Steps for Migration of Rajasthan VAT dealers to GSTN portal

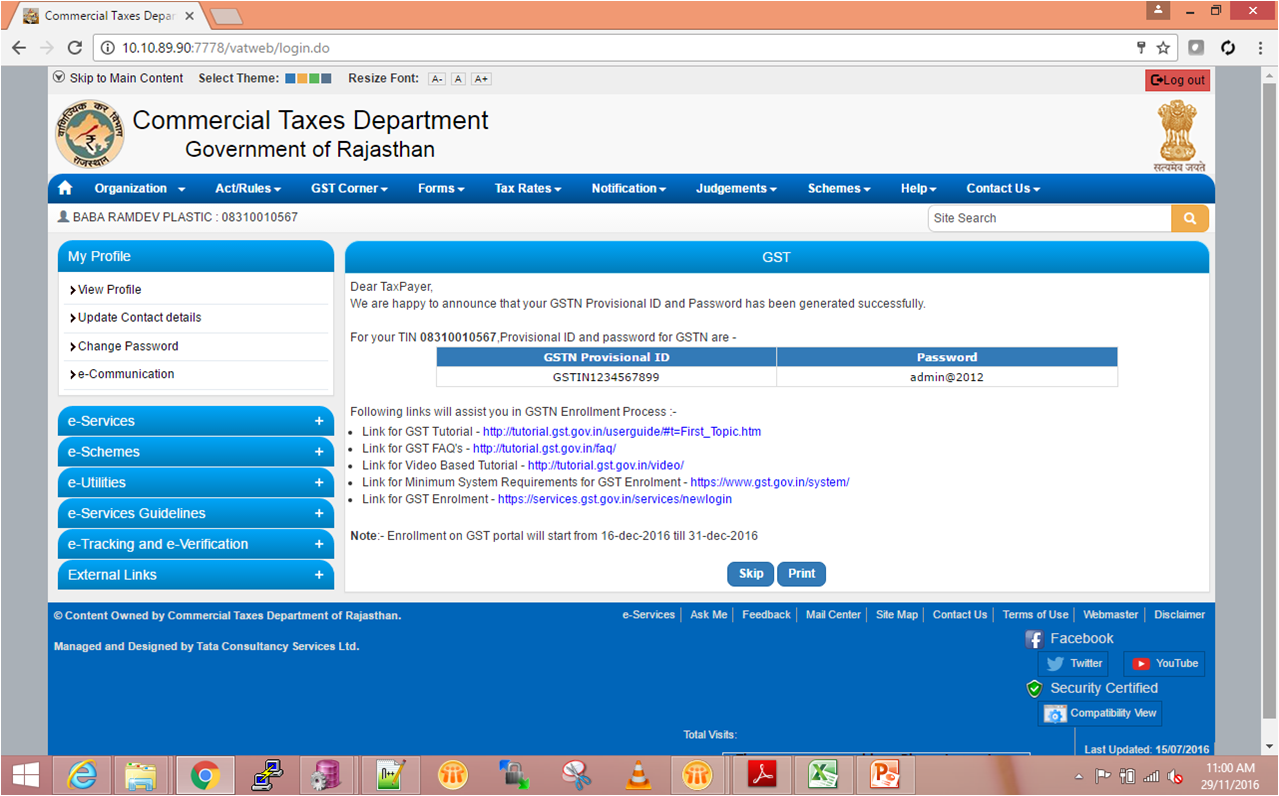

Migration schedule is proposed from 16th to 31st December, 2016 for dealers of Rajasthan.

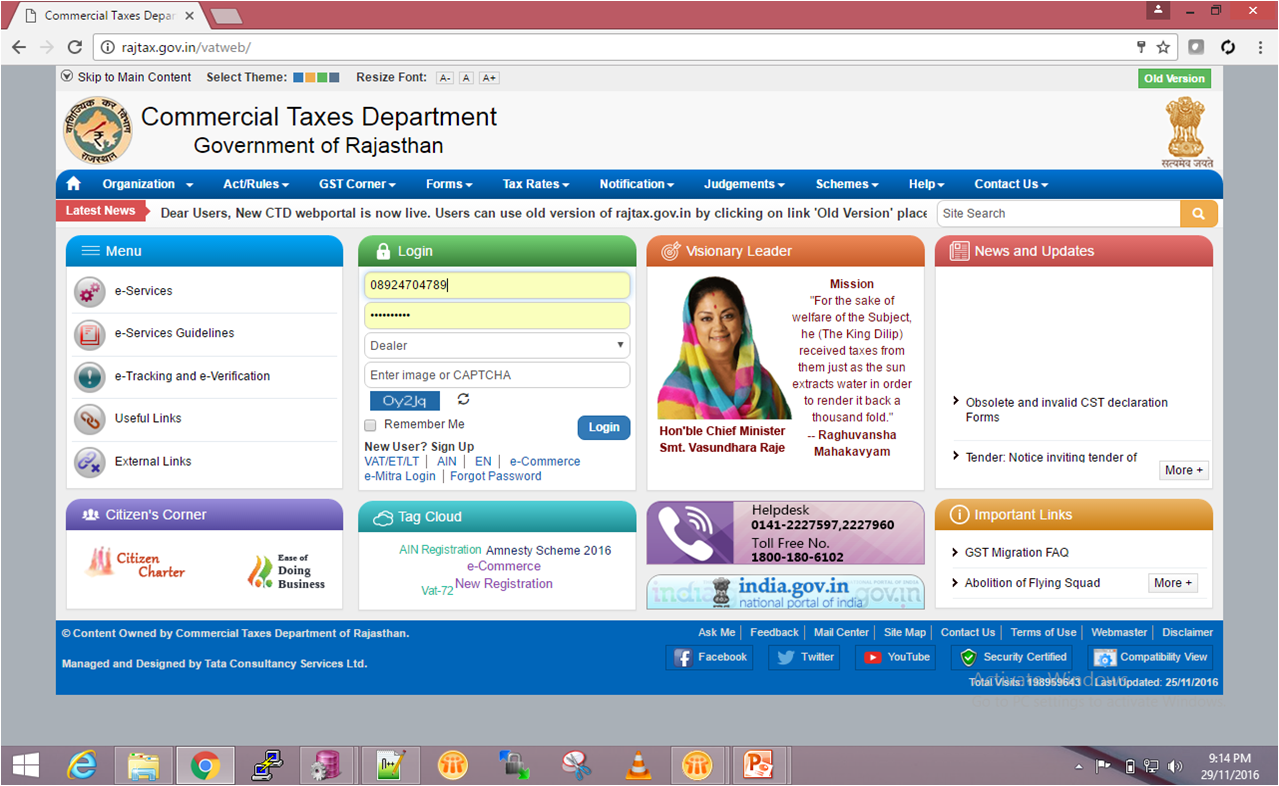

Dealers may update their registered Email ID and Mobile number on CTD portal. http://rajtax.gov.in/

All existing dealers will be migrated to GST.

Multiple TIN with single PAN will be discontinued.

Provisional user ID (GSTIN) and password will be provided to all such dealers, whose PAN has been verified.

- Dealer will logs on to rajtax website http://rajtax.gov.in/ with his Login ID and Password.

2. Dealer will be able to view his GSTN No. and Password on the first screen which appears after his Login.

3 Enter Provisional ID and password (Provided by Commercial Tax Department Rajasthan ). at www.gst.gov.in

ØE mail and Mobile number to be verified by separate One Time Passwords.

ØTaxpayer shall change his user id and password after first login.

ØTaxpayer shall require to fill the information required in the application form.

ØInformation related to additional place of business, Bank account, commodity in respect of goods and services dealt in (top five) are also required to be filled.

ØFollowing documents are required to be uploaded :-

- a) Photograph

- b) Constitution of Taxpayer

- Partnership deed (in case of partnership)

- Registration Certificate (in case of Society, Trust, Club, Government Department, Association of Person or Body of Individual, Local Authority, Statutory Body and Others etc.)

- c) Proof of principal/ additional place of business

- d) Bank account related proof

ØForm GST REG-20 will be required to digitally sign.

Øe-Signature facility will be available on the common portal for Aadhar holders (Other than any company, LLP etc.).

ØIf the information and the particulars furnished in the application are found to be correct and complete, a certificate of registration in FORM GST REG-06 shall be made available to the registered taxable person electronically on the Common Portal.

Related Post