Time of Supply under GST of India

Time of Supply under Model GST Law (MGL)

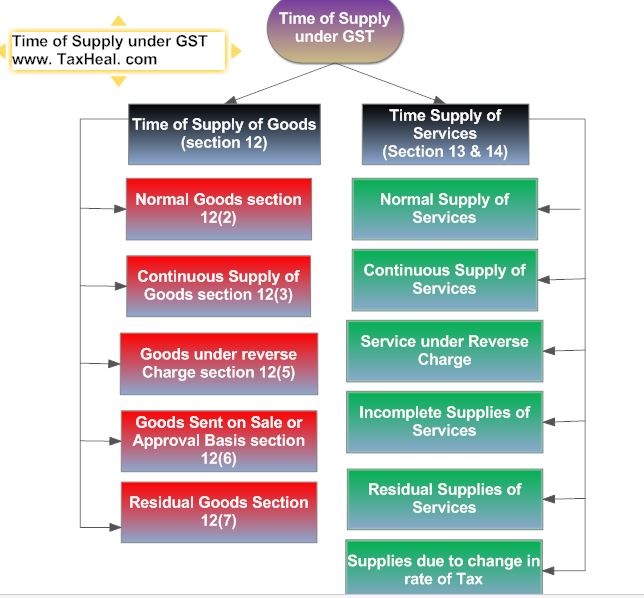

- Section 12 of Model GST Law deals with Supply of Goods

- section 13 of Model GST Law & 14 deals with Supply of Services.

A solds goods to B for Rs.100000/-. Various events of sale transactions are as under:

| Event | Date |

| Invoice Issued by A | 10.04.2017 |

| Goods Removed by A | 10.04.2017 |

| Goods received by B | 01.05.2017 |

| Purchase in the Books by B | 05.05.2017 |

| Payment received by A | 01.06.2017 |

GST Law : Tax needs to be paid within 20 days of closing of month of time of supply.

Question : Whether the GST needs to be paid by

- 20th May 2017 ?

- 20th june 2017 ?

- 20th july 2017 ?

Time of Supply of Goods can be divided under five broad heads.

- Normal Goods section 12(2)

- Continuous Supply of Goods section 12(3)

- Goods under reverse Charge section 12(5)

- Goods Sent on Sale or Approval Basis section 12(6)

- Residual Goods Section 12(7)

1. Time of Supply of Goods in case of Normal Goods

If goods are required to be removed then

Date of removal.

Section 2 (83) “removal’’, in relation to goods, means –

(a) dispatch of the goods for delivery by the supplier thereof or by any other person acting on behalf of such supplier, or

(b) collection of the goods by the recipient thereof or by any other person acting on behalf of such recipient;

Example :

| Event | Invoice Issued by A | Goods Removed by A | Goods received by B | Purchase Entry in Books by B | Time of Supply (i.e Goods Removed by A) |

| Goods Required to be Removed | 11.04.2017 | 10.04.2017 | 01.05.2017 | 05.05.2017 | 10.04.2017 |

If goods are not required to be removed then

[This can happen when goods are physically not capable of moving, supplied in assembled or installed form, supplied by the supplier to his agent or his principal.]

Earliest of any of followings :-

- Date of making goods available to the recipient. [i.e when the goods are placed at the disposal of the recipient.]

- Date of Receipt of Payment of Goods by supplier.[ i.e Earlier of the date of Credit in bank or entry in Books ]

- Date of Invoice.

- Record date by recipient in his books.

Event Invoice Issued by A Making available Goods to Recipient Entry of Payment made by B Entry of Receipt of Payment by A Credit of amount in Bank account of A Time of Supply Goods Not Required to be Removed 10.06.2017 10.06.2017 01.05.2017 02.06.2017 05.06.2017 01.05.2017

2. Time of Supply of Goods in case of Continuous Supply of Goods.

As per Section 2 (30) “continuous supply of goods” means a supply of goods which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, whether or not by means of a wire, cable, pipeline or other conduit, and for which the supplier invoices the recipient on a regular or periodic basis. As to which of the cases will be regarded as continuous supply of goods may be specified by notification by Govt.

If successive statements of accounts are issued or successive payments are involved, then

- Date of expiry of the period to which such successive statements of accounts

- Date of expiry of such successive payment period.

Event- Continuous Supply of Goods Date of invoice /

removal by A

Date of receipt of

invoice by B

Date of statement

by

supplier i.e A

Date of expiry of

successive

statements

of A/c

Date of expiry of

successive

payment

Time of Supply (5) or (6)

(1) (2) (3) (4) (5) (6) Supply of RMC 10.04.2017 11.04.2017 Supply of RMC 11.04.2017 12.04.2017 Supply of RMC 13.04.2017 15.04.2017 18.04.2017 18.04.2017 21.04.2017 18.04.2017

If no such statement of account, then

Earliest of any of the followings:-

- Date of Invoice (or any other document) or

- Date of receipt of payment

Event- Continuous Supply of Goods Date of invoice by A

Date of receipt of

payment by A

Time of Supply (1) (2) (3) Supply of RMC 21.06.2017 22.06.2017 21.06.2017 Supply of RMC 22.06.2017 23.06.2017 22.06.2017 Supply of RMC 26.06.2017 27.06.2017 26.06.2017

3. Time of Supply of Goods in case of Reverse Charge .

Earliest of any of followings :-

- Date of Receipt of goods by recipient

- Date of Payment [Earlier date of i) Debit in bank or ii) entry in books of accounts of Recipients]

- Date of Receipt of Invoice

- Date of Debits in Books of Accounts of recipient

Event- Receipt of goods by recipient Payment Entry in Books by recipient Date of Debit in the bank account of recipient Receipt of Invoice Debits in Books of Accounts of recipient Time of Supply (1) (2) (3) (4) (5) (6) Reverse Charge 29.04.2017 28.04.2017 29.04.2017 26.04.2017 25.04.2017 25.04.2017

Section 2 (85) “reverse charge’’, means the liability to pay tax by the person receiving goods and / or services instead of the person supplying the goods and / or services in respect of such categories of supplies as the Central or a State Government may, on the recommendation of the Council, by notification, specify

4. Time of Supply of Goods in case of Sale or Approval basis ( Goods removed before it is known supply will take place or not)

Earlier of the time :-

- When it becomes known that supply has taken place OR

- Six months from the date of removal (Removal with purpose of giving up control not ownership as transfer of property is not one of the precondition of supply)

Event- Date of Removal

Date of receipt by

recipient

Date of approval

Date of expiry of 6 months

from the date

of removal

Time of Supply (1) (2) (3) (4) (5) Goods sent/taken on approval basis or sale/return or similar term 10.07.2017 20.07.2017 11.08.2017 09.01.2018 11.08.2017 14.06.2017 19.06.2017 Awaited 13.12.2017 13.12.2017

5. Time of Supply of Goods in case of Residual Supplies.

[Where it is impossible to determine the Time of Supply ]

Earlier of Followings

- Date on which Periodical Return is to be filed OR

- Date on which CGST / SGST is paid,

Section 2 (83) “removal’’, in relation to goods, means –

(a) dispatch of the goods for delivery by the supplier thereof or by any other person acting on behalf of such supplier, or

(b) collection of the goods by the recipient thereof or by any other person acting on behalf of such recipient;

Time of Supply of Services can be divided under six broad heads.

- Normal Supply

- Continuous Supply

- Service under Reverse Charge

- Incomplete Supplies

- Residual Supplies

- Supplies due to change in rate of Tax.

1. Time of Supply of Services in case of Normal Supply of Services

- If Invoice is issued within prescribed period (to be prescribed by Rules) then time of supply of services to pay GST will arise earliest of

- Date of Issue of Invoice

- Date of receipt of payment [ Date on which the payment is entered in the books of accounts of the supplier or the date on which the payment is credited to his bank account, whichever is earlier]

2. If Invoice is not issued, time of supply of services to pay GST will arise earliest of

- Date of completion of service.

- Date of receipt of payment [ Date on which the payment is entered in the books of accounts of the supplier or the date on which the payment is credited to his bank account, whichever is earlier]

3. If the above provisions (i) and (ii) do not apply then time of supply of services to pay GST will shall be date on which the recipient shows the receipt of services in his books of account.

2. Time of Supply of Services in case of Continuous Supply of Services.

[Govt. may notify services which are deemed to be continuous supply of Services ]

- where the due date of payment is ascertainable from the contract, then time of supply of services shall be

Date on which the payment is liable to be made by the recipient of service, whether or not any invoice has been issued or any payment has been received by the supplier of service;

2. where the due date of payment is not ascertainable from the contract, , then time of supply of services shall be earliest of each such time when the supplier of service

- Receives the payment

- Issues an invoice

3. where the payment is linked to the completion of an event, then time of supply of services shall be the time of completion of that event

3. Time of Supply of Services in case of Reverse Charge

Earliest of

(a) Date of receipt of services, or

(b) Date on which the payment is made [Date on which the payment is entered in the books of accounts of the recipient or the date on which the payment is debited in his bank account, whichever is earlier], or

(c) Date of receipt of invoice, or

(d) Date of debit in the books of accounts.

Section 2 (85) “reverse charge’’, means the liability to pay tax by the person receiving goods and / or services instead of the person supplying the goods and / or services in respect of such categories of supplies as the Central or a State Government may, on the recommendation of the Council, by notification, specify

4. Time of Supply of Services in case of Incomplete Supplies of Services

In a case where the supply of services ceases under a contract before the completion of the supply, such services shall be deemed to have been provided at the time when the supply ceases.

5. Time of Supply of Services in case of Residual Supplies of Services [where it is impossible to determine the time of supply of services]

Time of supply of services shall be earlier of the

- Date on which Periodical Return is to be filed OR

- The date on which CGST / SGST is paid,

6. Supply of Services due to Change in Rate of Tax

Service provided before change in rate of tax then

- where the invoice has been issued and the payment is also received after the change in effective rate of tax, the time of supply shall be earliest of

- Date of receipt of payment or

- Date of issue of invoice,

Illustration -1

For our analysis let’s consider a case that the Tax rate till 30th Nov 2017 is 18% and

From 1st Dec 2017 the tax rate is being increased to 18.5%.

A Ltd agrees to do the service of diesel generator and accordingly it has

i) completed the service on 20th Nov 2017

ii) Issued an invoice on 5th Dec 2017 and

iii) Received the payment on 10th Dec 2017.

In this case, the service has been provided before the change of the tax rate i.e prior to 1st Dec 2017 and the earliest date and the time of supply is 5th Dec 2017 as invoice is issued on 5th Dec 2017 and payment is received on 10th Dec 2017 (earliest of the invoice or the payment date). The tax rate applicable here is 18%.

Illustration -2

For our analysis let’s consider a case that the Tax rate till 30th Nov 2017 is 18% and

From 1st Dec 2017 the tax rate is being increased to 18.5%.

A Ltd agrees to do the service of diesel generator and accordingly it

i) Completed the service on 20th Nov 2017 and

ii) Received the payment on 7th Dec 2017.

ii) Has issued an invoice on 15th Dec 2017 and

In this case, the service has been provided before the change of the tax rate i.e prior to 1st Dec 2017 and the earliest date and the time of supply is 7th Dec 2017 as payment is received 7th Dec 2017 invoice is issued on 15th Dec 2017 (earliest of the invoice or the payment date). The tax rate applicable here is 18%.

2. where the invoice has been issued prior to change in effective rate of tax but the payment is received after the change in effective rate of tax, the time of supply shall be the date of issue of invoice;

For our analysis let’s consider a case that the Tax rate till 30th Nov 2017 is 18% and From 1st Dec 2017 the tax rate is being increased to 18.5%.

Illustration -3

B Ltd enters into a contract to provide special security with C Ltd for their factory located in Badi from the period 1st Nov 2017 to 30th Nov 2017. B Ltd issues an invoice on 25th Nov 2017 and receives payment on 9th Dec 2017.

Invoice has been issued on 25th Nov 2017 and service is completed on 30thNov 2017 and these two dates are before the date of effective change of tax rate, the time of supply for services is 25th Nov 2017, so the effective tax rate will be 18%.

Illustration 4

Let’s say there was increase in tax rate from 18% to 20% w.e.f. 1-6-2017. What is the tax rate applicable when services provided and invoice issued before change in rate in April 2017, but payment received after change in rate in June 2017?

Ans. The old rate of 18% shall be applicable as services are provided prior to 1-6-2017.

3.where the payment is received before the change in effective rate of tax, but the invoice for the same has been issued after the change in effective rate of tax, the time of supply shall be the date of receipt of payment;

Illustration -5

For our analysis let’s consider a case that the Tax rate till 30th Nov 2017 is 18% and From 1st Dec 2017 the tax rate is being increased to 18.5%

B Ltd enters into a contract to provide special security with C Ltd for their factory located in Badi from the period 1st Nov 2017 to 30th Nov 2017. B Ltd receives payment on 19th Nov 2017 and issues an invoice on 4th Dec 2017.

Payment has been received on 19th Nov 2017 and service is completed on 30thNov 2017 and these two dates are before the date of effective change of tax rate, the time of supply for services is 19th Nov 2017, so the effective tax rate will be 18%.

Service provided after change in effective rate of tax then

- where the payment is received after the change in effective rate of tax but the invoice has been issued prior to the change in effective rate of tax, the time of supply shall be the date of receipt of payment;Illustration -6For our analysis let’s consider a case that the Tax rate till 30th Nov 2017 is 18% and From 1st Dec 2017 the tax rate is being increased to 18.5% . X Ltd agrees to do preventive maintenance for all the critical machinery in the factory by 25th of Dec 2017 and accordingly it has received payment on 28th of Dec 2017 and issued an invoice on 27th of Nov 2017.In the above case, the time of supply will be the date on which payment has been received i.e 28th Dec 2017 and the effective tax rate would be 18.5% as service is completed after the tax rate change.

- where the invoice has been issued and the payment is received before the change in effective rate of tax, the time of supply shall be earliest of

- Date of receipt of payment or

- Date of issue of invoicellustration -7For our analysis let’s consider a case that the Tax rate till 30th Nov 2017 is 18% and From 1st Dec 2017 the tax rate is being increased to 18.5% . A Ltd agrees to do the service of diesel generator and accordingly it has issued an invoice on 15th Nov 2017 ,received the payment on 17th Nov 2017 and completed the service on 20th Dec 2017.In the case, the effective tax rate would be 18%, as the time of supply is 15thNov 2017, this is the earliest date of issue of invoice or receipt of payment.

3.where the invoice has been issued after the change in effective rate of tax but the payment is received before the change in effective rate of tax, the time of supply shall be the date of issue of invoice.

For our analysis let’s consider a case that the Tax rate till 30th Nov 2017 is 18% and From 1st Dec 2017 the tax rate is being increased to 18.5%

A Ltd agrees to do the service of diesel generator and accordingly r eceived the payment on 7th Nov 2017.It has issued an invoice on 10th Dec 2017 and completed the service on 20th Dec 2017

In this case, the time of supply will be the issue of invoice date i.e 10th Dec 2017 and the tax rate will be 18.5%

Note

- “the date of receipt of payment” shall be the date on which the payment is entered in the books of accounts of the supplier or the date on which the payment is credited to his bank account, whichever is earlier:

- Date of receipt of payment shall be the date of credit in the bank account when such credit in the bank account is after four working days from the date of change in the effective rate of tax.

Q :Suppose part advance payment is made or invoice issued is for part payment, whether the time of supply will cover the full supply?

Ans. No. The supply shall be deemed to have been made to the extent it is covered by the invoice or the part payment.

Meaning of ‘supplier’

“Supplier” in relation to any goods and/or services shall mean the person supplying the said goods and/or services and shall include an agent acting as such on behalf of such supplier in relation to the goods and/or services supplied – clause 2(91) of GST Model Law, 2016.

Meaning of ‘recipient’

As per clause 2(80) of GST Model Law, 2016, “recipient” of supply of goods and/or services means—

| (a) | where a consideration is payable for the supply of goods and/or services, the person who is liable to pay that consideration, | |

| (b) | where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available, and | |

| (c) | where no consideration is payable for the supply of a service, the person to whom the service is rendered,and any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply. |

Explanation – The expression “recipient” shall also include an agent acting as such on behalf of the recipient in relation to the goods and/or services supplied.

Free Education Guide on Goods & Service Tax (GST)