GST Challan

Following is the detailed process for making payment of GST Challan along with screenshots. If you are not familiar with how to calculate GST in India read How to Calculate and Pay GST in India ; Example. After you have correctly calculated the GST , pay GST by method described below .

Key Points of GST Challan for Payment of Tax , Interest etc

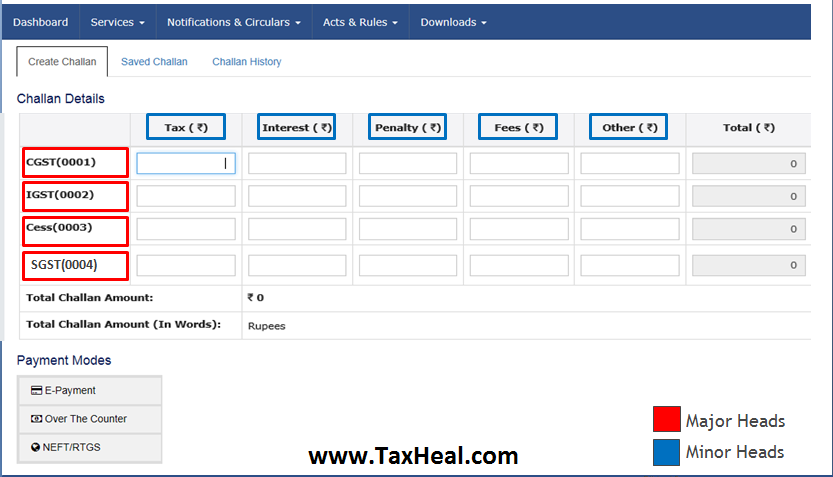

- Use GST Challan – GST PMT-06 for payment of tax, interest, penalty, fees or any other amount

- Single challan for SGST, CGST, & IGST payments (including cess)

- Challan for making GST Payments are generated online

- GST challans are created online at GST Portal

- Pre login mode – challan cannot be saved

- Post login mode – All saved challans are available for up to 7 days

- Before generation of Challan, it will be in My Saved Challans & after generation it will be Challan History.

- Challans can be saved & edited for a maximum of 7 days after which they are purged by the system

- At any point of time, there can be only 10 challans saved

- Once a challan is generated, it is valid for 15 days

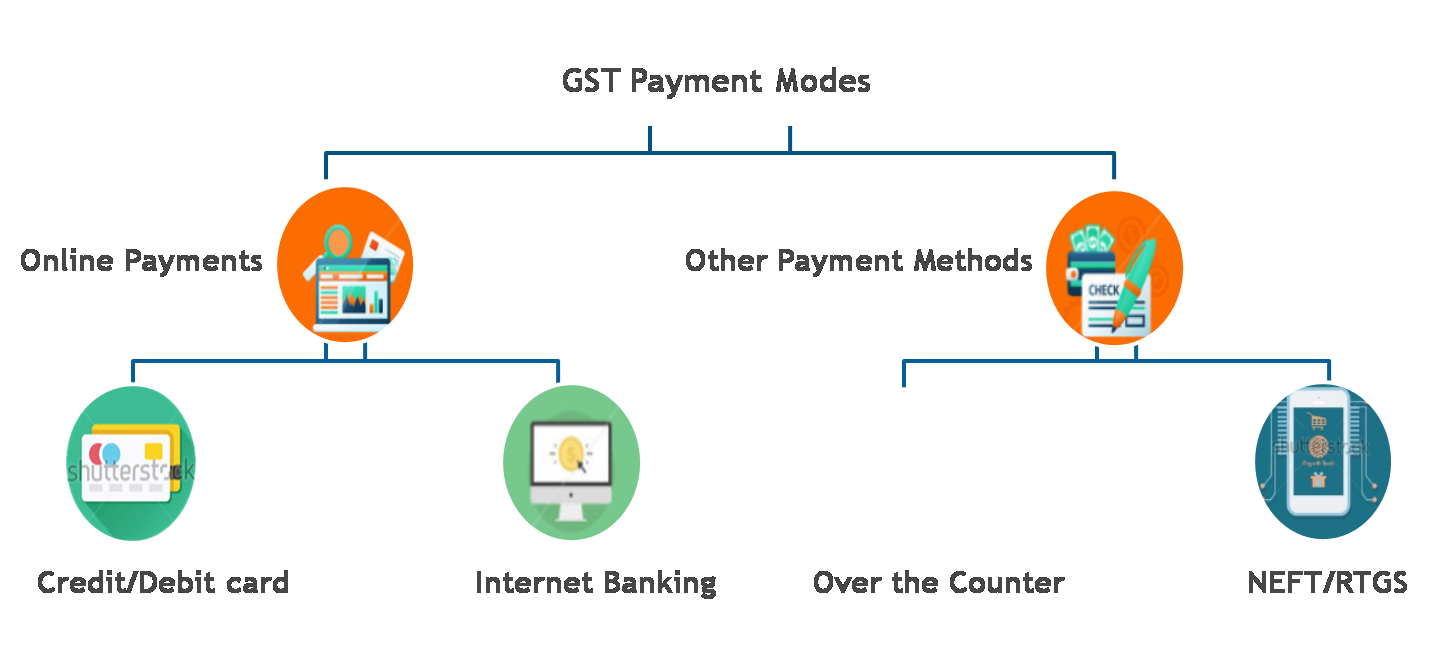

GST Challan Payment Modes

NOTE: All payments are deposited into the Electronic Cash Ledger & funds are utilized from it when taxpayer makes payments for liabilities.

Making Payments: GST Challans

- You can make GST payments online through e-Payment

- Internet Banking

- Credit/Debit Card

For online payments – bank name to be mentioned after generating challan therefore will not be shown on challan

- You can also make the payments for GST Challan using

- NEFT & RTGS

- OTC at authorized banks (up to INR 10,000 per challan per tax period)

For OTC, NEFT, & RTGS – bank name must be mentioned before generating challan therefore will be shown on challan

GST Challans Screen Shots

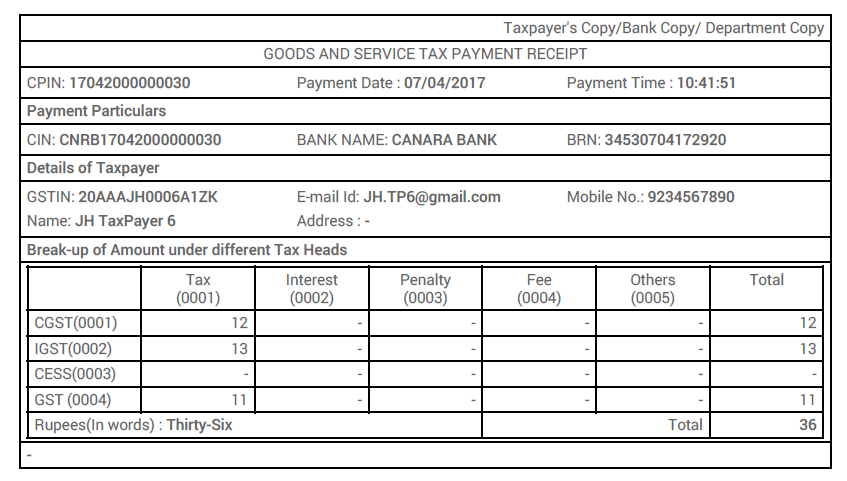

Receipt – Reference Screenshot of Receipt generated after Payment

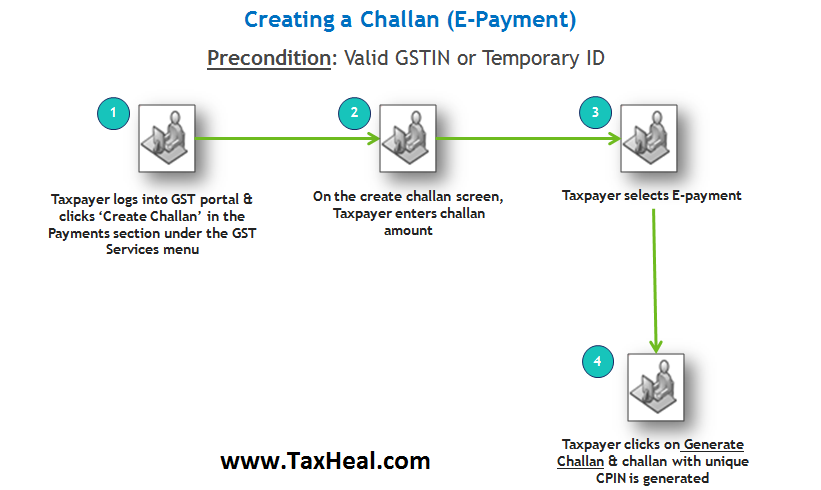

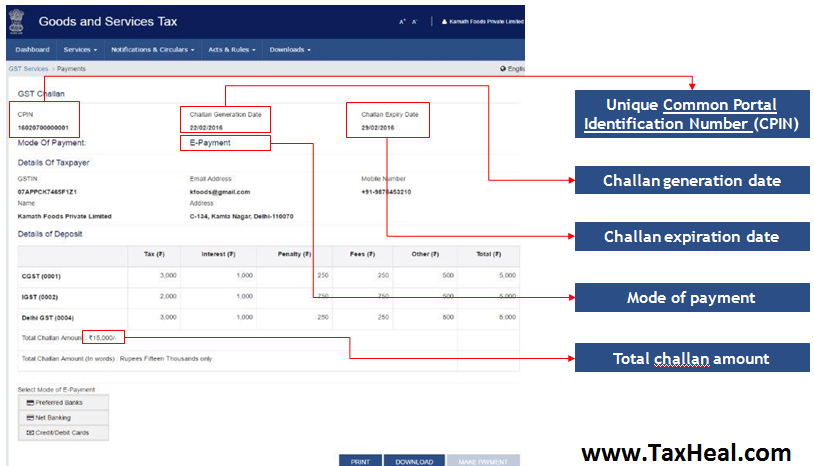

GST Challan generation by E-Payment

Precondition: Valid GSTIN or Temporary ID

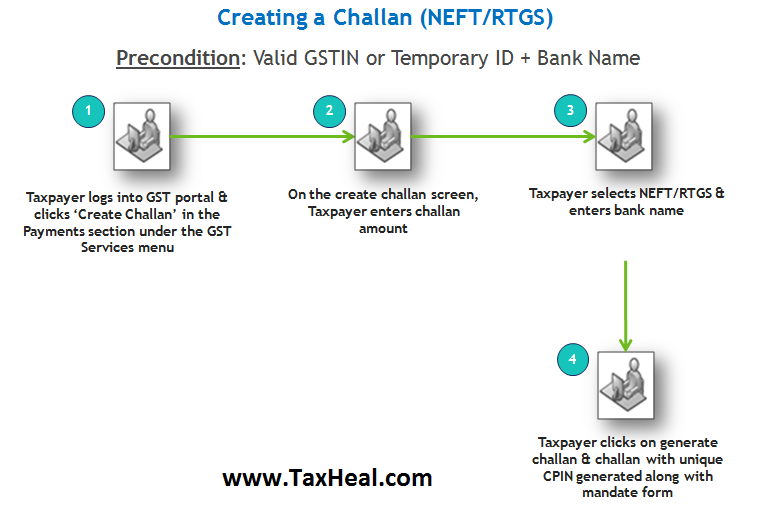

GST Challan generation by RTGS / NEFT

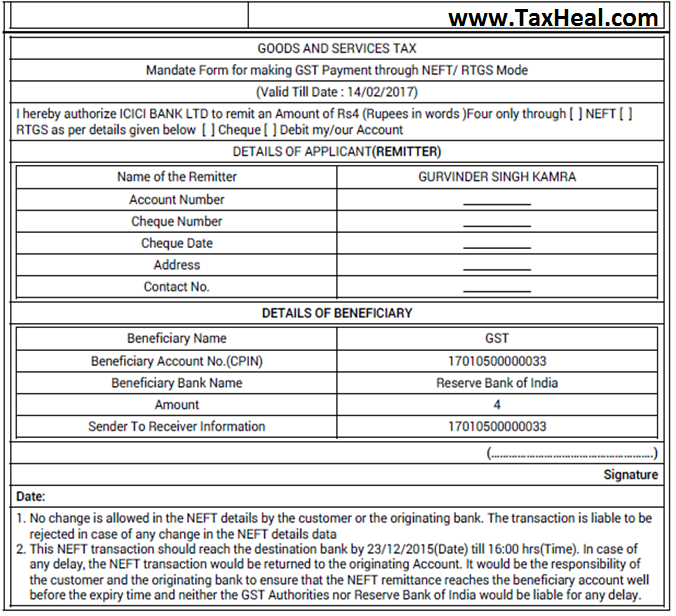

Mandate form for making GST Payment Through RTGS/ NEFT mode

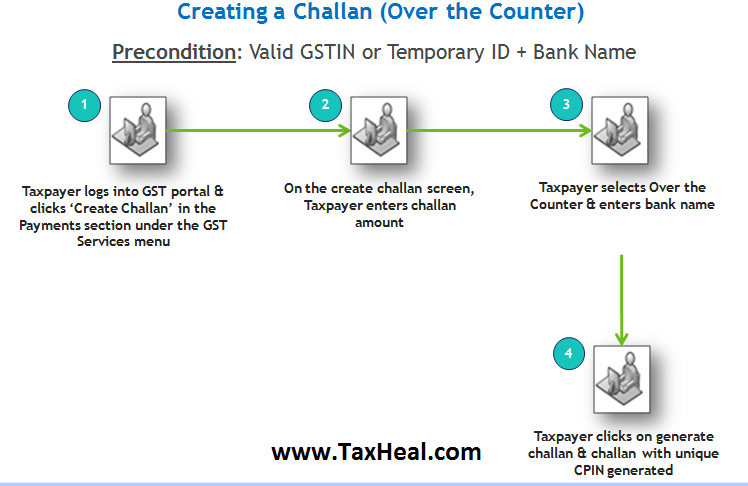

GST Challan generation over the Counter

Reference Screenshot of Generated GST Challan from GST Portal

GST Challan Payments: My Saved Challans

- Before generation of Challan, it will be in My Saved Challans & after generation it will be Challan History.

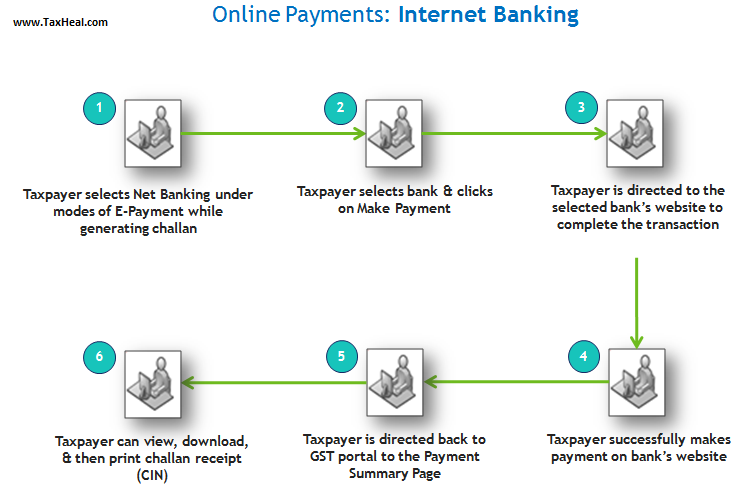

GST Challan Online Payments : Internet Banking

Precondition 1: Challan with e-Payment has been generated

Precondition 2: Taxpayer has net banking facility with authorized bank

Precondition 3: Challan should be valid at the time of tendering the payment

GST Challan Online Payments by Credit/Debit Card

Precondition 1: Challan with e-Payment has been generated

Precondition 2: Taxpayer has valid credit/debit card

Precondition 3: Challan should be valid at the time of tendering the payment

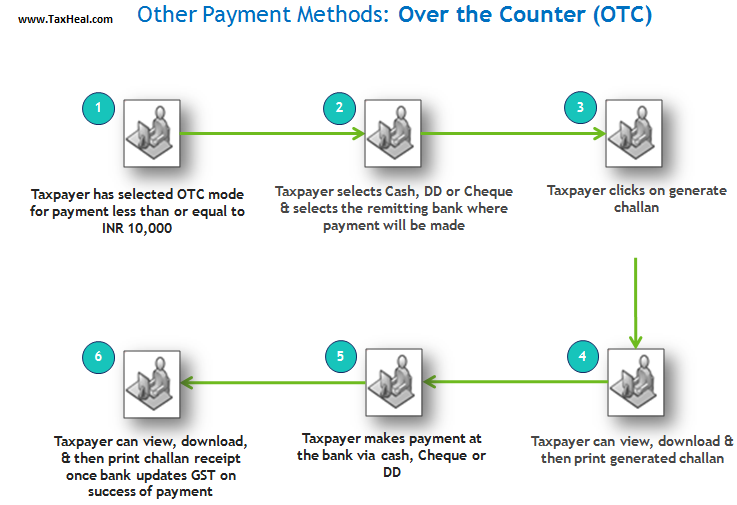

GST Challan Payment : Over the Counter (OTC)

Precondition 1: Taxpayer’s selected OTC mode before generating challan

Precondition 2: Challan should be valid at the time of tendering the payment

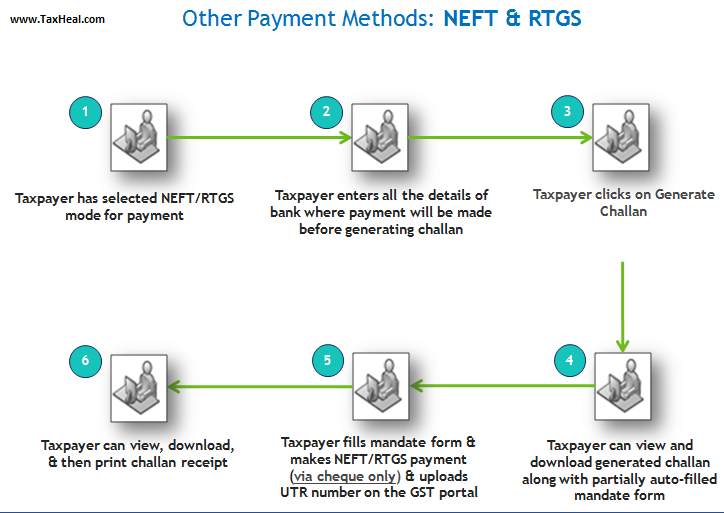

GST Challan Payment : NEFT & RTGS

Precondition 1: Taxpayer’s selected NEFT/RTGS before generating challan

Precondition 2: Challan should be valid at the time of tendering the payment

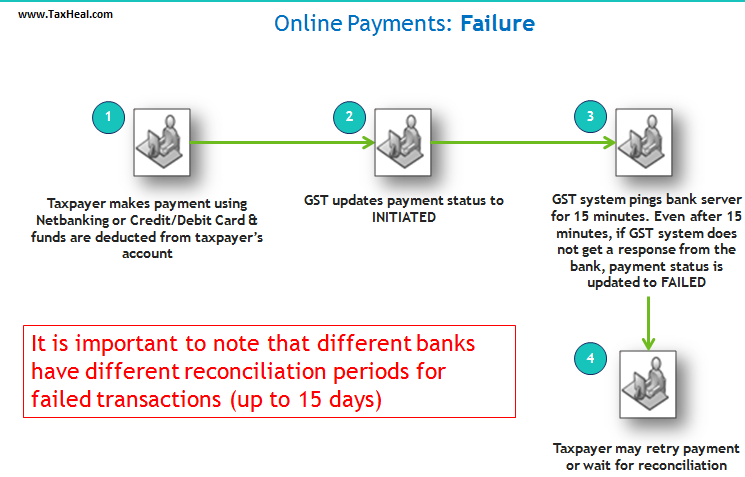

GST Challan Failure of Online Payments

GST Payments: Tax Officials

- During enforcement activities, tax officials can collect cash & deposit payments over the counter in banks without any limit

- Such cases are usually a result of a raid or surprise vehicle inspection

- Tax Official’s can see pendency & collection of payments almost real-time in the Tax Official’s Interface Dashboard

- Some payment related reports available to Tax Officials are:

- Collection Target

- Payments received to date

- Payments pending

Forms relating to tax payment under GST

Use GST Challan – GST PMT-06

| Form GST PMT-01 | Electronic tax liability register will be maintained in Form GST PMT-01 |

| Form GST PMT-02 | Electronic credit ledger will be maintained in Form GST PMT-02 |

| Form GST PMT-03 | Order of rejection of claim for refund of balance in Electronic credit ledger/Electronic cash ledger, issued by an authorised officer |

| Form GST PMT-04 | If a person notices any discrepancy in his Electronic credit ledger, he can communicate the same using Form GST PMT-04 |

| Form GST PMT-05 | Electronic cash ledger will be maintained in Form GST PMT-05 |

| Form GST PMT-06 | Challan for payment of tax, interest, penalty, fees or any other amount |

| Form GST PMT-07 | If a person’s bank account has been debited but CIN has not been generated or CIN has been generated but not communicated to the GST portal, the person can inform the same using Form GST PMT-07 |

If you have any though on GST Challan , share by commenting below