GST Refunds Process in India

We are making analysis of GST refunds process as per CGST Act 2017 and IGST Act 2017 released by Govt of India

Provisions of GST Refunds are given in :-

i) Chapter XI Refunds of CGST Act 2017

ii) Chapter VI Refund of integrated tax to international tourist of IGST Act 2017

iii) GST Refund Rules released on 31.03.2017 by CBEC

1. Types of GST Refunds

There are 4 types of refunds available in GST:-

1. Unutilized ITC – [Section 54(3) of CGST Act, 2017 and Rule 1 of Refund Rules] .

2. Balance in electronic cash ledger– [Section 54(1) of CGST Act, 2017 and Rule 1 of Refund Rules]

3. Advance tax deposited by CTP (Casual Taxable Person) or NRTP ( Non Resident Taxable Person) – [, Section 27(3) of CGST Act 2017 read with Section 49(6) of CGST Act 2017 , Section 54(1) of CGST Act, 2017 and Rule 1 of Refund Rules]

4. Refund by persons specified under Section 55 of CGST Act 2017 (Embassy, Agency of UNO, etc.) – [Section 54(2) of CGST Act, 2017 and Rule 7 of Refund Rules]

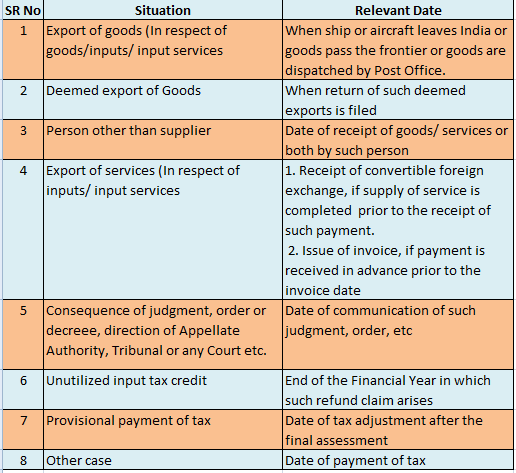

2. Meaning of relevant date for GST Refunds

As per Explanation 2 to Section 54 of CGST Act 2017 : Relevant Date means

3. Eligibility & requirement for refund of unutilized ITC

Section 54(3) of CGST Act 2017 and Rule 1 of Refund Rules provide for refund

Note 1 : “refund” includes refund of tax paid on zero-rated supplies of goods or services or both or on inputs or

input services used in making such zero-rated supplies, or refund of tax on the supply of goods regarded as

deemed exports, or refund of unutilised input tax credit as provided under sub-section (3)

Note 2 : If the person has defaulted in furnishing return or if the person is required to pay any taxes, then proper officer may withhold the refund or may deduct tax payable from the refund amount.

Note 3: If refund is on account of export or supply to SEZ, then 90% amount shall be refunded on provisional basis

4. Types of Forms relating to GST refunds Process Claim

As per GST Refund Rules released on 31.03.2017 by CBEC

5.Documents required for filing refund of unutilized ITC under GST

Documents to be enclosed for claiming refund by the exporter/Person supplying to SEZ/Person :-

i. Export of goods – Statement containing the number and date of shipping bills or bills of export and the number and date of relevant export invoices,

ii. Export of services – Statement containing the number and date of invoices and the relevant Bank Realization Certificates or Foreign Inward Remittance Certificates,

iii. Supply of goods/services to SEZ – Statement containing details of invoices, evidence regarding endorsement by specified officer regarding receipt of goods/services for authorized operations.

i) Supply of goods to SEZ :- Statement containing the number and date of invoices as prescribed in rule Invoice.1 along with the evidence regarding endorsement by the specified officer of the Zone . Thus application for refund shall be filed by the supplier of goods after such goods have been admitted in full in the Special Economic Zone for authorized operations, as endorsed by the specified officer of the Zone .

ii) Supply of Services to SEZ :- Statement containing the

a) Number and date of invoices,

b) The application for refund shall be filed by the supplier of services along with such evidence regarding receipt of services for authorized operations as endorsed by the specified officer of the Zone

c) Details of payment, along with proof thereof, made by the recipient to the supplier for authorized operations as defined under the Special Economic Zone Act, 2005

iv. Deemed exports :- Statement containing the number and date of invoices along with such other evidence as may be notified in this behalf.

v. Refund of any unutilized input tax credit under sub-section (3) of section 54 where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies, other than nil-rated or fully exempt supplies; :- Statement in Annex 1 of FORM GST RFD-01 containing the number and date of invoices received and issued during a tax period.

vi. Refund arises on account of finalisation of provisional assessment – Reference number of the final assessment order and a copy of the said order.

iv.Documentary or other evidence

Such documentary or other evidence as the applicant may furnish to establish that the amount of tax and interest, if any, paid on such tax or any other amount paid in relation to which such refund is claimed was collected from, or paid by, him and the incidence of such tax and interest had not been passed on to any other person:

Including the documents referred to in section 33 i.e where any supply is made for a consideration, every person who is liable to pay tax for such supply shall prominently indicate in all documents relating to assessment, tax invoice and other like documents, the amount of tax which shall form part of the price at which such supply is made.

If refund claim is Less than Rs. 2 Lakh – . No Documentary evidence is required to establish that the incidence of Tax , Interest and any other amount has passed on to any other person . Only such person is required to :-

A) Furnish declaration that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person

B) Certificate in Annex 2 of FORM GST RFD-01 issued by a chartered accountant or a cost accountant to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person

However such declaration and Certificate is not required to be furnished in respect of cases covered under clause (a) or clause (b) or clause (c) or clause (d) of sub-section (8) of section 54 as given below :-

(a) refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies;

(b) refund of unutilised input tax credit at the end of any tax period: under sub-section (3) of section 54 in case of ;

(i) zero-rated supplies made without payment of tax;

(ii) where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies), except supplies of goods or services or both as may be notified by the Government on the recommendations of the Council:

However no refund of unutilised input tax credit shall be allowed in cases

a) where the goods exported out of India are subjected to export duty:

b) If the supplier of goods or services or both avails of drawback in respect of central tax or claims refund of the integrated tax paid on such supplies.

(c) refund of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued, or where a refund voucher has been issued;

(d) refund of tax in pursuance of section 77 (Tax wrongfully collected and paid to Central Government or State Government) as under :-

A registered person who has paid the Central tax and State tax or, as the case may be, the central tax and the Union territory tax on a transaction considered by him to be an intra-State supply, but which is subsequently held to be an inter-State supply, shall be refunded the amount of taxes so paid in such manner and subject to such conditions as may be prescribed.

6 Transfer of GST Refund to Consumer Welfare Fund

If the applicant is not able to follow the prescribed procedure as per rules, then in such cases the amount of refund claimed will be transferred to Consumer Welfare Fund.

As per Section 54(8) of CGST Act 2017 Cases where the same is not applicable are, i.e. refund is not to be transferred to consumer welfare fund in the following cases:-

i. Refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies;( It’s a case of tax paid on Export/sale to SEZ or inputs/ input services used.)

ii. Refund of unutilized ITC ( Section 54(3) of CGST Act 2017 )

iii. Refund of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued, or where a refund voucher has been issued;

iv. Refund of tax wrongfully collected and paid (section 77 of the CGST Act 2017 )

v. Tax and interest, if any, or any other amount paid by the applicant, if he had not passed on the incidence of such tax and interest to any other person;

vi. Tax or interest borne by such other class of applicants as the Government may, on the recommendations of the Council, by notification, specify.

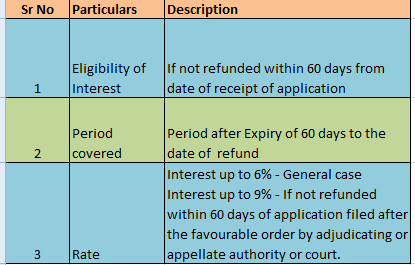

7. Interest on delayed refunds under GST

Section 56 of CGST Act 2017 explains Interest on delayed refunds.

8. FAQs on Refunds under GST

FAQs on Refunds under GST as released by CBEC on 31.03.2017

Q 1. What is refund?

Ans. Refund has been discussed in section 54 of the CGST/SGST Act.

“Refund” includes

(a) any balance amount in the electronic cash ledger so claimed in the returns,

(b) any unutilized input tax credit in respect of

(i) zero rated supplies made without payment of tax or,

(ii) where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies),

(c) tax paid by specialized agency of United Nations or any Multilateral Financial Institution and Organization notified under the United Nations (Privileges and Immunities) Act, 1947, Consulate or Embassy of foreign countries on any inward supply

Q 2. Can unutilized Input tax credit be allowed as refund?

Ans. Unutilized input tax credit can be allowed as refund in accordance with the provisions of sub-section (3) of section 54 in the following situations: –

(i) Zero rated supplies made without payment of tax;

(ii) Where credit has accumulated on account of rate of tax on inputs being higher than the rate of taxes on output supplies (other than nil rated or fully exempt supplies)

However, no refund of unutilized input tax credit shall be allowed in cases where the goods exported out of India are subjected to export duty, and also in the case where the supplier of goods or services or both avails of drawback in respect of central tax or claims refund of the integrated tax paid on such supplies.

Q 3. Can unutilized ITC be given refund, in case goods Exported outside India are subjected to export duty?

Ans. Refund of unutilized input tax credit is not allowed in cases where the goods exported out of India are subjected to export duty – as per the second proviso to section 54(3) of CGST/SGST Act.

Q 4. Will unutilized ITC at the end of the financial year (after introduction of GST) be refunded?

Ans. There is no such provision to allow refund of such unutilized ITC at the end of the financial year in the GST Law. It shall be carried forward to the next financial year.

Q 5. Suppose a taxable person has paid IGST/ CGST/SGST mistakenly as an Interstate/intrastate supply, but the nature of which is subsequently clarified. Can the CGST/SGST be adjusted against wrongly paid IGST or vice versa?

Ans. The taxable person cannot adjust CGST/SGST or IGST with the wrongly paid IGST or CGST/SGST but he is entitled to refund of the tax so paid wrongly – section 77 of the CGST/SGST Act.

Q 6. Whether purchases made by Embassies or UN are taxed or exempted?

Ans. Supplies to the Embassies or UN bodies will be taxed, which later on can be claimed as refund by them in terms of section 54(2) of the CGST/SGST Act. The claim has to be filed in the manner prescribed under CGST/SGST Refund rules, before expiry of six months from the last day of the month in which such supply was received.

[The United Nations Organization and Consulates or Embassies are required to take a Unique Identity Number [Section 26(1) of the CGST/SGST Act] and purchases made by them will be reflected against their Unique Identity Number in the return of outward supplies of the supplier(s)]

Q 7. What is the time limit for taking refund?

Ans. A person claiming refund is required to file an application before the expiry of two years from the “relevant date” as given in the Explanation to section 54 of the CGST/SGST Act.

Q 8. Whether principle of unjust enrichment will be applicable in refund?

Ans. The principle of unjust enrichment would be applicable in all cases of refund except in the following cases: –

i. Refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies

ii. Unutilized input tax credit in respect of

(i) zero rated supplies made without payment of tax or,

(ii) where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies

iii. refund of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued;

iv. refund of tax in pursuance of section 77 of CGST/SGST Act i.e. tax wrongfully collected and paid to Central Government or State Government

v. if the incidence of tax or interest paid has not been passed on to any other person;

vi. such other class of persons who has borne the incidence of tax as the Government may notify.

Q 9. In case the tax has been passed on to the consumer, whether refund will be sanctioned?

Ans. Yes, the amount so refunded shall be credited to the Consumer Welfare Fund – section 57 of the CGST/SGST Act

Q 10. Is there any time limit for sanctioning of refund?

Ans. Yes, refund has to be sanctioned within 60 days from the date of receipt of application complete in all respects. If refund is not sanctioned within the said period of 60 days, interest at the rate notified will have to be paid in accordance with section 56 of the CGST/SGST Act.

However, in case where provisional refund to the extent of 90% of the amount claimed is refundable in respect of zero-rated supplies made by certain categories of registered persons in terms of sub-section (6) of section 54 of the CGST/SGST Act, the provisional refund has to be given within 7 days from the date of acknowledgement of the claim of refund.

Q 11. Can refund be withheld by the department?

Ans. Yes, refund can be withheld in the following circumstances:

i. If the person has failed to furnish any return till he files such return;

ii. If the registered taxable person is required to pay any tax, interest or penalty which has not been stayed by the appellate authority/Tribunal/ court, till he pays such tax interest or penalty;

The proper officer can also deduct unpaid taxes, interest, penalty, late fee, if any, from the refundable amount – section 54(10) (d) of the CGST/SGST Act

iii. The Commissioner can withhold any refund, if, the order of refund is under appeal and he is of

the opinion that grant of such refund will adversely affect revenue in the said appeal on

account of malfeasance or fraud committed – section 54 (11) of the CGST/SGST Act.

Q 12. Where the refund is withheld under section 54(11) of the CGST/SGST Act, will the taxable person be given interest?

Ans. If as a result of appeal or further proceeding the taxable person becomes entitled to refund, then he shall also be entitled to interest at the rate notified [section 54(12) of the CGST/SGST Act].

Q 13. Is there any minimum threshold for refund?

Ans. No refund shall be granted if the amount is less than Rs.1000/-. [section 54 (14) of the CGST/SGST Act]

Q 14. How will the refunds arising out of existing law be paid?

Ans. The refund arising out of existing law will be paid as per the provisions of the existing law and will be made in cash and will not be available as ITC.

Q 15. Whether refund can be made before verification of documents?

Ans. In case of any claim of refund to a registered person on account of zero rated supplies of goods or services or both (other than registered persons as may be notified), 90% refund may be granted on provisional basis before verification subject to such conditions and restrictions as may be prescribed in accordance with sub-section 6 of section 54 of the CGST/SGST Act

Q 16. In case of refund under exports, whether BRC is necessary for granting refund?

Ans. In case of refund on account of export of goods, the refund rules do not prescribe BRC as a necessary document for filing of refund claim. However, for export of services details of BRC is required to be submitted along with the application for refund.

Q 17. Will the principle of unjust enrichment apply to exports and supplies to SEZ Units?

Ans. The principle of unjust enrichment would not be applicable to zero-rated supplies [i.e. exports and supplies to SEZ units]

Q 18. How will the applicant prove that the principle of unjust enrichment does not apply in his case?

Ans. Where the claim of refund is less than Rs.2 Lakh, a self-declaration by the applicant based on the documentary or other evidences available with him, certifying that the incidence of tax has not been passed on to any other person would make him eligible to get refund. However, if the claim of refund is more than Rs.2 Lakh, the applicant is required to submit a certificate from a Chartered Accountant or a Cost Accountant to the effect that the incidence of tax has not been passed on to any other person.

Q 19. Today under VAT/CST merchant exporters can purchase goods without payment of tax on furnishing of a declaration form. Will this system be there in GST?

Ans. There is no such provision in the GST law. They will have to procure goods upon payment of tax and claim refund of the unutilized input tax credit in accordance with section 54(3) of the CGST/SGST Act.

Q 20. Presently under Central law, exporters are allowed to obtain duty paid inputs, avail ITC on it and export goods upon payment of duty (after utilizing the ITC) and thereafter claim refund of the duty paid on exports. Will this system continue in GST?

Ans. Yes. In terms of Section 16 of the IGST Act, a registered taxable person shall have the option either to export goods/services without payment of IGST under bond or letter of undertaking and claim refund of ITC or he can export goods/services on payment of IGST and claim refund of IGST paid.

Q 21. What is the time period within which an acknowledgement of a refund claim has to be given?

Ans. Where an application relates to a claim for refund from the electronic cash ledger as per sub-section (6) of Section 49 of the CGST/SGST Act made through the return furnished for the relevant tax period the acknowledgement will be communicated as soon as the return is furnished and in all other cases of claim of refund the acknowledgement will be communicated to the applicant within 15 days from the date of receipt of application complete in all respect.

Q 22. What is the time period within which provisional refund has to be given?

Ans. Provisional refund to the extent of 90% of the amount claimed on account of zero-rated supplies in terms of sub-section (6) of section 54 of the CGST/SGST Act has to be given within 7 days from the date of acknowledgement of complete application for refund claim.

Q 23. Is there any specified format for filing refund claim?

Ans. Every claim of refund has to be filed in Form GST RFD 1. However, claim of refund of balance in electronic cash ledger can be claimed through furnishing of monthly/quarterly returns in Form GSTR 3, GSTR 4 or GSTR 7, as the case may be, of the relevant period.

Q 24. Is there any specified format for sanction of refund claim?

Ans. The claim of refund will be sanctioned by the proper officer in Form GST RFD-06 if the claim is found to be in order and payment advice will be issued in Form GST RFD-05. The refund amount will then be electronically credited to the applicants given bank account.

Q 25. What happens if there are deficiencies in the refund claim?

Ans. Deficiencies, if any, in the refund claim has to be pointed out within 15 days. A form GST RFD-03 will be issued by the proper officer to the applicant pointing out the deficiencies through the common portal electronically requiring him to file a refund application after rectification of such deficiencies.

Q 26. Can the refund claim be rejected without assigning any reasons?

Ans. No. When the proper officer is satisfied that the claim is not admissible he shall issue a notice in Form GST RFD-08 to the applicant requiring him to furnish a reply in GST RFD -09 within fifteen days and after consideration of the applicant’s reply, he can accept or reject the refund claim and pass an order in Form GST RFD-06 only.

Source- GST FAQ by CBEC- 2nd Edition. 31.03.2017 – Download -Print

Pingback: Notification No 01/2020 Central Tax : CGST Amendment from 01.01.2020