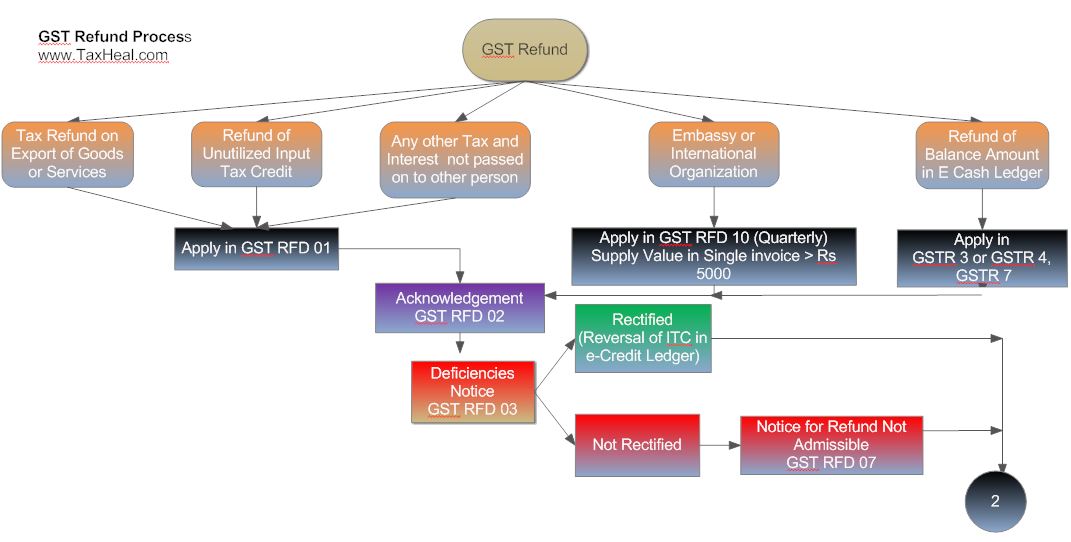

GST Refund Process -Flow Chart

Key Points about GST Refund :-

- The refund claimed in Part B of GSTR-3 shall be deemed to be an application filed for refund.

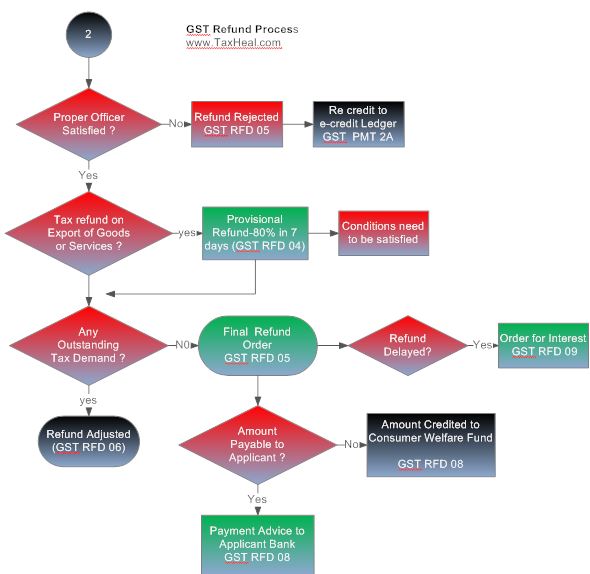

- The provisional refund, i.e., 80% of refund claimed shall be granted on satisfaction of following conditions:-

- ➢ Person claiming refund has not been prosecuted for any offence under GST during any 5 preceding years. If he has been prosecuted under an earlier law, the amount of tax evaded should not exceed Rs.2,50,000.

- ➢ GST compliance rating of the applicant is not less than 5 on a scale of 10.

- ➢ No proceeding for any appeal, review or revision is pending on issues which form the basis of the refund andif pending, the same has not been stayed by the appropriate authority or court.

- Refund shall be granted after adjusting any outstanding demand payable by the applicant.

- If Proper Officer is satisfied that refund is not payable then he shall issue a notice requiring applicant to furnish a reply within 15 days.

- Any amount rejected as refund shall be re-credited to the electronic credit ledger.

- Person claiming refund of tax paid on inward supplies shall apply for refund in FORM GST RFD-10 once in every quarter.

Download Following GST Refund Formats:-

GST RFD 01, GST RFD 02, GST RFD 03, GST RFD 04, GST RFD 05, GST RFD 06, GST RFD 07, GST RFD 08, GST RFD 09, GST RFD 10

Sl. No | Form Number | Content |

1. | GST RFD 01 | Refund Application form-Annexure 1 Details of Goods–Annexure 2 Certificate by CA |

2. | GST RFD 02 | Acknowledgement |

3. | GST RFD 03 | Notice of Deficiency on Application for Refund |

4. | GST RFD 04 | Provisional Refund Sanction Order |

5. | GST RFD 05 | Refund Sanction/Rejection Order |

6. | GST RFD 06 | Order for Complete adjustment of claimed Refund |

7. | GST RFD 07 | Show cause notice for reject of refund application |

8. | GST RFD 08 | Payment Advice |

9. | GST RFD 09 | Order for Interest on delayed refunds |

10. | GST RFD 10 | Refund application form for Embassy/International Organizations |

Download Draft GST Refund Rules released by Govt

Download Draft GST Refund Forms released by CBEC

Free Education Guide on Goods & Service Tax (GST)