Rates of interest on advances and Loans to Govt. employees, for construction/Purchase of houses/flats

No.5(3)-B(PD)/2015

Government of India

Ministry of Finance

Department of Economic Affairs

(Budget Division)

Room No. 263-B, North Block, New Delhi

dated the 3rd February, 2016.

Office Memorandum

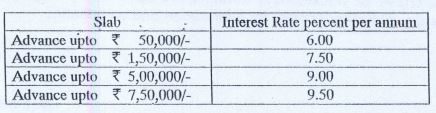

The undersigned state-that the rates of interest on advances and loans given to Government employees for construction/purchase of houses/flats during 2015-16 i.e. 1st April, 2015 to 31st March, 2016 and

until further orders will be as under

The rates remain unchanged from those applicable for the financial year 2014-15.

Ministry of Urban Development is requested to issue separate O.M. at its level on the above issue.

This issues with the-approval of Hon’ble Finance Minister.

(A.K. Bhatnagar)

Under Secretary (Budget)

TeI. No.23095083