GST Retun Filing Process

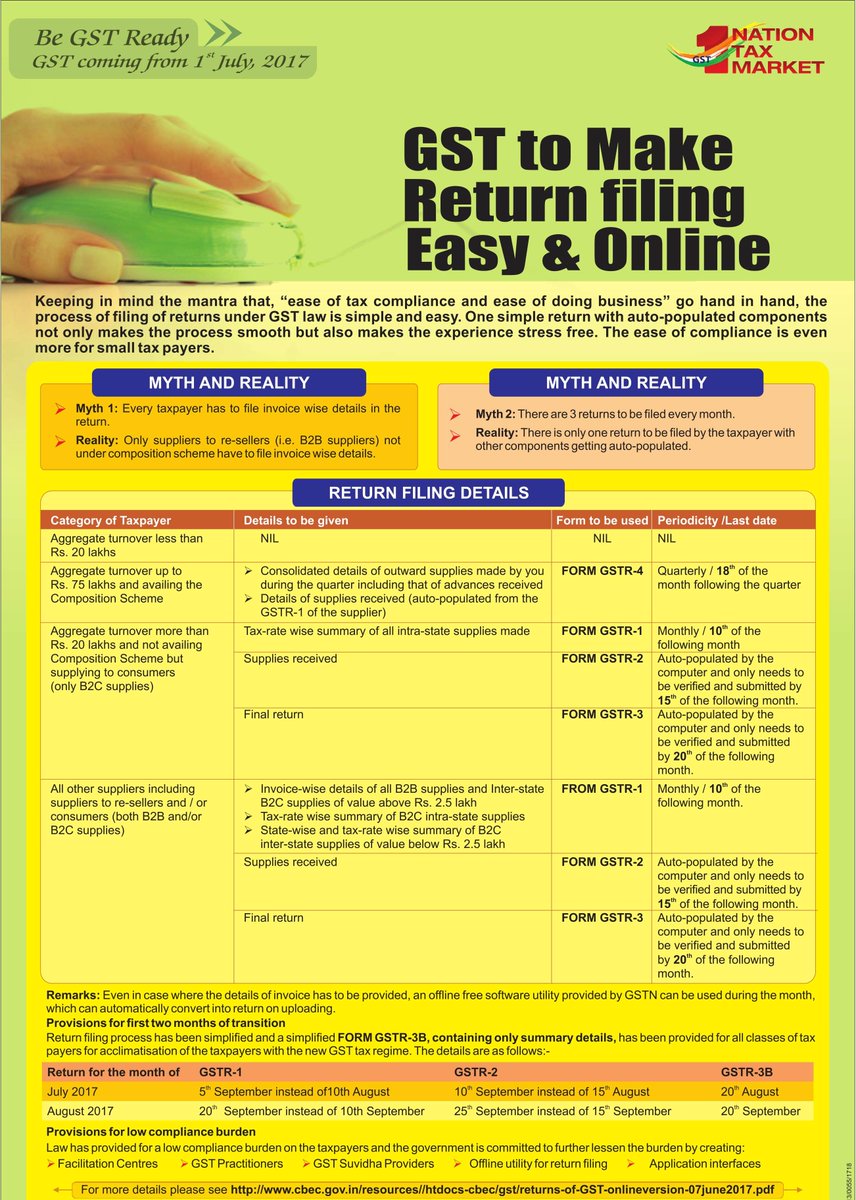

Under the GST law, a normal taxpayer will be required to furnish three returns monthly and one

annual return as mentioned in the table below:

| Type of Return | Form No. | Due Date | Act | GST Return Rules |

| Outward Supplies made by the taxpayer during the month | GSTR 1 | 10th of the next month | Section 37 | Rule 1 |

| Inward Supplies/purchases received during the month | GSTR 2 | 15th of the next month | Section 38 | Rule 2 |

| Monthly Return | GSTR 3 | 20th of the next month | Section 39 (1) | Rule 3 |

| Annual Return | GSTR 9 | By 31st December of next FY | Section 44 | Rule 21 |

Apart from the above, other type of taxpayers like – Input Service Distributors, non-resident

taxable person, composition suppliers, person required to deduct tax at source, electronic

commerce operator, and person having unique identification number are required to file the

returns under the following specified forms:

| Type of Return | Form No. | Due Date | Act | Return Rule |

| Quarterly Return for Compounding dealers | GSTR 4 | 18th of the month next to quarter | Section 39 (2) | Rule 4 |

| Return for Non-Resident Taxable Person | GSTR 5 | Within 20 days from the end of tax period or within 7 days after the last day of the validity period of registration whichever is earlier | Section 39 (5) | Rule 5 |

| Return by persons providing online information and database access or retrieval services | GSTR 5A | On or before the 20th day of the month succeeding the calendar month or part thereof | Section 39 (5) | Rule 5A |

| Return for Input Service Distributor | GSTR 6 | 15th of the next month | Section 39 (4) | Rule 6 |

| Return for persons required to deduct tax at source | GSTR 7 | 10th of the next month | Section 39 (3) | Rule 7 |

| Return for E-Commerce operators | GSTR 8 | 10th of the next month | Section 52 (4) | Rule 8 |

| GST Inward Supplies Statement for unique identification number | GSTR 11 | Section 55 | Rule 23 |

Online GST Return Filing Process:

The return filing process for a normal taxpayer is explained below:

1. The registered taxpayer (outward supplier) needs to have an active GSTIN and login

credentials.

2. He should log in to the GST portal, select the financial year and the relevant tax period

and select on GSTR 1.

3. The taxpayer is required to furnish the details of outward supplies of goods or services or

both in FORM GSTR 1 electronically through the common portal.

4. The taxpayer need to fill in the following details in GSTR 1 within the due date as

mentioned above:

a. Invoice wise details of all:

i. Inter-state and intra state supplies made to registered persons (B2B)

ii. Inter-state supplies with invoice value of more than Rs. 2.5 lacs made to unregistered persons

b. Consolidated details of all:

i. Intra-state supplies made to unregistered persons for each rate of tax

ii. State wise inter-state supplies with invoice value less than Rs.2.5 lacs made to unregistered persons for each rate of tax

c. Debit and Credit notes, is any, issued during the month for invoices issued previously

5. Consolidated detail of nil rated, exempt outward supply details should also be furnished

by the taxpayer.

6. Once all the particulars are furnished correctly as above, the taxpayer is required to sign

digitally either through a digital signature certificate (DSC) or Aadhar based e-signature

verification to authenticate the return.

7. The details as submitted above gets auto populated in Form GSTR 2A and will be

available electronically to the concerned registered persons (recipient tax payer) for all

the inward supplies.

8. The recipient taxpayer may either accept the information as furnished by the outward

supplier or may add, delete, or correct the information which has been received by him in

GSTR 2A .

9. The modifications, if any made in GSTR 2A will be communicated back to the outward

supplier electronically through the GSTN portal in Form GSTR 1A.

10. The outward supplier has to either accept or reject the corrections as done by the recipient

by 17th of the Month.

11. If the outward supplier accepts the corrections, then the GSTR 1 as furnished by the

taxpayer (outward supplier) shall stand modified, as applicable.

12. If the outward supplier does not accept the corrections as made by the recipient, then the

claim of input tax credit would be treated as mismatched.

13. The total tax liability for the taxpayer would be calculated and auto populated in GSTR 3

based on the details of outward and inward supplies as made above.

14. The taxpayer has to submit the Monthly Return – GSTR 3 and make the tax payment by

20th of the Month.

15. Apart from the Monthly Returns, the taxpayer is also required to file Annual Return –

Form GSTR 9 for every financial year by 31st December following the end of the financial year through the GSTN Portal. Along with the return, the taxpayer whose aggregate turnover during a financial year exceeds two crore rupees is also required to submit the audited annual accounts and a reconciliation statement in Form GSTR 9C.

GST Return – Analysis

How to File GST Return – Explained with screenshots / Examples

Fees for Late Filing of GST Returns in India

GST Return Formats

Related Topic on GST

| Topic | Link |

| GST Acts | Central GST Act and States GST Acts |

| Rules | GST Rules |

| Rates | GST Rates |

| Notifications | GST Act Notifications |

| Press Release | GST Press Release |

| Commentary | Topic wise Commentary on GST Act of India |

| GST Online Course | Join GST online Course |