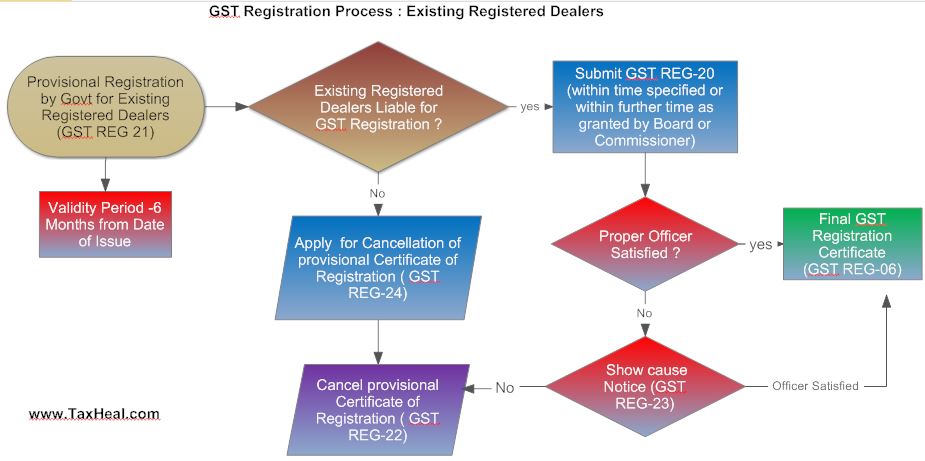

GST Registration Process for Existing Registered Dealer- Flow Chart

1. Provisional GST Registration for Existing Dealers :– As per section 142(1) of Model GST ,the Existing registered dealers under any of the earlier laws shall be issued a certificate of GST registration on a provisional basis in such form and manner as may be prescribed.

2.Form for Issue of Provisional GST Registration:- Rule 14(1) says that provisional GST certificate of registration shall be issued in Form GST REG-21.

Download GST REG 21

3. Validity period of Provisional GST Registration for Existing Dealers :- Existing dealer shall get certificate of GST Registration on provisional basis, which shall be, as section 142(2), valid for the period of 6 months from the date of issue.

4. Form for making GST Registration Application for Existing Dealers: When a dealer will get provisional GST certificate, he is required to submit Form GST REG-20. This form should be signed and accompany specified document (this specified documents may be copy of PAN/Address Proof/MOA/AOA/Bank Account detail etc)

Download GST REG 20

5. Time for Submission of Form GST REG 20 :- It shall be kept in mind that Form GST REG-20 should be submitted within time specified or within further time as granted by Board or Commissioner.

6. Final Certificate of GST Registration :– Then If information submitted in Form GST REG-21 and accompanied documents found satisfactory to proper officer then finally he will issue Final Certificate of GST Registration in Form GST REG-06

Download GST REG 06

6. Notice for Discrepancies :- If Proper Officer does not find information in order then Proper Officer will issue show cause Notice in Form GST REG-23.

Download GST REG 23

7. Cancellation of Provisional Certificate if Officer not Satisfied :- on non getting satisfactory reply from dealer then he will cancel provisional Certificate of Registration by issuing an order in Form GST REG-22

Download GST REG 22

8.Apply for Cancellation of Provisional GST Registration :- It may be possible that some existing Registered dealers do not liable to get them self registered in GST, but as they are existing registered dealer so they will get provisional certificate of Registration. In that case they submit Form GST REG-24 for cancellation of Provisional Certificate.

Download GST REG 24

Free Education Guide on Goods & Service Tax (GST)