ICAI Submitted its Suggestions on GST Rules

April 2017

Indirect Taxes Committee

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA NEW DELHI

The Institute of Chartered Accountants of India considers it a privilege to submit its suggestions on Draft Rules of

- Composition

- Input Tax Credit Rules

- Determination of Value of Supply,

- Transitional Provisions,

- Registration,

- Tax Invoice,Debit & Credit Notes,

- Refund,

- Accounts & Records,

- Appeals & Revision,

- E-way Bill,

- Return,

- Advance Ruling,

- Assessment & Audit.

- Payment of Tax

VALUATION RULES

- Delete the term ‘open market value’ from GST Valuation Rules

Draft Valuation Rules introduces a new concept of ‘open market value’, to be the first value to be applied in case a transaction does not satisfy the requirements of Section 15

Issue

It is a new and untested concept and is not even based on a well-developed law or international convention. The overlap of open market value (OMV) with the next concept of ‘like kind and quality’ has potential to lead to litigation. Further, OMV does not all adjustments for demonstrable differences on account of variations on account of commercial circumstances of the transaction in question versus transaction of OMV. Due to the absoluteness of OMV, it can lead to sub-optimal results in resolving valuation disputes/differences. Lastly, recourse of other sub-rules is possible only is ‘OMV is not determinable’ which is an insurmountable hurdle.

The value arrived at based on ‘like kind and quality’ does not suffer from the deficiencies noted above in the case of OMV. Hence, valuation based on ‘like kind and quality’ will yield better results due to the permissibility of qualitative adjustments permitted in this provision. Also, similar phrase used in Customs Valuation (for Determination of Price of Imported Goods) Rules, 2007 has addressed many valuation disputes/differences at the assessment level itself.

Suggestion

It is suggested the concept of Open Market Value be done away with from the Valuation Rules entirely and instead valuation based on ‘like kind and quality’ be provided for.

An alternative for goods is that as Central Excise Valuation Rules are now settled, they be applied

2. Value of supply in case of supply between distinct persons or related persons

Rule 2 [Draft Valuation Rules ] provides for a mechanism to arrive at a value in case of distinct persons and related persons by following the same options as available in Rule 1.

Issue

While supply between distinct persons being covered by this rule is workable, supply between ‘ related persons ’ may be excluded from this rule. When a supply is between related persons , the issue is regarding extraneous consideration flowing between them and as such, Rule 1. alone may be sufficient to address this issue. By including ‘related persons’ also in Rule 2 , the availability of this rule will attract all related party supplies to be dragged into valuation review without establishing that there is some extraneous consideration defeating Section 15. And if extraneous consideration is established, then Rule 1 is sufficient

Also, the relief from proviso to Rule 2 is adequate for valuation between distinct persons and not in the case of related persons.

Suggestion

It is suggested the term ‘related persons’ be removed from the scope of Rule 2

3. Determination of value in respect of certain supplies

Rule 6 of draft GST Valuation Rules provides for different mechanisms for valuation in various cases like value of supply of services in relation to purchase or sale of foreign currency, including money changing, booking of tickets for travel by air provided by an air travel agent, in relation to life insurance business, buying and selling of second hand goods, value of a token, or a voucher, or a coupon, or a stamp (other than postage stamp) which is redeemable against a supply of goods or services or both etc.

Issue

The non-obstante clause overrides the ‘Act’ itself and this would be an overuse of the scope of Rules. Also, by declaring that the value under Rule 6 will be the value for GST, it discards the taxable person’s right to pay tax based on actual transaction value.

For example: In the case of a token or voucher, the amount paid for voucher can be lesser than the redeemable value as the transaction involves intermediaries. Since, every taxable person would be liable to pay tax even in case of vouchers; the redeemable value need not always be the actual transaction value. Tax on the difference between the cumulative amount paid and the redeemable value, if any, can be paid on redemption. If not, tax will be zero or negative in the hands of intermediaries.

Suggestion

It is suggested that:

- The words “notwithstanding anything contained in the Act” be removed from Rule 6 and instead the words “taxable person may opt to pay tax on the value determined under this rule” be used in its place.

- Further, in sub-rule 6 – ‘value of a token ………… be the amount actually paid for the token and not the redeemable value of the goods or services or both….’

4. Value in case of Pure Agent

Rule 7 of draft GST Valuation Rules provides that the expenditure or costs incurred by the supplier as a pure agent of the recipient of supply of services shall be excluded from the value of supply if the following conditions are satisfied:

(i) the supplier acts as a pure agent of the recipient of the supply, when he makes payment to the third party for the services procured as the contract for supply made by third party is between third party and the recipient of supply;

(ii) the recipient of supply uses the services so procured by the supplier service provider in his capacity as pure agent of the recipient of supply;

(iii) the recipient of supply is liable to make payment to the third party;

(iv) the recipient of supply authorises the supplier to make payment on his behalf;

(v) the recipient of supply knows that the services for which payment has been made by the supplier shall be provided by the third party;

(vi) the payment made by the supplier on behalf of the recipient of supply has been separately indicated in the invoice issued by the supplier to the recipient of service;

(vii) the supplier recovers from the recipient of supply only such amount as has been paid by him to the third party; and

(viii) the services procured by the supplier from the third party as a pure agent of the recipient of supply are in addition to the supply he provides on his own account.

Issue

The aforesaid eight clauses need to be simplified in order to avoid litigation. For example, clause (i) will never be satisfied because there will be no contract available to prove that instructions to act as pure agent are issued. An inference may be drawn to provide that a existence of a contract is mandatory which might not be the intention of the law.

Suggestion

If this rule is meant for only statutory and fee payments then this be made clear.

If not, it is suggested that the aforesaid conditions to verify the expenditure or costs incurred by the supplier as a pure agent be reconsidered especially clauses (i), (iv) and (vii).

5. Rate of exchange of currency

Rule 8 of draft GST valuation Rules provides that the rate of exchange for determination of value of taxable goods or services or both shall be the applicable reference rate for that currency as determined by the Reserve Bank of India on the date when point of taxation arises in respect of such supply in terms of Section 12 or, as the case may be, Section 13 of the Act.

Issue

The rules make a reference to the ‘point of taxation’ and such the concept of Point of Taxation does not exist in GST.

Suggestion

It is suggested the words “point of taxation” be replaced with the words ‘time of supply’.

- Manner to determine Value of Reputation of a Product

Explanation (b) to Rule 8 to draft GST Valuation Rules provide that “supply of goods or services or both of like kind and quality” means any other supply of goods or services or both made under similar circumstances that, in respect of the characteristics, quality, quantity, functional components, materials, and reputation of the goods or services or both first mentioned, is the same as, or closely or substantially resembles, that supply of goods or services or both.

Issue

The definition term “supply of goods or services or both of like kind and quality” considers even reputation to be comparable. There is no uniform formula for measuring the value of reputation which varies from market to market and product to product. These terms are imported from customs valuation rules, which may not suit for GST levy. It may lead to many litigations and issues of frivolous notices.

Suggestion

It is suggested that the Rules be amended to bring interpretative notes to explain how the value reputation of the product is determined

- Value of supply of services in relation to purchase or sale of foreign currency, including money changing

Rule 6(2) of draft GST Valuation Rules provides that the value of supply of services in relation to purchase or sale of foreign currency, including money changing, shall be determined by the supplier of service in the following manner: –

(a) For a currency, when exchanged from, or to, Indian Rupees (INR), the value shall be equal to the difference in the buying rate or the selling rate, as the case may be, and the Reserve Bank of India (RBI) reference rate for that currency at that time, multiplied by the total units of currency.

(b) At the option of supplier of services, the value in relation to supply of foreign currency, including money changing, shall be deemed to be

(i) one per cent. of the gross amount of currency exchanged for an amount up to one lakh rupees, subject to a minimum amount of two hundred and fifty rupees;

(ii) one thousand rupees and half of a per cent. of the gross amount of currency exchanged for an amount exceeding one lakh rupees and up to ten lakh rupees; and

(iii) five thousand rupees and one tenth of a per cent. of the gross amount of currency exchanged for an amount exceeding ten lakh rupees, subject to maximum amount of sixty thousand rupees

Issue

The Rule has no provision for an authorised foreign exchange dealer or money changer to pay tax on commission earned and hence actual ‘transaction value’ is rejected. The basic principle of GST levy is to accept the transaction value as long as the transaction is at arms’ length and applying the service tax valuation rules here deviates from the basic GST principles.

Suggestion

It is suggested that there be made a provision for an authorised foreign exchange dealer or money changer to pay tax on commission earned being the actual transaction value

- Value of supply of services in relation to life insurance business

Rule 6(4) of draft GST Valuation Rules provides that the value of supply of services in relation to life insurance business shall be:

(a) the gross premium charged from a policy holder reduced by the amount allocated for investment, or savings on behalf of the policy holder, if such amount is intimated to the policy holder at the time of supply of service;

(b) in case of single premium annuity policies other than (a), 10% of single premium charged from the policy holder; or

(c) in all other cases, 25% per cent. of the premium charged from the policy holder in the first year and twelve and a half per cent. of the premium charged from policy holder in subsequent years:

Provided that nothing contained in this sub-rule shall apply where the entire premium paid by the policy holder is only towards the risk cover in life insurance.

Issue

The rules in the case of Single premium annuity policy and Life insurance policy with investment portion has put the composition rate at 25% and 10% respectively from 1.4% and 3.5% for first year and 1.75 % from second year onwards for the respective policies under service tax. When service tax rate was 14% the composition rate was 1.4% and 3.5% for first year and 1.75 % from second year and when the expected GST rate is 18% for such services it seems the rate has no rationale.

Suggestion

It is suggested that rates of 10% & 25% be rationalised and brought at par with the rates fixed up under service tax valuation rules. For example if GST rate is 18% for said services the composition rate may be 1.8% for the first year etc.

- Illustration required in Rule 6(5) of Determination of Value of Supply Rules

Rule 6(5) of draft GST Determination of Value of Supply Rules provides for method of valuation in case of supply of second hand goods.

(5) Where a taxable supply is provided by a person dealing in buying and selling of second hand goods i.e. used goods as such or after such minor processing which does not change the nature of the goods and where no input tax credit has been availed on purchase of such goods, the value of supply shall be the difference between the selling price and purchase price and where the value of such supply is negative it shall be ignored.

Suggestion

To enable the public at large to understand an illustration be inserted in this rule as done in case of various other rules.

TRANSITIONAL PROVISIONS

- Application in respect of tax or duty credit carried forward under any existing law or on goods held in stock on the appointed day

Rule 1 of draft GST Transitional Provision Rules requires voluminous details like the amount of tax or duty availed or utilized by way of input tax credit under each of the existing laws till the appointed day, the amount of duty or tax yet to be availed or utilized by way of input tax credit under each of the existing laws till the appointed day; etc. And an application to be filed by the taxable person

Issues

This would be a humongous task for existing manufacturers/Dealers/service providers to upload such data on the GST portal. Also, the requirement to file an application defeats the concept of seamlessness of credit. It may be inferred that ‘application’ may lead to ‘approval’ by tax administration which might not purport the concept of ease-of-doing-business.

Suggestion

It is suggested that the requirement of ‘application’ be replaced with ‘intimation’ and the elaborate information required to be filed on GSTN be simplified to support the assessees during transition.

- Time Limit to carry forward credit under any existing law or on goods held in stock on the appointed day

Rule 1 of draft GST Transitional Provision Rules provides that every registered person entitled to take credit of input tax under section 140 shall, within 60 days of the appointed day, submit an application electronically in FORM GST TRAN-1, duly signed, on the Common Portal specifying therein, separately, the amount of tax or duty to the credit of which the said person is entitled under the provisions of the said section.

Issue

The said time limit of 60 days is very less and also there exists no provision for extension of such time limit.

Suggestion

It is suggested that time limit of 60 days be reviewed and a provision for extension of time limit under special circumstances be provided to allow for proper compilation of carry forward of duties and taxes paid under the existing law and documentation thereof.

- Credit to be allowed when document evidencing payment is not in the possession

As per Rule 1(3)(a) of draft GST Transitional Provision Rules a registered person, who was not registered under the existing law, availing credit in accordance with the proviso to sub-section (3) of Section 140 shall be allowed to avail input tax credit on goods held in stock on the appointed day in respect of which he is not in possession of any document evidencing payment of central excise duty.

Such credit shall be allowed at the rate of [forty per cent.] of the central tax applicable on supply of such goods after the appointed date and shall be credited after the central tax payable on such supply has been paid.

The scheme shall be available for six tax periods from the appointed date

Issues

- 40% is too small a sum considering the tax paid under existing law and central tax to be paid under GST.

- 6 months’ time for supply of the stock and payment of the CGST will be a short period. In the event of not happening the supply, the eligible credit would lapse. Also, this time period conflicts with the time allowed under Section 140(8) of CGST Act.

Suggestions

It is suggested that:

- percentage of 40% be suitably increased to 60%, to enable the taxable person to compete with the persons who are acquiring goods under new regime.

- time period of six tax periods from the appointed date be reviewed in cases where supply doesn’t take place eventually leading to loss of credit. The words “six tax periods” be replaced with the words ‘next tax period but not later than due date of filing return for September 2018 or annual return ,whichever is earlier’.

- Declaration of Stock held by Principal

Rule 2 of draft GST Transitional Provision Rules provides that every person to whom the provisions of Section 141. apply shall, within 60 days of the appointed day, submit an application electronically in FORM GST TRAN-1, specifying therein, the stock or, as the case may be, capital goods held by him on the appointed day details of stock or, as the case may be, capital goods held by him as a principal at the place/places of business of his agents/branch, separately agent-wise/branch-wise.

Issue

The Rule specifies for declaration of stock by principal under the provisions of Section 141 which contains the provisions related to job work. However, rule 2 does not provide for declaration of stocks in case of Job Work rather it provides for agents/branch etc. Due to this a principal, whose material is lying at Job worker premises would not be able to declare his stock under this rule.

Suggestion

It is suggested that in order to enable a principal to declare his stock in case of Job worker this rule be redrafted as follows: –

Every person to whom the provisions of Section 141 apply shall, within sixty days of the appointed day, submit an intimation electronically in FORM GST TRAN-1, specifying therein, the stock or, as the case may be, capital goods held by him on the appointed day details of stock or, as the case may be, capital goods held by him as a principal at the place/places of business of his Job workers, agents/branch, separately agent-wise/branch-wise.

- Interest on wrong claim of transition credit

Rule 4 of draft GST Transitional Provision Rules provides that amount credited under sub-rule (3) of rule 1 may be verified and proceedings under Section 73 or, as the case may be Section 74 shall be initiated in respect of any credit wrongly availed, whether wholly or partly. Thus it also provides for demand of interest in case of wrong claim of transition credit.

Issue

The rate on interest applicable in case of wrong claim of transitional credit is not provided for.

Suggestion

It is suggested that the words ‘…..interest under sub-section 1 of Section 50 will apply….’ be added to the said rule.

INPUT TAX CREDIT (ITC)

- Documentary requirements and conditions for claiming input tax credit

Rule 1 of draft GST ITC Rules requires that input tax credit shall be availed by a registered person, including the Input Service Distributor, on the basis of any of the following documents, namely: –

- a) an invoice issued by the supplier of goods or services or both in accordance with the provisions ofSection 31;

- b) a debit note issued by a supplier in accordance with the provisions ofSection 34;

- c) a bill of entry;

- d) an invoice issued in accordance with the provisions of clause (f) of sub-section (3) ofSection 31;

- e) a document issued by an Input Service Distributor in accordance with the provisions of sub-rule (1) of rule7;

- f) a document issued by an Input Service Distributor, as prescribed in clause (g) of sub-rule (1) ofrule 4

Issue

The aforesaid Rule fails to cover the documents where inputs/capital goods are imported by post or Courier.

Suggestion

It is suggested that rules be amended to include the documents where inputs/capital goods are imported by post or Courier.

- Documentary evidence for claiming credit by registered person

Rule 1(2) of draft GST ITC Rules provides that Input tax credit shall be availed by a registered person only if all the applicable particulars as prescribed in Chapter —- (Invoice Rules) are contained in the said document, and the relevant information, as contained in the said document, is furnished in FORM GSTR-2 by such person.

Issue

The condition being placed on the recipient of ensuring all the prescribed particulars as prescribed are contained in the said document is unjustified since it is the duty of supplier to include all the necessary particulars in the Invoice. A recipient cannot be punished for the mistakes of supplier. Submission of prescribed particulars by the recipient in GSTR-2 should be enough compliance for him to take the credit with other conditions as prescribed under Section 16, Section 17 and Section 18 of the law.

Further, the GSTR 2 return only provides a field which is Yes/ No in determining the eligibility of credit. The field Yes does not distinguish the quantum of Common Credit / Zero Rated Supply Credits and hence linking this to the GSTR 2 return is not practical until and unless the fields are modified in the GSTR 2 returns.

Suggestions

It is suggested that in order to rationalise the provisions and remove the undue hardship on the recipient the rule 1(2) be redrafted as follows: –

Input tax credit shall be availed by a registered person only if all the relevant information, as contained in the invoice, is furnished in FORM GSTR-2 by such person.

- Reversal of credit due to non-payment of consideration

Rule 2 of draft GST ITC Rules provides that a registered person, who has availed of input tax credit on any inward supply of goods or services or both, but fails to pay to the supplier thereof the value of such supply along with the tax payable thereon within the time limit specified in the second proviso to subsection (2) of Section 16., shall furnish the details of such supply and the amount of input tax credit availed of in FORM GSTR-2 for the month immediately following the period of 180 days from the date of issue of invoice.

Issue

As Valuation Rules may require payment of GST based on notional value increase over the transaction value of a supply, requirement to pay the ‘value of supply’ creates an anomaly where the notional value may need to be paid in order to retain credit. This is obviously not the intention of the law.

Further, this rule is applicable to all supplies even in case of distinct persons and related persons. Once, credit is linked to time, additional condition of payment is not relevant to distinct persons and even related persons.

Suggestion

It is suggested that:

- The words ‘value of supply’ be deleted and be replaced with the words ‘price actually payable for supply’

- It be provided that the ‘provision will not apply to supply between distinct persons or related persons’

- Further, it be provided that ‘payment shall include settlement of amount payable in the accounts appropriately including all forms of bank payments, e-payments and adjustment with any other receivables/payables’

- Drafting anomaly & reference in the Rule 3

Rule 3(b) of draft GST ITC Rules provides that banking company or a financial institution shall avail the credit of tax paid on inputs and input services referred to in the second proviso to sub-section (4) of Section 16 and not covered under clause (a).

Issue

The Rule 3 pertaining to claim of credit by a banking company or a financial institution makes wrong reference of provisions in clause (b). It is pertinent to mention that there is no proviso to sub-section (4) of Section 16.

Suggestion

It is suggested that the wrong reference so provided in clause (b) be corrected.

- Distribution of credit by ISD

Rule 4 of draft GST ITC Rules provides for a mechanism for distribution of credit by ISD

Issue

The said Rule provides for distribution of credit in the ‘same month’ which also includes all ‘ineligible credits’.

Suggestion

It is suggested that Rule 4 be suitably amended to:

- a) permit distribution not later than due date for filing return for September next year

- b) delete the requirement to distribute ineligible credit including reference to credit under Section 17(5)

- Distribution of input tax credit by Input Service Distributor

Rule 4(d) of draft GST ITC Rules provides for the manner of distribution of ITC by an Input Service Distributor.

The input tax credit that is required to be distributed in accordance with the provisions of clause (d) and (e) of sub-section (2) of Section 20 to one of the recipients ‘R1’, whether registered or not, from amongst the total of all the recipients to whom input tax credit is attributable, including the recipient(s) who are engaged in making exempt supply, or are otherwise not registered for any reason, shall be the amount, “C1”, to be calculated by applying the following formula:

C1 = (t1÷T) × C

where,

“C” is the amount of credit to be distributed,

“t1” is the turnover, as referred to in Section 20, of person R1 during the relevant period, and

“T” is the aggregate of the turnover of all recipients during the relevant period

Issue

- The formula so provided appears to be very cumbersome as compared to the formula provided under existingRule 7 of CENVAT Credit Rules, 2004for distribution of credit by Input Service Distributors.

- Rule 4(1)(d)provides for method of distribution of credit in case of common credits which are attributable to more than one recipient. However this rule does not provide for distribution of credit which is attributable directly to a single recipient and does not refer to Section 20(2)(c) which contains the provision in such cases. Due to this, directly attributable credits will be left to be distributed.

Suggestion(s)

- It is suggested that the present formula of distribution of credit by Input Service Distributors provided underRule: 7 of CENVAT Credit Rules 2004be imported to make the pro-rata distribution rate simpler and easier to understand.

- Further, it is suggested that, to enable the distribution of directly attributable credits, a separate sub rule be inserted beforerule 4(1)(d)which will provide for the method of such direct distribution.

- Further, there be inserted another sub rule to exclude credits directly distributed from the total credits so that the common credits may be identified, which would ultimately be referred inrule 4(1)(d).

- Alternatively, the rule may be redrafted as follows:

- a) If assesse Maintain Separate set of Books of accounts, eligible credit for the taxable invoices be taken.

- b) Where separate set of books of accounts are not maintained for Taxable and Non Taxable activities, eligible credit to be calculated in the following way

ITC eligible = Total ITC × (Taxable Turnover / Total Turnover)

- Correction of spelling of Chartered Accountant underRule 5 of ITC Rules

Under rule 5 of draft GST ITC Rules in clause d the spelling of Chartered Accountant is mistakenly written as Chartered Account.

Suggestion

It is suggested that spelling mistake be corrected with words Chartered Accountant.

- Input tax credit (ITC) on shifting of factory from one State to another

A manufacturer having factory in West Bengal is discharging central excise duty and VAT/CST, as applicable, while clearing the goods manufactured at the said factory. He is intending to shift the entire factory set up to a new site in Maharashtra. Entire stock in process and finished goods and capital goods would also be transferred to the said location in Maharashtra.

Present Indirect Tax implications – The said manufacturer will be able to transfer the entire amount of unutilised CENVAT credit balances to the new site at Maharashtra in terms of Rule 10(1) of the CENVAT Credit Rules, 2004 (‘CCR 2004’). In so far as the accumulated VAT ITC is concerned, he can claim refund in the quarterly returns filed in normal course.

Situation in Proposed GST regime – Clause 18(3) of the CGST Act, 2017 read with Rule 6 of the draft GST Input Tax Credit Rules, proposes to allow transfer of ITC only in case of change in the constitution of a registered person on account of sale, merger, demerger, amalgamation, lease or transfer of business with the specific provision for transfer of liabilities. [ Read Draft GST ITC Rules ]

Issue

No provision as on date appears to take care of a situation where the manufacturer, in the proposed GST regime, merely shifts his factory from one State to another. In case of shifting of factory, there is no change in the constitution of the said manufacturer (registered person) on account of sale, merger, demerger, amalgamation, lease or transfer of business. The question of provision for transfer of liability would also not arise.

The present CCR 2004 allows transfer of accumulated CENVAT Credit balances in both the situations –

(1) when there is mere physical shifting of factory from one place to another place and

(2) when there is a change in the constitution of the manufacturer on account of sale, merger, demerger, amalgamation, lease or transfer of business with the specific provision for transfer of liabilities.

The said transfer of accumulated credit balance is allowed even if the credit balance does not exactly correspond to the actual stock of finished goods or WIP or capital goods. The said transfer of accumulated credit balance is permissible if the available stock of finished goods or WIP and capital goods lying in the factory are transferred to the new site.

Ideally, the manufacturer should be allowed to transfer the accumulated Credit balances of CGST or IGST in the above situation. It appears that there is inadvertent omission in the draft provision to care of the situation stated above.

Suggestion

It is suggested to provide for transfer of unutilised input tax credit balance, under Clause 18(3), in case the registered person shifts his factory to another State, in the electronic credit ledger of the registered person having the same permanent account number.

- Reference of Input Services missing in Rule 7(1)(d)

Clause d of Rule 7(1) of draft GST ITC Rules provides that the amount of input tax, out of ‘T’, in respect of inputs on which credit is not available under sub-section (5) of Section 17, be denoted as ‘T3’.

Issue

Rule 7(1)(d) provides for exclusion of blocked credit under Section 17(5), however here the word Input services are not included. Although the credit is denied itself in Section 17(5), still this should effectively be there under rule 7(1)(d) to avoid any possible conflict of taking credit of services specified in Section 17(5).

Suggestion

It is suggested that rule 7(1)(d) be redrafted as follows:

The amount of input tax, out of ‘T’, in respect of inputs and input services on which credit is not available under sub-section (5) of Section 17, be denoted as ‘T3’

- Payment of interest

Rule 7(2)(a) of draft GST ITC Rules provides that where the aggregate of the amounts calculated finally in respect of ‘D1’ and ‘D2’ exceeds the aggregate of the amounts determined under sub-rule (1) in respect of ‘D1’ and ‘D2’, such excess shall be added to the output tax liability of the registered person for a month not later than the month of September following the end of the financial year to which such credit relates and the said person shall be liable to pay interest on the said excess amount at the rate specified in subsection (1) of Section 50 for the period starting from first day of April of the succeeding financial year till the date of payment;

Issue

The method prescribed for estimation is based on the turnover of the month which can vary, hence interest cannot be demanded from first day of the month

Suggestion

It is suggested that interest be payable after the due date of return for September following the end of financial year or filing of annual return whichever is earlier.

- Manner of determination of input tax credit in respect of capital goods and reversal thereof in certain cases

Rule 8(1) of draft GST ITC Rules clause c,d & e provides as follows:

(c) the amount of input tax in respect of capital goods not covered under clauses (a) and (b), denoted as ‘A’, shall be credited to the electronic credit ledger and the useful life of such goods shall be taken as 5 years:

Provided that where any capital goods earlier covered under clause (a) is subsequently covered under this clause, the value of ‘A’ shall be arrived at by reducing the input tax at the rate of five percentage points for every quarter or part thereof and the amount ‘A’ shall be credited to the electronic credit ledger;

(d) the aggregate of the amounts of ‘A’ credited to the electronic credit ledger under clause (c), to be denoted as ‘Tc’, shall be the common credit in respect of capital goods for a tax period:

Provided that where any capital goods earlier covered under clause (b) is subsequently covered under this clause, the value of ‘A’ arrived at by reducing the input tax at the rate of 5 percentage points for every quarter or part thereof shall be added to the aggregate value ‘Tc’;

(e) the amount of input tax credit attributable to a tax period on common capital goods during their residual life, be denoted as ‘Tm’ and calculated as:-

Tm= Tc÷60

Issue

The formula given in clause (e) for calculating input tax credit on common capital goods for a tax period is by dividing aggregate of common input tax credit on capital goods with 60. Thus, even if any capital goods exclusively used for exempted or taxable supplies, say for a period of 2 years, is commonly used thereafter, the common credit pool would only cover the credit attributable to balance life i.e. 3 years but monthly common credit would still be arrived at after dividing the common credit pool by 60 even if it contains some capital goods whose effective life is less than 60 months.

Further, clause (h) of sub-rule (1) provides that common input credit attributable towards exempted supplies should be added to the output tax liability of the person making such claim of credit for every tax period of the residual life of the concerned capital goods along with applicable interest. This interest is demanded in respect of unwanted credit.

Suggestion

It is suggested that:

- a) the amount of input tax credit attributable to a tax period on common capital goods be allowed to be computed for each capital goods depending upon its residual life

- b) the reversal on such account only be added to the output liability for the said month and not any interest thereon. Even if the interest is payable, it be clarified whether it is payable from the first day of the availment of credit till every month of reversal or for one month for every reversal.

Alternatively, it is suggested that a mechanism be provided for the registered person to avail the credit every tax period instead of reversal which will avoid payment of any interest

Also, replace in 8(1)(h) the interest payable to ‘…reverse immediately when credit no longer required but pay interest in case reversal is delayed….’

- Manner of reversal of credit under special circumstances

Rule 9(1) of draft GST ITC Rules provides that amount of input tax credit, relating to inputs lying in stock, inputs contained in semi- finished and finished goods lying in stock, and capital goods lying in stock, for the purposes of sub-section (4) of Section 18 or sub-section (5) of Section 29, shall be determined in the following manner namely, –

(a) For inputs lying in stock, and inputs contained in semi-finished and finished goods lying in stock, the input tax credit shall be calculated proportionately on the basis of corresponding invoices on which credit had been availed by the registered taxable person on such input.

(b) For capital goods lying in stock the input tax credit involved in the remaining residual life in months shall be computed on pro-rata basis, taking the residual life as five years.

Issue

There seems to be a drafting anomaly here with the words “taking the residual life as five years”.

Suggestions

It is suggested that the words “taking the residual life as five years” be replaced with ‘….taking the useful life as 5 years…’.

- Conditions and restriction in respect of inputs and capital goods sent to the job worker

If the inputs or capital goods are not returned to the principal within the time stipulated in Section 143, the challan issued under sub-rule (1) shall be deemed to be an invoice for the purposes of this Act. [ Read – Rule 10 (4) of Draft GST ITC Rules ]

Issue

Here the date of challan will become the time of supply and accordingly the tax paid on the basis of such challan will attract interest and penalty which will cause undue hardship to the assessee.

Suggestions

- It is suggested that no interest or penalty be levied and tax paid by Principal on deemed supply be refunded if Job worker subsequently returns the processed inputs/capital goods to principal.

- Alternatively, it is suggested that these cases may call for reversal of credit which would also be in lines withRule 4(5) CENVAT Credit Rules, 2004.

COMPOSITION RULES

- Intimation of Composition Levy

Rule 1(1) of draft GST Composition Rules provide that any person who has been granted registration on a provisional basis under sub-rule (1) of rule Registration.16 and who opts to pay tax under Section 10, shall electronically file an intimation in FORM GST CMP-01, duly signed, on the Common Portal, either directly or through a Facilitation Centre notified by the Commissioner, prior to the appointed day, but not later than thirty days after the said day, or such further period as may be extended by the Commissioner in this behalf.

Issue

The declaration filed prior to appointed date will not have any legal sanctity due to non-existence of statute

Suggestion

- It is suggested that filing date of declaration be only after appointed date and within 180 days.

• Also, it be clarified that time limit will apply from date of grant of certificate of registration

- Conditions & Restrictions for Composition Levy

Rule 3 of draft GST Composition Rules deals with Conditions and Restrictions for composition levy. Rule 3(1)(b), (c), (d) & (g) thereof requires a person opting for composition scheme to comply with the following conditions:

- b) ………………….

- c) the goods held in stock by him have not been purchased from an unregistered person and where purchased, he pays the tax under sub-section (4) of Section 9.;

- d) he shall pay tax under sub-section (3) or sub-section (4) ofSection 9. on inward supply of goods or services or both received from un-registered persons;

- g) he shall mention the words “composition taxable person” on every notice or signboard displayed at a prominent place at his principal place of business and at every additional place or places of business.

Issue

- A person opting for composition levy will primarily be a small trader. He will obviously have stock containing purchases from unregistered dealers. He will also make purchases as well as avail services from unregistered persons. If such person is made liable to pay tax on such inward supply of goods or services, it will become a part of his cost as he will not be eligible to claim input tax credit on the same. Further, he will also be required to pay tax on such purchases and receipt of services at full rate. Such a provision will act as a deterrent for him to go for this scheme.

- Mere non-display of the words “composition taxable person” on every notice or signboard will penalise the assessee.

Suggestion

- It is suggested that the conditions specified inRule 3(1)(c) & (d)requiring a person opting composition levy to pay tax under reverse charge be removed.

• Further, the requirement of displaying the words “composition taxable person” on every notice or signboard displayed at a prominent place at his principal place of business and at every additional place or places of business be dispensed with.

- Validity of Composition Levy

Rule 4(4) of draft GST Composition Rule provides that where the proper officer has reasons to believe that the registered person was not eligible to pay tax under Section 10 or has contravened the provisions of the Act or these rules, he may issue a notice to such person in FORM GST CMP-05 to show cause within 15 days of the receipt of such notice as to why option to pay tax under Section 10 should not be denied.

Issue

There shall be a limitation period beyond which the proper officer may not issue the notice for showing cause as to why the option shall not be denied. If it is not specified, there is always an uncertainty upon the person as to his eligibility for the concessional tax status.

Suggestion

It is suggested that a time limit be provided beyond which the proper officer may not issue a notice to the person who is not eligible to pay tax under Section 10 or has contravened the provisions of the Act or these rules.

- Condition of not having stocks of Imported goods

As per rule 3(1)(b) of draft GST Composition Rules a composition dealer is required to comply with following condition: –

The goods held in stock by him on the appointed day have not been purchased in the course of inter-State trade or commerce or imported from a place outside India or received from his branch situated outside the State or from his agent or principal outside the State, where the option is exercised under sub-rule (1) of rule 1;

Issue

It seems that restriction in such cases is imposed since the dealer pays a lower or concessional rate of tax on such purchases at present and he will be going to pay tax at Composition rate. However, imports are brought after paying at full rates of BCD, CVD and SAD. No Concession whatsoever is granted in the tax rates of Imports. Thus, restriction of such purchases is unjustified.

Also, it is very difficult to recognize which item was purchased from outside state or from unregistered dealer out of closing stock held on appointed date.

Suggestions

It is suggested that the condition for not having stocks of Imported goods be removed.

REGISTRATION RULES

- Exclusion of Input Service Distributors (ISD) & OIDAR

Rule 1(1) of draft GST Registration Rules provides that every person (other than a non-resident taxable person, a person supplying online information and data base access or retrieval services from a place outside India to a non-taxable online recipient referred to in Section 14 of the Integrated Goods and Services Tax Act, a person required to deduct tax at source under Section 51 and a person required to collect tax at source under Section 52 ) who is liable to be registered under sub-section (1) of Section 25 and every person seeking registration under sub- section (3) of Section 25 (hereinafter referred to in this Chapter as “the applicant”) shall, before applying for registration, declare his Permanent Account Number (PAN), mobile number, e-mail address, State or Union territory in Part A of FORM GST REG-01 on the Common Portal either directly or through a Facilitation Centre notified by the Commissioner.

Issue

- ISD does not avail credit nor charge tax. Hence registration process of ISD must be distinct from that applicable to taxable persons.

- Rule 1(1) excludes “a person supplying online information and data base access or retrieval services from a place outside India to a non-taxable online recipient referred to inSection 14of the Integrated Goods and Services Tax Act” from the list of applicant.

Section 14 of the IGST Act contains the phrase “supply of online information and database access or retrieval services by any person located in a non-taxable territory and received by a non-taxable online recipient”.

Suggestions

-

It is suggested that ISD be also included in the excluded list and separate registration provisions be provided for ISDs.

• It is suggested that the words “place outside India” in Rule 1(1) be replaced by “non-taxable territory” to make both the provisions aligned with each other.

- Registration of persons having one PAN carrying any business in more than one trade name at different locations in a state

Persons having one PAN and carrying business in more than one trade name at different locations in a state are facing problem in view of provision of only one trade name in GST REG-01 and GST REG-06. It is to b noted that more than one business may be there for Different place / same Location as at one place more than one business can also be carried out.

Suggestion

It is suggested that provision for trade name be made available in column 16 of GST REG-01 requiring information of additional place of business and Annexure B of GST REG-06 certifying place of business of the person. It will enable the person to continue to carry business in different trade name at different place within the same state having one GSTN.

- Cancellation of Registration

Rule 13 of draft GST Registration Rules provides that the registration granted to a person is liable to be cancelled if the said person—

(a) does not conduct any business from the declared place of business; or

(b) issues invoice or bill without supply of goods or services in violation of the provisions of this Act, or the rules made thereunder.

Issue

The conditions for cancellation of registration are already provided for under Section 29 of the CGST Act, 2017.

Suggestion

It is suggested that the conditions pertaining to cancellation be provided at one place only either in rules or in the Act as duplication might lead to interpretational issues.

- Date of cancellation prescribed under Rule 14(3) to be amended

Rule 14(3) of draft GST Registration Rules provides that where a person who has submitted an application for cancellation of his registration is no longer liable to be registered or his registration is liable to be cancelled, the proper officer shall issue an order in FORM GST REG-18, within 30 days from the date of application submitted under sub-rule (1) of rule 12 or, as the case may be, the date of reply to the show cause issued under sub-rule (1), cancel the registration, with effect from a date to be determined by him and notify the taxable person, directing to pay arrears of any tax, interest or penalty including the amount liable to be paid under sub-section(5) of Section 29.

Issue(s)

- In all these cases the proper officer is entitled to cancel the registration with effect from a date to be determined by him. This provisions gives freedom to the proper officer even where application for cancellation is moved by registered taxable person himself. In such cases, effective date should be the date from which the registered taxable person seeks cancellation. There may be a capping of period as prescribed inrule 12to prevent late applications. But the complete power in this regard should not be vested in the hands of proper officer.

- Sub-rule (3) of Rule 14makes a reference to an application “submitted under sub-rule (1) of rule 12”. Rule 12 deals with application for cancellation of registration but has no sub-rule.

Suggestions

- It is suggested thatRule 14(3)be redrafted as follows:

Where a person who has submitted an application for cancellation of his registration is no longer liable to be registered or his registration is liable to be cancelled, the proper officer shall issue an order in FORM GST REG-18, within thirty days from the date of application submitted under rule 12 or, as the case may be, the date of reply to the show cause issued under sub-rule (1), cancel the registration, with effect from the date of occurrence of event as specified in rule 12 where application is submitted in accordance with rule 12 and with effect from a date to be determined by him in any other cases and notify the taxable person, directing to pay arrears of any tax, interest or penalty including the amount liable to be paid under sub-section(5) of Section 29.

- Further, drafting anomaly ofRule 14(3)with regard to Rule 12(1) be rectified.

- Physical Verification of Business Premises

Rule 17 of draft GST Registration Rules provides that where the proper officer is satisfied that the physical verification of the place of business of a registered person is required after grant of registration, he may get such verification done and the verification report along with other documents, including photographs, shall be uploaded in FORM GST REG-29 on the Common Portal within 15 working days following the date of such verification.

Issue

Physical verification of exiting registered premises will result in more administrative efforts and cost. Further, situations making the proper officer believe that physical verification of premises is required have not been provided for.

Suggestions

- It is suggested that verification of existing registered premises be avoided.

• Further, situations making the proper officer believe that physical verification of premises is required be clearly enlisted.

- General Suggestions related toRegistrations

- It is suggested that the decoding of GSTIN be provided as to which character is alphabetic and which is numeric.

• It is suggested that requirement of having name board with GSTIN as perRule 10be removed as it can be procedurally cumbersome and may be misused by certain categories of person.

TAX INVOICE, CREDIT AND DEBIT NOTE RULES

- Advance voucher and refund voucher

Rule 5 of draft GST Tax invoice, Credit and Debit Notes Rules provides for issuance voucher for receipt of advance.

However no formats have been prescribed for the receipt voucher or refund voucher.

Suggestion

It is suggested the words ‘…..in the formats prescribed…’ be added and suitable formats be prescribed.

- Transportation of Goods Without Issue of Invoice

Rule 8(1) of draft GST Tax invoice, Credit and Debit Notes Rules provides that for the purposes of:

- a) supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known,

b) transportation of goods for job work,

c) transportation of goods for reasons other than by way of supply, or

d) such other supplies as may be notified by the Board,

the consigner may issue a delivery challan, serially numbered, in lieu of invoice at the time of removal of goods for transportation, containing following details:

(i) date and number of the delivery challan,

(ii) name, address and GSTIN of the consigner, if registered,

(iii) name, address and GSTIN or UIN of the consignee, if registered,

(iv) HSN code and description of goods,

(v) quantity (provisional, where the exact quantity being supplied is not known),

(vi) taxable value,

(vii) tax rate and tax amount – central tax, State tax, integrated tax, Union territory tax or cess, where the transportation is for supply to the consignee,

(viii) place of supply, in case of inter-State movement, and

(ix) signature.

Issues

- The purpose of “Supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known” is not understood. If the purpose is to capture supply through pipelines or other conduit, it shall also include other goods such as chemicals, crude etc. Also, in case of pipeline supply carrying delivery challan for transportation is practically not possible.

- Point (iii) viz name, address and GSTIN or UIN of the consignee, if registered appears to be ambiguous and needs clarification.

Suggestions

- With respect to point (a) Supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known if the purpose is to capture some other transactions, the same be clarified.

- In (iii) the wordings be name, address and GSTIN or UIN, if registered, of the recipient to align with the other provisions of the law and to provide clarity as the existing wording would create ambiguity as to whether the name and address of the recipient be included if he is not registered.

- Alternatively, it may be provided that there is no requirement to provide special treatment in case of liquid gas. With availability of credit note for stock loss after invoicing or other document in case of removal not involving supply,Rule 8may not be required.

- Invoice issued by construction industry not considered as a special case

It is suggested that tax invoice issued by construction industry be included as a special case under Rule 7 ( Draft GST Tax Invoice Rules , Credit and Debit Notes Rules ), particularly where R/A bills are issued. Because of its inherent nature prone to litigation, if a specific format is given for this industry, it could help mitigate litigation to some extent.

- Transportation of Goods in a semi-knocked down or completely knocked down condition

Rule 8(5) of Tax invoice, Credit and Debit Notes provides that where the goods are being transported in a semi knocked down or completely knocked down condition,

- a) the supplier shall issue the complete invoice before dispatch of the first consignment;

b) the supplier shall issue a delivery challan for each of the subsequent consignments, giving reference of the invoice;

c) each consignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and

d) the original copy of the invoice shall be sent along with the last consignment.

Issue

Clause a & d of the said rule contradict each other so as to determine if invoice is to go with first or last consignment.

Suggestion

It is suggested that clause d be deleted from the aforesaid rule as original copy of invoice must go with first shipment itself. This has also been provided in present excise procedures.

REFUND RULES

- Drafting anomaly in Rule 4

Sub rule 3 of Rule 4 of draft GST Refund Rules provide that “where the proper officer is satisfied that the amount refundable under sub rule (1) and sub rule (2) is payable to the applicant under subsection (8) of Section 48, he shall make an order………” Section 48 relates to Goods and services tax practitioners.

Suggestions

It is suggested that in the aforesaid sub-rule, the words “subsection (8) of Section 48 ” be replaced with “subsection (8) of Section 54” which relates with refund provisions.

- Time Limit for communicating deficiencies in form GST RFD-03 by proper officer

Rule 2(3) of the draft GST Refund Rules provide that where any deficiencies are noticed, the proper officer shall communicate the deficiencies to the applicant in FORM GST RFD-03 through the Common Portal electronically, requiring him to file a refund application after rectification of such deficiencies. However, the time limit for issuing FORM GST RFD-03 by proper officer has not been provided and only time limit of 15 days is provided for issuing acknowledgement FORM GST RFD-02.

Suggestion

It is suggested that time limit for issuing FORM GST RFD-03 by proper officer be provided for.

- Appeal on account of refund pending

Clause c of Rule 3(1) of draft GST Refund Rules provide that provisional refund may be granted subject to condition that no proceedings of any appeal, review or revision is pending on any of the issues which form the basis of the refund and if pending, the same has not been stayed by the appropriate authority or court.

Issue

Pendency of appeals from current regime is no fault of taxable person. This also renders rule 3 inoperative due to large pendency of appeals on account of refund rejected on frivolous grounds and non-disposal by appellate authorities for years.

Suggestion

It is suggested that clause c of rule 3(1) be deleted.

- Time Limit for Issuing Order sanctioning refund

Rule 4 of draft GST Refund Rules provides for the order sanctioning refunds in FORM GST RFD-06 (approval of refund), FORM GST RFD-07 (adjustment of refund against existing demand) & FORM GST RFD-08 (refund not admissible). However, the time limit for issuing these forms by proper officer has not been provided for.

Suggestion

It is suggested that time limit for issuing FORM GST RFD-06, 07 & 08 by proper officer be provided for.

ACCOUNTS AND RECORDS RULES

It is suggested that Rules ( Draft GST Accounts and Records Rules) be redrafted as follows:

Rule 1 – Accounts

Every registered taxable person shall maintain and preserve accounts as follows:

- a) Prescribed under Companies Act, 2013 to the person having same PAN

- b) If (a) is not applicable, those prescribed under any other law which requires the person having same PAN to maintain accounts

- c) If (a) and (b) are not applicable, accounts prescribed under either (a) or (b) had the same been applicable

Rule 2 – Records

Every registered taxable person shall maintain and preserve accounts as follows:

- a) Documents and records that form the basis for the information available on Common Portal in respect of allotted registration number

- b) Contracts, agreements and other documents of arrangements with other persons

- c) Documents and records in respect of nature of transaction with other distinct persons

- d) Such other documents as may be specified by Commissioner

Rule 3 – Accounts and Records on Computer System

Every registered taxable person may maintain accounts and records in any computer system or other software application at any location including remote location. The remote location shall not be such as to render the information unavailable at any time.

The information referred above shall be maintained separately by every distinct person in a manner that the following information is available in respect of transactions at every location in the State:

Inward and outward supplies

Removal of goods not being supplies and their returns

Portion of its information that is uploaded on Common Portal by said registered taxable person

APPEALS AND REVISION RULES

- Consequence of delay in filing hardcopy of appeal

Rule 4(2) of the draft GST Appeals & Revision Rules requires filing of hardcopy of appeal within 7 days. But the said rules does not provide for the consequences of delay in filing of an appeal.

Issue

There may be bona fide reasons for not filing with hardcopies within the time prescribed. Without a clear provision regarding the implications, there may be an interpretation that the appeal may be treated as null and void. This would diminish the statutory force of e-filing of appeals

Suggestion

It is suggested that after Rule 4(2) a proviso be inserted as follows:

“provided where an appeal has not been filed within the time permitted above, the Appellate Authority may not dismiss the appeal filed under Section 107 without examining the reasons for delay or omission to file the hardcopy as required”

RETURN RULES

- Cross-references rule number incorrect

Rule 2(5) of draft GST return rules refers to ISD invoice ‘…. issued under rule 7….”

However, there appears to be an error as ISD invoice is referred in rule 6 and not 7

Suggestion

It is suggested that said rule be amended by making the reference to “rule 6”instead of “rule 7”

E-WAY BILL RULES

1. E-Way Bill required to be simplified

Rule 1 (Draft GST E-Way Bill Rules ) requires the use of e-Way bill for all removals including those involving supply.

Issue

When invoice is already issued, issuance of e-way bill increases the compliance at the time of removal of goods. This is not in line with ease of doing business. Hence, comprehensive suggestion is made to the rules. Clearly few aspects are required:

a) E-way bill not required for intra-State movement all though provision is required for innocent passage via other State

b) Invoice is sufficient for movement ‘by way of supply’ which has IRN generated on common portal. Same facility to be allowed in all other cases of movement where some other document or challan is also generated

c) RFID requirement to be optional for transporter

Suggestion

Owing to the issues enlisted above the entire e-way bill rules be redrafted as follows:

- Information to be furnished prior to commencement of inter-State movement of goods and generation of e-way bill

(1) Every registered person who causes inter-State movement of goods as follows—

(ii) for reasons, other than supply of consignment value exceeding Rs. 5 lakhs; or

(iii) due to inward supply from an unregistered person of consignment value exceeding Rs 2 lakhs,

shall, before commencement of movement, furnish information relating to the said goods in Part A of FORM GST INS-01, electronically, on the common portal and

(a) where the goods are transported by the registered person as a consignor or the recipient of supply as the consignee, whether in his own conveyance or a hired one, the said person or the recipient may generate the e-way bill in FORM GST INS-1 electronically on the common portal after furnishing information in Part B of FORM GST INS-01; or

(b) where the e-way bill is not generated under clause (a) and the goods are handed over to a transporter, the registered person shall furnish the information relating to the transporter in Part B of FORM GST INS-01 on the common portal and the e-way bill shall be generated by the transporter on the said portal based on the information furnished by the registered person in Part A of FORM GST INS01:

Provided that the registered person or, as the case may be, the transporter may, at his option, generate and carry the e-way bill even if the value of the consignment is less than that specified.

Provided further that where the movement is caused by an unregistered person either in his own conveyance or a hired one or through a transporter, he or the transporter may, at their option, generate the e-way bill in FORM GST INS-01 on the common portal in the manner prescribed in this rule.

Provided further, where no e-way bill is provided on account of intra-State movement of goods by the supplier or other consignor, the transporter may generate e-way bill in FORM GST INS-01 in case the journey involves inter-State innocent passage.

Provided further that where the movement is in relation to supply, the following documents uploaded on the Common Portal against a duly issued Invoice Reference Number or Challan Reference Number or Customs Reference Number and accompanying the consignment will suffice invoice without the requirement to issue an e-way bill separately:

i) invoice issued underSection 31by a supplier

ii) document issued by ISD for distribution of credit

iii) challan issued under Section 19 in respect of goods sent for job-work by the Principal or by intermediate job-workers to other job-workers

iv) challan issued under sSection 31(7) for sale on approval

v) bill of entry issued under Customs Act in respect of imports including supply from SEZ

vi) challan issued for intra-State movement of goods where consignor and consignee are same registered person

Explanation. – For the purposes of this sub-rule, where the goods are supplied by an unregistered supplier to a recipient who is registered, the movement shall be said to be caused by such recipient if the recipient is known at the time of commencement of movement of goods.

(2) Upon generation of the e-way bill on the common portal, a unique e-way bill number (EBN) shall be made available to the supplier, the recipient and the transporter on the common portal.

(3) Any transporter transferring goods from one conveyance to another in the course of transit shall, before such transfer and further movement of goods, generate a new e-way bill on the common portal in FORM GST INS-01 specifying therein the mode of transport.

(4) Where multiple consignments are intended to be transported in one conveyance, the transporter shall indicate the serial number of e-way bills generated in respect of each such consignment electronically on the common portal and a consolidated e-way bill in FORM GST INS-02 shall be generated by him on the common portal prior to the movement of goods:

Provided that where the consignor has not generated FORM GST INS-01 in accordance with provisions of sub-rule (1) and the value of goods carried in the conveyance is more than fifty thousand rupees, the transporter shall generate FORM GST INS-01 on the basis of invoice or bill of supply or delivery challan, as the case may be, and also generate a consolidated e-way bill in FORM GST INS-02 on the common portal prior to the movement of goods.

(5) The information furnished in Part A of FORM GST INS-01 shall be made available to the registered supplier on the common portal who may utilize the same for furnishing details in FORM GSTR-1:

Provided that when information has been furnished by an unregistered supplier in FORM GST INS-01, he shall be informed electronically, if the mobile number or the e mail is available.

(6) Where an e-way bill has been generated under this rule, but goods are either not being transported or are not being transported as per the details furnished in the e-way bill, the e-way bill may be cancelled electronically on the common portal, either directly or through a Facilitation Centre notified by the Commissioner, within 24 hours of generation of the e-way bill:

Provided that an e-way bill cannot be cancelled if it has been verified in transit in accordance with the provisions of rule 3.

(7) An e-way bill or a consolidated e-way bill generated under this rule shall be valid for the period as mentioned in column (3) of the Table below from the relevant date, for the distance the goods have to be transported, as mentioned in column (2):

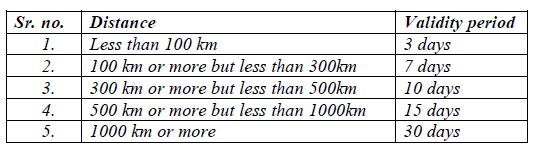

Table

Provided that the Commissioner may, by notification, extend the validity period of e-way bill for certain categories of goods as may be specified therein.

Explanation. — For the purposes of this rule, the “relevant date” shall mean the date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated.

(8) The details of e-way bill generated under sub-rule (1) shall be made available to the recipient, if registered, on the common portal, who shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

(9) Where the recipient referred to in sub-rule (8) does not communicate his acceptance or rejection within 72 hours after the of validity of the e-way bill duly made available to him on the common portal, it shall be deemed that he has accepted the said details.

(10) The e-way bill generated under rule 1 of the CGST rules or GST rules of any other State shall be valid in the State.

Explanation. – The facility of generation and cancellation of e-way bill may also be made available through SMS.

- Documents and devices to be carried by a person-in-charge of a conveyance

( Refer Draf GST E way Bill )

(1) The person in charge of a conveyance shall carry —

(a) the invoice or bill of supply or delivery challan, as the case may be; or

(b) a copy of the e-way bill or the e-way bill number, either physically or mapped to a Radio Frequency Identification Device (RFID) embedded on to the conveyance in such manner as may be notified by the Commissioner.

(3) Where the registered person uploads the invoice under sub-rule (1), the information in Part A of FORM GST INS-01 shall be auto-populated by the common portal on the basis of the information furnished in FORM GST INV-1.

(4) The Commissioner may, by notification, require a class of transporters to obtain a unique RFID and get the said device embedded on to the conveyance and map the e-way bill to the RFID prior to the movement of goods:

(5) Notwithstanding anything contained clause (b) of sub-rule (1), where circumstances so warrant, the Commissioner may, by notification, require the person-in-charge of conveyance to carry the following documents instead of the e-way bill:

(a) tax invoice or bill of supply or bill of entry; or

(b) a delivery challan, where the goods are transported other than by way of supply.

- Verification of documents and conveyances

(1) The Commissioner or an officer empowered by him in this behalf may authorise the proper officer to intercept any conveyance to verify the e-way bill or the e-way bill number in physical form for all inter-State and intra-State movement of goods.

(2) The Commissioner shall get RFID readers installed at places where verification of movement of goods is required to be carried out and verification of movement of vehicles shall be done through such RFID readers where the e-way bill has been mapped with RFID.

(3) Physical verification of conveyances shall be carried out by the proper officer as authorized by the Commissioner or an officer empowered by him in this behalf:

Provided that on receipt of specific information of evasion of tax, physical verification of a specific conveyance can also be carried out by any officer after obtaining necessary approval of the Commissioner or an officer authorized by him in this behalf.

- Inspection and verification of goods

(1) A summary report of every inspection of goods in transit shall be recorded online by the proper officer in Part A of FORM GST INS – 03 within 24 hours of inspection and the final report in Part B of FORM GST INS – 03 shall be recorded within three days of the inspection.

(2) Where the physical verification of goods being transported on any conveyance has been done during transit at one place within the State or in any other State, no further physical verification of the said conveyance shall be carried out again in the State, unless specific information relating to evasion of tax is made available subsequently.

- Facility for uploading information regarding detention of vehicle

Where a vehicle has been intercepted and detained for a period exceeding thirty minutes, the transporter may upload the said information in FORM GST INS- 04 on the common portal.