Procedure for Issuing Tax Invoice under GST

(1) Every registered person supplying Taxable Goods shall before or at the time of removal of goods for supply to the recipient shall issue Tax Invoice containing description quantity, value of goods, rate of tax and tax charged thereon [Sec.31(1)].

(2) In respect of taxable services Tax Invoice shall be issued before or within a period of 30 days from the date of supply of service. But in respect of banking company, financial institutions, insurance company within a period of 45 days from the date of supply of service.

(3) In the case of supply of goods (Rule-48):-

The invoice/delivery challan, wherever applicable shall be prepared in triplicate, in the following manner, namely,-

(a) The original copy being marked as ORIGINAL FOR RECIPIENT;

(b) The duplicate copy being marked as DUPLICATE FOR

TRANSPORTER; and

(c) The triplicate copy being marked as TRIPLICATE FOR SUPPLIER.

(4) In the case of the supply of services

The invoice shall be prepared in duplicate, in the following manner, namely,-

(a) the original copy marked as ORIGINAL FOR RECIPIENT; and

(b) the duplicate copy marked as DUPLICATE FOR SUPPLIER.

(5) The serial number of invoices issued during a tax period shall be furnished electronically through the common portal in FORM GSTR-1.

6) Tax Invoice shall be issued by the Registered person containing following particulars

(Rule 46) namely:-

(a) Name, address, GSTIN of the supplier

(b) Consecutive Sl. No., not exceeding 16 characters in one or multiple series, containing alphabets or numeral unique for a financial year.

(c) Date of issue.

(d) Name, address, GSTIN / UIN of the recipient if registered.

(e) Name, address, GSTIN of the recipient (if un-registered), address of delivery with state name & its code, where the value of supply is Rs. 50,000 and above. In case of taxable supply less than Rs. 50,000/- if such un-registered recipient request for such details in the Tax Invoice.

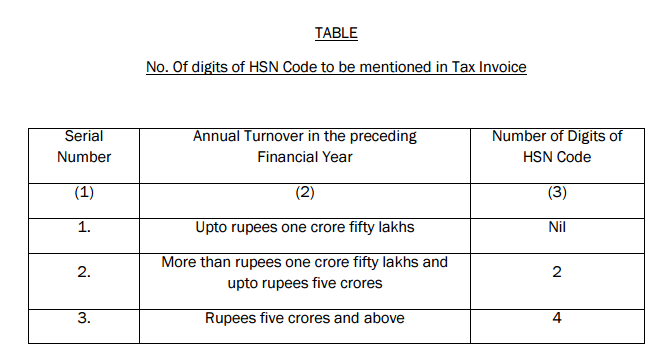

(f) HSN code or accounting code of services. * Please refer Table below *

(g) Description of Goods or Services & Quantity.

(h) Total value of supply and taxable value of supply.

(i) Rate of Tax and amount charged (CGST, SGST, IGST).

(j) Place of supply and address of delivery (if different from place of supply).

(k) Signature of the issuer.

7) Bill of supply:-

Every registered person supplying exempted goods or services or paying tax under composition scheme under Sec.(10) shall issue bill of supply instead of Tax Invoice and shall contain all the details as in Tax Invoice except rate of tax and tax charged (Rule-49).

(8) Receipt Voucher and Refund Voucher:-

Every registered person shall issue receipt voucher for receipt of advance payment with respect to any supply of goods or services. If no supply is made against the advance a refund voucher shall be issued for such payment. The receipt/refund voucher shall contain details as prescribed for Tax Invoice with amount of advance taken or refunded(Rule-50 & 51).

(9) Tax under GST Act shall be collected only by registered persons [Sec.32(1)] and in accordance with the GST Act and Rules [Sec.32(2)].

(10) After issue of Tax Invoice if the taxable value and tax charge found to be higher or in case of return of goods shall issue credit note [Sec.34(1)].

(11) After issue of Tax Invoice if the taxable value and tax charge found to be lesser than the taxable value or tax charge shall issue debit note [Sec.34(3)].

(12) Payment voucher:-

Every registered person who is liable to pay tax on reverse charge basis shall issue a payment voucher and shall contain details as prescribed for Tax Invoice with details of amount paid(Rule-52).

(13) Delivery challan:-

Every registered person who is transporting goods for job work, other than by way of supply, supply of liquid gas or when the quantity at the time of supply is not known shall issue delivery challan and shall contain details as prescribed for Tax Invoice(Rule-55).

For further information / clarification please contact your assessing authority / helpdesk or toll free number : 1800 425 1717

GST Tax Invoice : Free Study Material

Tax Invoice under GST of India – Analysis

Final GST Tax Invoice Rules – Approved by GST Council 18.05.2017

Related Topic on GST

| Topic | Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | Central Tax Circulars / Orders |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course

|