Krishi Kalyan Cess Accounting code notified by Govt as per Following Circular : 507-Krishi Kalyan Cess

Circular No. 194/04/2016-ST

F. No. 354/31/2016-TRU

Government of India

Ministry of Finance Department of Revenue

(Tax Research Unit)

***

Dated the 26th May, 2016.

To

Principal Chief Commissioners of Customs and Central Excise(All)

Principal Chief Commissioners of Central Excise & Service Tax (All)

Principal Director Generals of Goods and Service Tax/System/CEI

Director General of Audit/Tax Payer Services,

Principal Commissioners/ Commissioners of Customs and Central Excise (All)

Principal Commissioners/Commissioners of Central Excise and Service Tax (All)

Principal Commissioners/Commissioners of Service Tax (All)

Principal Commissioners/Commissioners LTU/Central excise/Service Tax (Audit)

Madam/Sir,

Subject: Accounting code for payment of Krishi Kalyan Cess – regarding.

Chapter VI of the Finance Act, 2015 will come into effect from 1st June, 2016. Krishi Kalyan Cess is leviable on all taxable services, other than services which are fully exempt from Service Tax or services which are otherwise not liable to Service Tax under section 66B of the Finance Act, 1994, at the rate of 0.5%.

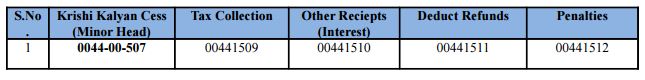

2. Accordingly, accounting codes have also been allotted by the Office of the Controller General of Accounts for the new Minor Head “507-Krishi Kalyan Cess” and new Sub-heads as under:

4. All concerned are requested to acknowledge the receipt of this circular.

5. Trade Notice/ Public Notice to be issued. Wide publicity through local news media including vernacular press may be given. Hindi version shall follow.

Yours faithfully,

(Abhishek Chandra Gupta)

Technical Officer (TRU)

Related Post