Frontend Business Process on GST Portal

Q 1. What is GSTN?

Ans. Goods and Services Tax Network (GSTN) is a nonprofit non-government company, which will provide shared IT infrastructure and service to both central and state governments including tax payers and other stakeholders. The Frontend services of registration, Returns and payments to all taxpayers will be provided by GSTN. It will be the interface between the government and the taxpayers.

Q 2. What is the genesis of GSTN?

Ans. The GST System Project is a unique and complex IT initiative. It is unique as it seeks, for the first time to establish a uniform interface for the tax payer and a common and shared IT infrastructure between the Centre and States. Currently, the Centre and State indirect tax administrations work under different laws, regulations, procedures and formats and consequently the IT systems work as independent sites. Integrating them for GST implementation would be complex since it would involve integrating the entire indirect tax ecosystem so as to bring all the tax administrations (Centre, State and Union Territories) to the same level of IT maturity with uniform formats and interfaces for taxpayers and other external stakeholders. Besides, GST being a destination based tax, the inter- state trade of goods and services (IGST) would need a robust settlement mechanism amongst the States and the Centre. This is possible only when there is a strong IT Infrastructure and Service back bone which enables capture, processing and exchange of information amongst the stakeholders (including taxpayers, States and Central Government, Bank and RBI).

This aspect was discussed in the 4th meeting of 2010 of the Empowered Committee of State Finance Ministers held on 21/7/2010. In the said meeting the EC approved creation of an ‘Empowered Group on IT Infrastructure for GST’ (referred as EG) under the chairmanship of Dr. Nandan Nilekani along with Additional Secretary (Rev), Member (B&C) CBEC, DG (Systems), CBEC, FA Ministry of Finance, Member Secretary EC and five state commissioners of Trade Taxes (Maharashtra, Assam, Karnataka, West Bengal and Gujarat). The Group was mandated to suggest, inter alia, the modalities for setting up a National Information Utility (NIU/ SPV) for implementing the Common Portal to be called GST Network (GSTN) and recommend the structure and terms of reference for the NIU/ SPV, detailed implementation strategy and the road map for its creation in addition to other items like training, outreach etc.

In March 2010, TAGUP constituted by the Ministry of Finance had recommended that National Information Utilities should be set up as private companies with a public purpose for implementation of large and complex Government IT projects including GST. Mandate of TAGUP was to examine the technological and systemic issues relating to the various IT projects such as GST, TIN, NPS, etc.

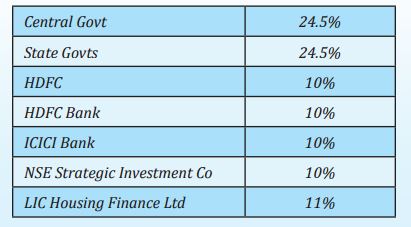

The EG had seven meetings between 2nd August 2010 and 8th August 2011 to discuss the modalities. After due deliberations, the EG recommended creation of a Special Purpose Vehicle for implementing the GST System Project. To enable efficient and reliable provision of services in a demanding environment, the EG recommended a nonGovernment structure for the GSTN SPV with Government equity of 49% (Centre – 24.5% and States – 24.5%) after considering key parameters such as independence of management, strategic control of Government, flexibility in organizational structure, agility in decision making and ability to hire and retain competent human resources.

In view of the sensitivity of the role of GSTN and the information that would be available with it, the EG also considered the issue of strategic control of Government over GSTN. The Group recommended that strategic control of the Government over the SPV should be ensured through measures such as composition of the Board, mechanisms of Special Resolution and Shareholders Agreement, induction of Government officers on deputation, and agreements between GSTN SPV and Governments. Also, the shareholding pattern would ensure that the Centre individually and States collectively are the largest stakeholders at 24.5% each. In combination, the Government shareholding at 49% would far exceed that of any single private institution.

EG also brought out the need to have technology specification to run this company so that there is 100 percent matching of returns. The business knowledge resides with the officials of Government of India and States. However, professionals with sophisticated technology knowledge will be required to run this company independently, similar to NSDL which is working professionally and independently. EG also recommended a non-government company as that will have operational freedom.

These recommendations were presented before the Empowered Committee of State Finance Ministers in its 3rd meeting of 2011 held on 19th August 2011 and in the 4th meeting of 2011 of the EC held on 14th Oct 2011. The proposal of the EG on IT infrastructure for GST regarding GSTN and formation of a non-profit section 25 company with the strategic control with the Government were approved by the Empowered Committee of State Finance Ministers (EC) in its meeting held on 14.10.11.

The note of Department of Revenue for setting up a Special Purpose Vehicle to be called Goods and Services Tax Network on the lines mentioned above was considered by the Union Cabinet on 12th April 2012 and approved. The Union cabinet also approved the following:

i. Suitable and willing non-government institutions will be identified and firmed up by the Ministry of Finance to invest in GSTN-SPV prior to its incorporation.

ii. The strategic control of the Government over the SPV would be ensured through measures such as composition of the Board, mechanisms of Special Resolution and Shareholders Agreement, induction of Government officers on deputation, and agreements between GSTN SPV and Governments.

iii. The Board of Directors of GSTN SPV would comprise 14 Directors with 3 Directors from the Centre, 3 from the States, a Chairman of the Board of Directors appointed through a joint approval mechanism of Centre and States, 3 Directors from private equity stake holders, 3 independent Directors who would be persons of eminence and a CEO of the GSTN SPV selected through an open selection process.

iv. Relaxation in relevant rules to enable deputation of Government officers to the GSTN SPV for exercise of strategic control and for bringing in necessary domain expertise.

v. GSTN SPV would have a self- sustaining revenue model, where it would be able to levy user charges on the tax payers and the tax authorities availing services.

vi. GSTN SPV to be the exclusive national agency responsible for delivering integrated indirect Tax related services involving multiple tax authorities. Accordingly, any other service provider seeking to deliver similar integrated services would be required to enter into a formal arrangement with GSTN SPV for the services.

vii. A one- time non- recurring Grant- in aid of Rs. 315 crore from the Central Government towards expenditure for the initial setting up and functioning of the SPV for a three year period after incorporation.

In compliance of the Cabinet decision, GST Network was registered as a not-for-profit, private limited company under section 25 of the Companies Act, 1956 with the following equity structure:

The GSTN in its current form was created after taking after approval of Empowered Committee of State Finance Ministers and Union Government after due deliberations over a long period of time.

Q 3. What services will be rendered by GSTN?

Ans. GSTN will render the following services through the Common GST Portal:

(a) Registration (including existing taxpayer master migration and issue of PAN based registration number);

(b) Payment management including payment gateways and integration with banking systems;

(c) Return filing and processing;

(d) Taxpayer management, including account management, notifications, information, and status tracking;

(e) Tax authority account and ledger Management;

(f) Computation of settlement (including IGST settlement) between the Centre and States; Clearing house for IGST;

(g) Processing and reconciliation of GST on import and integration with EDI systems of Customs; (h) MIS including need based information and business intelligence;

(i) Maintenance of interfaces between the Common GST Portal and tax administration systems;

(j) Provide training to stakeholders;

(k) Provide Analytics and Business Intelligence to tax authorities; and

(l) Carry out research, study best practices and provide training to the stakeholders

Q 4. What is the interface system between GSTN and the states/CBEC?

Ans. In GST regime, while taxpayer facing core services of applying for registration, uploading of invoices, filing of return, making tax payments shall be hosted by GST System, all the statutory functions (such as approval of registration, assessment of return, conducting investigation and audit etc.) shall be conducted by the tax authorities of States and Central governments.

Thus, the frontend shall be provided by GSTN and the backend modules shall be developed by states and Central Government themselves. However 24 states (termed as Model 2 states) have asked GSTN to develop their backend modules also. The CBEC and rest of the states (Model 1) have decided to develop and host the back-end modules themselves.

Q 5. What will be the role of GSTN in registration?

Ans. The application for Registration will be made Online on GST Portal.

Some of the key data like PAN, Business Constitution, Aadhaar, CIN/DIN etc. (as applicable) will be validated online against respective agency i.e. CBDT, UID, MCA etc, thereby ensuring minimum documentation.

The application data, supporting scanned documents shall be sent by GSTN to states/ Centre which in turn shall send the query, if any, approval or rejection intimation and digitally signed registration to GSTN for eventual download by the taxpayer.

Q 6. What is the role of Infosys in GSTN?

Ans. GSTN has engaged M/S Infosys as a single Managed Service Provider (MSP) for the design, development, deployment of GST system, including all application software, tools and Infrastructure and operate & maintain the same for a period of 5 years from Go-Live.

Q 7. What are the basic features of GST common portal?

Ans. The GST portal shall be accessible over Internet (by Taxpayers and their CAs/Tax Advocates etc.) and Intranet by Tax Officials etc. The portal shall be one single common portal for all GST related services e.g.–

i. Tax payer registration (New, surrender, cancelation, etc.);

ii. Invoices upload, auto-drafting of Purchase register of buyer Periodic GST Returns filing;

iii. Tax payment including integration with agency banks;

iv. ITC and Cash Ledger and Liability Register;

v. MIS reporting for tax payers, tax officials and other stakeholders;

vi. BI/Analytics for Tax officials.

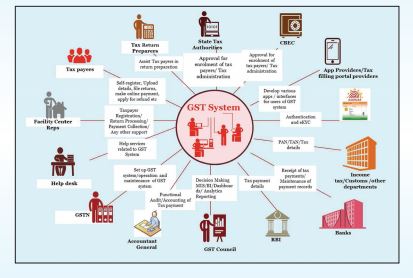

Q 8. What is the concept of GST Eco-system?

Ans. A common GST system will provide linkage to all State/UT Commercial Tax departments, Central Tax authorities, Taxpayers, Banks and other stakeholders. The eco-system consists of all stakeholders starting from taxpayer to tax professional to tax officials to GST portal to Banks to accounting authorities. The diagram given below depicts the whole GST eco-system.

Q 9. What is GSP (GST Suvidha Provider)?

Ans. The GST System is being developed by Infosys, the Managed Service Provider (MSP). The work consists of development of GST Core System, provisioning of required IT infrastructure to host the GST System and running and operating the system for five years.

The proposed GST envisages all filings by taxpayers electronically. To achieve this, the taxpayer will need tools for uploading invoice information, matching of input tax credit (ITC) claims, creation of party-wise ledgers, uploading of returns, payment of taxes, signing of such document with digital signature etc.

The GST System will have a G2B portal for taxpayers to access the GST Systems, however, that would not be the only way for interacting with the GST system as the taxpayer via his choice of third party applications, which will provide all user interfaces and convenience via desktop, mobile, other interfaces, will be able to interact with the GST system. The third party applications will connect with GST system via secure GST system APIs. All such applications are expected to be developed by third party service providers who have been given a generic name, GST Suvidha Provider or GSP.

Taxpayers will interface with GST System via GST system portal or via GSP ecosystem provided by way of applications for activities such as Registration, Tax payments, Returns filing and other information exchange with GST core system. The GSPs will become the user agencies of the GST system APIs and build applications and web portals as alternate interface for the taxpayers.

Q 10. What will be the role of GST Suvidha Providers?

Ans. The GSP developed Apps will connect with the GST system via secure GST system APIs. Some of the functions of GSP are:

• Development of various apps / interfaces for taxpayer, TRPs of GST system

• Providing other value added services to the taxpayers

The GST Suvidha Providers (GSPs) are envisaged to provide innovative and convenient methods to taxpayers and other stakeholders in interacting with the GST Systems from registration of entity to uploading of invoice details to filing of returns. Thus there will be two sets of interactions, one between the App user and the GSP and the second between the GSP and the GST System.

Q 11. What are the benefits to taxpayers in using the GSPs?

Ans. A GSP providing tax accounting software will have the advantage of already providing the tax payer with a vast majority of the taxation functionality. It will help the tax payer if the delta process of upload of the invoice/ return and reconciliation of the same is also provided by the GSP. Whereas in case of GST portal, another set of exercise manually or otherwise will have to be done to upload the invoice data or the return. The interface and features exposed by GST portal will be uniform for all taxpayers and might be basic in form and design. On the other hand GSPs are expected to have richer interfaces and features required by specific group (large taxpayers with completely automated financial system,SME with semi-automated system and small size with no system) of taxpayers. Also, by sheer size the GST portal will not be as nimble as that provided by a GSP

GSPs can come up with application to provide GST filing facility in existing software or develop end-to-end solution for SME and small taxpayer to manage their sale/purchase and GST filing e.g. an offline utility like spread sheet, which taxpayer can fill their invoice details and then upload on GST portal for processing. Similarly, for Tax Consultants (TC), GSPs can provide dashboard to display list of his/her all clients and clicking on a particular client can give TC the snapshot of the actions/ pending actions by client.

GSPs can provide innovative/value added features, which would distinguish them with other GSPs in the market.

Source: http://www.gstn.org/ecosystem/faq_question.php

Q 12. What will be the role of taxpayers w.r.t GST Common Portal being developed and maintained by GSTN?

Ans. Some of the functions which will be performed by taxpayers through GSTN are:

• Application for registration as taxpayer, and profile management;

• Payment of taxes, including penalties and interest;

• Uploading of Invoice data & filing returns / annual statements;

• Status review of return/tax ledger/cash ledger

Q 13. What will be the role of tax officers from State and Central Govt in respect of the GST system being developed by GSTN?

Ans. The officers will be required to use GSTN information at the backend for following functions:

• Approval/rejection for enrollment/registration of taxpayers;

• Tax administration of state tax(Assessment / Audit /Refund / Appeal/ Investigation);

• MIS and other functions.

Q 14. Will GSTN generate a unique identification for each invoice line in GSTN system?

Ans. No, GSTN will not generate any new identification. The combination of Supplier’s GSTIN, Invoice no and Financial year with HSN/SAC Code will make each line unique

Q 15. Can invoice data be uploaded on day to day basis?

Ans. Yes, GST Portal will have functionality to take invoice data on any time basis. Earlier one uploads better it is as it will get reflected to the receiver who can see the same in his/her purchase register.

Q 16. Will GSTN provide tools for uploading invoice data on GST portal?

Ans. Yes, GSTN will provide spreadsheet (like Microsoft Excel) like tools free of cost to taxpayers to enable them to compile invoice data in the same and upload invoice data in one go. This will be an offline tool which can be used to inputs invoice data without being online and then upload the invoice data in one go for few hundred invoices.

Q 17. Will GSTN be providing mobile based Apps to view ledgers and other accounts?

Ans. Yes, the GST portal is being designed in such a way that it can be seen on any smart phone. Thus ledgers like cash ledger, liability ledger, ITC ledger etc. can be seen on a mobile phone.

Q 18. Will GSTN provide separate user ID and password for Tax Professional to enable them to work on behalf of their customers (Taxpayers) without requiring user ID and password of taxpayers, as happens today?

Ans. Yes, GSTN will be providing separate user ID and Password to Tax Professional to enable them to work on behalf of their clients without asking for their user ID and passwords. The tax professional will be able to do all the work on behalf of taxpayers as allowed under GST Law except final submission, which will be done by the taxpayers using e-sign (OTP) or Digital Signature Certificate.

Q 19. Will tax payer be able to change the tax professional once chosen in above mentioned facility?

Ans. Yes, a taxpayer may choose a different tax professional by simply unselecting it at GSTN portal and delegating to a new tax professional.

Q 20. Will existing taxpayers under Central Excise or Service Tax or State VAT have to apply for fresh registration under GST?

Ans. No, the existing taxpayers whose PAN have been validated from CBDT database will not be required to apply afresh. They will be issued provisional GSTIN by GST portal, which will be valid for six months for providing relevant data as per GST registration form. On completion of data filing provisional registration will get converted into regular Registration. Further notification giving timelines will be issued by respective tax authorities.

Q 21. Will GSTN put training videos on various aspects of working on GST portal for the benefit of taxpayers?

Ans. Yes, GSTN is preparing Computer Based Training materials which have videos embedded into them for each process to be performed on the GST portal. These will be put on the GST portal as well as on the website of all tax authorities.

Q 22. Will the return and registration data furnished by the taxpayers on the GST Common Portal will remain Confidential?

Ans. Yes, all steps are being taken by GSTN to ensure the confidentiality of personal and business information furnished by the taxpayers on GST Common Portal. This will be done by ensuring Role Based Access Control (RBAC) and encryption of critical data of taxpayers both during transit and in storage. Only the authorized tax authorities will be able to see and read the data.

Q 23. What are the security measures being taken by GSTN to ensure security of the GST system?

Ans. GST Systems project has incorporated state of art security framework for data and service security. Besides high end firewalls, intrusion detection, data encryption at rest as well as in motion, complete audit trail, tamper proofing using consistent hashing algorithms, OS and host hardening etc., GSTN is also establishing a primary and secondary Security Operations Command & Control center, which will proactively monitor and protect malicious attack in real time. GSTN is also ensuring secure coding practices through continuous scanning of source code to protect against commonly known and unknown threats.