GST Return filing Process in India

GST Return filing Process

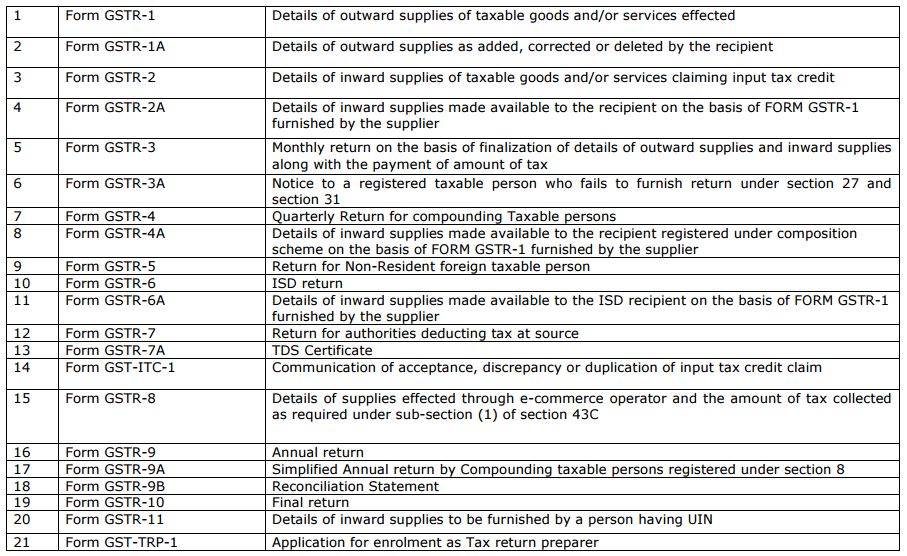

GST Return Forms – 27 Forms

GST Return : Who … What….When….to File GST Return

| Sr.No | Form | Who to File ? | What to file? | When to File ? |

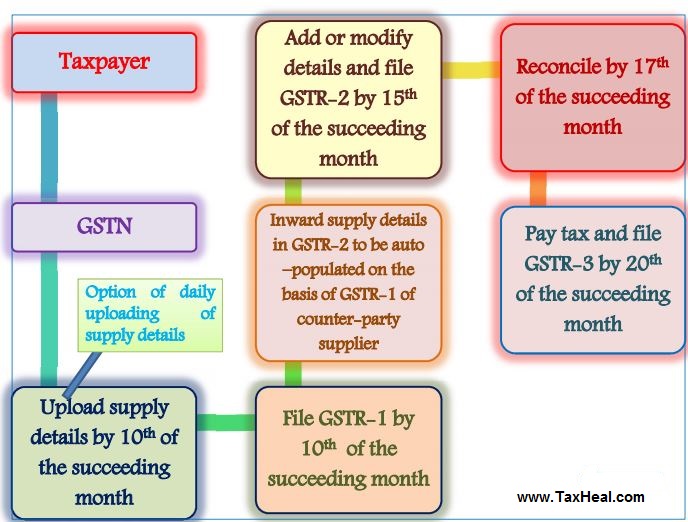

| 1 | GSTR-1 | Registered taxable supplier | Outward supplies | 10th of the month succeeding the tax period |

| 2 | GSTR-2 | Registered taxable recipient | Inward supplies /Purchases | 15th of the month succeeding the tax period |

| 3 | GSTR-3 | Registered taxable person | Outward supplies , inward supplies, ITC availed, tax payable, tax paid and other particulars as prescribed | 20th of the month succeeding the tax period |

| 4 | GSTR-4 | Composition supplier | Outward supplies, inward supplies | 18th of the month succeeding the quarter |

| 5 | GSTR-5 | Non-resident person | Outward supplies, inward supplies | 20th of the month succeeding tax period & within 7 days after expiry of registration |

| 6 | GSTR -6 | Input service distributor | details of tax invoices on which credit has been received | 13th of the month succeeding the tax period |

| 7 | GSTR-7 | Tax deductor | Details of tax deducted | 10th of the month succeeding the month of deduction |

| 8 | GSTR-8 | E commerce operator/tax collector | Details of tax collected. | 10th of the month succeeding the tax period |

| 9 | GSTR-9 | Registered Taxable Persons | Annual Return | 31st December of the next Financial Year] |

| 10 | GSTR 9A | Taxable Person paying tax u/s 8 (Compounding Taxable Person) | Annual Return | 31st December of the next Financial Year] |

| 11 | GSTR 9B | Registered Taxable Person (if Turnover Exceeds 1Crore) | Audit Report with Reconciliation Statement | 31st December of the next Financial Year |

| 12 | GSTR 10 | Taxable person whose registration has been surrendered or cancelled | Final return | within three months of the date of cancellation or date of cancellation order, whichever is later |

| 13 | GSTR 11 | Persons having Unique Identity Number and Claiming Refund | Details of inward supplies | 28th of the month following the month for which statement is filed |

GST Return Due date and Relevant Form:

Download Draft GST Return Formats released by Govt

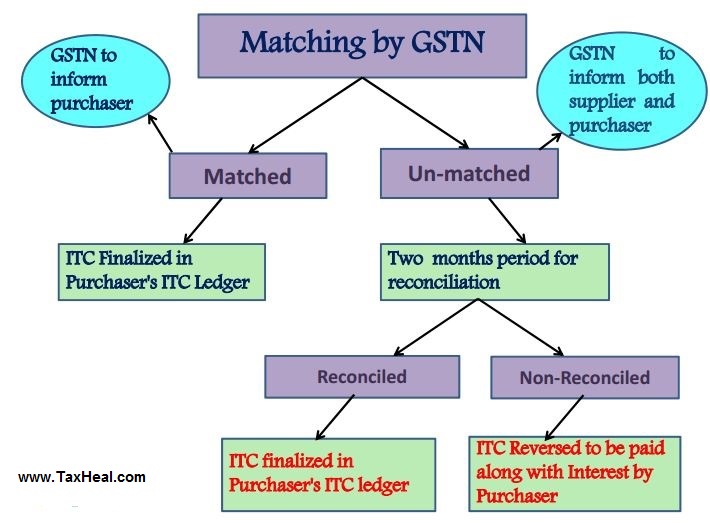

GST Return Matching at GSTN Portal

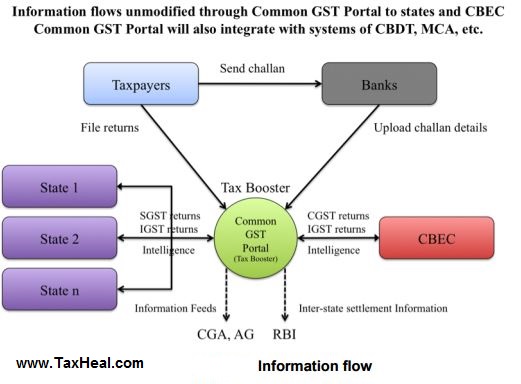

GST Return Information Flow to Govt Agencies

GST Return Filing Steps

GST Return filing process for Normal Assessee:

Step 1: Supplier (GSTR-1):

Cover all outward supplies effected during/in earlier tax period and submit GSTR-1;

Step 2: Recipient (GSTR-2):

- GSTR-2A (of recipient) shall be auto-generated based on GSTR-1 filed by Supplier;

- Following shall also be made available with recipient for preparation of GSTR-2

- Part-A of GSTR-2A showing inward supplies & DN/CN of suppliers;

- Part-B of GSTR-2A showing ITC transferred to recipient by ISD as per GSTR-6;

- Part-C of GSTR-2A showing TDS deducted by deductor as per GSTR-7;

- Part-D of GSTR-2A showing TCS collected by E-commerce operator as per GSTR-8;

- Recipient shall correct any mistake in GSTR-2 on basis of auto-populated GSTR-2 & 2A and BOA;

- Recipient shall mention ITC ineligible on inward supplies relating to non-taxable supply/ personal use of goods/ etc. in GSTR-2;

- Any correction made by recipient in GSTR-2 shall be auto populated and made available using GSTR-1A to the supplier for making corrections in GSTR-1.

Note: GSTR 1 relevant details are auto-populated in GSTR-2A which is visible to recipient and GSTR-2 relevant details are auto-populated in GSTR-1A which is visible to supplier.

Step 3: Monthly GST Return (GSTR-3)

- Part-A of GSTR-3 shall be auto-populated from GSTR-1 & GSTR-2 details of Assessee;

- Pay Tax as per GSTR-3 & fill the details in Part-B;

- Apply for refund in Part-B in case of balance in Electronic Cash Ledger (option of Assessee)

Step 4: GST Mismatch Report (GST ITC-1) (Assuming compliance for August)

- Communication of mismatch to both supplier and recipient latest by last date of the month in which mismatch being carried out (by Sept. end);

- If rectification not done by ___ date, then Output liability of recipient would be increased by such amount succeeding the month in GSTR-3 in which discrepancy communicated (i.e. of Oct.);

2) GST Return – Miscellaneous Points

a) Reduction of Sales Value of Invoice – Process

- Issuance of Credit Note (CN) by Supplier;

- Insertion of details in GSTR-1 by Supplier;

- Acceptance of CN in GSTR-2A by recipient.

b) TDS Certificate shall be issued automatically in GSTR-7A on the basis of return filed by deductor in GSTR-7.

c) GSTR-1 (Sales Register): HSN Code for goods – in invoice level details

- HSN Code Classification

| Condition | HSN Code required |

| Turnover in Preceding FY | |

| – Below 1.5 crore | Only description required |

| – Above 1.5 crore | HSN upto 2 digits |

| – Above 5 crore | HSN upto 4 digits |

| Voluntary | HSN upto 6/8 digits |

| Exports/ Imports | 8 digits |

- Accounting codes for Services is mandatory

- Requirement to mention Invoice level details:

| Transaction Type | Details required |

| B2B (Intra/Inter State transaction) | Invoice level details required |

| B2C :Inter State with Transaction value > 2.5 Lakh | |

| B2C :Inter State with Transaction Value < 2.5 Lakh | Summary details on basis of recipient required |

| B2C – Intra State Transaction |

d) GSTR- 2 (Purchase Register)

- Due date is 15th of the next month but data can be uploaded on daily, fortnight, weekly too.

e) GSTR-3 (Monthly Return Form)

- Part- A is fully automated;

- Only adjustment entries and challan information will be entered in Part-B;

- Cash ledger (tax deposit in cash and TDS/ TCS) will made separately for CGST , SGST and IGST

f) Mismatching:

- Any mismatch being rectified at a later stage would be shown in GST ITC-1;

- In case of reversal of interest paid on mismatch on account of rectification of returns, the refund amount shall be credited to electronic cash ledger in GST PMT-3

- The following case shall be assumed as no mismatch:

- If ITC claimed by Buyer is less than Output tax paid by Seller

- If Reduction of Output Liability by Supplier using Credit note is less than the ITC claim reduced in return by recipient.

Free Education Guide on Goods & Service Tax (GST)