Dear Deductor/Collector,

Its time to file the quarterly TDS/TCS statement. The quick steps are as follows:

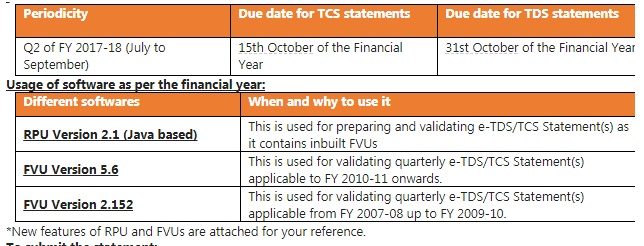

Due Date:

To submit the statement:

You need to know about

Quick links

e-TDS/TCS Return Preparation Utility (RPU) and File Validation Utilities (FVUs)

https://www.tin-nsdl.com/ downloads/e-tds/eTDS-download- regular.html

TIN Facilitation Centers (TIN-FCs) nearest to your location

https://www.tin-nsdl.com/tin- facilities.html

In case of any query with regards to the feature or to submit the statement please call us at 020-27218080.

For and on behalf of Tax Information Network

Services of NSDL e-Gov.

1. EzeeWill The simple way to make your WILL online.

2. Vidyasaarathi – technology-enabled initiative to bridge the gap in education finance.

3. e-Sign – Electronic Signatures at par with physical (Wet) Signatures, an initiative towards Digital India.

4. Vidya Lakshmi Single window to access information and make application for education loan.

5. GST Suvidha Provider Enroll for Application Service Provider (ASP) Services and GST Suvidha Provider (GSP) Services

6. Online PAN Application The simple way to make PAN application online

Key Features – Return Preparation Utility (RPU) version 2.1

Change in validations for all section codes available for Form 27EQ

Remark “C” (i.e. for higher rate deduction) is made applicable for all sections

available for Form 27EQ.

“C” remark is only allowed when the values ‘PANAPPLIED’, ‘PANINVALID’ or

‘PANNOTAVBL’ are present in the field ‘PAN of Deductee’.

In such case, total TCS amount has to be 5% or more of the field “Amount of

receipt / debited”.

The above referred validations are applicable for Regular and Correction

statements pertaining to FY 2017-18 onwards.

Addition of new field i.e. “Goods and Service Tax Number (GSTN)“ under form

page of TDS/TCS statements

15 digit alpha-numeric value to be entered under this field.

Applicable for regular and correction statements pertains to all forms and

FYs.

Change in validation for section code “194J – Fees for Professional or Technical

Services” for Form 26Q:

Remark ‘B’ is made applicable under this section which represents either no

deduction or lower deduction.

The same is applicable for regular and C3 type of correction Statement

pertaining to FY 2017-18 onwards.

Incorporation of latest File Validation Utility (FVU) version 5.6 (applicable for

TDS/TCS statements pertaining to FY 2010-11 onwards) and FVU version 2.152

(applicable for TDS/TCS statements from FY 2007-08 up to FY 2009-10).