History of GST in India

What are the major chronological events that have led to the introduction of GST?

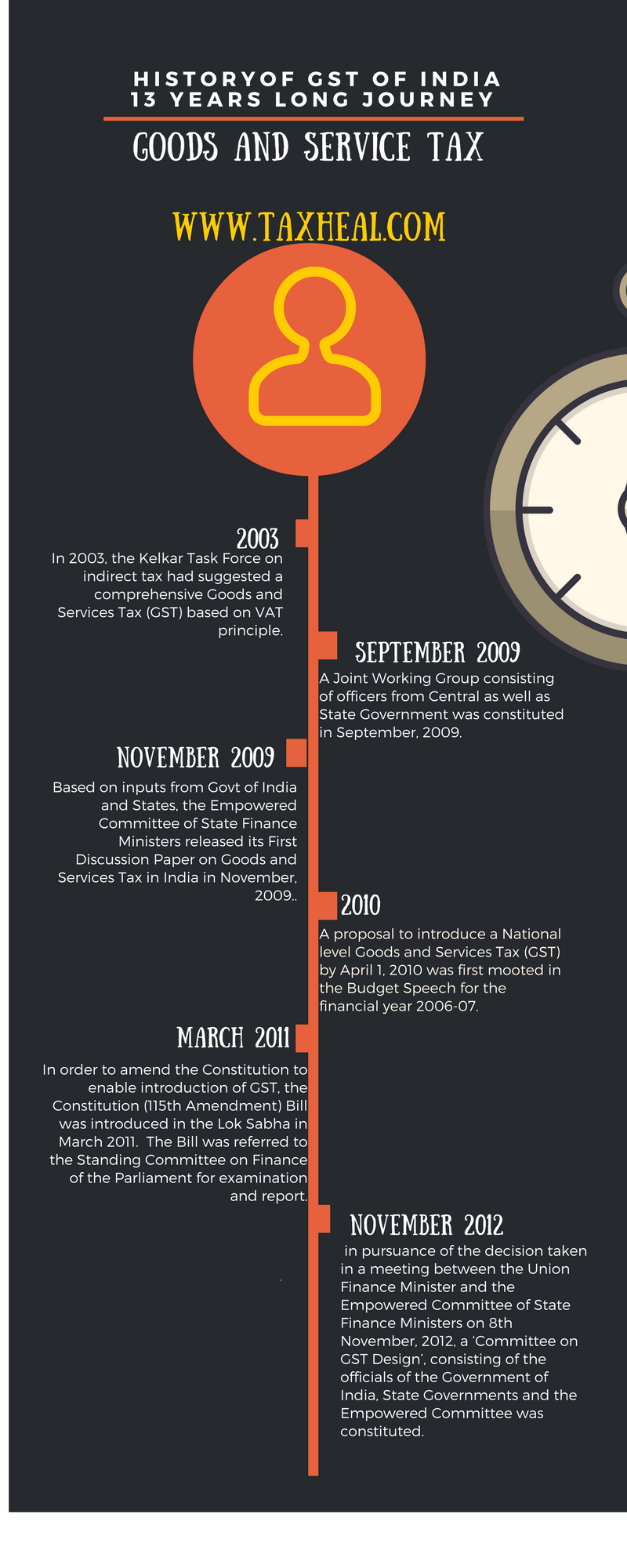

History of GST India : 13 years Long Journey

GST is being introduced in the country after a 13 year long journey since it was first discussed in the report of the Kelkar Task Force on indirect taxes. A brief chronology outlining the major milestones on the proposal for introduction of GST in India is as follows:

- In 2003, the Kelkar Task Force on indirect tax had suggested a comprehensive Goods and Services Tax (GST) based on VAT principle.

- A proposal to introduce a National level Goods and Services Tax (GST) by April 1, 2010 was first mooted in the Budget Speech for the financial year 2006-07. As per Budget Speech , Para 116 of Finance Minister :-

116. I wish to record my deep appreciation of the spirit of cooperative federalism displayed by State Governments and especially their Finance Ministers. At my request, the Empowered Committee of State Finance Ministers has agreed to work with the Central Government to prepare a roadmap for introducing a national level Goods and Services Tax (GST) with effect from April 1, 2010.

- Since the proposal involved reform/ restructuring of not only indirect taxes levied by the Centre but also the States, the responsibility of preparing a Design and Road Map for the implementation of GST was assigned to the Empowered Committee of State Finance Ministers (EC).

- Based on inputs from Govt of India and States, the EC released its First Discussion Paper on Goods and Services Tax in India in November, 2009.[ Read First Discussion Paper on Goods and Services Tax in India dated 10.11.2009]

- In order to take the GST related work further, a Joint Working Group consisting of officers from Central as well as State Government was constituted in September, 2009.

- In order to amend the Constitution to enable introduction of GST, the Constitution (115th Amendment) Bill was introduced in the Lok Sabha in March 2011. As per the prescribed procedure, the Bill was referred to the Standing Committee on Finance of the Parliament for examination and report.

- Meanwhile, in pursuance of the decision taken in a meeting between the Union Finance Minister and the Empowered Committee of State Finance Ministers on 8th November, 2012, a ‘Committee on GST Design’, consisting of the officials of the Government of India, State Governments and the Empowered Committee was constituted.

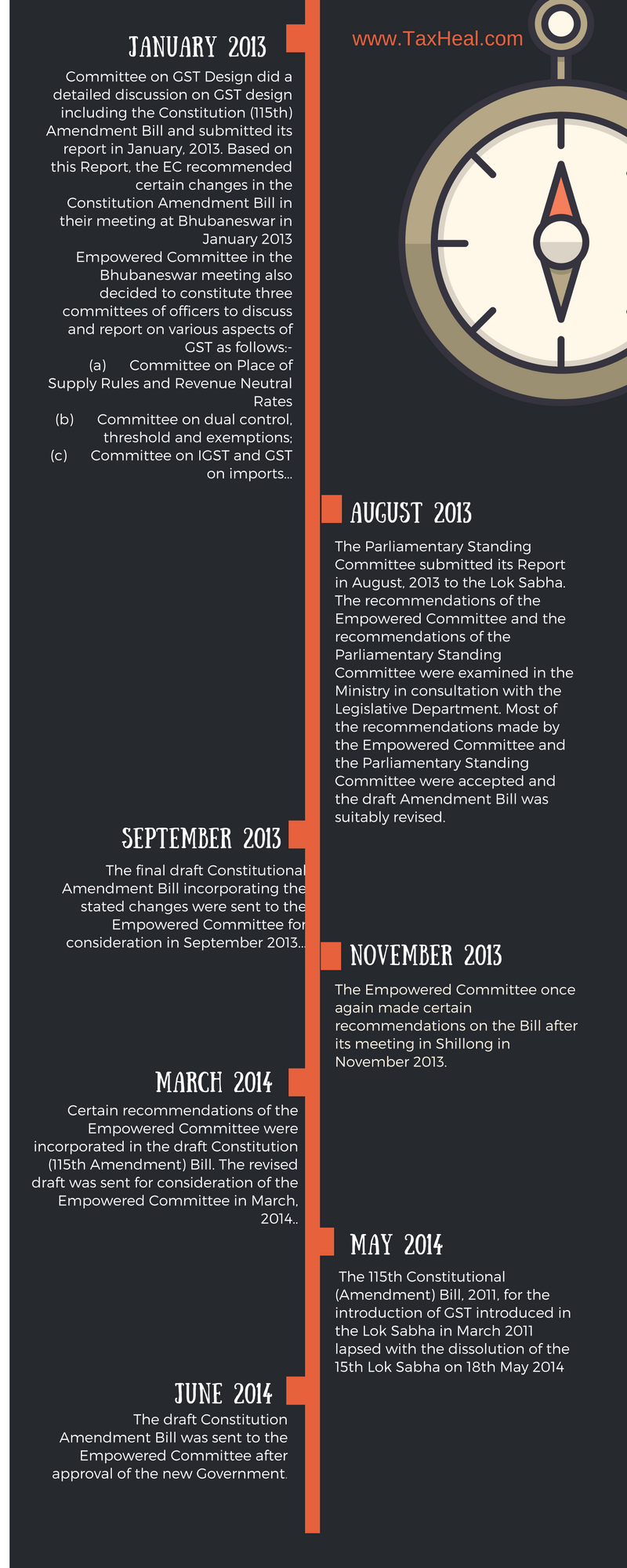

- This Committee did a detailed discussion on GST design including the Constitution (115th) Amendment Bill and submitted its report in January, 2013. Based on this Report, the EC recommended certain changes in the Constitution Amendment Bill in their meeting at Bhubaneswar in January 2013.

- The Empowered Committee in the Bhubaneswar meeting also decided to constitute three committees of officers to discuss and report on various aspects of GST as follows:-

(a) Committee on Place of Supply Rules and Revenue Neutral Rates;

(b) Committee on dual control, threshold and exemptions;

(c) Committee on IGST and GST on imports.

- The Parliamentary Standing Committee submitted its Report in August, 2013 to the Lok Sabha. The recommendations of the Empowered Committee and the recommendations of the Parliamentary Standing Committee were examined in the Ministry in consultation with the Legislative Department. Most of the recommendations made by the Empowered Committee and the Parliamentary Standing Committee were accepted and the draft Amendment Bill was suitably revised.

- The final draft Constitutional Amendment Bill incorporating the above stated changes were sent to the Empowered Committee for consideration in September 2013.

- The EC once again made certain recommendations on the Bill after its meeting in Shillong in November 2013. Certain recommendations of the Empowered Committee were incorporated in the draft Constitution (115th Amendment) Bill. The revised draft was sent for consideration of the Empowered Committee in March, 2014.

- The 115th Constitutional (Amendment) Bill, 2011, for the introduction of GST introduced in the Lok Sabha in March 2011 lapsed with the dissolution of the 15th Lok Sabha.

- In June 2014, the draft Constitution Amendment Bill was sent to the Empowered Committee after approval of the new Government.

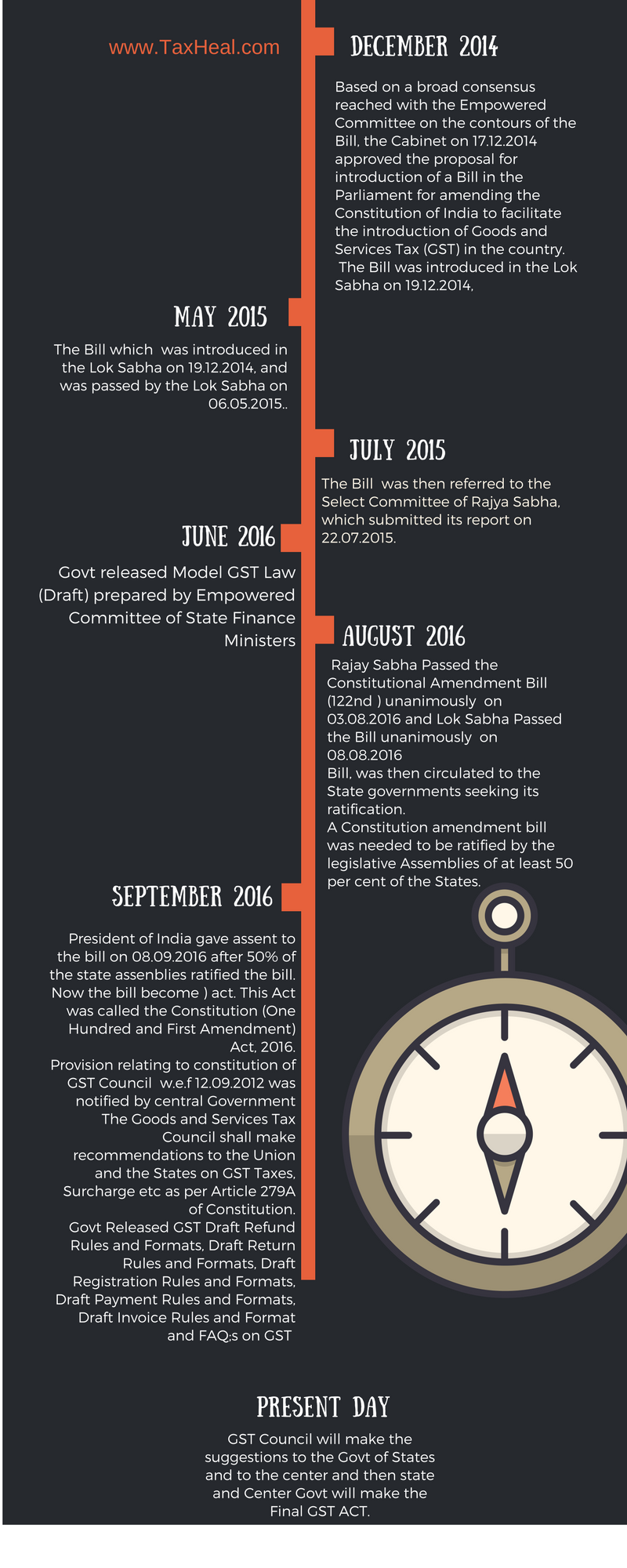

- Based on a broad consensus reached with the Empowered Committee on the contours of the Bill, the Cabinet on 17.12.2014 approved the proposal for introduction of a Bill in the Parliament for amending the Constitution of India to facilitate the introduction of Goods and Services Tax (GST) in the country. The Bill was introduced in the Lok Sabha on 19.12.2014, and was passed by the Lok Sabha on 06.05.2015. It was then referred to the Select Committee of Rajya Sabha, which submitted its report on 22.07.2015.

History of GST : List of States who ratified the GST Constitutional Amendment Bill

| S.NO | State | Passed On | Government |

| 1 | Assam | 12th August, 2016 | BJP, CM Chief Minister Sarbananda Sonowal |

| 2 | Bihar | 16TH August, 2016 | RJD-JDU, CM Nitish Kumar |

| 3 | Jharkhand | 17th August, 2016 | BJP, CM Raghubar Das |

| 4 | Himachal Pradesh | 22nd August, 2016 | Congress, CM Virbhadra Singh |

| 5 | Chhattisgarh | 22nd August, 2016 | BJP, CM RAMAN SINGH |

| 6 | Gujrat | 23rd August, 2016 | BJP, CM Vijay Rupani |

| 7 | Madhya Pradesh | 24th August, 2016 | BJP, CM Shivraj Singh Chouhan |

| 8 | Delhi | 24th August, 2016 | AAP, CM Arvind Kejriwal |

| 9 | Nagaland | 26th August, 2016 | Naga People’s Front, CM T.R. Zeliang |

| 10 | Maharashtra | 29th August, 2016 | BJP-SHIVSENA, CM Devendra Fadnavis |

| 11 | Haryana | 29th August, 2016 | BJP, CM Manhoar Lal Khattar |

| 12 | Sikkim | 30th August, 2016 | SDF, Pawan Kumar Chamling |

| 13 | Telangana | 30th August, 2016 | TRS, CM Kalvakuntala Chandrasekhara Rao |

| 14 | Mizoram | 30th August, 2016 | Congress, CM Lal Thanawala |

| 15 | GOA | 31th August, 2016 | BJP, CM Lakshmikant Pareskar |

| 16 | Odhisha | 1th September, 2016 | BJD, CM Naveen Patnaik |

| 17 | Puducherry | 2th September, 2016 | Congress, V. Narayanaswamy |

| 18 | Rajasthan | 2th September, 2016 | BJP, CM Vasundhara Raje |

| 19 | Andhra Pradesh | 8th September, 2016 | TDP, CM N. Chandrababu Naidu |

| 20 | Arunachal Pradesh | 8th September, 2016 | Janta Party, CM Prem Khandu |

| 21 | Meghalya | 9th September, 2016 | Congress, CM Mukul Sangma |

| 22 | Punjab | 12th September, 2016 | BJP-AKAALI, CM Prakash Singh Badal |

| 23 | Tripura | 26th September, 2016 | CPI, CM Manik Sarkar |

Related Post

- Model GST Law Released by Govt

- FAQs on GST Released by Govt

- Book on GST- Complete Guide to Model GST Law- June 2016 Edition

- Model GST Draft Law ;Brief Analysis

- TDS Provisions under Model GST Law : Analysis

- Buy-one-get-one-free deals to come under GST

- GST on E commerce transactions

- Cross-charge transactions under GST

- GST – Treatment of Supply without consideration

- Time of Supply Rules under Model GST Law

- Model GST Law Key Points

- Agriculture in Model GST Law

- Roadmap for the implementation of GST