E Book on Panchnama

INDEX

1. Introduction

2. Importance of Pancnama in Customs, Central Excise and Service tax proceedings

3. Summary of Legal Provisions

4. Panchas

5. How to draw a Panchnama-Some Basics

6. Types of Panchnama

7. Points to be incorporated in a Panchnama

8. Do’s and Don’ts while recovering Documents

9. Guidelines prescribed by CBEC to be followed while drawing the panchanama

1. Introduction

1.1. The word „PANCHNAMA‟ literally means a “record of observation by five people”. Panchnama is essentially a document recording certain things which occur in the presence of the Panchas and which are seen and heard by them. Panchas are taken to the scene of an offence to see and hear certain things. Therefore, panchas are liable to be examined at the trial to depose to those things and their evidence is relied upon in support of the testimony of an investigating officer. A panchanama of this kind recorded and relied upon in support of evidence from the panchas is akin to a statement previously made by him under Section 157 of the Indian Evidence Act, 1878 which says that former statement of witnesses may be proved to corroborate later testimony as to the same fact.

1.2. A Panchanama is an essential document not only influencing the course of proper investigation but a record of memory and refresher of memory so that important details are not forgotten. Section 159 of the Evidence Act, 1878 says a witness may refresh his memory by referring to any writing made by himself and even written by anyone else

1.3. Accordingly the panchnama must be factual incorporating what was actually seen and heard by the witnesses, written in their hand or written out or certified by him as found to be true and correct and as seen, witnessed, and heard by them.

2. Importance of Panchnama in Customs, Central Excise and Service tax proceedings:

2.1 In Central Excise / Service Tax / Customs cases or in the cases pertaining to Foreign Exchange etc. the Panchanama is a major document and could even be of evidentiary value. During investigation, it plays very important role in establishing guilt of accused. Moreover, sometimes „PANCHNAMA‟ becomes key document in the appreciation of evidence by the court. The reality of the situation has to be properly and correctly grasped in the panchanama. The panch (witness) may have to render accurately the facts of the scene where the goods were found. The panch witnesses must be available at the spot. They must know and see for themselves as to how the facts and circumstances came out, that existed at the time of search and seizure, as to how the offender was discovered or the suspect was located as to the evidence collected relating to the goods that have offended the provisions of the act and as to how the suspect has come into possession and became owner.

2.2 A panchanama seen and heard by the panchas and recorded by a scribe or an officer is only a modus as dictated by an officer and will not render the panchanama invalid and panchanama would be admissible in evidence.

2.3 A panchanama properly drawn and carefully incorporating facts seen and heard is an important part of an investigation. The material facts disclosed in a panchanama help in discharging the burden of proof resting on the prosecution. Presumption of guilt in the offender may stand adduced if the panchanama is clear and unambiguous.

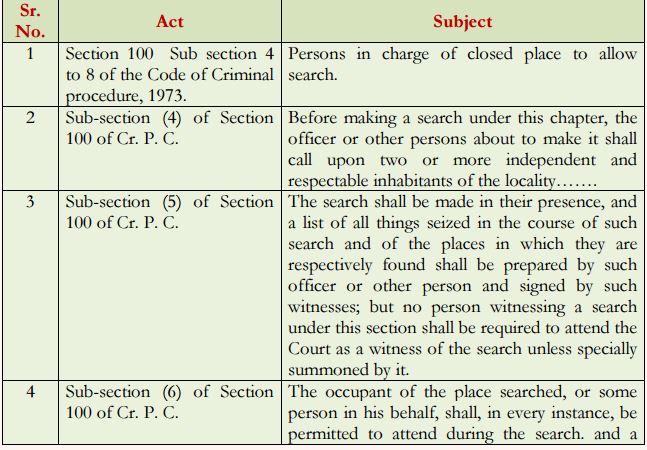

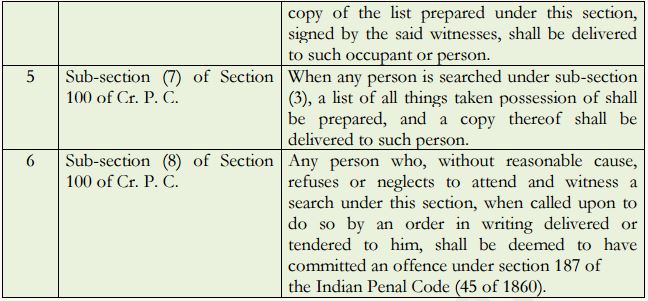

3. Summary of Legal Provisions

The drawl of Panchnama is an integral activity to carry out any search, jamatalashi or seizure proceedings of any contraband or unaccounted raw material or final product in Customs and Central Excise. Although, in Customs Act, 1962 or Central Act, 1944 or rules made thereunder, no legal provision for Panchnama is given but while conducting search, the provisions contained in Section 100 of the Code of Criminal Procedure are to be followed.

Therefore, making of Panchnama is a means to carry out the search and/or seizure proceedings in a transparent and justifiable manner

4. Panchas

‘Panchas’ should be independent and respectable people. They should normally belong to the locality and/or neighborhood of the place where the panchanama is drawn. There is however no bar in getting panchas from distant places also if need be or to overcome the non-availability of local panch witnesses. The panchas should, however, be,-

(a) Intelligent

(b) Literate as far as possible

(c) Respectable citizens

(d) Should possess an understanding and of impartial nature

(e) Must be with good antecedents. No convictions earlier.

(f) Should not be interested /prejudiced in the matter they are attending to.

(g) Should not be easily influenced by pecuniary / other considerations.

(h) Should not be a minor.

(i) Acceptable to the religious sentiments of the owner of the house.

(j) Free from contagious diseases and infirmities as to effect their being proper panchas (for instance deaf, mute, blind etc.)

(k) Should have no relationship either with the place or persons searched.

(l) Complainant or owner of the house should not be made a pancha.

(m) Well-to-do or affluent persons may not necessarily be respectable persons,

(n) No objection if panchas are Government servants,

(o) Other Important things regarding Panchas:-

(i) Panchas should be present from the time of entry into the premises.

(ii) They should have knowledge of the purpose of the search.

(iii) Should be present from the beginning to the end of the search.

(iv) Should initial the documents/records for identification of having seen it at the time of search for use at a later date.

(v) They may be explained that they should carefully watch the proceedings in the search.

5. How to draw a Panchnama-Some Basics

5.1 The Panchanama should be drawn as follows:

(a) Heading, time, date.

(b) Details such as Names, addresses, S/o, W/o etc. of the panchas for closer identification.

(c) Occupation of Panchas

(d) Age of Panchas

(e) Residential address of Panchas

5.2 Where female members are there in the place of search, try to include female panch witness also. Panchas should be either two or more, not less than two. Explain to the panchas the purpose of the search. Introduce the owners to the panchas. Identify the suspect in the panchanama by taking his full name, his father’s/husband’s name etc., occupation, residential address, identification marks, if any. Take the signatures of the panchas, the owner/suspect on the warrant or the authorization for search and specify the details of the said documents in the panchanama and state that the same has been dated and signed by the panchas and suspects. Give a brief and accurate description of the search carried out.

5.3 Offer yourself and the panchas for personal search before entry and again at the time of the closure of search, specify descriptively as to the article where found, in what manner, its identification narks, size, numbers, weight, colour etc. If documents are found collect them, serially number them, have each page dated and signed by panchas and suspect and if voluminous -stitch them together by sealing the ends of the thread on a piece of paper with seal and signatures and date of the panchas and suspect and have the papers in the bunch serially numbered. Also give the condition of the article/document if necessary (especially if damaged or torn etc.).

5.4 If currency notes are found place them according to denominations and bunch them together by passing a thread through the bundle with needle and tie the ends of thread and have the ends sealed with the piece of paper below seal bearing. Take the Signatures of the panchas and owner-cum-suspect, try to take down the serial numbers of notes, in case of high denomination notes of Rs. 100/- and above.

5.5 During the course of panchanama relevant and important clarification in connection with the goods/document/claims and modus involved can be put to the owner/suspect and incorporated in the panchanama. It would form part of what is heard. Be brief, but details should not be omitted, in the sense that no point is left out. Thumb impression may be taken where the panch witness is an illiterate.

5.6 The panchanama should be signed by panchas, suspect/owner, officer, and dated on each page. Time of closure and date should be indicated. Time of commencement should also be mentioned.

5.7 Panchanama should be drawn on the spot. Where it is not possible to do so, for reasons of security, peace and tranquility, the panchanama may be drawn at the safe and convenient place but the panch should be present at the spot and continue throughout the entire process and the panchanama should incorporate details/reasons why the panchanama was being drawn elsewhere. Panchanama may be drawn during the day as far as possible but it can be drawn at night if circumstances so necessitate.

5.8 Panchanama should be written only once. There is nothing like a rough and fair copy. Do not destroy a panchanama drawn. If any differences arise state reasons in the same panchanama and continue. Write them neatly and legibly and corrections must be attested by the panchas. Avoid erasures.

5.9 Get the articles and documents identified by the owner, suspect and incorporate the identification in the panchanama by taking initials and date on the articles and documents also. Take the help of goldsmith when gold is seized or being taken over, samples in cases of materials like chemicals, oils etc. can be drawn and sealed with panchas signature for chemical tests.

5.10 A panchanama can be proved by examining the panch witnesses in the Court. Panchanama can be submitted in court as documentary evidence in pursuance of the oral submissions of the witness or witnesses.

6. Types of Panchnama

6.1 The Panchnamas are of the following types:

Panchnama for checking (without search warrant) in the factory/dealers premises duly registered with Central Excise.

Panchnama for search of a factory/dealers‟ premises, business place or office on the authority of a search warrant.

Panchnama for search of residential premises

Panchnama during the course of transit checks etc.

Panchnama for service of summons, notice, refusal to sign statements etc. by way of pasting on the walls, gates etc

7. Points to be incorporated in a Panchnama

7.1 Panchnama is the single most important document in the context of search and seizure operations. This document should, therefore, be prepared carefully incorporating, inter alia, the following points.

Name, parentage, age, address and occupation of Panchas.

Date, time and place of proceedings.

Reason/authority for search or purpose of visit.

The fact that the officers conducting the search disclosed their identity to the Panchas. Name and designation of the officer leading the team.

The fact of presence of the occupants/representatives of the premises to be searched during the course of the search.

Execution of the search warrant upon the occupant/representative of the premises to be searched. The fact that one of the occupants/representatives of the party and both panchas have signed the search warrant.

The fact of offering personal search of each member of the search team before commencing search and again after conclusion of search.

The fact of presence of a lady officer in the party conducting the search (in case of search of residence etc.)

Mention any important event taking place during the operation e.g. arrival of more officers/persons, calling a photographer for photography, drawing of samples, detection of large amount of cash, sealing of any almirah, cupboard etc.

Mention the details of production of statutory Central Excise records and other private records, Account Books etc. presented by the representative of the party for inspection in case of checking (in case of search the officers themselves have to take into possession all records).

Mention how the verification of excisable goods, inputs was undertaken (procedure adopted for weighment, measurement, test checking of standard packages/units etc). It should be supported by inventory of stocks verified.

Record the fact that in respect of goods verified physically, no other stock was available/left over. Current day‟s production and issue of inputs may be specifically mentioned as excluded.

Make a separate annexure for inventories of records/documents to be resumed and articles/goods seized.

Mention the grounds forming the reasons to believe that goods seized were liable to confiscation under the Central Excise Act, 1944 or the rules made there under and the provisions under which seizure effected.

Mention the value and duty of goods seized/detained & whether seized goods given in „supurdagi‟ or taken into possession.

Record facts regarding drawl of samples, if any. If sealed, a specimen of the seal to be given on the body of panchnama.

In case of concealment of excisable goods, records or evidences, give facts regarding place of storage (basement etc.) and manner of concealment.

Every page of records resumed/seized should be numbered following one set pattern viz. 1,2,3 etc. (& not 1,3,5….).

The first and last page of every file, register, Account Book etc. should be got signed by the authorized representative of the party or the person upon whom the search warrant has been executed.

Every loose paper/vital document should be got signed individually from the concerned person from whose seat or cabin the same was recovered and from the person on whom search warrant was executed.

In case any of the portion of the premises, almirah, safe, store etc. is found to be locked and cannot be opened for some reasons or the other, the same may be sealed and a mention may be made accordingly in the panchnama. This sealed premises can be searched using fresh search warrant on any following day.

The details of any locker, almirah or any section of premises which has been sealed for reasons that the officers could not immediately obtain access for want of the keys, hypothecation to the bank or any other reason, should be incorporated.

The grounds for seizure/resumption of records/documents, should be described in the Panchnama.

8. Do’s and Don’ts while recovering Documents

8.1 Documents are recovered for the reasons that the same are useful as evidence in any proceedings under the Central Excise Act / Finance Act / Customs Act.

The foremost thing to be done in case physical stock verification is to be conducted is to recover the record maintained for making entries of production and clearance. This record should be authenticated by the authorized signatory with the remark that this is the record maintained by their unit /company for making entries of production and clearance on a day today basis and other than this they do not maintain any other record for their production and clearance. The authorized person‟s signature should be obtained with stamp.

Simultaneously records maintained at the main gate/security should be recovered which gives an idea of inward and outward movement of goods.

Records which are secreted in places which are not meant for storage of records specific mention has to be made in the panchanama of places from where recovered. For example kitchen/ canteen, bathroom, workers quarters , store room, raw material godown, laboratory etc.,

If 5 years records are recovered then it has to be ensured that all the records are recovered. For example in the case of RG 23 A the unit may maintain a number of books in a year, care should be taken to see that all the records without any break of period are recovered.

All such records should be kept at one place and entries made in the annexure year wise accordingly ( indicating the number of books for the year).

While recovering private records care should be taken to get the private record authenticated All the private record/ slips should be carefully tagged , serially numbered, and the concerned persons along with witnesses should append their signatures

Record the statement of the author of the private record/ slips on the day of the search itself.

To distinguish records recovered from various places a suffix or prefix with an alphabet like F for factory, H or R for residence should be made.

9. Guidelines prescribed by CBEC to be followed while drawing the panchanama

9.1 While affecting any seizure, a search list or panchanama must be drawn on the spot of seizure giving a full and complete account of goods seized. The panchanama must be drawn in terms of Section 103(2) of the Cr.P.C.

9.2 Deficiencies in Panchnama are often exploited by parties and they escape penalty / punishment otherwise due, by establishing that the Panchnama did not reflect the facts properly & therefore could not be relied upon. In order to streamline the procedure for seizure of goods and preparation of Panchnama, the following guidelines must be scrupulously followed by all officers affecting seizures:-

(a) The search of the premises / persons should be conducted, invariably, by persons with due authorisation / authorities, in the presence of two independent and respectable Panch witnesses of the locality and the occupants of the place or their representative(s). The leader of the party conducting search must show / read out the search authorisation to the Panch witnesses as well as the occupants of the premises or their representative(s) and must obtain their signatures on the search authorisation, in token of the same having been seen by them:

(b) All the members of the search party, before starting search, must offer themselves for being searched by the witnesses and / or the occupants of the premises and / or their representative(s), and this fact must be clearly incorporated in the Panchnama.

(c) Care must be taken in recording in the Panchnama all relevant & precise details of the incriminating goods including valuables, currency notes or documents recovered and seized during the search. The denominations of currency & total amount, details of valuables or other contraband goods (with identification marks, wherever possible), both in quantity and value terms and the manner of packing / sealing of the goods seized, should be clearly mentioned in the Panchnama, to avoid any controversy of the actual contents / value in different seized packages, at a later date;

(d) Detailed inventory of all offending/contraband goods proposed to be seized under the reasonable belief that these are liable to confiscation under the provisions of the Customs Act, 1962 should be prepared & got duly authenticated by the Panchas as well as representative(s) of the person(s) whose premises are searched;

(e) The description of places / packages, etc., from where these goods / currency / valuables etc, were recovered & if concealed, the manner of concealment, etc. should be clearly mentioned, unless it becomes impractical to undertake a detailed inventory of contents of each packages. Each package should be got sealed and labelled in the presence of Panchas and the owner / person incharge from whose premises these goods are recovered and labels got duly signed;

(f) The detailed inventory, as stated above, and copies of Panchnama, on each page, must be signed by the Panchas and the owner / person incharge of the premises, who have witnessed the search / seizure and a copy of the Panchnama shall be handed over to him;

(g) It should be clearly mentioned in the Panchnama that except for the documents / goods seized under Panchnama, nothing else was seized and / or taken in possession;

h) The time and date of starting the search as well as the time and date of concluding the search, should be clearly mentioned in the Panchnama and a facsimile of the seal used during the search should also be embossed on the Panchnama;

(i) Any untoward incident occurred during search should be clearly mentioned in the Panchnama. If search was conducted smoothly, this fact should be mentioned in the Panchnama;

(j) On completion of the search all members of the search party, must again offer themselves for being searched by the witnesses and / or the occupants of the premises, and / or their representative(s) and this fact should also be incorporated in the Panchnama;

(k) On completion of the Panchnama, it must be read over to all concerned, in vernacular, and signatures of Panch witnesses as well as occupants of the premises / their representative(s) should be obtained on the Panchnama;

(l) A copy of the Panchnama should be handed over to the occupants of the premises or their representative(s), under proper acknowledgement.

[ Ministry’s letter No. 394/226/98-Cus (AS) dt.30.8.1999]

In addition to the above guidelines, the following must also be followed:

(i) While seizing the documents, the procedure as given below should be adopted :

(a) All loose documents should be signed by the witnesses.

(b) Each page of all exercise books registers, etc. must be numbered and the pages containing writing must be signed by the witnesses. The number of written pages and the pages should be separately indicated in the documents.

(c) The first and last pages in the register, the exercise books, etc. must be signed by the witnesses.

(d) The seizing officer will also cause all seized goods to be properly sealed with the Customs seal as well as the seal of the owner (if any) if he so desires.

(ii) A memo should be served on the spot, where required, directing the owner to attend the Customs Office on the specified day and time for the preparation of the detailed inventory, examination and valuation of his goods. If inspite of this memo, the owner fails to attend the Custom Office within the specified time-limit for examination of the goods, etc. the goods may be examined in his absence before two independent witnesses

Though all efforts have been made to make this document error free, but it is possible that some errors might have crept into the document. If you notice any errors, the same may be brought to the notice to the NACEN, RTI, Kanpur on the Email addresses: rtinacenkanpur@yahoo.co.in or goyalcp@hotmail.com. This may not be a perfect E-book. If you have any suggestion to improve this book, you are requested to forward the same to us.

Source NACEN,RTI, Kanpur.