GST on Travel Agents Services

GST on Travel Agents Services rendered to tourist will be treated as ‘supply’ under CGST Act 2017 and IGST Act 2017 of India . Since taxable event is supply under GST, it is necessary to understand certain terms like Location of Supplier of Service, Location of Recipient of Service and Place of Supply. Travel agents supplies bundle of services and hence definition of Composite Supply and Mixed supply also needs to be understood.

Key Impact of GST on Travel Agents Services in India

- Claim of GST Credit of Tax Payments : As definitions of Input, Capital Goods and Input Services under GST are simplified therefore many registered travel agents shall be able to claim credit of their tax payments on infrastructure development except those in respect of which input tax credit is specifically not allowable.Read Section 16,Section 17 and Section 18 of CGST Act 2017

Since existing assessee will also be eligible to take credit of their capital goods on hand as shown in their books of accounts for which documents like invoices are available as per Rule 5 of Draft Input Tax Credit Rules, it will also create substantial credit on hand as on appointed date of GST

2.Nature of Supply :- Lot of services by Travel Agents may be in the form of a bundle. It would thus have to be seen whether the services being provided are composite in nature or a mixed supply. Both composite and mixed supplies have been defined separately under the GST Law. [ Note: if a travel agent makes Mixed Supplies , then GST will have to be paid on item that which attracts the highest rate of tax. , but if a travel agent makes Composite supply then GST rate will be as applicable on Principal Supply ]

3. Pay GST on Supply from Unregistered person :- If a travel agent registered under GST takes taxable Goods or services or both from unregistered person , then he may be liable to pay GST under Reverse Charge as per Section 9(4) of CGST Act 2017.

4. Discounts to Customers :– Any discount given by Travel agent which is not known at the time of entering transaction with customer shall not get the benefit of reduction in corresponding taxes under the GST regime.

5. No input Tax credit on Construction of Office Building :- The money paid by travel agent as taxes on the works contract services when supplied for construction of an immovable property is not allowed as Input tax credit when such services are not used for further supply of works contract service.

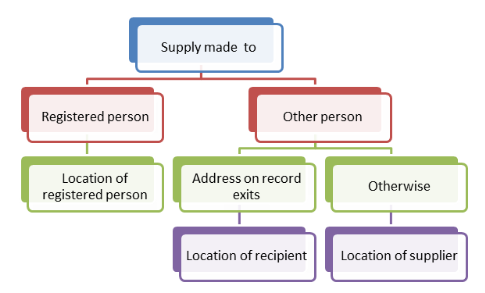

6. Place of Supply : which type of GST (IGST or CGST Plus SGST/UTGST) will be paid by Travel Agents will depend upon the place of Supply provisions under GST

Key Terms under GST affecting Travel Agents for Invoicing

Location of Supplier of Services

As per Section 2(71) of CGST Act 2017

“location of the supplier of services” means,—

(a) where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is made from more than one establishment, whether the place of business or fixed establishment, the loca-tion of the establishment most directly concerned with the provisions of the supply; and

(d) in absence of such places, the location of the usual place of residence of the supplier;

Location of Recipient of Services

As per Section 2(70) of CGST Act 2017

“location of the recipient of services” means,—

(a) where a supply is received at a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is received at more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the receipt of the supply; and

(d) in absence of such places, the location of the usual place of residence of the recipient;

Place of Supply

As per Section 2(86) of CGST Act 2017

“place of supply” means the place of supply as referred to in Chapter V of the Integrated Goods and Services Tax Act;

Mixed Supply

As per Section 2(74) of CGST Act 2017

“mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply:

Illustration : A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drinks and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately;

Composite Supply

As per Section 2(30) of CGST Act 2017

“composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

Illustration: Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply;

Tax Liability in case of Mixed Supply or Composite Supply

If a travel agent makes Mixed Supplies , then GST will have to be paid on item that which attracts the highest rate of tax. , but if a travel agent makes Composite supply then GST rate will be as applicable on Principal Supply

As per Section 8 of CGST Act 2017

The tax liability on a composite or a mixed supply shall be determined in the following manner, namely:—

(a) a composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply; and

(b) a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax.

Key Terms under GST affecting Travel Agents for Input Tax Credit

Key factors in GST is ease of availing input tax credit and therefore it is necessary to understand definition of Input Tax, input, Input Service and Capital Goods to understand allowability of various taxes paid on inward supplies.

Input Tax

As per Section 2(62) of CGST Act 2017

“input tax” in relation to a registered person, means the central tax, State tax, integrated tax or Union territory tax charged on any supply of goods or services or both made to him and includes—

(a) the integrated goods and services tax charged on import of goods;

(b) the tax payable under the provisions of sub-sections (3) and (4) of section 9;

(c) the tax payable under the provisions of sub-sections (3) and (4) of section 5 of the Integrated Goods and Services Tax Act;

(d) the tax payable under the provisions of sub-sections (3) and (4) of section 9 of the respective State Goods and Services Tax Act; or

(e) the tax payable under the provisions of sub-sections (3) and (4) of section 7 of the Union Territory Goods and Services Tax Act,

but does not include the tax paid under the composition levy;

[ Therefore it covers all the tax paid under CGST Act, IGST Act, SGST Act, UTGST Act and Tax Payable on reverse charge basis under CGST, IGST, UTGST or SGST Act ]

Input

As per Section 2(59) of CGST Act 2017

“input” means any goods other than capital goods used or intended to be used by a supplier in the course or furtherance of business;

Input Service

As per Section 2(60) of CGST Act 2017

“input service” means any service used or intended to be used by a supplier in the course or furtherance of business;

Capital Goods

As per Section 2(19) of CGST Act 2017

“capital goods” means goods, the value of which is capitalised in the books of account of the person claiming the input tax credit and which are used or intended to be used in the course or furtherance of business;

( Note : Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income-tax Act, 1961 (43 of 1961), the input tax credit on the said tax component shall not be allowed. ]

Payments by Travel Agent within 180 days to suppliers of Goods and Services

Travel agents takes various goods and avails various services from various suppliers. If the travel agents does not pay within 180 days from date of Invoice, then they will have to reverse Input Tax credit and will have to pay interest also.

As per Section 16(2) of CGST Act 2017

where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon.

Type / Taxability of GST on Travel Agents Services (Place of Supply generally & Applicable Taxes)

( Read Place of Supply in GST – India , Place of Supply Rules GST India ]

Keeping in mind above general Rule we will analysise GST on Travel Agent services , If a Travel Agent Provides (Accomodation + Travel + Sight Seeing + Food + Local Transport)

[Note : J & K means – Jammu and Kashmir . CGST Act 2017 and IGST act 2017 extends to whole of India except the State of Jammu and Kashmir ]