Instruction for filling Application for New Registration.

Form GST REG 01 (Application for Registration under Section 19(1) of Goods and Services Tax Act, 20–) has been prescribed for filling Application for New Registration under GST of India

List of documents to be uploaded as evidence for filling Application for New Registration under GST (GST REG 01 )

- Photographs (wherever specified in the Application Form)

(a) Proprietary Concern – Proprietor

(b) Partnership Firm / LLP – Managing/Authorized/Designated Partners (personal details of all

partners is to be submitted but photos of only ten partners including that of Managing Partner

is to be submitted)

(c) HUF – Karta

(d) Company – Managing Director or the Authorised Person

(e) Trust – Managing Trustee

(f) Association of Person or Body of Individual –Members of Managing Committee (personal

details of all members is to be submitted but photos of only ten members including that of

Chairman is to be submitted)

(g) Local Authority – CEO or his equivalent

(h) Statutory Body – CEO or his equivalent

(i) Others – Person in Charge - Constitution of Taxpayer: Partnership Deed in case of Partnership Firm, Registration

Certificate/Proof of Constitution in case of Society, Trust, Club, Government Department,

Association of Person or Body of Individual, Local Authority, Statutory Body and Others etc. - Proof of Principal/Additional Place of Business:

(a) For Own premises –

Any document in support of the ownership of the premises like Latest Property Tax Receipt or

Municipal Khata copy or copy of Electricity Bill.

(b) For Rented or Leased premises –

A copy of the valid Rent / Lease Agreement with any document in support of the ownership of

the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of

Electricity Bill.

(c) For premises not covered in (a) & (b) above –

A copy of the Consent Letter with any document in support of the ownership of the premises

of the Consenter like Municipal Khata copy or Electricity Bill copy. For shared properties also,

the same documents may be uploaded. - Bank Account Related Proof:

Scanned copy of the first page of Bank passbook / one page of Bank Statement

Opening page of the Bank Passbook held in the name of the Proprietor / Business Concern –

containing the Account No., Name of the Account Holder, MICR and IFSC and Branch details. - Authorization Form:-

For each Authorised Signatory mentioned in the application form, Authorization or copy of

Resolution of the Managing Committee or Board of Directors to be filed in the following

format:

Declaration for Authorised Signatory (Separate for each signatory)

I/We —

(Details of Proprietor/all Partners/Karta/Managing Directors and whole time

Director/Members of Managing Committee of Associations/Board of Trustees etc)

1. << Name of the Proprietor/all Partners/Karta/Managing Directors and whole time

Director/Members of Managing Committee of Associations/Board of Trustees etc>>

2.

3.

hereby solemnly affirm and declare that <<name of the authorized signatory>> to act as an

authorized signatory for the business << GSTIN – Name of the Business>> for which

application for registration is being filed/ is registered under the Goods and Service Tax Act,

20__.

All his actions in relation to this business will be binding on me/ us.

Signatures of the persons who are Proprietor/all Partners/Karta/Managing Directors and

whole time Director/Members of Managing Committee of Associations/Board of Trustees etc.

S. No. Full Name Designation/Status Signature

Acceptance as an authorized signatory

I <<(Name of the authorized signatory>> hereby solemnly accord my acceptance to act as

authorized signatory for the above referred business and all my acts shall be binding on the

business

Signature of Authorised Signatory

Place (Name)

Date Designation/Status

Instruction for filling Application for New Registration under GST (GST REG 01 )

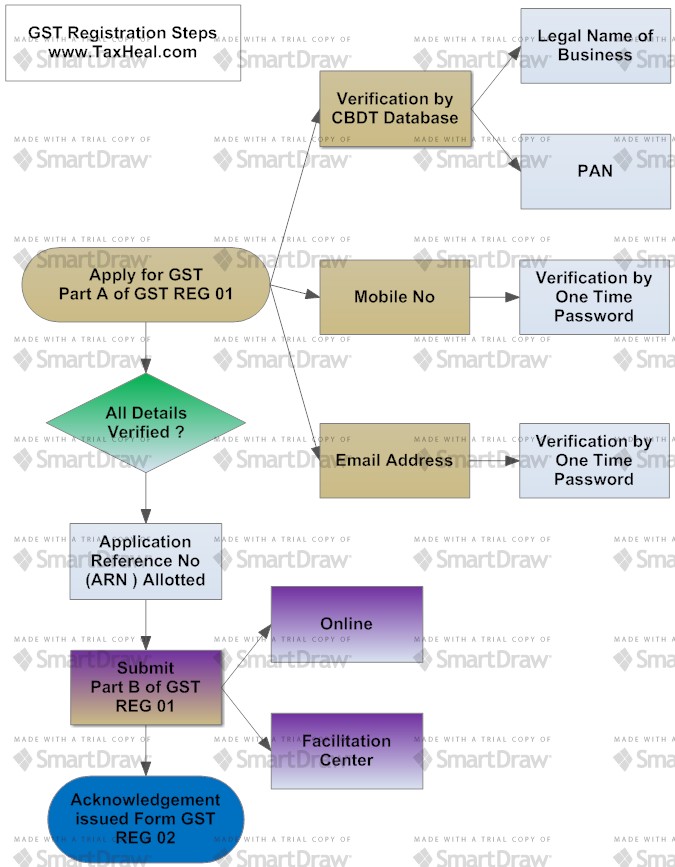

- Enter Name of taxpayer as recorded on PAN of the Business. In case of Proprietorship concern, enter name of proprietor at Legal Name and mention PAN of the proprietor. PAN shall be verified with Income Tax database

- Provide Email Id and Mobile Number of primary authorized signatory for verification and future

communication which will be verified through One Time Passwords to be sent separately, before filling up Part-B of the application - Applicant need to upload scanned copy of the declaration signed by the Proprietor/all

Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of

Associations/Board of Trustees etc. in case the business declares a person as Authorised Signatory. - Following person can digitally sign application for New Registration under GST (GST REG 01)

- Information in respect of Authorized Representative is optional. Please select your Authorized

representative from the list as provided under Tax Return Preparer (TRP). - State specific information are relevant for the concerned State only.

- Application filed by undermentioned persons shall be signed digitally:-

- All information related to PAN, Aadhaar, DIN, CIN shall be online validated by the system and

Acknowledgment Receipt Number will be generated after successful validation of all the filled information. - Status of the online filed Application can be tracked on the Common Portal.

- No fee is payable for filing application for registration.

- Authorised signatory should not be a minor.

- Any person having multiple business verticals within a State, requiring a separate

registration for any of its business verticals under sub-section (2) of section 19 shall need to

apply in respect of each of the verticals subject to the following conditions: Such person has

more than one business vertical as defined under sub-section (18) of section 2 of the Act. - A registered taxable person eligible to obtain separate registration for business verticals

may file separate application in FORM GST REG-1 in respect of each such vertical. - After approval of application Registration Certificate shall be made available indicating all

additional places of business for the principal place of business and separate registration

certificate for every declared additional place of business indicating the address of that place

besides address of principal place of business. Such certificate shall be made available to the

applicant on the Common Portal. - The certificate of registration shall be effective from the date on which the person

becomes liable to registration where the application for registration has been submitted within

30 days from such date. In case application for registration is filled after 30 days, certificate

of registration shall be effective from the date of registration

Free Education Guide on Goods & Service Tax (GST)