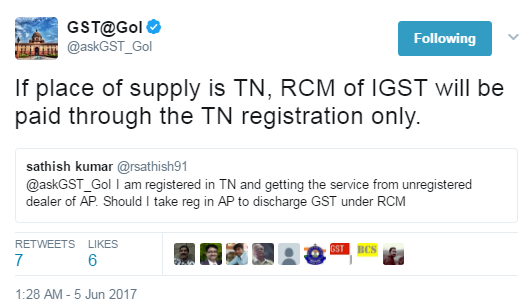

Q I am registered in TN [ Tamil Nadu ] and getting the service from unregistered dealer of AP [ Andhra Pradesh ]. Should I take regestration in AP to discharge GST under RCM [ Reverse Charge Mechanism ]

If place of supply is TN [ Tamil Nadu ] , RCM of IGST will be paid through the TN [ Tamil Nadu ] registration only.

[ Reply as per Twitter Account of Govt of India for GST queries of Taxpayers ]

Dear Sir

I agree . But what should be done if unregistered person of AP (Andhra Pradesh ) provides services in AP to the person registered in TN (Tamil Nadu)

Pls offer your valuable suggestions

Regards