आयकर निदेशालय (पद्धनि)

DIRECTORATE OF INCOME TAX (SYSTEM)

ए आर ए सेंटर, भू-िल, ई-2 झंडेवालाि एक्स

ARA Center, Ground Floor, E-2, Jhandewalan Extension,

New Delhi – 110055

F.No. System/ITBA/Assessment/Notice 142(1)/2017-18

Dated: 19-03-2018

To,

All Principal Chief Commissioners of Income-tax/ PrDGsIT/ CCsIT/ DGsIT ,

All Principal Commissioner of Income-tax/ PrDsIT/ DsIT/ CsIT/CsIT (Admin&TPS),

All Assessing Officers

Sir/Madam:

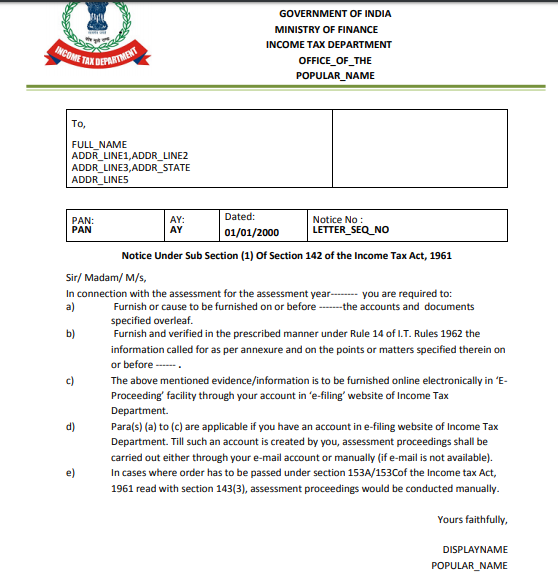

Subject: Issue of notices under section 142(1)(ii) & (iii) of Income –tax Act 1961 in revised

format- regd.

The concept of electronic assessment proceeding was introduced last year and its scope was

gradually enlarged. The e-assessment proceeding is now facilitated through e-filing portal. The

CBDT Instruction No. 01/2018, dated 12-02-2018 has mandated that except for search related

assessments and exceptional circumstance mentioned therein all other pending scrutiny assessment cases shall be conducted only through the ‘E-Proceedings’ functionality in ITBA/Efiling.

2. To facilitate conduct of e-assessment proceedings, the CBDT vide F.No. 225/157/2017/ITA-II dated 23-06-2017 had issued revised format of notices under section 143(2) of the Act so that the language of notices are in accordance with requirement of electronic proceedings and the same have already been provided in the system. It may be mentioned that specifically the need to produce documents and to be present in person has been done away with except as provided in the aforementioned Instruction.

3. However, notice u/s 142(1) was not amended in conformity with e-assessment

procedures and old format has been continued. To correct this inconsistency, the format of

notice u/s 142(1)(ii)&(iii) has been revised and the same is enclosed herewith. This revised

format now incorporates the same language as in the 143(2) notice to facilitate the taxpayer to

submit the documents and respond electronically and the requirement to visit the office has

been removed. This has also been implemented in ITBA system. Therefore, all the assessing

officers are requested to use this format for the cases in e-assessment proceedings.

4. In case where notice u/s 142(1) (i) &(ii) is already issued in old format to the assessees,

requiring them to furnish information mentioned in notice at the date and time fixed in the

office of Assessing Officer, an SMS/Email is being sent to all such assessees intimating them to

furnish the said information electronically through their account in e-filing website. Therefore

any compliance of the assessee through his e-filing account in response to the notice issued in

old format should be considered valid.

5. This is issued with prior approval of Pr. DGIT(S).

Yours sincerely

(Ramesh Krishnamurthi)

Addl. DG(S)-3, CBDT, New Delhi

Thousands of hours in the air conditioned chambers must have been spent for preparing the circular and draft of the notice besides lacs of sophisticated infrastructure. The circular and the notice as usual are totally useless, unproductive and old wine in new bottle. CBDT OFFICIALS ought to have spent the time in resolving lacs of grievances pending before the sleeping officers.