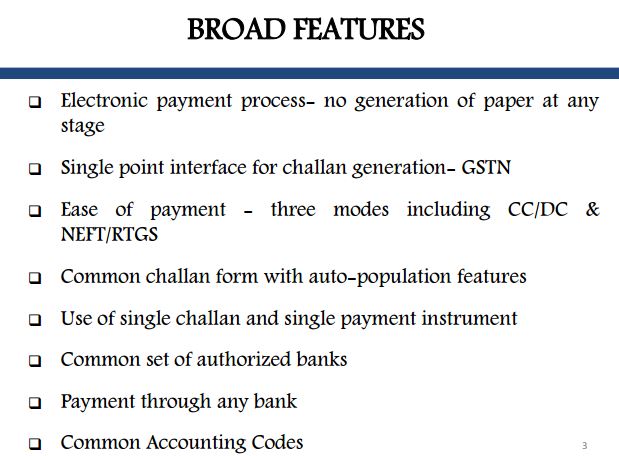

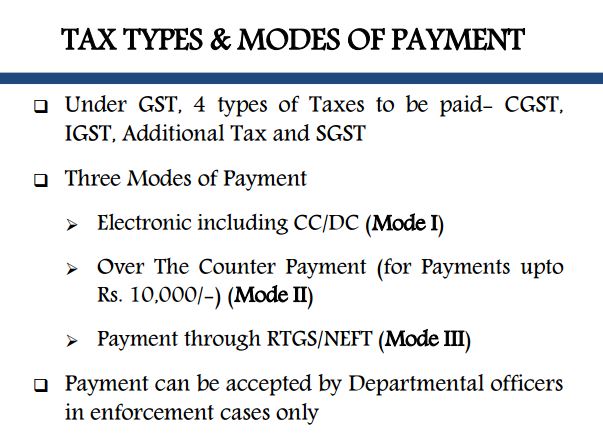

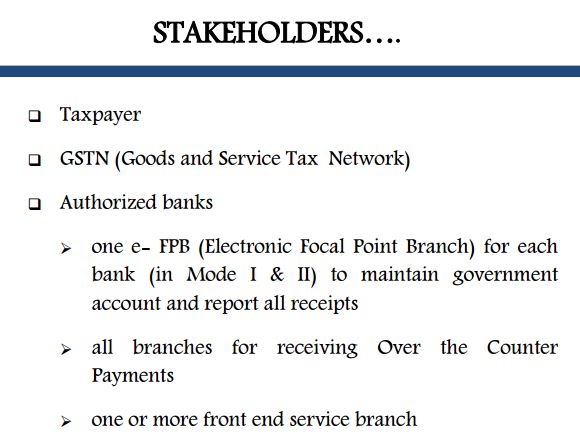

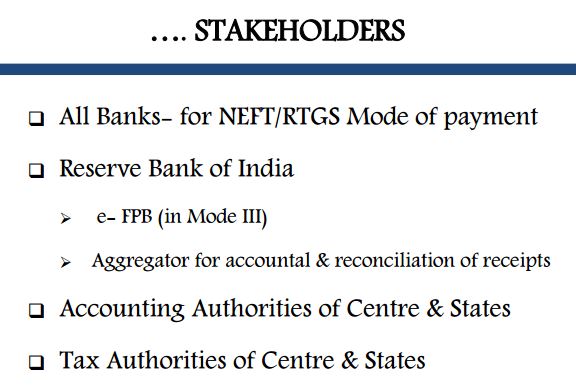

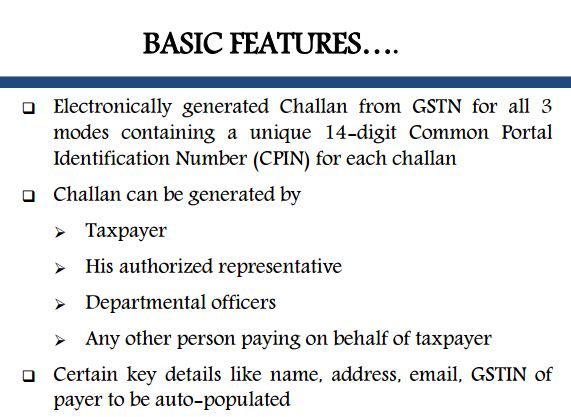

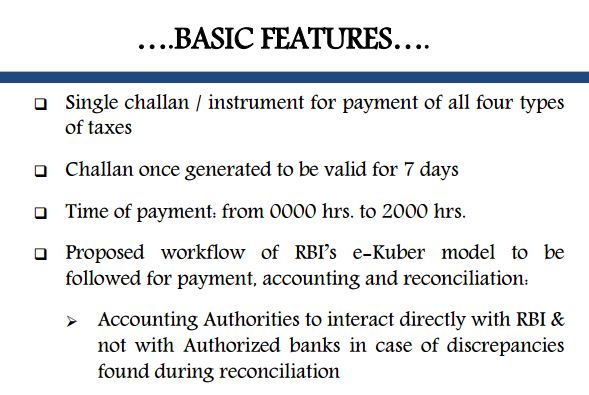

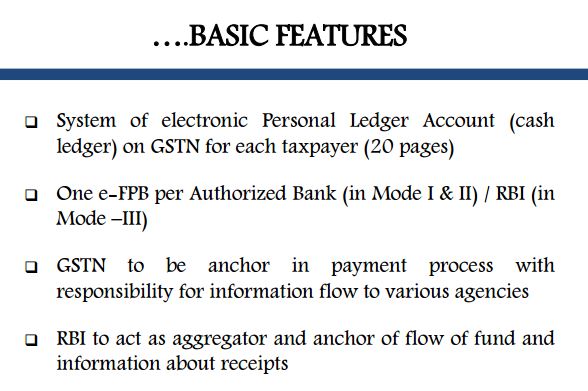

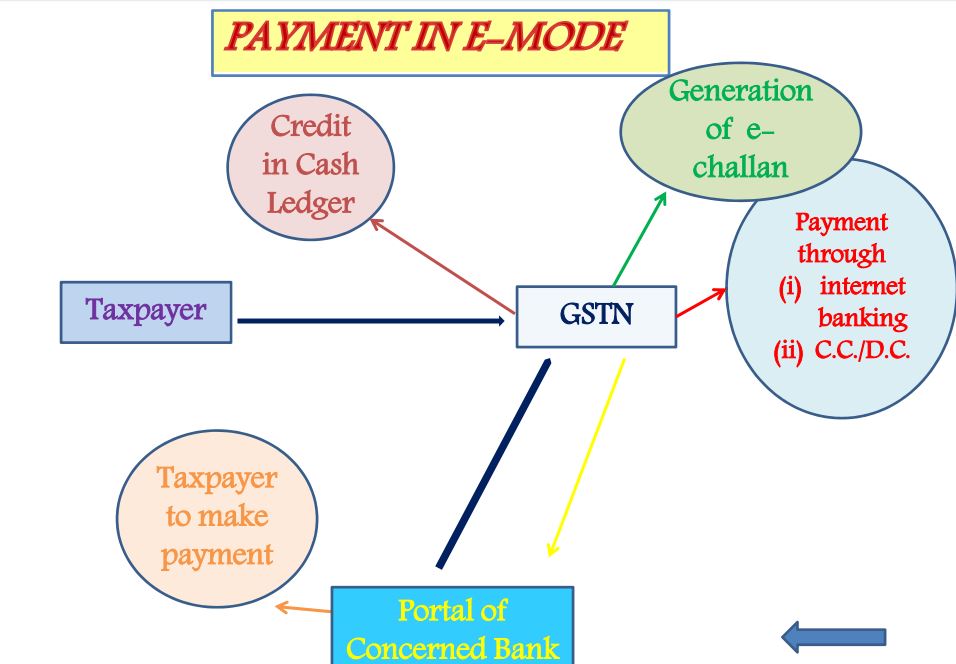

GST Payment Process in India

Download GST -Draft Registration formats released by CBEC

Download GST -Draft Registration Rules Released by CBEC

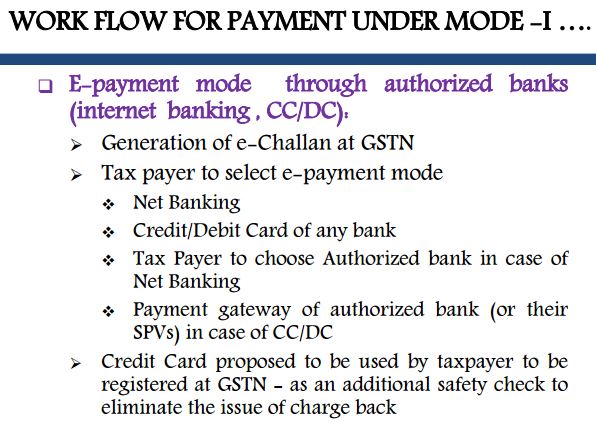

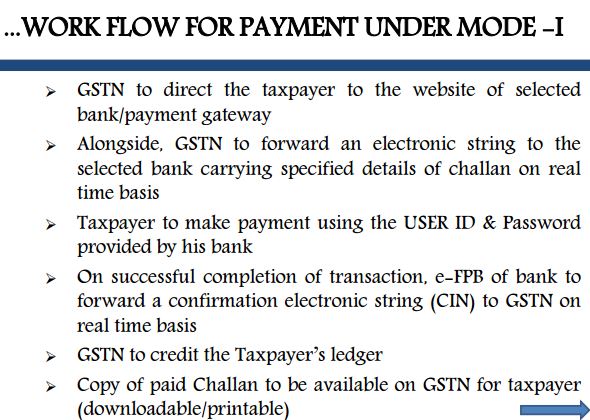

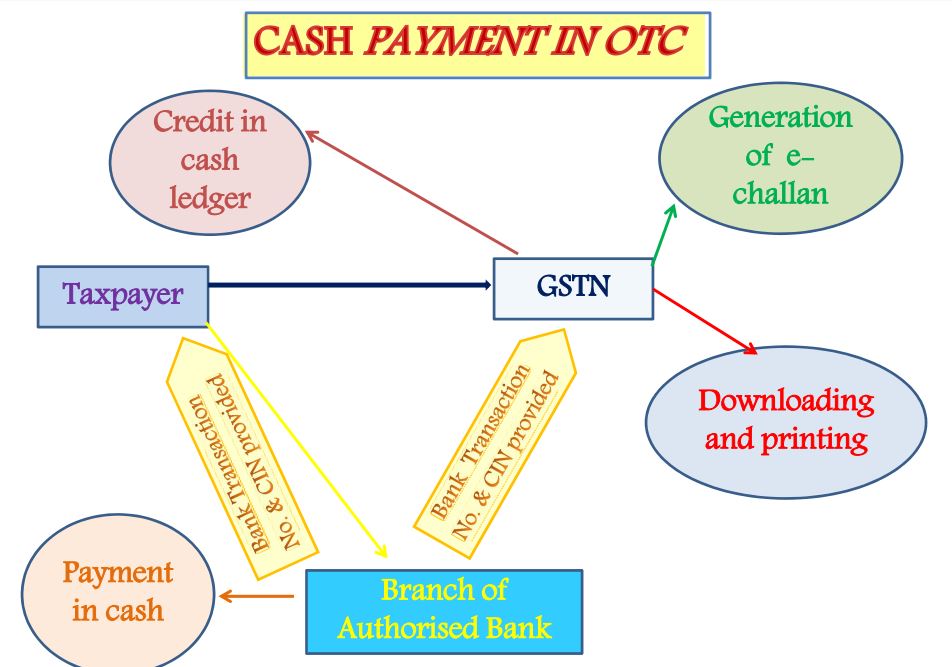

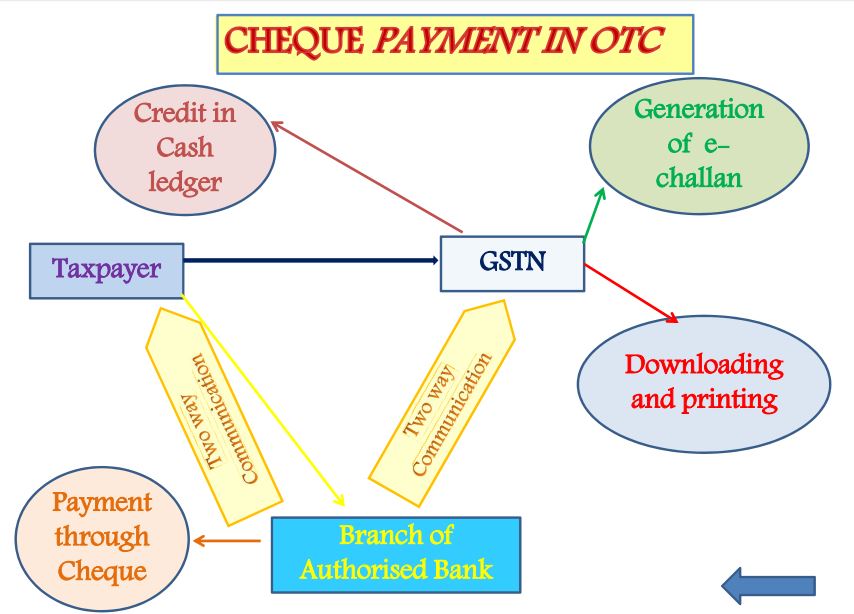

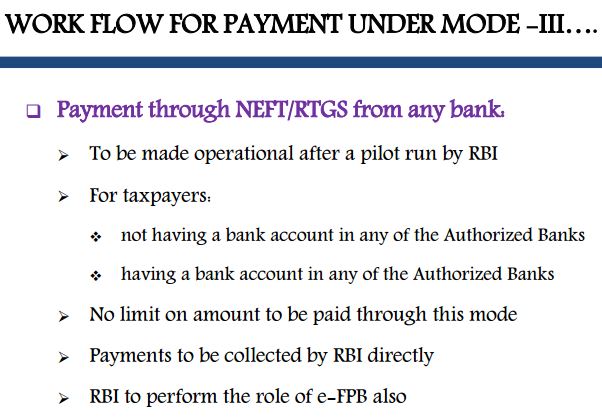

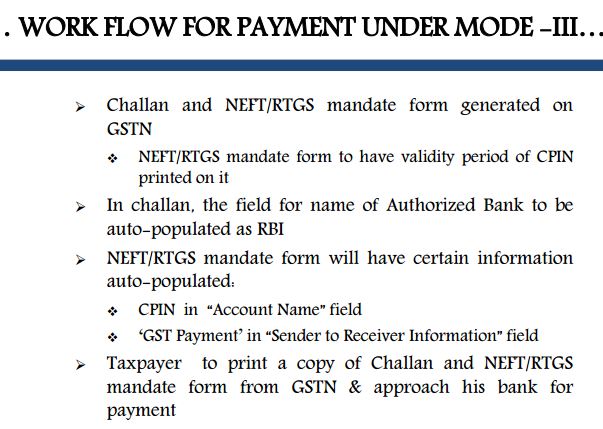

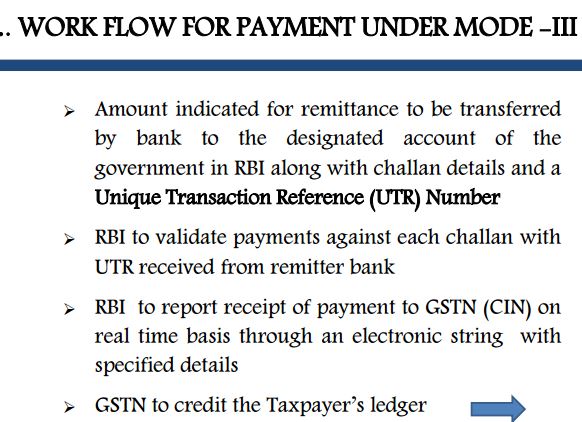

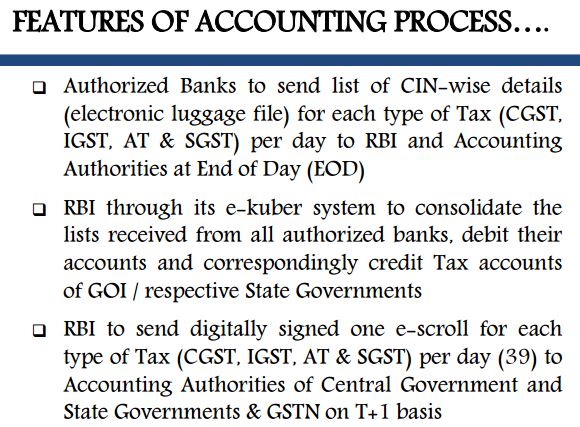

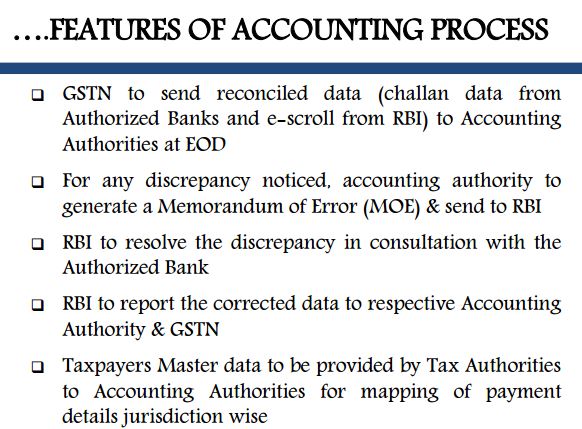

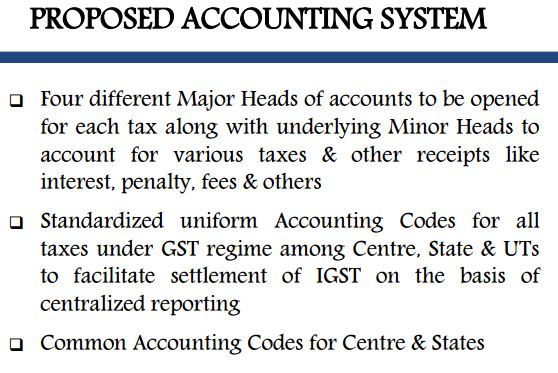

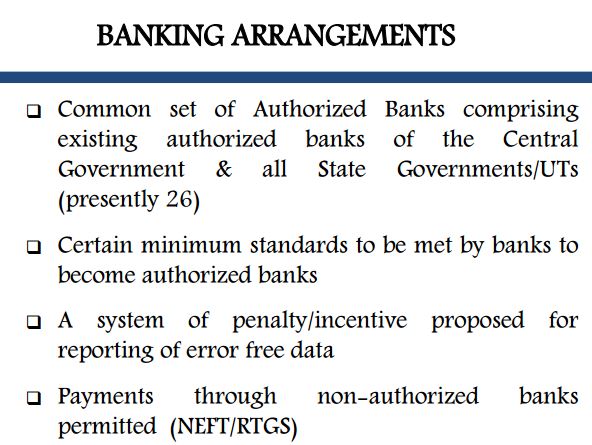

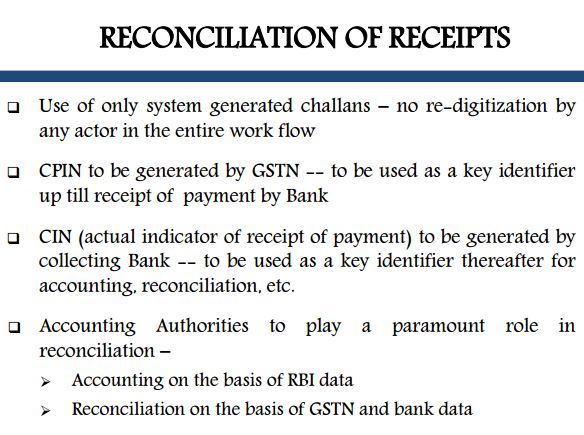

Download GST Draft Payment Rules Released by CBEC

Download GST Draft Payment formats Released by CBEC

Download Draft GST Refund Rules released by Govt

Download Draft GST Refund Forms released by CBEC

Download Draft GST Return Rules Released by Govt

Download Draft GST Return Formats released by Govt

Education Guide on Goods & Service Tax (GST)