Source : Securities and Exchange Board of India 03.12.2015

Concept paper for issuance of Green Bonds

1. Background

A green bond is like any other bond where a debt instrument is issued by an entity for raising funds from investors. However what differentiates a Green bond from other bonds is that the proceeds of a Green Bond offering are ‘ear-marked’ for use towards financing ‘green’ projects.

Thus the key difference between a ‘green’ bond and a regular bond is that the issuer publicly states it is raising capital to fund ‘green’ projects, assets or business activities with an environmental benefit, such as renewable energy, low carbon transport etc.

However, as of now there is no standard definition of green bonds and the one that is being currently used is based on market practice.

2. Need for Green Bonds

Infrastructure financing in India has traditionally been supported by the institutions such as banks, NBFCs and Financial Institutions. However, given the huge investment requirements in infrastructure space, it is widely accepted that current project financing sources may not be sufficient for capacity addition. Thus, there is a need to introduce new means of financing and innovative financial instruments that can leverage a wider investor base such as pension funds, sovereign wealth funds, insurance companies, etc. that can invest in the infrastructure sector. Corporate bond markets have long been considered towards providing this much required alternate source of financing.

India’s Intended Nationally Determined Contribution (INDC) document puts forth the stated targets for India’s contribution towards climate improvement and following a low carbon path to progress. The document also impresses upon the need of financing needs for achieving the stated goals, where a preliminary estimate suggests that at least USD 2.5 trillion (at 2014-15 prices) will be required for meeting India’s climate change actions between now and 2030. In this regard the document talks about the introduction of Tax Free Infrastructure Bonds of INR 50 billion (USD 794 million) for funding of renewable energy projects during the year 2015-16.

Further, India has embarked upon an ambitious target of building 175 gigawatt of renewable energy capacity by 2022 and this requires a massive estimated funding of USD 200 billion. Thus, the financing needs of renewable energy space require new channels to be explored which can provide not only the requisite financing, but may also help in reducing the cost of the capital. Green bonds as a part of corporate bonds space may be one of the answer to this problem.

3. Benefits of issuing Green Bonds

The key benefits of issuing green bonds are as under:

i. Positive public Relations

Green bonds can help in enhancing an issuer’s reputation, as this is an effective way for an issuer to demonstrate its green credentials. It displays the issuers commitment towards the development and sustainability of the environment. Further, this may also generate some positive publicity for the issuer.

ii. Investor Diversification

There are specific global pool of capital, which are earmarked towards investment in Green Ventures. This source of capital focuses primarily on environmental, social and governance (ESG) related aspects of the projects in which they intend to invest. Thus, green bonds provide an issuer the access to such investors which they otherwise may not be able to tap with a regular bond.

iii. Potential for pricing advantage

The green bond issuance attracts wider investor base and this may in turn benefit the issuers in terms of better pricing of their bonds vis-a-vis a regular bond. Currently there is very limited evidence available in this regard, however as demand of green bonds increases it is likely to drive increasingly favorable terms and a better price for the issuer. Further, with increasing focus of the global investor community towards green investments, it is expected that new set of investors will enter into this space leading to lowering the cost of funding for green projects.

4. International Experience

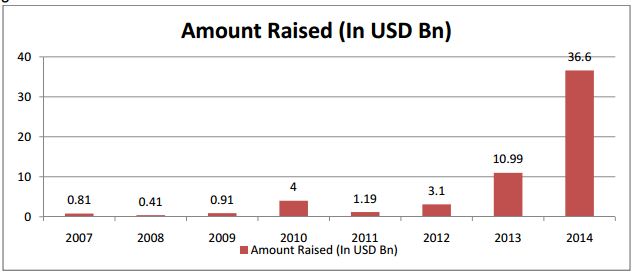

Issuance of green bonds started in year 2007 and in the initial years Green Bonds were a niche product, pioneered by a handful of development banks. The period between 2007-2012 was featured with the issuance of green bonds by the Supranational organizations such as the European Investment Bank and the World Bank, along with few governments etc.

However, with growing market appetite for such bonds there is increasing diversification of issuers and investors participating in Green Bonds. Year 2013 saw the participation from corporate sector, which substantially increased in year 2014. This has lead to overall growth in the fresh issuance of green bonds, where the market has almost tripled in size between 2013 and 2014, with around US$37 billion issued in 2014.

Placed below is a graph showing the growth in issuance of green bonds across the globe: ( KPMG International Report “Gearing up for Green Bonds”)

5. Indian Experience

India has lately seen issue of Green Bonds by three entities, brief details of which are as under

i. Yes Bank

Yes Bank came out with first green bond issuance in India in February 2015, which was a Rs 1000 crore 10-year issue. The issue was oversubscribed almost twice and the issue proceeds will be utilised towards funding renewable energy projects such as solar, wind and biomass projects.

Further Yes Bank came out with another issue of Green Bonds in August 2015, which was a Rs 315 core 10-year issue. The entire issue was subscribed by the International Finance Corporation.

ii. CLP India

CLP India, in came out with an issue of green bonds, the first from an Indian corporate issuer. CLP India raised Rs 600 crore. The bonds have been offered at a coupon of 9.15 per cent per annum, in three series of equal amounts and will mature every April in 2018, 2019 and 2020.

iii. Exim Bank of India

Exim Bank came out with a dollar denominated Green Bond issue in March 2015. The offer was of a five-year $500 million green bond. The issue was subscribed nearly 3.2 times and the proceeds from the issue would be utilised towards funding eligible green projects in countries including Bangladesh and Sri Lanka.

iv. IDBI Bank

IDBI Bank has raised US$350m 5-year bonds, priced at Treasuries plus 255bp, with issue receiving an oversubscription of three times i.e. around US$1bn. Maximum investment came from Asia at 82% of the book and rest from Europe at 18%

6. Principles for issuance of Green Bonds

While there are no set guidelines defining the principles for issuance of Green Bonds, International Capital Market Association (ICMA) has however come out with a document called Green Bond Principles (GBP) (http://www.icmagroup.org/assets/documents/Regulatory/Green‐Bonds/GBP_2015_27‐March.pdf)

GBP outlines a set of principles that delineates good practices for the process of issuing a green bond, which are divided in four components. Brief details of the same are as follows:

i. Use of proceeds: issuers to define and disclose their criteria for what is considered ‘green’ i.e. which projects, assets or activities will be considered ‘eligible’ and how much funds will be spent on.

ii. Project evaluation and selection: what process will be used to apply ‘green’ criteria to select specific projects or activities.

iii. Management of proceeds: what processes and controls are in place to ensure funds are used only for the specified ‘green’ projects.

iv. Reporting: how projects will be evaluated and progress reported, against both environmental and financing criteria.

7. Proposal

Issuance of Green Bonds in India does not require any amendment to the existing SEBI regulations for issuance of corporate bonds, SEBI (Issue and Listing of Debt Securities) Regulations, 2008 (hereinafter “ILDS Regulations”). The issue, listing and disclosure requirements as prescribed under ILDS Regulations will continue to be applicable, like any regular corporate bond issuance.

However, for designating an issue of corporate bonds as green bonds, in addition to the compliance with the requirements under ILDS Regulations, an issuer shall have to disclose in the offer document following additional information about the green bonds, which have been based upon the Green Bond Principles, 2015:

i. Use of proceeds:

Issuer shall define and disclose in their offer document, the criteria for identification as ‘green’ i.e. what projects, assets or activities will be considered ‘eligible for financing’ and quantum of funds to be spent on the projects/assets/activities.

For assigning the status of the bonds as Green, the broad categories of areas where such monies may be invested may be one or more of the following:

• Renewable and sustainable energy (wind, solar etc.)

• Clean transportation (mass transportation)

• Sustainable water management (clean and/or drinking water, water recycling etc)

• Climate change adaptation

• Energy efficiency (efficient and green buildings)

• Sustainable waste management (recycling, waste to energy etc.)

• Sustainable land use (including sustainable forestry and agriculture, afforestation etc.)

• Biodiversity conservation

However, it is to be noted that this is an indicative list and may include other categories as specified by Board.

Further, an issuer, if proposes to utilise a proportion of the proceeds of the issue of Green Bonds, towards refinancing of existing green assets, it shall be clearly provided in the offer document and wherever possible, shall also provide the details of the portfolio/assets/projects which are identified for such refinancing.

ii. Project evaluation and selection:

The issuer of a Green Bond shall provide the details of decision-making process, it will/has followed for determining the eligibility of projects for using Green Bond proceeds. An indicative guideline of the details to be provided is as under:

• process followed/ to be followed for determining how the project(s) fit within the eligible Green Projects categories;

• the criteria, making the projects eligible for using the Green Bond proceeds; and

• environmental sustainability objectives.

iii. Management of proceeds:

The proceeds of Green Bonds shall be credited to an escrow account, and shall be utilised only for the stated purpose, as in the offer document. The use of proceeds shall be tracked as per an approved internal policy of issuer and such policy shall be disclosed in the offer document/placement memorandum.

The utilisation of the proceeds may also be verified/supplemented by the report of an external auditor, or other third party, to verify the internal tracking method and the allocation of funds towards the projects, from the Green Bond proceeds.

iv. Reporting:

In addition to reporting on the use of proceeds issuers shall also provide, at least on an annual basis, a list of projects to which Green Bond proceeds have been allocated. This may also include the details of the expected environmental impact of such projects.

The environmental impact report may provide for qualitative performance indicators and, where possible, quantitative performance measures of the expected environmental sustainability impact of the specific project. However, where confidentiality agreements or competition issues limit the amount of detail that can be made available, information can be presented in generic terms.

8. Public Comments:

In order to take into consideration views of various stakeholders, public comments are solicited on the proposal as mentioned at point 7 above. Comments may be emailed on or before December 18, 2015 to greenbonds@sebi.gov.in or sent by post, to:-

Ms Richa G Agarwal,

Deputy General manager

Investment Management Department

Securities and Exchange Board of India

SEBI Bhavan

Plot No. C4-A, “G” Block,

Bandra Kurla Complex,

Bandra (East), Mumbai – 400 051

Issued on: December 03, 2015