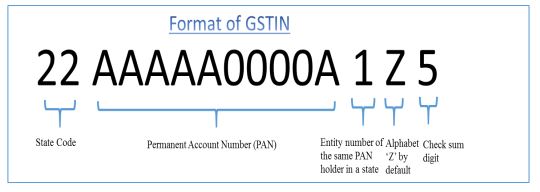

GSTIN Number Format

All of businesses registered under GST will be assigned a unique Goods and Services Tax Identification Number ( GSTIN ) under GST of India.

- The first two digits of GSTN number will represent the state code as per Indian Census 2011

- The next ten digits will be the PAN number of the taxpayer

- The thirteenth digit will be assigned based on the number of registration within a state

- The fourteenth digit will be Z by default

- The last digit will be for check code

A format of proposed GSTIN has been shown in the image below.

Provisional GSTIN and final GSTIN will be same

GSTIN declaration mandatory for all Importer and Exporters w.e.f 01.07.2017

PAN/GSTIN to be used as IEC code – Importer Exporter Code : DGFT

Sir,

I am a service provider.

My annual turnover is FAR LESS than Rs. 20.00 lakhs.

As per Sec. 22, I need not obtain the Regn. number.

But my clients, who have computerised their data-base, want me to mention the GSTN in their data-format.

I am threatended that I will loose my clients, due to no fault of mine.

Kindly advise me, what should I do to tide over this hassle.

What are Govt. guidelines in such cases.

Does the Govt. want small and tiny service providers to fall in line with farmers.

M.Balachandran

Chartered Engineer, Hyderabad

9959177768

I want purchase a car on my partner ship firm name , can under GST , ITC on car be adjusted with Out put GST of my partnership firm