portal from the database maintained by the Central Board of Direct Taxes

- The mobile number is verified through a one-time password sent to the said mobile number.

- The e-mail address is verified through a separate one-time password sent to the said e-mail address.

Download GST REG 01

- On successful verification of the PAN, mobile number and e-mail address, an Application Reference number (ARN) is generated and sent on the mobile number and e-mail address provided.

- Using the application reference number or ARN generated Part B of FORM GST REG-01 has to be submitted. It must be signed and documents specified in the Form must be submitted at the Common Portal either directly or through a Facilitation Centre, notified by the Board.

- After successfully filing of Part B, You will get acknowledgment No in Form GST REG-02.

Download GST REG 02

- Where Proper Officer is not satisfied with particulars provided and/or document submitted the he will intimate to applicant in Form GST REG-03 (within 3 working days from the date of application).

Download GST REG 03

- The you are required to give clarification or information as sought in Form GST REG-03 in REG-04 (within 7 working days from the date of intimation)

Download GST REG 04

- Even after clarification as provided in REG-04, If Proper officer is not satisfied then he will reject application in Form GST REG-05

Download GST REG 05

- And if Proper Officer is satisfied with applicant information then he will final Certificate of Registration in Form GST REG-06.

Download GST REG 06

Free Education Guide on Goods & Service Tax (GST)