User Guide for Online Verification of Cash Deposits during 9th Nov to 30th Dec 2016

Income Tax Department released procedure for Online Verification of Cash Deposits during 9th Nov to 30th Dec 2016 -User Guide

1. Background

Income Tax Department (ITD) intends to leverage technology and data analytics for effective utilization of demonetisation data i.e. transactions related to cash deposits during 9th Nov to 30th Dec 2016. ITD has enabled online verification of these transactions to optimise ITD resources and reduce compliance cost for the taxpayers.

2. Overview of online verification

The online verification has been enabled on e-filing portal (for taxpayers) which will be synchronised with the internal verification portal of ITD. The salient features of online verification mechanism are:

i. Data analytics has been used for comparison of demonetisation data with information in ITD databases to identify taxpayers wherein the cash transactions do not appear to be in line with the taxpayer’s profile. The information in respect of these cases is being pushed to the online portal (at https://incometaxindiaefiling.gov.in) seeking explanation of source of funds and the taxpayer will be able to submit online explanation without any need to visit Income Tax office.

ii. The information relating to cash deposits will be displayed to the PAN holder in the efiling portal (after log in) under the link “ Cash Transactions 2016 ” under “ Quick Links ” or “Compliance” section.

iii. Email and SMS will also be sent to the taxpayer tomorrow informing the taxpayer about the information and requesting for submission of online response on the e-filing portal. Taxpayers who are not yet registered on the e-filing portal (at https://incometaxindiaefiling.gov.in) should register by clicking on the ‘Register Yourself’ link. Registered taxpayers should verify and update their email address and mobile number on the e-filing portal to receive electronic communication.

iv. This user guide and quick reference guide is available on the portal to assist the taxpayer in submitting online response.

v. Data analytics will be used to select cases for verification, based on approved risk criteria. If the case is selected for verification, request for additional information and its response will also be communicated digitally. The information on the online portal is dynamic and will be updated on receipt of new information, response and data analytics.

vi. The response of taxpayer will be assessed against available information and in case explanation of source of cash is found to be justified, the verification will be closed without any need to visit Income Tax Office. The verification will also be closed if cash deposit is declared under PMGKY.

[Related post on Cash Transactions 2016 Demonetization : SOP Issued for Assessing Officer for Verification of Cash Transactions by CBDT , Cash Transaction 2016 -FAQ&;s released for e-filing on income tax website ]

3. Communication with the taxpayers

Email and SMS will be sent to the taxpayer informing that information has been received in the case and response may be submitted on the e-filing portal. In cases where no response is received within reasonable time, other proceedings and enforcement actions will be considered.

3.1 Registration of taxpayer in e-Filing portal

Taxpayers who are not yet registered on the e-filing portal (at https://incometaxindiaefiling.gov.in) should register by clicking on the ‘Register Yourself’ link.

Step 1: Go to the e-Filing portal of the Income Tax Department (https://incometaxindiaefiling.gov.in)

Step 2: Click on the “Register yourself” Button available on the home page. The registration page will open.

Step 3: Select the User Type (such as Individual, Firm etc) and Click on “Continue” button.

Step 4: Enter Basic Details and click on “Continue” button. After verification, the Registration Form will open.

Step 5: Enter the details in the Registration Form and click on “Submit” button. On successful validation, Taxpayer will get the message “Registration successful”.

Step 6: A confirmation e-mail will be sent to the Email provided with an Activation link. An SMS along with OTP (One time Password) will also be sent to the Mobile number provided. In order to activate the account, the taxpayer should click on the Activation link and enter the OTP received by SMS on Mobile. On success, the account is activated.

3.2 Updating contact details in e-Filing portal

Registered taxpayers should verify and update their email address and mobile number on the e-filing portal (at https://incometaxindiaefiling.gov.in) to receive electronic communication.

Step 1: Login to e-filing portal at https://incometaxindiaefiling.gov.in.

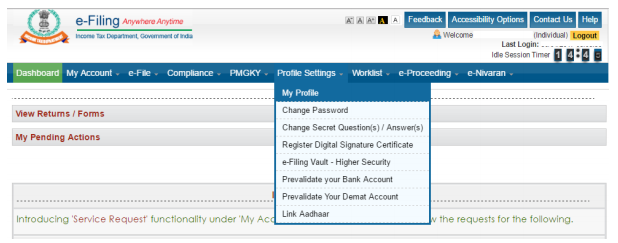

Step 2: Click on “My Profile” link under “Profile Settings” section and you will be directed to the “My Profile” page.

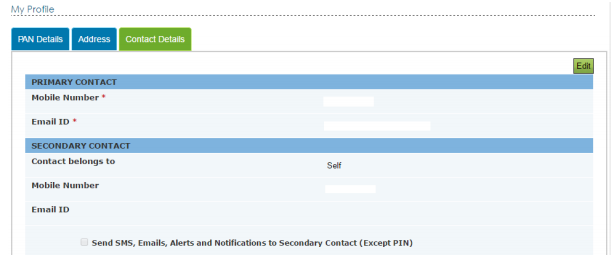

Step 3: The contact details of the taxpayer will be displayed.

Step 4: The user should update their personal Mobile number and Email so that the updated contact particulars are registered with the Department and taxpayer will be able to directly receive communication from the Department about status of processing and issue of refunds etc. Upon submitting the details, Department would immediately send OTPs (PIN1 & PIN2) to new mobile number and Email ID.

Step 5: The PINs (PIN1 and PIN2) received through Mobile number and E-mail ID should be entered in the respective input fields to authenticate that the email ID and mobile are correct. Upon successful validation the Mobile number and email ID would be updated in the taxpayer’s profile and the process would be complete.

Note:

i. One mobile number or email ID can be used for a maximum of 10 user accounts as the Primary Contact- Mobile Number and Email ID in e-Filing. This is to ensure that family members (not exceeding 10 separate users) not having personal email or mobile can be covered under a common email or mobile, but in general taxpayers should have their own unique email ID and Mobile registered with the Department.

ii. The taxpayer can enter any other person’s email or mobile number in addition as a Secondary Contact (without any restriction on the number of user accounts linked as a Secondary Contact).

iii. The taxpayer can select to include the Secondary Contact to also receive emails, alerts etc.

Taxpayers should verify and update their email address and mobile number on the efiling portal (at https://incometaxindiaefiling.gov.in) to receive electronic communication.

Taxpayer should include the emails and SMS from the Income tax Department in the ‘safe list’ or ‘white list’ to prevent the communications from the Department from being blocked or rejected or sent to Spam folder.

4. Viewing information

The information relating to cash deposits will be displayed to the PAN holder in the e-filing portal (after log in). The taxpayer can view the information as under:

Step 1: Login to e-filing portal at https://incometaxindiaefiling.gov.in.

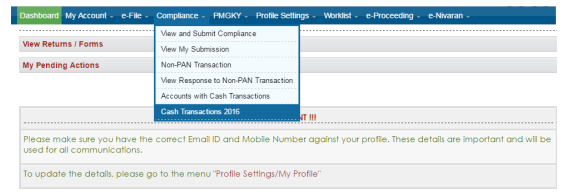

Step 2: Click on “Cash Transactions, 2016” link under “Quick Links” or “Compliance” section and you will be directed to the “Cash Transactions 2016” page.

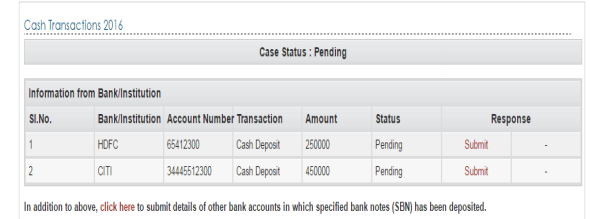

Step 3: The details of transactions related to cash deposits during 9th Nov to 30th Dec 2016 will be displayed.

Cash transaction data is only shown in cases where it does not appear to be in line with the taxpayer profile.

The information on the online portal will be dynamic and will be updated on receipt of new information, response and data analytics.

5. Submission of response

The taxpayer response is in two steps. In the first step the taxpayer needs to confirm that the bank account relates to the PAN of the taxpayer. Further details are required to be provided in the second step only if the taxpayer confirms that the account relates to the taxpayer.

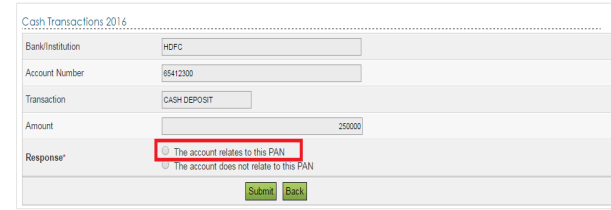

5.1 Confirmation of account

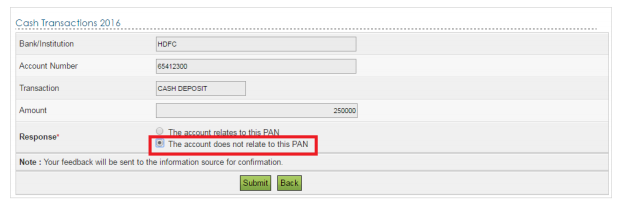

The user is provided with two options i.e. “The account relates to this PAN” and “The account does not relate to this PAN”. If the user selects the response option “The account relates to this PAN” the screen for capturing details will be displayed to the user.

If the user selects the response option “The Account does not relate to this PAN” then message “Your feedback will be sent to the information source for confirmation.” will be displayed. On clicking the submit button, the success message along with Transaction ID is displayed on the Screen.

If the account belongs to the PAN but the value of cash deposit is not correct, the user should select the response option “The account relates to this PAN”. The correct value of cash deposit can be submitted in the details screen.

5.2 Explanation of cash deposit

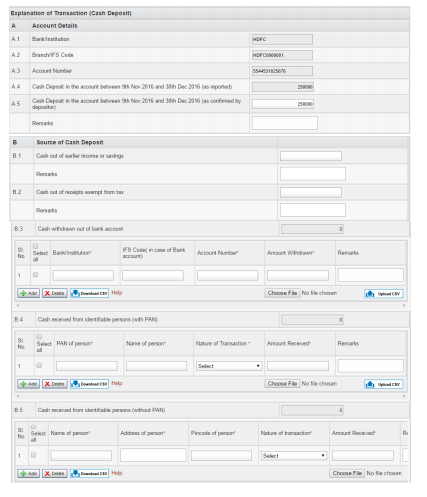

If the user selects the response option “The account relates to this PAN” the screen for capturing details will be displayed to the user. At this stage, the user will be able to modify the value of cash deposit (if it is different than the displayed value). The user will also be able to provide the explanation of transaction (source of cash deposit) digitally without visiting the Income tax office. The various categories for providing the explanation are:

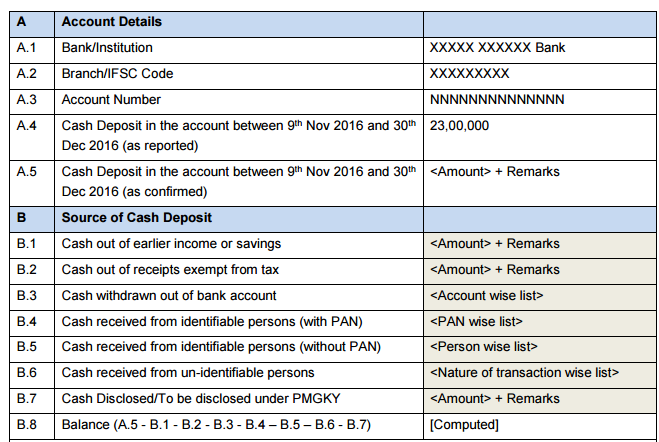

Explanation of Transaction (Cash Deposit)

The screens for capturing the explanation are as under:

5.3 Important aspects regarding submission of response

Following aspects may be considered while providing the response:

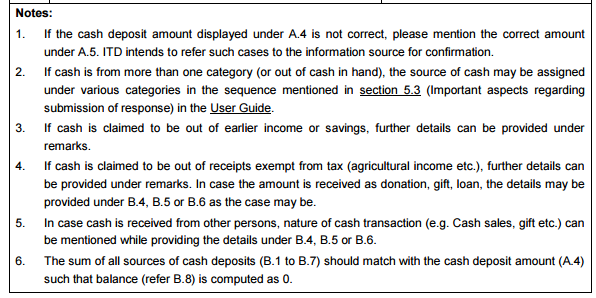

i. If the cash deposit amount displayed under A.4 is not correct, please mention the correct amount under A.5. ITD intends to refer such cases to the information source for confirmation.

ii. If cash is claimed to be from more than one category (or out of cash in hand), the source of cash may be assigned under various categories in the following sequence (Adopting other sequence may result in case being selected for verification based on risk criteria)

a) Cash withdrawn out of bank account (Refer B.3)

b) Cash received from identifiable persons (with PAN) (Refer B.4)

c) Cash received from identifiable persons (without PAN) (Refer B.5)

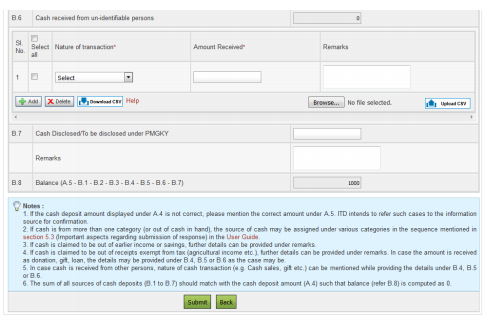

d) Cash received from un-identifiable persons (Refer B.6)

e) Cash out of receipts exempt from tax (Refer B.2)

f) Cash out of earlier income or savings (Refer B.1)

g) Cash Disclosed/To be disclosed under PMGKY (Refer B.7)

iii. In case there are multiple entries under B.3 to B.6, facility has been provided for online submission as well as upload of CSV (Comma Separate Values).

iv. In case cash is claimed to be withdrawn out of bank account, the account wise details are required to be provided (Refer B.3).

v. In case cash is received from other persons (on account of cash sales, loan, gift, donation etc.), it should be mentioned under B.4, B.5 or B.6 as the case may be. The nature of cash transaction can be mentioned while providing the details.

vi. If cash is claimed to be out of receipts exempt from tax (agricultural income etc. but excluding cases of gift, donation etc. which have been covered earlier), further details can be provided under remarks. In case the amount is received as donation, gift, loan, the details may be provided under B.4, B.5 or B.6 as the case may be. If receipts exempt from tax (Refer B.2) is not in line with the taxpayer profile or other available information, the case may be selected for verification based on risk criteria.

vii. If cash is claimed to be out of earlier income or savings, further details can be provided under remarks. If this information (Refer B.1) is not in line with the taxpayer profile or other available information, the case may be selected for verification based on risk criteria

viii. The sum of all sources of cash deposits (B.1 to B.7) should match with the confirmed cash deposit amount (A.5) such that balance (refer B.8) is computed as 0.

5.4 Uploading lists using CSV

A facility has been provided to enable upload of CSV (Comma Separate Values) in following categories:

Cash withdrawn out of bank account

Cash received from identifiable persons (with PAN)

Cash received from identifiable persons (without PAN)

Cash received from un-identifiable persons

Following aspects may be considered while uploading lists using CSV:

Download the CSV template from link (“Download CSV”).

Click on the “Template” and provide a file name to save the CSV file.

Update data as per the headings provided in CSV template.

Ensure that the filled template is saved in .CSV format. The same can be done by going to File

Save As Provide File name to save the Template Select Save as type as “CSV (Comma delimited) (*.csv)” Save.

Click on “Choose File” button to browse and select the updated CSV file, then click on “Upload CSV” to update the data.

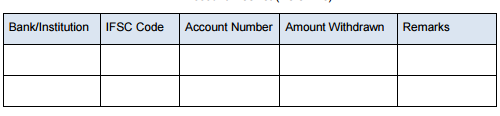

5.4.1 Capturing data in CSV for “Cash withdrawn out of bank account”

The format for capturing information is as under:

Account wise list (Refer B.3)

In “CSV Template”, the data provided should comply with the below requirements:

“Bank/Institution” is a Mandatory field.

“IFS Code” should be exactly 11 characters. First 4 characters should be ALPHABETS, 5th character must be zero (0) and remaining 6 characters should be either numbers or alphabets. This is a Mandatory field. The same shall be validated with RBI list.

“Account Number” can be alphanumeric, with two specific Special characters (Forward slash ‘/’ and Hyphen ‘-‘) not exceeding 20 characters. This is a Mandatory field.

“Amount Withdrawn” field should only be “Numeric, Non-negative and No decimals”. This is a Mandatory field.

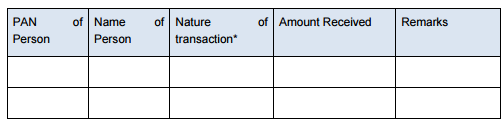

5.4.2 Capturing data in CSV for “ Cash received from identifiable persons (with PAN) ”

The format for capturing information is as under:

In “CSV Template”, the data provided should comply with the below requirements:

“PAN of Person” field should be 10 Characters. First 5 Alphabets, next 4 numbers and at the end 1 Alphabet.

“Name of Person” is a Mandatory field.

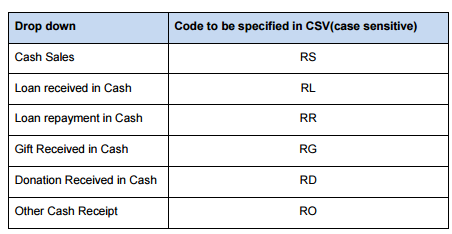

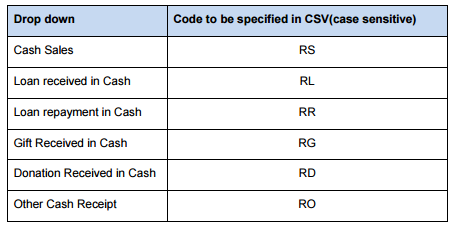

The drop down values of “Nature of Transaction” should be entered as per the codes mentioned below:

“Amount Received” field should be “Numeric, Non-negative and No decimals”. This is a Mandatory field.

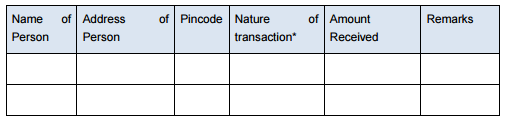

5.4.3 Capturing data in CSV for “ Cash received from identifiable persons (without PAN) ”

The format for capturing information is as under:

Person wise list (Refer B.5)

In “CSV Template”, the data provided should comply with the below requirements:

Name of Person” is a Mandatory field.

“Address of Person” is a Mandatory field.

“Pin Code” field must be 6 digits and should not start with zero. This is a Mandatory field.

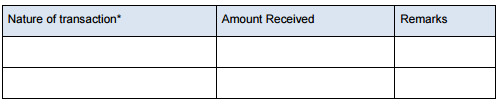

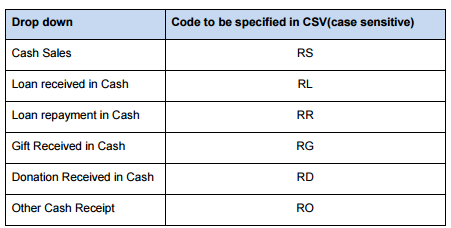

The drop down values of “Nature of Transaction” should be entered as per the codes mentioned below:

“Amount Received” field should be “Numeric, Non-negative and No decimals”. This is a Mandatory field

5.4.4 Capturing data in CSV for “Cash received from un-identifiable persons”

The format for capturing information is as under:

Nature of transaction wise list (Refer B.6)

In “CSV Template”, the data provided should comply with the below requirements:

The drop down values of “Nature of Transaction” should be entered as per the codes mentioned below:

“Amount Received” field should be “Numeric, Non-negative and No decimals”. This is a Mandatory field.

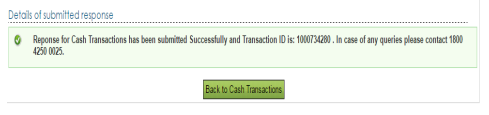

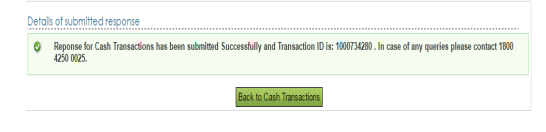

5.5 Validation during submission

The sum of all sources of cash deposits (B.1 to B.7) should match with the confirmed cash deposit amount (A.5) such that balance (refer B.8) is computed as 0. On successful validation, the success message along with Transaction ID is displayed.

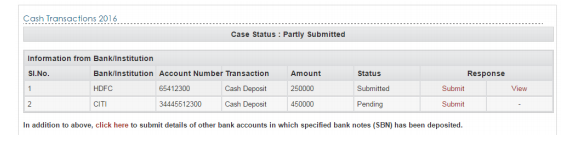

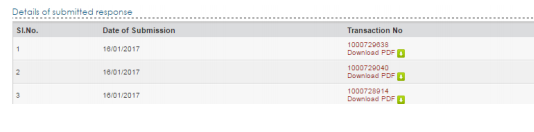

6. Viewing submitted response

The user can view submitted responses.

Step 1: Click on “View” button against the respective Bank Account under “Cash Transactions 2016”.

Step 2: Click on “Transaction No” to view /download the response submitted.

The user can revise the submitted response by clicking on the “Submit” button.

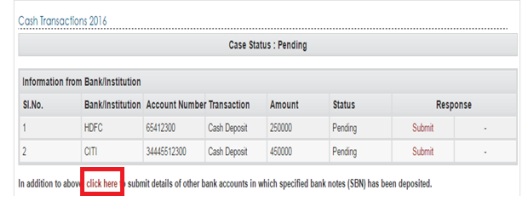

7. Submission of details of other bank details

The user is required to submit details of other bank accounts (other than the one displayed) in which specified bank notes (SBN) has been deposited.

Step 1: Click on the hyperlink below the list of bank accounts

Step 2: Provide explanation of cash deposits as explained in section 5.2 to section 5.6 earlier.

Step 3: On successful validation, the success message along with Transaction ID is displayed on the Screen.

The user can revise the submitted response by clicking on the “Submit” button.

The user can view submitted responses by clicking on “View” button against the respective Bank Account. User can view/download the response submitted by clicking on “Transaction No”.

The user can revise the submitted response by clicking on the “Submit” button.

8. Verification of case

Some cases will be selected for verification based on risk criteria. If the case is selected for verification, request for additional information and its response will also be communicated digitally. The information request will be communicated to the PAN holder with a hyperlink for uploading information. An e-mail concerning the additional information will be sent to the e-mail id of the taxpayer.

The response of taxpayer will be assessed against available information and in case explanation of source of cash is found to be justified, the verification will be closed without any need to visit Income Tax Office. If cash deposit is declared under PMGKY, the verification will be closed.

Taxpayers should verify and update their email address and mobile number on the e-filing portal (at https://incometaxindiaefiling.gov.in) to receive electronic communication.

Helpline Nos

Please contact 1800 4250 0025 for queries regarding e-filing issues.

Please send mail at cash2016@incometaxindia.gov.in for queries regarding verification.