Circular No. 32 / 2016 – Customs

F. No: 473 / 05 / 2015 – LC

Govt. of India

Ministry of Finance

Dept. of Revenue

Central Board of Excise and Customs

North Block, New Delhi

Dated 13th July 2016

All Principal Chief Commissioners Customs,

All Principal Chief Commissioners of Customs & Central Excise,

All Chief Commissioners of Customs,

All Chief Commissioners of Customs & Central Excise,

All Directors General, Chief Departmental Representative,

All Principal Commissioners of Customs,

All Principal Commissioners of Customs & Central Excise,

All Commissioners of Customs,

All Commissioners of Customs & Central Excise.

Subject: – Procedure regarding Duty Free Shops.

Madam/Sir,

Please refer to Notification No. 66/2016 – Customs (N.T.) dated 14th May 2016, Special Warehouse Licensing Regulations, 2016, Special Warehouse (Custody & Handling of Goods) Regulations, 2016 and Circular no. 20 / 2016 – Customs dated 20th May 2016.

2. It may be noted that the Special Warehouse (Custody & Handling of Goods) Regulations, 2016 prescribe maintenance of a computerized system for accounting. Accordingly, a system of accounting of receipt, storage, operations and removal of goods with regard to Duty Free Shops is prescribed below:

3. Maintenance of records of warehoused goods only in digital form:

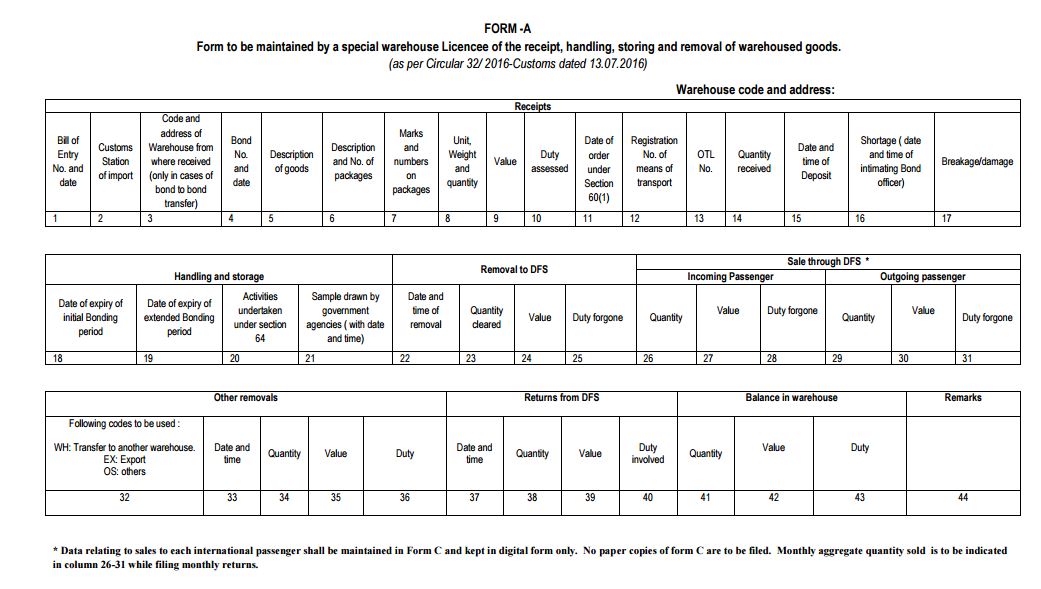

(a) Every licensee shall maintain electronic records of receipt, handling, storage and removal of the warehoused goods based upon data elements contained in Form A appended to this circular. While the data elements contained in the Form are mandatory, the licensee will be free to add or continue with any additional data fields, as per their commercial requirements. It would be necessary for the data to be maintained as per systems of “stock keeping unit” (SKU)

(b) All licensees are required to enter data accurately and immediately upon the goods being deposited in or removed from the warehouse. Such electronic records should be kept updated, accurate, complete and shall be available at the warehouse at all times so as to be accessible to the bond officer or any other authorised officer, for verification.

(c) The software for maintenance of electronic records must incorporate the feature of audit trail which means a secure, computer generated, time-stamped electronic record that allows for reconstruction of the course of events relating to the creation, modification, or deletion of an electronic record and includes actions at the record or system level, such as, attempts to access the system or delete or modify a record.

4. Filing of returns in relation to warehoused goods:

(a) The Regulations also prescribe that,-

(i) a licensee shall file with the bond officer a monthly return of the receipt, storage, operations and removal of goods in the warehouse, within ten days after the close of the month to which such return relates.

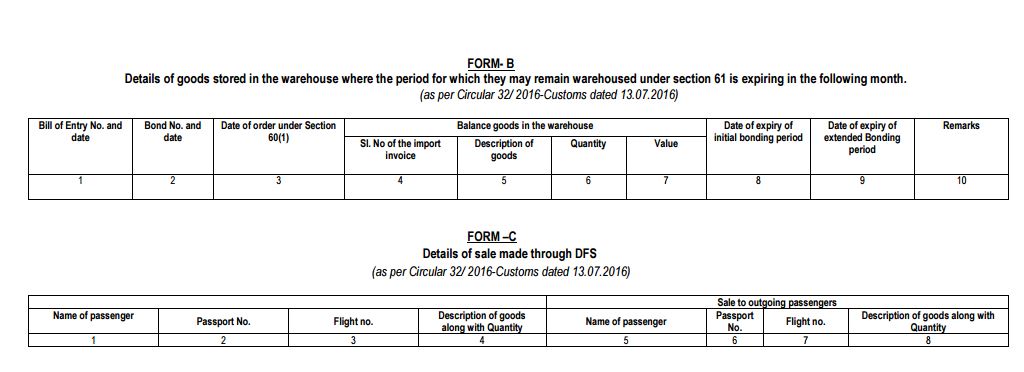

(ii) where the period specified in section 61 of the Customs Act, 1962 for warehousing of goods is expiring in a particular month, the licensee shall furnish such information to the bond officer on or before the 10th day of the month immediately preceding the month in which the period of storage of goods in the warehouse is expiring.

(b) The monthly return, as per para 4 (a) (i), containing transactions undertaken during the month, shall be filed by the licensee in Form A appended to this circular. The Return may be filed as a paper copy or in digital form, as preferred by the licensee (digital form means, such as, in a Pen drive or CD). The Return need not include details of sales to individual international passengers. These can be verified by the bond officer or any authorised officer, from the digital records maintained by the licensee.

(c) The monthly return to be filed by the licensee as per para 4 (a) (ii) shall be filed in Form B appended to this circular. The Return shall be filed with the Bond officer as a paper copy.

(d) The Duty Free Shop Operator shall also maintain digital records of sales to international passengers as per Form C. The digital file containing these details shall be integrated with the records maintained for the warehoused goods, every 24 hours, and should be available for inspection as a part of the data maintained as per Form A. However, filing of returns would not be required for the record maintained as per Form C.

5. Acknowledgement of the receipt of goods in the warehouse:

The Licensee shall follow the procedure contained in Regulation 6 of the Special Warehouse (Custody & Handling of Goods) Regulations 2016. Upon receipt of the goods in a warehouse, the licensee shall, send an acknowledgement of such receipt, duly signed by the bond officer, as follows:

(i) in case where goods are received from a customs station, to the Assistant/Deputy Commissioner in charge of the Bond section at the Customs station of import; or

(ii) in case where the goods are received from another warehouse, to the proper officer of the warehouse from where the goods have been received.

6. Facilities:

In view of the requirement in the regulations to retain photocopies of documents such as bills of entry, transport documents and Form for transfer of goods from a warehouse, send acknowledgement of receipt of goods in the warehouse etc., the licensee shall maintain facilities such as computer, photocopier, scanner and printer at the warehouse.

7. Effective Date:

The above requirement of maintaining digital records, in the prescribed Forms, is applicable from the 14th May 2016. Thus, the record of any goods received on or after 14th May 2016 shall be maintained as per the prescribed Forms. However, during the consultations with Duty Free Shop Operators, it was gathered that they are already maintaining records in software based systems but due to the requirement of maintaining the bond register, records are being reduced to manual form to comply with prescribed columns. Now that a system of computerised record keeping has been prescribed, the information regarding the stock of goods lying deposited in the warehouse can be integrated into the digital record prescribed under this circular. It is clarified that data relating to goods already removed from the warehouse by 13th May 2016, are not required to be updated in the digital records. However, the stocks lying for sale in the duty free shops should be entered in the digital records since their duty liability is not extinguished till their sale to international passengers. In so far as goods deposited, removed and already sold through Duty Free Shops before 14th May 2016 are concerned, the information recorded in the extant bond register shall suffice.

8. Procedure for removal of goods from the warehouse and accounting thereof:

The Board has approved the following procedure for accounting of the goods removed from a warehouse licensed under section 58A of the Customs Act, 1962, without payment of duty:

a. Upon removal of goods from the warehouse licensed under section 58A, the licensee shall immediately record the same in the records;

b. The removal of goods from the warehouse, without payment of duty, is subject to the condition that the goods are removed to the customs area for sale to passengers arriving into or departing from India.

c. The records relating to removal of the goods to the duty free shops at the arrival area and departure area shall be maintained separately.

d. The bond officer shall escort the goods from the warehouse to the point of sale (DFS) in the customs area, whereupon, their subsequent sales to passengers arriving into or going abroad from India shall be under the general supervision of the customs officers on duty at the passenger terminals.

e. Every duty free shop shall record their sales to passengers by a computer generated invoice, which shall contain the name of the passenger, flight number & passport number. This data shall be stored digitally, in Form C.

f. The records of the warehouse shall be updated every 24 hours with the data elements contained in Form C.

9. Security and Solvency Requirements:

The Board has dispensed with the requirement of security to be furnished under section 59 of the Customs Act, 1962 by a DFS operator in respect of his imports (Circular No.21/2016- Customs refers).

9.1 As regards requirements of solvency, as provided under clause (b) of regulation 3 of the Special Warehouse Licensing Regulations 2016, the Board has decided that the Licensee shall furnish a solvency certificate of a value equivalent to the amount of duty involved on the goods proposed to be stored at any point of time. In this connection, it may be noted that proviso to the aforesaid clause, waives the requirements of a solvency certificate in respect of the PSU owned duty free shops (for example, ITDC).

10. In-flight duty free shop:

Requests have been received for clarifying whether the existing business practice of inflight duty free sales can be continued by Airlines.

10.1 The removal of goods from the warehouse licensed under section 58A of the Customs Act, 1962, without payment of duty, is subject to the condition that the goods are removed to the customs area for sale to passengers arriving into or departing from India. In other words, as long as the said goods are sold to passengers arriving from abroad or going abroad, the mode of sale shall not affect the due accounting of the goods removed from the warehouse.

10.2 Accordingly, goods removed from a warehouse licensed under section 58A of the Customs Act, 1962 and loaded on a scheduled commercial airline for sale to passengers going abroad, as inflight duty free shop sales, shall be permitted. In such a case, the bond officer shall escort the goods up to the aircraft and shall take into record the copy of the manifest, which must duly reflect the quantity of goods loaded for in-flight duty free sales. Further, the licensee must have accounting procedures, in conjunction with the Airlines, to record the inflight sales with the name of the passenger, passport number and flight number. The data relating to the inflight sales has to be provided by the Airlines to the inflight duty free shop operator immediately upon return of the aircraft to India. In turn, the operator shall update the electronic records to co-relate with goods removed from the warehouse.

11. Recovery of costs:

Clause (e) of Regulation 3 of the Special Warehouse Regulations 2016 and circular no. 20 / 2016 – Customs dated 20th May 2016 provide that the Licensee of a special warehouse shall undertake to bear costs of customs supervision on Merchant Over Time basis or on Cost Recovery. Now, the Board has approved the following guidelines:

a. The Licensee shall have to indicate the frequency with which the warehouse has to be operated per day / per week and the expected business hours of such operation.

b. The Principal Commissioner / Commissioner shall evaluate the projected requirement and the distance of the warehouse from the customs office to determine which of the modes of recovery of costs needs to be applied.

c. Illustratively, if the requirement of the licensee warrants the operation of the warehouse on a frequency which is, say, once in a week, the cost of supervision shall be charged on Merchant Over Time basis. Or, in cases, where the services of the Customs officer are required once a day, cost of supervision could also be based upon Merchant Over Time. However, if the warehouse is at such distance from the nearest customs office or the nature and duration of work is such that, the visit of the bond officer on every day basis, means his absence from his office for an entire day or better part thereof, the licensee shall have to undertake the services on cost recovery basis. Further, in cases where the licensee requires services of a customs officer for more than once in a day, he shall have to undertake supervision on cost recovery basis. Similarly, in case where round the clock services are requested, the licensee will have to bear charges on cost recovery basis for a suitable number of officers. Basically, this issue has to be examined on the above lines for deciding the recovery of costs from the licensee.

12. Administrative arrangements:

For the purposes of uniformity of jurisdiction and supervision, the Board has also approved the following:

a. The duty free shops shall be under the general supervision of the Principal Commissioner/ Commissioner of the Airport (Passenger Terminal).

b. A warehouse licensed in the precincts of the Airport complex shall also be in the jurisdiction of the Principal Commissioner / Commissioner of the Airport (Passenger Terminal). Accordingly, he shall be the licensing authority.

c. A warehouse licensed under section 58A, which is located outside the precincts of the airport shall be under the Principal Commissioner / Commissioner having jurisdiction over that site. Accordingly, he shall be the licensing authority and also allot the Bond Officer(s) required

d. Principal Commissioners / Commissioners shall ensure a smooth transition to the above system on or before 13th August 2016.

13. Difficulties, if any, should be brought to the notice of the Board.

14. Hindi Version follows.

Yours faithfully,

(S. Kumar)

Commissioner (Customs)

Encl: Forms A, B and C

Related post