Direct Taxes Committee of ICAI made detailed representation to Central Board of Direct Taxes during the Direct Tax Workshop with CBDT which was followed by written representation to Chairman, CBDT on 31.03.2016 and Hon’ble Finance Minister, on 7.04.2016 for deferment of implementation of ICDS(For copy click here). On invitation by CBDT subsequently, the ICAI representatives met Joint Secretary (TPL-I) and Director (TPL-III) at North Block, New Delhi on 18th April, 2016 and 27th April, 2016 and made detailed presentation on difficulties that would be faced by stakeholders on implementation of ICDS. The representations made by ICAI were considered positively by the Expert Committee on ICDS in meeting held on 12.05.2016 and ICAI was asked to prepare detailed FAQs and amendments to ICDS which were submitted on 20.05.2016 (For copy click here).

Annexure

Frequently Asked Questions (FAQs) on Income Computation Disclosure Standards (ICDSs)

Question 1: Preamble of ICDS I states that this ICDS is applicable for computation of income chargeable under the head “Profits and gains of business or profession” or “Income from other sources” and not for the purposes of maintenance of books of accounts. However, Para 1 states that ICDS I deals with significant accounting policies. Accounting policies are applied for recording entries in books of account and preparing financial statements. So, what is the interplay between ICDS I and computation of total income?

Answer: ICDS is not meant for passing entries in the books of accounts or preparing financial statements. Its scope is restricted to computation of total income. Taxpayers are required to prepare financial statements as per Generally Accepted Accounting Policies applicable to them. For example, companies are required to maintain books of account and prepare financial statements as per requirements of Companies Act 2013. ICDS 1 does not apply to such taxpayers except Para 4(ii) and paras 6 to 10. ICDS 1 applies to those taxpayers (like individuals , HUF, Partnership firms and LLPs) who prepare financial statements pursuant to section 44AA and 44AB of the Act i.e. for the limited purpose of computation of total income under the Act.

Question 2: Does ICDS apply to non-corporate taxpayers who are not required to maintain books of account and/or those who are covered by presumptive scheme of taxation like s.44AD, 44AE, 44ADA, 44B, 44BB, 44BBA, etc.?

Answer : These sections 44AD, 44AE, 44ADA , 44BB , 44BBA etc. deals with a situation where assessee is engaged in business and provides special mechanism for computing income under the Head “Profits & Gains from business” in terms of special deeming provisions for income and deductions. Preamble to each ICDS specifies that in case of a conflict between the provisions of the Act and ICDS, and then the provisions of the Act will prevail. Also, such assessee are not required to maintain any books of accounts and follow any method of accounting, the provisions of section 145(1) does not apply to such assessee and ICDS are notified under section 145 of the Act. Hence, ICDS shall not apply to taxpayers covered by presumptive scheme of taxation like section 44AD, 44AE, 44ADA, 44B, 44BB, 44BBA, etc. Further, for the purposes of proper and efficient administration of ICDS, it is also clarified that ICDS shall not apply to Individuals, HUFs, partnership firms and LLPs who are not required to get their accounts audited under section 44AB of the Act.

Question 3: If there is conflict between ICDS and other specific Rules governing taxation of income like Rule 9A, 9B, etc., which provisions shall prevail?

Answer: In case of conflict between ICDS and other Income Tax Rules, specific Income Tax Rules, 1962 shall prevail.

Question 4: ICDS is framed on the basis of accounting standards notified by Ministry of Corporate Affairs vide Notification No. GSR 739(E) dated 7 December 2006 under section 211(3C) of erstwhile Companies Act 1956. However, MCA has notified in February 2015 a new set of standards called ‘Indian Accounting Standards’ (Ind-AS) which represent converged form of IFRS standards. How will ICDS apply to companies covered by Ind-AS?

Answer: ICDS will apply for computation of taxable income under the head Profit & Gains of Business under the Income Tax Act. This is irrespective of the accounting standards i.e. either Accounting Standards or Ind-AS. The computation of book profit for MAT purpose will be as per the existing provisions of the Income Tax Act.

Question 5: Whether ICDS will impact Minimum Alternate Tax liability under section 115JB of the Act for companies or under section 115JC of the Act for taxpayers other than companies?

Answer : Minimum Alternate Tax under section 115JB of the Act is computed on ‘book profit’ of companies for which start point is net profit as per Profit and Loss Account prepared under Companies Act and which further is subjected to specified upward and downward adjustments. ICDS shall not impact computation of such ‘book profit’ since ICDS is applicable to computation of income under normal provisions of the Act.

However, Alternative Minimum Tax under section 115JC of the Act is computed on the basis of total income computed under normal provisions of the Act subject to addition of specified tax incentives. Hence, ICDS shall apply to computation of total income which forms start point for such computation of Alternative Minimum Tax.

Question 6: Certain taxpayers like Banks, non-banking financial institutions, insurance companies, power sector, telecom sector, etc. are governed by sector specific accounting guidelines laid down by RBI, NHB, IRDA, TRAI, etc. Does ICDS override the accounting guidelines laid down by such sector specific guidelines?

Answer: It is hereby clarified that ICDS is meant for computation of total income under Income Tax Act 1961 and not for the purpose of maintenance of books of accounts. Taxpayers like Banks, nonbanking financial institutions, insurance companies, power sector, telecom sector, etc. will continue to follow accounting guidelines by its Regulators for maintenance of books of accounts &preparation of financial statements. Further, it is also clarified that ICDS does consider that certain taxpayers may be governed by sector specific guidelines. For example, ICDS VIII relating to securities does not apply to securities held by mutual funds, venture capital funds, banks and public financial institutions. Similarly, ICDS X excludes contingent provisions, contingent liabilities and contingent assets arising in insurance business from contracts with policyholders. Further, there are specific provisions in the Act like sections 42, 43D, 44, Chapter XII-G, etc. which govern taxation of taxpayers governed by sector specific regulations. Therefore, such sector specific taxpayers like Banks, non-banking financial institutions, insurance companies, power sector, telecom sector, etc. will be required to compute taxable income as per ICDS and by sector specific provisions of Income Tax Act,1961 which shall override anything contained contrary in ICDS. However, if there are any specific concerns on application of ICDS, the relevant issues may be forwarded to CBDT through the respective sector regulator for clarification.

Question 7: Please explain the impact on the computation of income in the absence of materiality principle.

Answer : The principle of materiality is not recognized under the income tax act and therefore same is not also included in the ICDS. However, if the application of ICDS leads to certain timing difference of recognition of income / loss for tax purposes, the assessing officer should not make any adjustment on account of ICDS if quantum of addition involved is less than 5% of turnover or 5% of returned income / loss whichever is higher. This will provide certainty to tax payers that no addition on petty items will be made.

Question 8: ICDS I does not incorporate concept of ‘prudence’ for selection of accounting policies. Does it mean that Tax Authorities will deny deduction for expected losses but tax incomes even if it has not accrued to the taxpayers (e.g. claims raised on customers, interest on NPA loans, etc.)?

Answer: The concept of ‘prudence’ precludes recognition of anticipated profit and requires recognition of expected losses. Since this amounts to differential treatment for recognition of income and losses, ICDS I provide that expected losses or mark-to-market losses shall not be recognised unless permitted by any other ICDS. This does not mean that incomes shall be taxed even if it has not accrued to the taxpayers. For example, ICDS IV provides that revenue shall be recognised only when there is reasonable certainty of ultimate collection. ICDS X also provides that contingent assets shall be recognised only when it becomes reasonably certain that inflow of economic benefit will arise. Further, it is also hereby clarified that ICDS does not override the provisions of section 4 and 5 of the Act. The Assessing Officers should consider well settled principles of ‘accrual’ of income based on binding judicial precedents before applying ICDS.

Question 9: Para 4(ii) of ICDS provides that MTM loss or an expected loss shall not be recognized unless the recognition is in accordance with the provisions of any other ICDS. Whether similar consideration applies to recognition of MTM gain or expected incomes?

Answer: Yes, MTM profits or expected incomes shall also not be recognised unless warranted by any other ICDS.

Question 10: ICDS I provides that an accounting policy shall not be changed without ‘reasonable cause’. The term ‘reasonable cause’ is not defined. Please clarify what shall constitute ‘reasonable cause’.

Answer: Tax Accounting Standard I notified under Notification No. S.O. 69(E) dated 25 January 1996 permitted change in accounting policy due to change in statute or change for more appropriate presentation of financial statements. Those shall continue to be recognized under ICDS I. Further, taxpayer shall be permitted to change accounting policy for any other ‘reasonable cause’ which will depend upon facts and circumstances of each case.

Question 11: The definition of ‘Inventories’ in ICDS is same as in NACAS AS-2. But, unlike NACAS AS-2, there is no scope exclusion for work in progress arising in the ordinary course of business of service providers. Further, Para 6 of ICDS II states that the cost of service in case of a service provider shall consist of labour, other cost of personnel and attributable overheads. Further, there is a change in revenue recognition in ICDS IV read with ICDS III which requires service providers to recognize revenue on POCM basis. Please clarify the applicability of ICDS II to service providers.

Answer: ICDS IV read with ICDS III requires all service providers to recognise revenue on the basis of ‘Percentage of Completion Method’ (POCM). Under POCM, the work done till year end is recognised as revenue based on percentage of completion till that date. Hence, there is no requirement to value inventory of work in progress arising in ordinary course of business of service providers under ICDS II. As in case of ICAI AS-2, ICDS II shall apply to other items of inventories of service providers.

Question 12: ICDS II does not recognize the Standard Costing Method which would be against the principles of Ease of doing business?

Answer: It is clarified that if the tax assessee has been following standard costing method on regular basis then tax payer may continue to follow the same.

Question 13: Para 22 of ICDS III provides that contracts commenced prior to 1 April 2015 and not completed before that date shall be recognized as per ICDS III but ‘after taking into account’ revenues and costs already recognized prior to 1 April 2015. Please clarify how this Para needs to be applied if a taxpayer has hitherto been following Completed contract method or has already recognised foreseeable loss on entirety of contract prior to 31 March 2015.

Answer: The intent of transitional provisions of ICDS is to ensure that neither any income is doubly taxed nor any income escapes from taxation in view of implementation of ICDS. Accordingly, it is clarified that if a taxpayer has hitherto been following Completed contract method, he shall be required to recognize contract revenue, costs and profits as per Percentage of Completion Method from 1 April 2015. However, contract revenue, costs and profits for work done till 31 March 2015 shall be recognized in the year of completion of project as per erstwhile method. The taxpayer is not required to recognize entirety of profits/loss incurred on the contract till 31 March 2015 in F.Y. 2015- 16.

Similarly, if the taxpayer has already recognized foreseeable loss on entirety of the contract prior to 31 March 2015, Para 22 of ICDS III does not require reversal of such loss in F.Y. 2015-16. It merely requires recognition of incremental loss or profit based on percentage of work completed till 31 March 2016.

For example, loss booked in prior years is Rs. 10 crores and contract reaches 60% completion till 31 March 2016, loss of Rs. 4 Cr (representing loss on 40% unfinished work) is not required to be reversed in F.Y. 2015-16. If estimate of total loss increases to Rs. 12 crores on 31 March 2016, no incremental loss will be recognised in F.Y. 2015-16 since loss already recognised till 31 March 2015 (Rs. 10 crores) exceeds 60% of total loss of Rs. 12 Crores (i.e. Rs. 7.20 crores). However, if the estimate of total loss increases to Rs. 20 crores on 31 March 2016, incremental loss of Rs. 2 crores will be recognised in F.Y. 2015-16 to align with 60% of total loss (i.e. Rs. 12 Crores). On the other hand, if taxpayer estimates total profit of Rs. 2 Cr on the contract, the taxpayer will need to reverse loss of Rs. 10 Cr as also recognise 60% of Rs. 2 Cr in F.Y. 2015-16.

Question 14: Whether Retention Money, receipt of which is contingent on the satisfaction of certain performance criterion is to be recognized as revenue on billing?

Answer: The relevant provisions of ICDS III worth noting are that ICDS III Para 6 prescribe Contract Revenue comprises of “Retention Money”. Para 1(c) defines “Retentions are amounts of progress billing which are not paid until satisfaction of conditions specified in the contract for the payment of such amounts or until defects have been rectified”. Para 4 provides Contract Revenue shall be recognized when there is reasonable certainty of its ultimate collection. Therefore, like contract revenue, retention money should be included as part of contract revenue only on satisfaction of performance criterion i.e. on reasonable certainty of ultimate collection.

Question 15: Since there is no specific scope exclusion for Real estate development activity and BOT projects from ICDS IV on Revenue Recognition, please clarify whether ICDS III and IV should be applied by real estate developers and BOT operators. Also, there is no specific exclusion for lease income in ICDS IV. Please clarify whether ICDS IV is applicable for lease income.

Answer: The Accounting Standards Committee has recommended that separate ICDS should be notified for real estate development activity, BOT projects and Leases. A draft ICDS on Leases was also published for public comments but not finally notified. Hence, pending notification of specific ICDS to deal with these revenue items, they shall continue to be governed by existing tax laws. It is clarified that ICDS III and ICDS IV do not apply to these business activities.

Question 16: The condition of reasonable certainty of ultimate collection is not laid down for taxation of interest, royalty and dividend. Whether the taxpayer is obliged to account for such income even when the collection thereof is uncertain?

Answer: Para 5 ICDS IV provides where ability to access the ultimate collection with reasonable certainty is lacking at time of raising any claim for escalation of price and export incentive, revenue recognition in respect of such claim shall be postpones. Whereas AS 9 Para 9.2 provides similar provision for “interest etc.” also apart from claim for escalation of price and export incentive. To harmonize the ICDS with settled principle laid down at ED Sasson& Co. Ltd 26 ITR 27 (SC) & Godhra Electricity Co. Ltd 225 ITR 746 (SC) which provides unless there is established right to receive income, no tax shall be received it is clarified that similar to AS 9 Para 9.2 the conditions of Para 5 ICDS IV shall be also applicable to income from interest, royalty and dividend.

Question 17: Please clarify whether ICDS is applicable to revenues which are liable to tax on gross basis like interest, royalty and fees for technical services for non-residents u/s. 115A of the Act.

Answer: ICDS is applicable to those sources of incomes which are assessable on net basis and does not apply to incomes liable to tax on gross/presumptive basis. This is because specific provisions of the Act shall prevail over ICDS.

Question 18: Please clarify whether POCM should be applied to all service contracts irrespective of time duration of such contracts. Blanket application of POCM to all service revenues irrespective of duration of service contracts gives rise to various difficulties and ambiguities on short duration services.

For example, for a courier company, issue arises whether 50% of courier charges should be recognised as revenue if courier has covered 50% distance as at midnight of 31st March. Similarly a bank will face practical challenges in unbilled revenue recognition of loan applications/credit card applications, etc. in process as at 31st March. A consulting company will find it difficult to capture revenue of unbilled services as at 31st March where the fees are agreed on lump sum basis and are payable only on completion of the short duration assignment. It would be burdensome for the industry to track revenue of each and every incomplete service as at 31 March every year.

Answer: POCM is prescribed to remove alternative between completed contract method and POCM available under ICAI AS-9 and to bring uniformity in computation of total income of all taxpayers. It is not intended to increase compliance burden for taxpayers in case of short duration contracts. Hence, for a proper and efficient administration of ICDS and as a measure to remove any hardships for taxpayers, it is directed that Assessing Officers shall examine compliance of POCM only for long duration service contracts which are expected to exceed one year duration. Service contracts which are not expected to last for more than a year shall be recognized as per accepted method of accounting regularly employed under section 145.

Question 19: In some service contracts, taxpayers cannot expect revenue until specified billing milestones are achieved or success is achieved. Following are certain illustrations:-

(i) In case of AMC contracts, the revenue is typically agreed with reference to a specified period (say 1 year). However, actual estimation of costs is difficult since the services rendered will largely depend on the number of visits/ calls by customers.

(ii) Another example would be of a merchant banker who is entitled to receive service fees only on successful negotiation of deal. At the year end the fate of the deal is uncertain. The merchant banker record the expenses as and when incurred. However, revenue is booked only on successful completion of the deal.

(iii) Similarly, there is practical difficulty in applying POCM in case of insurance agents who are entitled to commission on acceptance of proposal by insurance companies, advertising companies rendering comprehensive media planning and execution services entitled to revenue based on percentage of ad spend.

(iv) Consulting service providers also find it difficult to ascertain the revenue potential of unbilled work as at year end. The service provider can expect revenue only if the work is completed till billing milestone agreed with the client.

Please clarify how revenue should be recognized in such cases.

Answer: Para 9 of ICDS III provides that revenue should be recognized when there is reasonable certainty of its ultimate collection. Hence, if revenue can be earned only if a particular milestone is achieved (e.g. success fee model), ICDS IV read with ICDS III does not require recognition of such revenue until the milestone is achieved

Where taxpayers adopt POCM under ICAI AS-9 and recognize revenue as per specific criteria representing percentage of work completed till year end, such basis shall be ordinarily acceptable for the purposes of ICDS IV. Such basis for determining stage of completion may include ‘time’ or SLM basis in certain circumstances where such basis represents the most appropriate criteria for revenue recognition like AMC contracts. The method of recognition of revenue as illustrated in Appendix to ICAI AS-9 for different types of service contracts are consonant with ICDS IV

It is also clarified that it is only where taxpayers follow Completed Service Method in their books as per ICAI AS-9 that ICDS IV will require them to adopt POCM for tax purposes

Question 20: ICAI AS-7 provides flexibility to adopt any method for determining stage of completion that measures reliably the work performed. In contrast, ICDS restricts the choice to following three methods for determining stage of completion:

proportion of contract costs incurred for work performed upto the reporting date bear to the estimated total contract costs; or

surveys of work performed; or

completion of a physical proportion of the contract work.

If a taxpayer has chosen a particular method from the above referred three methods, can the Assessing Officer dispute the method and enforce any one of the other two methods.

Answer: A taxpayer is free to choose the method of determining stage of completion from three alternatives provided in ICDS III and such choice will be binding on the Tax Authority unless, in the opinion of the Assessing Officer, such method does not result in reflection of correct income of the taxpayer. However, with a view to reduce litigation and provide certainty to taxpayers, it is clarified that Assessing Officer shall take prior approval of jurisdictional CIT/PCIT before rejecting method adopted by the taxpayer and also provide the taxpayer a reasonable opportunity of being heard and raise its objections. The Assessing Officer shall consider the objections raised by the taxpayer and pass a speaking order on the same before proceeding with the assessment.

It is also clarified that if the taxpayer has been following POCM as per ICAI AS-9 for recognition of service contracts prior to notification of ICDS which has been accepted in past concluded assessments and there is no pending litigation on correctness of method as on 1 April 2015, the Assessing Officer shall not dispute the method of accounting adopted by the taxpayer unless the Assessing Officer proves that there was fraud or misrepresentation of facts by the taxpayer.

Question 21: ICDS V states expenditure incurred on commissioning of project, including expenditure incurred on test runs and experimental production shall be capitalized. It also states that expenditure incurred after the plant has begun commercial production i.e., production intended for sale or captive consumption shall be treated as revenue expenditure. What is the treatment of expense incurred between period when trial run commenced but commercial production has not begun?

Answer: AS 10 provides option to treat such expenditure either as deferred revenue expenditure to be spread over 3 to 5 years or as revenue expenditure to be fully written off in year of incurrence. Since, the Act does not recognize the concept of deferred revenue expenditure; post-trial run expenditure shall be allowable in full in year of incurrence. This is also buttressed by the ratio of judgment reported at NTPC Ltd 357 ITR 253 (DEL) wherein it has been held that assessee was entitled to Depreciation in respect of capital construction equipment which was not used by contractor but ready for use. This principle is also supported by the provision of section 3 of the income tax act where the expenditure is allowed once the business is setup.

Hence, the expenditure incurred after the trial run should be allowed as revenue expenditure.

Question 22: ICDS VI denies allow ability of MTM loss on certain specific derivative contracts which are executed for trading purposes. Further, MTM loss on other derivative contracts which are not covered by ICDS VI (and thus, may fall within scope of ICDS I), can also not be claimed on account of modification in the concept of prudence under ICDS I (which denies deduction for MTM loss). Please clarify the applicability of above to derivative contracts entered into by banks as a service to their constituents.

Answer: ICDS VI and Para 4(ii) of ICDS I do not apply to banks and authorized dealers which offer derivative products to their constituents under guidelines prescribed by RBI. ICDS VI and Para 4(ii) of ICDS I apply to the constituents which enter into such contracts with the banks and authorized dealers.

Question 23: The exchange difference relating to foreign exchange liability or borrowing for acquisition of an imported asset is adjusted to the cost of asset at the time of payment as per Section 43A of the Act. Please clarify the treatment for exchange difference relating to foreign exchange liability or borrowing for acquisition of asset within India as per ICDS read with provisions of IT Act and Rules?

Answer: ICDS permits exchange loss on monetary items to be recognised as an expense and exchange gain as income based on closing rate subject to sections 43A and Rule 115. ‘Monetary items’ are money held and assets to be received or liabilities to be paid in fixed or determinable amounts of money, e.g. receivables, payables. Section 43A covers exchange difference relating to foreign exchange liability or borrowing for acquisition of an imported asset. The similar treatment should also be followed for the assets acquired from India.

This will align with the accepted principal of law that the loss / gain on capital item is neither deductible nor taxable.

Question 24: ICDS VI requires foreign exchange differences pertaining to non-integral foreign operations to be recognised as income or expense on year on year basis unlike ICAI AS-11 where they are accumulated in Foreign Currency Translation Reserve Account and recognised in P&L in the year of disposal of foreign operations. Please clarify how the same shall be applied for taxpayers having foreign branches. The balance sheet of foreign branch will comprise of fixed assets, current assets and liabilities relating to fixed assets and working capital.

Answer: Para 9 of ICDS VI provides for the procedure for translation of financial statements of nonintegral foreign operations i.e. foreign branch. It provides that the assets and liabilities, both monetary and non-monetary, of the foreign branch shall be translated at the closing rate and resulting exchange differences shall be recognized as income or expenses in that previous year. However, the translation and recognition of exchange difference as per section 43A and Rule 115 shall be carried out in accordance with provisions contained therein.

However, the distinction between assets and liabilities of capital nature and revenue nature which is well settled by judicial precedents also needs to be considered.

In case of depreciable assets, the assets acquired in the past would form part of ‘block of assets’. Section 43A permits adjustment only in respect of repayment of liabilities towards cost of the assets or foreign currency borrowings for acquiring the assets. Section 43A does not permit restatement of values of depreciable assets based on closing rates.

In case of non-depreciable assets, the translation at year end rates would be of capital nature and hence, would neither be taxable nor deductible in computation of total income.

Rule 115 of Income tax Rules provides for the rate of exchange for the calculation of the value in rupees of any income accruing or arising or deemed to accrue or arise to the assessee in foreign currency or received or deemed to be received by him or on his behalf in foreign currency. In terms of this rule, the exchange rate shall be the telegraphic transfer buying rate of such currency (as notified by State Bank of India) as on the ‘specified date’. The ‘specified date’ differs based on nature of income. For income in the nature of ‘Profits and gains of business or profession’ or ‘Income from other sources’ to which ICDS apply, the ‘specified date’ is the last day of the previous year of the assessee (i.e. year end rate). However, such process of conversion shall not apply if the income is received in, or brought into India by the assessee or on his behalf before the specified date. If the income is subjected to tax deduction at source, the exchange rate on the date on which tax was required to be deducted is adopted for the purposes of conversion.

Where the above process as per Rule 115 is applied, there would be no separate taxation of the business income earned by foreign branch.

Question 25: Please clarify the taxability of opening balance of FCTR as on 1 April 2015.

Answer: The intent of transitional provisions of ICDS is to ensure that neither any income is doubly taxed nor any income escapes from taxation in view of implementation of ICDS. The opening balance of FCTR balance as on 1 April 2015 which may have been accumulated over several years will not be taxable in entirety in F.Y. 2015-16 (A.Y. 2016-17) under Para 12(3) of ICDS VI. The opening balance shall be taxable when the same is actually realized and credited to P&L.

Question 26: An industrial promotion scheme of state Government may exempt stamp duty on purchase of land for constructing new factory. While stamp duty exemption on factory land may be treated as income under ICDS VII /2(24) (xviii), there is no provision to step up the land cost by the corresponding amount taxed as income. Similar challenge arises in case of waiver or concessional duty levy on expenses such power or water charges and/or grant of interest free/concessional loan (like VAT/sales tax deferral), etc. While section 2(24)(xviii) read with ICDS VII captures the waiver/concession as income leading to taxation of notional income, there is no corresponding provision to allow corresponding deduction for higher power or water charges attributable to notional income. Kindly clarify the provisions?

Answer: Assistance from Government received by way of exemption from statutory levies like stamp duty for land, VAT on sales, etc. and/or by way of interest-free loan is taxable as income under clause (xviii) to ‘income’ definition u/s.2 (24) inserted by Finance Act 2015. The only exception is where such assistance is covered by Explanation 10 to section 43(1) in terms of which such subsidy is reduced from ‘actual cost’ of asset.

If the taxpayer records/claims the relevant expense or cost net of benefit of assistance, there shall be no separate taxation under section 2(24) (xviii) read with ICDS VII.

Question 27: If a capital subsidy related to non-depreciable assets or grants in the nature of promoters’ contribution to encourage moving to backward area or generate employment are received prior to 1 April 2015 but not recognised in books in Capital Reserve pending satisfaction of related conditions and achieving reasonable certainty of receipt, how shall the balance portion be recognised under ICDS post 1 April 2015.

Answer: Para 13 of ICDS VII provides that the Government grants which meet the recognition criteria of Para 4 on or after 1st day of April 2015 in accordance with the provisions of ICDS VII after taking into account the amount, if any, of the said Government grant recognised for any previous year ending or before 31st day of March 2015.

Where taxpayer has partially availed capital subsidy related to non-depreciable assets or grants in the nature of promoters’ contribution to encourage moving to backward area or generate employment prior to 1 April 2015, the balance portion for which the taxpayer satisfies the related conditions or achieves reasonable certainty of receipt post 1 April 2015 shall be taxable in the year in which such criteria is met or the grant is actually received, whichever is earlier.

For example, if out of total capital subsidy entitlement of Rs. 10 Cr, Rs. 6 Cr is credited to capital reserve till 31 March 2015 and recognition of balance Rs. 4 Cr is deferred pending satisfaction of related conditions and achieving reasonable certainty of receipt, the balance amount of Rs. 4 Cr will be taxed in the year in which related conditions are met and reasonable certainty is achieved. If these conditions are met over two years, the amount of Rs. 4 Cr shall be taxed over a period of two years. It is hereby clarified that the amount of Rs. 6 Cr for which recognition criteria were met prior to 1 April 2015 shall not be taxable post 1 April 2015.

But if the subsidy is already received prior to 1 April 2015 in the form of land or any other asset, there shall be no taxation under section 2(24)(xviii) read with ICDS VII even if some of the related conditions are met on or after 1 April 2015. This is in view of Para 4(2) of ICDS VII which provides that Government grant shall not be postponed beyond the date of actual receipt.

Question 28: If the taxpayer sells a security on 30.04.2016. The interest payment dates are December and June. The actual date of receipt of interest is 30.06.2016 but the interest on accrual basis has been accounted as income on 31.03.2016. Whether the taxpayer shall be permitted to claim deduction of such interest i.e. offered to tax but not received while computing the capital gain?

Answer: The provisions of ICDS are not applicable to computation of income under the head “Capital gain”.

Question 29: ICAI AS-16 provides that a qualifying asset is an asset (capital asset or stock in trade) that necessarily takes substantial period of time to get ready for its intended use or sale and further provides for a benchmark period of 12 months as a substantial period of time unless a shorter or longer period can be justified on the basis of facts and circumstances of the case. However, ICDS IX provides a period of 12 months for stock in trade only and not for capital assets. Does this mean that interest cost for a capital asset should be capitalised for tax purposes regardless of time duration by which the capital asset gets ready for its intended use?

Answer: Proviso to section 36 (1) (iii) does not provide for any threshold time duration for capitalisation of interest. It provides that interest paid in respect of capital borrowed for acquisition of asset shall be capitalised for period beginning from date on which capital was borrowed for acquisition of an asset till the date on which such asset was first put to use.

ICDS IX provides for a threshold period of 12 months for interest on stock in trade to be capitalised. By way of practical expediency and for the purposes of proper and efficient administration of ICDS as also to remove any hardships for taxpayers, it is hereby clarified that interest costs on capital assets shall be capitalised under proviso to section 36 (1) (iii) and ICDS IX only if such capital asset takes a period of 12 months or more to get ready for its intended use. Thus, if capital asset takes a period of less than 12 months to get ready for intended use, no interest cost needs to be capitalised thereon.

Question 30: ICAI AS-16 requires borrowings costs of general purpose borrowings to be capitalised using a capitalisation rate. ICDS prescribes an allocation method as per Para 6, 7 and 8 for computing borrowing costs of general purpose borrowing which can be capitalised. This results in difference in amount which can be capitalized for books and tax purposes leading to additional compliance burden for taxpayers. Please clarify with illustration how interest shall be capitalised under Para 6, 7 and 8.

Answer: Para 6 provide for capitalisation of general borrowing cost as per following normative formula:-

A X B /C

i.e. borrowing cost incurred X Average cost of Qualifying Assets (QA)/ Average amount of total assets

The formula excludes specific borrowing cost, QA and total assets which are directly funded out of specific borrowing.

Para 7 provides that the capitalisation of borrowing costs shall commence, inter alia, in a case referred to in Para 6, from the date on which funds were utilised.

Para 8 provides that capitalisation of borrowing costs shall cease in case of capital assets when such asset is first put to use and in case of stock in trade, when substantially all the activities necessary to prepare such inventory for its intended sale are complete.

The term ‘qualifying assets’ is defined in Para 2(b) to include various tangible and intangible assets as also stock in trade. It is clarified that the ‘qualifying assets’ in numerator shall include only those assets which are not put to use or ready for intended sale, as the case may be, by the end of the relevant previous year. This is because once the asset is put to use or ready for intended sale, interest capitalisation ceases as per Para 8.

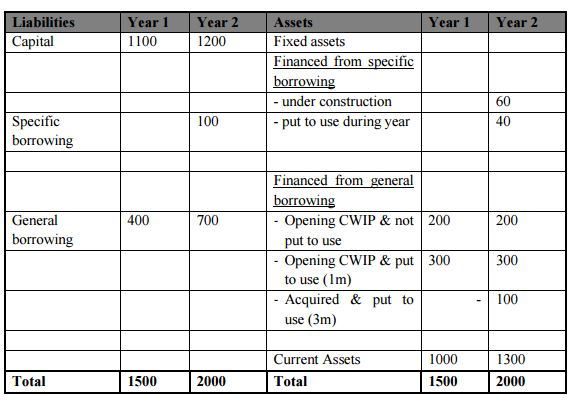

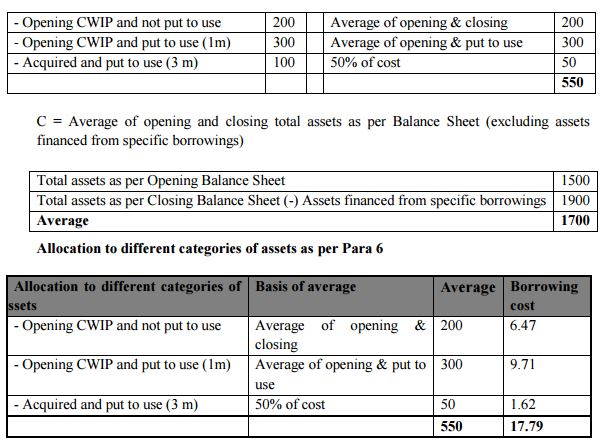

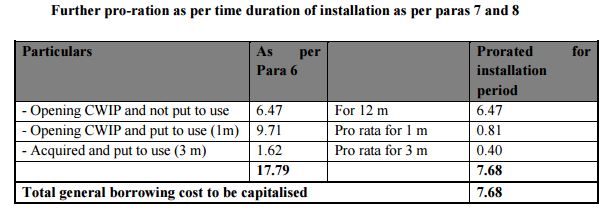

The allocation of general borrowing cost as per Para 6, 7 and 8 of ICDS IX is illustrated as follows:

General borrowing costs incurred in Year 2

On 400 @ 10% for full year 40

On 300@ 10% for half year 15

_________

Total general borrowing cost 55

Formula as per Para 6 = A X B / C

A = General borrowing cost for full year = 55

B = Average of qualifying assets

It is also further clarified that the cost of qualifying assets referred in the numerator B for the purpose of application of paras 6, 7 and 8 shall exclude the borrowing cost which is capitalised as per ICAI AS-16 or ICDS IX in earlier years. This is to avoid capitalisation of interest on interest. However, the term ‘total assets’ referred in denominator ‘C’ of the formula shall include interest cost capitalised in books as per ICAI AS-16.

Further, where an asset is partially funded from specific borrowing and partially from general borrowing, the portion funded from specific borrowing shall be excluded from both numerator B and denominator C which excludes assets which are directly funded out of specific borrowings.

Question 31: Under ICAI AS-16, if borrowed funds are temporarily invested pending utilization for specific purpose, the income earned from temporary investment can be reduced from borrowing cost. This is not permitted under ICDS IX. Please clarify how borrowing costs incurred during this period should be treated when no expenditure is incurred on related asset.

Answer: Since paras 7(a) and 8(a) of ICDS IX provide that capitalization should commence from date of borrowing and terminate with date of first use of the asset which period can spread across two or more financial years, it is clarified that interest costs incurred on borrowed funds which are pending utilization shall be carried over to future year and capitalized on pro-rata basis to the assets for which they were borrowed.

For example, if out of total borrowing of Rs. 100 Cr, Rs. 75 Cr is not utilized till end of year, the borrowing cost on Rs. 75 Cr can be carried forward and capitalized as and when it is actually utilized.

Question 32: There are specific provisions in the Act/Rules under which a portion of borrowing cost may get disallowed like s.14A, 43B, 40(a)(i), 40(a)(ia), 40A(2)(b), etc. Please clarify whether borrowing costs to be capitalized under ICDS IX should be after excluding portion which gets disallowed under such specific provisions.

Answer: Since specific provisions of the Act override ICDS, it is clarified that borrowing costs to be considered for capitalization under ICDS IX shall exclude those borrowing costs which are disallowed under specific provisions of the Act. Capitalization of borrowing cost shall apply for that portion of the borrowing cost which is otherwise allowable as deduction under the Act.

Question 33: If an assessee, by way of documentary evidence, substantiate that no general purpose borrowing is utilised for the purposes of acquisition of qualifying assets, whether requirement of capitalisation of borrowing cost as per Para No.6 of ICDS IX would still apply?

Answer: Para No.6 of ICDS IX provides that to the extent funds are borrowed generally and utilized for the purposes of acquisition, construction or production of a qualifying asset, the amount of borrowing costs to be capitalized shall be computed in accordance with the specified formula. The main condition for invoking such Para is where the general purpose borrowing is utilized to acquire qualifying assets. Therefore if an assessee is able to demonstrate by way of documentary evidences that general purpose borrowing are not utilized for the purpose of acquisition of a qualifying asset, Para No.6 become inapplicable and therefore no borrowing cost on such general purpose borrowing is required to be capitalized. However if any part of the general purpose borrowing is utilized for acquisition of an qualifying assets, Para No.6 become applicable and consequently an asssessee is required to capitalize the borrowing cost in accordance with the formula specified under Para No.6 of ICDS IX read with Para No. 7 & 8 thereof.

Question 34: If an assessee utilises specific/general borrowing for payment of a liability of qualifying asset after such asset was first put to use, whether an assessee is required to capitalise interest cost on specific/general borrowing to the cost of such asset in respect of the period of acquisition of such asset till it is first put to use? For example if an assessee purchases a qualifying asset on credit basis and makes payment to its supplier by utilising either specific or general borrowing after such asset is first put to use.

Answer: Para No.5 of ICDS IX provides that borrowing cost relating to specific borrowing specifically for the purpose of acquisition of a qualifying asset to be capitalized on such asset. Para No.6 of ICDS IX provides that to the extent funds are borrowed generally and utilized for the purposes of acquisition, construction or production of a qualifying asset, the amount of borrowing costs to be capitalized shall be computed in accordance with the specified formula.

As per Para No. 7, capitalization of borrowing cost will start from the date on which funds were borrowed in case of specific borrowing and in case of general purpose borrowing from the date when funds were utilized. Para No.8 also provides that capitalization of borrowing shall cease when a qualifying asset is first put to use and in case of a qualifying asset being inventory, when substantially all the activities necessary to prepare such inventory for it its intended sale are complete.

Considering the above provision, since an assessee has utilized its general/specific borrowing, the requirement of capitalization of borrowing cost in accordance with Para No. 5 & 6 will apply. However such capitalization ceases when a qualifying asset is first put to use. Since a qualifying assets is put to use before the utilization of borrowing (whether general or specific) to discharge the liability in respect of a qualifying asset, no borrowing cost is required to be capitalized in view of Para No. 8 of ICDS. However the requirement of capitalization of borrowing cost would still apply in respect of other qualifying assets if such assets are put to use after the date of specific borrowing/date of utilization of general borrowing.

Question 35: How to allocate borrowing costs relating to general purpose borrowing as computed in accordance with formula provided under Para No.6 of ICDS IX to different qualifying assets?.

Answer: Para No.6 of ICDS IX provides that to the extent funds are borrowed generally and utilized for the purposes of acquisition, construction or production of a qualifying asset, the amount of borrowing costs to be capitalized shall be computed in accordance with the specified formula. The formula takes into consideration the average cost of qualifying assets, average cost of total assets and borrowing cost incurred in a year. The resultant amount is the total amount of general borrowing cost that is required to be capitalized in a year. The date of commencement of capitalization of borrowing cost and the date of cessation of capitalization is provided in Para No.7 & 8. Considering such provision of such ICDS, the general purpose borrowing cost as computed, as per formula specified in such ICDS, can be allocated on each qualifying assets on the basis of number of days for its capitalization computed as per Para No.7 & 8 divided by 365 days. However the aggregate amount of capitalization, in no case, exceeds the amount of borrowing cost required to be capitalized as per Para No.6.

Similarly, the interest capitalization cost should not exceed the cost of the individual asset also.

Question 36: ICDS X requires recognition of provision in case it is reasonably certain (against probable as per AS-29) that a person has a present obligation as a result of past event. Similarly, it requires recognition of income from contingent asset when it becomes reasonably certain (against virtually certain as per AS-29) that inflow of economic benefit will arise. Please explain the differences in terms probable, reasonable certain and virtually certain?

Answer: The probable, reasonable certain and virtually certain are judgmental issues and varies from situation to situation depending upon the fact & circumstances of each transaction.

Probable is explained in AS 29 as “more likely than not”.

Whereas, reasonably certain could be understood as probable with some convincing evidence. The term ‘reasonably certain’ means fair and reasonable; being free from reasonable doubt, what reasonable person may believe as certain. Whether outflow of economic resources or inflow of economic resources has become ‘reasonably certain’ to warrant recognition of ‘provision’ or ‘contingent asset’ shall depend upon events happening during the relevant previous year.

It is clarify that the reasonable certain under ICDS X may be compared with a situation of probable under AS-29. The intention is to allow the claim of liabilities or expenditure when it is reasonably certain or probable.

If the claim is not reasonable or it is possible under AS-29, the same is only disclosed as contingent liability and will not be allowed from the taxable income.

Virtual certain is defined in dictionary as “something is so nearly true that for most purposes it can be regarded as true”.

The terms are explained in following example:

1) In situation of income/claim for damages to goods supplied by raising debit note.

Virtual certainty judgment: On receipt of Credit Note from the vendor;

Reasonable certainty judgment: On submission of claim in accordance with past experience and terms of agreement which prescribes procedure like lodgement within specified period, self-attested copy of challan, original piece of good, report of quality check or technical reviewer confirming the defect.

2) In situation of provision for warranty for car sales with warranty expenses ranging from 3% to 5% in last five years.

Reasonable certain judgment: It is reasonable certain that warranty expense shall be Unit Price X number of car sold X 3% (I.E at least lowest of the range of past expense 3 %to 5%)

Probable judgment: It is probable that warranty expense shall be Unit Price X number of car sold X any number between of 3 %to 5% (I.E less convincing level than reasonable certain situation)

Question 37: Please clarify the impact of Para 20 containing transitional provisions of ICDS X.

Answer: Para 20 of ICDS X provides that all the provisions or assets and related income shall be recognised for the previous year commencing on or after 1st day of April 2015 in accordance with the provisions of this standard after taking into account the amount recognised, if any, for the same for any previous year ending on or before 31st day of March, 2015.

The intent of transitional provision is that there is neither ‘double taxation’ of income due to application of ICDS nor there should be escape of any income due to application of ICDS from a particular date.

Accordingly, if a provision has crossed ‘reasonably certain’ criteria in any year prior to 1 April 2015, it shall be recognised as expense in the year in which the same is recorded in books or actually paid, whichever event happens earlier on or after 1 April 2015. However, if the taxpayer has already claimed and has been allowed deduction in any year prior to 1 April 2015, the same shall not be again allowed as deduction on or after 1 April 2015. In this regard, it is clarified that the term ‘actually paid’ shall not include payment by way of deposit as a pre-condition for further adjudication of dispute.

Similarly, if a contingent asset has crossed ‘reasonably certain’ criteria in any year prior to 1 April 2015, it shall be recognised as income in the year in which the same is recorded in books or actually received, whichever event happens earlier on or after 1 April 2015. However, if the taxpayer has already offered the said income to tax in any year prior to 1 April 2015, the same shall not be again be taxed on or after 1 April 2015.In this regard, it is clarified that the term ‘actually received’ shall not include receipt prior to final adjudication of dispute.

Question 38: The Committee had acknowledged that expenditure on most post-retirement benefits like provident fund, gratuity, etc. are covered by specific provisions. The Committee has also recommended amendment in the Act to deal with deduction for pension liability. There are other post-retirement benefits offered by companies like medical benefits. Such benefits are covered by ICAI AS-15 for which no parallel ICDS has been notified. Please clarify whether provision for these liabilities are excluded from scope of ICDS X.

Answer: It is clarified that provisioning for post-retirement benefits like provident fund, gratuity, leave encashment, pension, compensation for voluntary retirement or retrenchment compensation, post-retirement medical benefits, etc. are outside the scope of ICDS X and shall continue to be governed by specific provisions of the Act and relevant ICAI AS.

Question 39: It is possible that taxpayers are entitled to refunds from statutory authorities like income tax refunds, excise duty/service tax or customs refund but the refunds are yet to be released to the taxpayers by the respective Department. Please clarify whether such interest shall be treated as ‘reasonably certain’ to be taxed as income prior to actual receipt.

Answer: It is clarified that interest income on statutory refunds needs to be recognized as per ICDS X on actual receipt from statutory authority.

Question 40: ICDS requires disclosure of significant accounting policies & other ICDS specific disclosures. Where is the taxpayer required to make such disclosures specified in ICDS?

Answer: The disclosures as per each ICDS is the responsibility of the Tax payer and disclosures by auditor in Form 3CD which is auditors opinion only does not absolve assessee from responsibility cast upon him for specific disclosures as such Tax Return Forms are being modified to provide for disclosures of significant accounting policies and other ICDS specific disclosures .