[Under Section 45ZL of the Reserve Bank of India Act, 1934]

The third meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the amended Reserve Bank of India Act, 1934, was held on February 7 and 8, 2017 at the Reserve Bank of India, Mumbai.

2. The meeting was attended by all the members – Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; and Dr. Ravindra H. Dholakia, Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy – and was chaired by Dr. Urjit R. Patel, Governor.

3. According to Section 45ZL of the amended Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:–

(a) the resolution adopted at the meeting of the Monetary Policy Committee;

(b) the vote of each member of the Monetary Policy Committee, ascribed to such member, on resolutions adopted in the said meeting; and

(c) the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting.

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The Committee reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below.

Resolution

5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

- keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.25 per cent.

6. Consequently, the reverse repo rate under the LAF remains unchanged at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

7. The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving consumer price index (CPI) inflation at 5 per cent by Q4 of 2016-17 and the medium-term target of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below.

Assessment

8. Global growth is projected to pick up modestly in 2017, after slowing down in the year gone by. Advanced economies (AEs) are expected to build upon the slow gathering of momentum that started in the second half of 2016, led by the US and Japan. However, uncertainty surrounds the direction of US macroeconomic policies with potential global spillovers. Growth prospects for emerging market economies (EMEs) are also expected to improve moderately, with recessionary conditions ebbing in Russia and Brazil, and China stabilising on policy stimulus. Inflation is edging up on the back of rising energy prices and a mild firming up of demand. However, global trade remains subdued due to an increasing tendency towards protectionist policies and heightened political tensions. Furthermore, financial conditions are likely to tighten as central banks in AEs normalise exceptional accommodation in monetary policy.

9. International financial markets turned volatile from mid-January on concerns regarding the ‘Brexit’ roadmap and materialisation of expectations about economic policies of the new US administration. Within the rising profile of international commodity prices, crude oil prices firmed up with the OPEC’s agreement to curtail production. Prices of base metals have also increased on expectations of fiscal stimulus in the US, strong infrastructure spending in China, and supply reductions. Geopolitical concerns have also hardened commodity prices. More recently, the appetite for risk has returned in AEs, buoying equity markets and hardening bond yields as a response to the growing likelihood of further increases in the Federal Funds rate during the year. Coupled with expectations of fiscal expansion in the US, this has propelled the US dollar to a multi-year high.

10. The Central Statistics Office (CSO) released its advance estimates for 2016-17 on January 6, placing India’s real GVA growth at 7.0 per cent for the year, down from 7.8 per cent (first revised estimates released on January 31) a year ago. Agriculture and allied activities posted a strong pick-up, benefiting from the normal south-west monsoon, robust expansion in rabi acreage (higher by 5.7 per cent over the preceding year) and favourable base effects as well as the continuing resilience of allied activities. In contrast, the industrial sector experienced a sharp deceleration, mainly due to a slowdown in manufacturing and in mining and quarrying. Service sector activity also lost pace, concentrated in trade, hotels, transport and communication services, and construction, cushioned to some extent by public administration and defence.

11. Industrial output measured by the index of industrial production (IIP) finally shrugged off the debilitating drag from insulated rubber cables from November and was also pushed up by a favourable base effect. In December, the output of core industries accelerated on a year-on-year as well as on a sequentially seasonally adjusted basis. The drivers of the upturn were steel production and petroleum refinery throughput, the former, inter alia, supported by import tariff safeguards and the latter buoyed by external demand. The acceleration in coal production and thermal electricity generation since November after three consecutive months of contraction augur well for the outlook for power. Reflecting these developments, the manufacturing purchasing managers’ index (PMI) returned to expansion mode in January on the back of growth of new orders and output, and the future output index has risen strongly. On the other hand, the 76th round of the Reserve Bank’s industrial outlook survey suggests that financing conditions facing the manufacturing sector have worsened in Q3 of 2016-17 and are expected to remain tight in Q4. This is corroborated by the sharp slowdown in bank credit to industry and continuing sluggishness in the investment climate in some sectors.

12. High frequency indicators point to subdued activity in the services sector, particularly automobile sales across all segments, domestic air cargo, railway freight traffic, and cement production. Nevertheless, some areas stand out as bright spots, having weathered the transient effects of demonetisation – steel consumption; port traffic; international air freight; foreign tourist arrivals; tractor sales; and, cellular telephone subscribers. The services PMI for January 2017 remained in retrenchment, but the fall in output was the least in the current phase of three consecutive months of contraction.

13. Marking the fifth consecutive month of softening, retail inflation measured by the headline consumer price index (CPI) turned down sharper than expected in December and reached its lowest reading since November 2014. This outcome was driven by deflation in the prices of vegetables and pulses. Some moderation in the rate of increase in prices of protein-rich items – eggs, meat and fish – also aided the downturn in food inflation.

14. Excluding food and fuel, inflation has been unyielding at 4.9 per cent since September. While some part of this inertial behaviour is attributable to the turnaround in international crude prices since October – which fed into prices of petrol and diesel embedded in transport and communication – a broad-based stickiness is discernible in inflation, particularly in housing, health, education, personal care and effects (excluding gold and silver) as well as miscellaneous goods and services consumed by households.

15. The large overhang of liquidity consequent upon demonetisation weighed on money markets in December, but from mid-January rebalancing has been underway with expansion of currency in circulation and new bank notes being injected into the system at an accelerated pace. Throughout this period, the Reserve Bank’s market operations have been in liquidity absorption mode. With the abolition of the incremental cash reserve ratio from December 10, liquidity management operations have consisted of variable rate reverse repos under the LAF of tenors ranging from overnight to 91 days and auctions of cash management bills under the market stabilisation scheme (MSS) of tenors ranging from 14 to 63 days. The average daily net absorption under the LAF was ₹ 1.6 trillion in December, ₹ 2.0 trillion in January and ₹ 3.7 trillion in February (up to February 7) while under the MSS, it was ₹ 3.8 trillion, ₹ 5.0 trillion and ₹ 2.9 trillion, respectively. Money market rates remained aligned with the policy repo rate albeit with a soft bias, with the weighted average call money rate (WACR) averaging 18 basis points below the policy rate during December and January.

16. Turning to the external sector, export growth remained in the positive zone for the fourth month in succession in December. Imports other than petroleum oil and lubricants (POL) came out of the spike in November and moderated in December. In contrast, there was an increase of over 10 per cent in POL imports, in part reflecting the rise in international crude oil prices. Overall, the trade deficit shrank both sequentially and on a year-on-year basis, being lower for the period April-December by US$ 23.5 billion than its level a year ago. On the whole, the current account deficit is likely to remain muted and below 1 per cent of GDP in 2016-17. While the buoyancy in net foreign direct investment was sustained, there have been portfolio outflows beginning October on uncertainty relating to the direction of US macroeconomic policies and expectations of faster normalisation of US monetary policy in the year ahead. Foreign exchange reserves were at US$ 363.1 billion on February 3, 2017.

Outlook

17. In the fifth bi-monthly statement of December, headline inflation was projected at 5 per cent in Q4 of 2016-17 with risks lower than before but still tilted to the upside. The decline in headline CPI inflation in November and December has been larger than expected, but almost exclusively on the back of deflation in vegetables and pulses. While the seasonal ebb in the prices of vegetables that usually occurs with the onset of winter as well as some demand compression may have contributed to this outcome, anecdotal evidence points to some distress sales of perishables having accentuated the decline in vegetable prices, with spillovers into January as well. Looking beyond, prices of pulses are likely to remain soft with comfortable supply conditions, while vegetable prices may potentially rebound as the effects of demonetisation wear off.

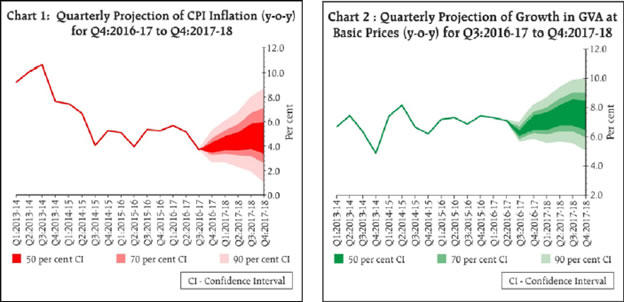

18. The Committee is of the view that the persistence of inflation excluding food and fuel could set a floor on further downward movements in headline inflation and trigger second-order effects. Nevertheless, headline CPI inflation in Q4 of 2016-17 is likely to be below 5 per cent. Favourable base effects and lagged effects of demand compression may mute headline inflation in Q1 of 2017-18. Thereafter, it is expected to pick up momentum, especially as growth picks up and the output gap narrows. Moreover, base effects will reverse and turn adverse during Q3 and Q4 of 2017-18. Accordingly, inflation is projected in the range of 4.0 to 4.5 per cent in the first half of the financial year and in the range of 4.5 to 5.0 per cent in the second half with risks evenly balanced around this projected path (Chart 1). In this context, it is important to note three significant upside risks that impart some uncertainty to the baseline inflation path – the hardening profile of international crude prices; volatility in the exchange rate on account of global financial market developments, which could impart upside pressures to domestic inflation; and the fuller effects of the house rent allowances under the 7th Central Pay Commission (CPC) award which have not been factored in the baseline inflation path. The focus of the Union budget on growth revival without compromising on fiscal prudence should bode well for limiting upside risks to inflation.

19. GVA growth for 2016-17 is projected at 6.9 per cent with risks evenly balanced around it. Growth is expected to recover sharply in 2017-18 on account of several factors. First, discretionary consumer demand held back by demonetisation is expected to bounce back beginning in the closing months of 2016-17. Second, economic activity in cash-intensive sectors such as retail trade, hotels and restaurants, and transportation, as well as in the unorganised sector, is expected to be rapidly restored. Third, demonetisation-induced ease in bank funding conditions has led to a sharp improvement in transmission of past policy rate reductions into marginal cost-based lending rates (MCLRs), and in turn, to lending rates for healthy borrowers, which should spur a pick-up in both consumption and investment demand. Fourth, the emphasis in the Union Budget for 2017-18 on stepping up capital expenditure, and boosting the rural economy and affordable housing should contribute to growth. Accordingly, GVA growth for 2017-18 is projected at 7.4 per cent, with risks evenly balanced (Chart 2).

20. The Committee remains committed to bringing headline inflation closer to 4.0 per cent on a durable basis and in a calibrated manner. This requires further significant decline in inflation expectations, especially since the services component of inflation that is sensitive to wage movements has been sticky. The committee decided to change the stance from accommodative to neutral while keeping the policy rate on hold to assess how the transitory effects of demonetisation on inflation and the output gap play out.

21. The Reserve Bank has conducted market liquidity operations consistent with the liquidity management framework put in place in April 2016, progressively moving the system level ex ante liquidity conditions to close to neutrality. This stance will continue. Surplus liquidity should decline with progressive remonetisation. Nonetheless, the currently abundant liquidity with banks is likely to persist into the early months of 2017-18. The Reserve Bank is committed to ensuring efficient and appropriate liquidity management with all the instruments at its command to ensure close alignment of the WACR with the policy rate, improved transmission of policy impulses to lending rates, and adequate flow of credit to productive sectors of the economy.

22. The Committee believes that the environment for timely transmission of policy rates to banks lending rates will be considerably improved if (i) the banking sector’s non-performing assets (NPAs) are resolved more quickly and efficiently; (ii) recapitalisation of the banking sector is hastened; and, (iii) the formula for adjustments in the interest rates on small savings schemes to changes in yields on government securities of corresponding maturity is fully implemented.1

23. Six members voted in favour of the monetary policy decision. The minutes of the MPC’s meeting will be published by February 22, 2017.

24. The next meeting of the MPC is scheduled on April 5 and 6, 2017.

Voting on the Resolution to keep the policy repo rate unchanged at 6.25 per cent

| Member | Vote |

| Dr. Chetan Ghate | Yes |

| Dr. Pami Dua | Yes |

| Dr. Ravindra H. Dholakia | Yes |

| Dr. Michael Debabrata Patra | Yes |

| Dr. Viral V. Acharya | Yes |

| Dr. Urjit R. Patel | Yes |

Statement by Dr. Chetan Ghate

25. The Union budget has largely adhered to a path of fiscal consolidation as shown in both the continuous decline in the revenue deficit and fiscal deficit. The focus in the budget on reducing revenue expenditure without compromising on capital expenditure suggests that the budget will not add to the inflationary momentum of the economy.

26. There is more clarity on the impact of demonetisation on real output in terms of its temporary component and its permanent component. The temporary (adverse) effect is getting reversed as the economy remonetises. This is confirmed by various enterprise surveys conducted by the Reserve Bank since the last review. What is a little more uncertain is the permanent effect, which will operate through wealth destruction, and work more gradually. Even so, the permanent (adverse) effect is not likely to be large in the long run. Overall, and as I mentioned in the last review, it appears that uncertainty on the production side has largely been mitigated. Since I do not see a persistent opening up of the output gap because of demonetisation, this does not warrant a rate cut.

27. Unlike production, uncertainty in the price level persists because of demonetisation obfuscating some of the trends that existed before November 8. While both 3 month and 1 year median inflationary expectations have fallen, it is unclear whether this will sustain. While fire sales have led to vegetable prices collapsing, vegetables always have a seasonal rebound. In fact, inflation net of vegetables continues to remain at 4.8 per cent, and momentum in food inflation increased in December. Inflation excluding food and fuel remains sticky, and since it is above headline inflation, this will exert upward pressure on headline inflation. These arguments suggest that a quicker pace of disinflation may not sustain on a durable basis. With a shift in focus towards the mid-point of the medium-term inflation target of 4 +/- 2 per cent, these arguments warrant no change in the policy rate.

28. While the Indian economy is very different now compared to the summer of 2013, the impact on financial markets of the possible ending of re-investment of principal payments by the US Fed from its balance sheet holdings needs to be watched carefully. Such a “balance sheet reduction” by the Fed may impart volatility.

29. Taking into account these considerations, I vote for keeping the policy repo rate unchanged at 6.25 per cent at today’s meeting of the Monetary Policy Committee.

Statement by Dr. Pami Dua

30. While the transitory effects of demonetisation on inflation and output gap have yet to be fully assessed, the ratio of currency in circulation to GDP is on the rise, suggesting that remonetisation is progressing well. Furthermore, in the aftermath of demonetisation, due to the increase in liquidity with the banks, banks have already reduced the marginal-cost-based lending rates which should fuel demand in the economy. The Budget is also conducive to growth in the key sectors and is expected to have multiplier effects. On the inflation front, while CPI inflation has softened primarily due to lower food prices, core inflation (excluding food and fuel) remains sticky, close to 5 per cent, partly due to rising international commodity prices. The Survey of Professional Forecasters conducted by the Reserve Bank also indicates that core CPI inflation is likely to remain sticky around 5 per cent till Q3-2017-18. On the external front, exports growth is likely to continue to provide support to the economy, but volatility in the foreign exchange markets is a concern. Moreover, while the US Fed maintained the status quo on interest rates, it is expected to hike rates in the future.

31. Furthermore, the international leading indexes produced by the Economic Cycle Research Institute (ECRI) indicate stronger global growth and inflation prospects for the coming months. The continued cyclical upswing in ECRI’s U.S. Future Inflation Gauge (that anticipates U.S. inflation) points to further increases in inflation. Further, the strength in leading indexes of U.S. economic growth signal higher economic growth. Both these factors may be consistent with multiple Fed rate hikes this year.

32. Taking the above considerations into account, I vote to keep the policy repo rate unchanged at 6.25 per cent.

Statement by Dr. Ravindra H. Dholakia

33. Surveys conducted by the Reserve Bank to provide input for the Monetary Policy indicate that: a) the capacity utilisation may decline marginally; b) cost of raw materials is likely to rise and firms may lose pricing power; c) investment outlook may remain subdued; d) lack of clearances and lack of funds are the major reasons for the stalled projects; e) inflationary expectations are declining for three months and one year ahead; and f) sentiments on employment and household income have worsened. These findings are consistent with our view that demonetisation of high value currency notes would have transitory adverse impact on growth of income and employment. The Economic Survey 2016-17 by the Ministry of Finance also corroborates the transitory nature of the impact though their estimate of the slowdown in the growth is marginally higher than the Reserve Bank’s forecast. In any case there is a general agreement that the growth in the coming quarters is likely to pick up with the economy returning to its pre-demonetisation growth path.

34. In this context, the Union Budget for the year 2017-18 presented on the 1st February 2017 has been very pragmatic and disciplined providing adequate boost to help the economy return to its pre-demonetisation growth path. However, the State Budgets have been the cause of concern of late because the movement in their fiscal deficits largely determines the variation in the combined fiscal deficit of the country. States have now started forming a larger proportion of the public expenditures and having a clear idea on their fiscal deficits is important for the monetary policy.

35. While the commodity prices are firming up, the wholesale price index (WPI) for manufacturing shows very low inflation. Since the items affected by it in the CPI do not have high weightage, the CPI inflation without food and fuel continues to be high around 5 per cent. The decline in overall CPI inflation is not reliably stable because it is mainly on account of vegetables and pulses coupled with the transitory impact of demonetisation.

36. As the transitory impact of demonetisation recedes and remonetisation sets in, the banks’ MCLRs are likely to increase marginally. Moreover, under the current global environment, the real neutral rate of interest in India seems to be higher than the one for most of the developed countries. However, their future policy direction indicates rapid strengthening of the rates.

37. Given all these factors, it is prudent not to tinker with the policy rate at this stage. In any case, under the given circumstances and reasonable forecasts for the future, I find the current rate to be optimal for liquidity in the economy. Therefore, a change of stance from accommodative to neutral at this stage is desirable. It can impart the necessary flexibility for the monetary policy in future to respond to any development on either side.

Statement by Dr. Michael Debabrata Patra

38. I vote for keeping the policy rate unchanged and for starting the withdrawal from accommodation in the policy stance for three compelling reasons. First, the recent sharp disinflation is entirely driven by transitory forces. Underneath, there is a broader-based firming up of inflation pressures. Excluding vegetables, CPI inflation was 4.8 per cent, 136 basis points above the headline number of 3.4 per cent in December. Vegetable prices may have been impacted by demonetisation, but they also exhibit strong seasonal behaviour and tend to turn up as the winter gets over. Excluding food, inflation was 4.7 per cent; and excluding both food and fuel, inflation was 4.9 per cent. Moreover, all of these levels have become persistent since September 2016. Secondly, the reflationary effects of remonetisation are likely being underestimated in the commentary around it. With transactions requirement of currency amply met, the positive shock that is travelling through the economy can be expected to fuel inflation well before the more sluggishly moving activity and demand respond. If the seasonal upturn in vegetables prices and these reflationary effects coincide as they might by as early as March-April, monetary policy needs to be preemptively on guard. Thirdly and importantly, forward-lookingness necessitated by lags in transmission requires monetary policy to centre its focus now on the mandated inflation target of 4 per cent – deviations out of the tolerance limits around the target for nine months consecutively will no longer be tolerated. This acquires some urgency because the tailwinds that propelled inflation down through 2014-17, some fortuitous like the collapse of international commodity prices, do not appear to be in sight over the next 12-month horizon. Instead, upside risks from global financial turbulence, international crude prices and a less than normal south west monsoon could individually materialise and even intensify together into a perfect storm.

39. It is eminently possible that the reasons cited above do not turn out to be so compelling and even dissipate. That will open up headroom for monetary policy to more directly address the objective of growth. If, on the other hand, they turn out to be real and present dangers, it is vital to unfetter monetary policy from a unidirectional stance.

Statement by Dr. Viral V. Acharya

40. This was a tough policy decision to take.

41. On the one hand, headline inflation has remained low, and there is a good case to be made that there is at least a temporary output gap created due to liquidity shortage induced by the currency replacement. Since our flexible inflation targeting mandate also requires paying attention to growth, it could be natural to lower the policy rate to restore growth levels, especially if the lower policy rate could be passed onto the areas of the economy most affected by the liquidity shortage, in particular, rural households, non-bank finance corporations which undertake most of the auto-based lending, and the realty sector.

42. On the other hand, low headline inflation has been largely driven by food deflation, and the most recent numbers have been heavily driven by the large dip in vegetable prices. In the past, food deflation has had strong seasonal patterns which have tended to rebound and with vengeance when rainfall disappoints. While some of the food deflation over the past few months has been steady due to supply-side factors, on balance it is fair to draw the conclusion that statistically, food component of headline inflation has had less signal to noise quality compared to the core inflation that excludes fuel and food, the latter having been more or less sticky in recent months. Rapid remonetisation implies likely swift reversal of the aggregate demand loss and the significant transmission to borrowers of easy funding conditions at banks suggests unlikely further transmission of a rate cut by banks.

43. Given the difficulty in resolving this trade-off between temporary effects on output gap and the persistent nature of core inflation, my attention turned heavily to international factors. Global uncertainty in trade due to protectionist tendencies in major developed economies, the prospect of a stronger dollar in wake of a probable “border tax” on imports in the US, and rising world-wide inflation in food, fuel and metals, have created a significant risk to domestic inflation. Second-round effects on funding costs due to portfolio outflows from debt and equity markets could be substantial if the central bank is not perceived as staying course on credible inflation targeting.

44. It is important to guard the Indian macro-economy from global headwinds, and having a reasonably good chance of attaining the 5 per cent target for headline inflation by end of March 2017, to keep the option open to start getting closer to our long-term target of 4 per cent headline inflation on a durable basis. Overall, this required no rate cut for now and switching to a neutral stance so as to remain fully flexible to raise rates, or to stay put, or to cut rates, as more data becomes available on both domestic and international fronts.

45. One final note on the monetary policy decision: The balanced budget, by focusing on fiscal stability and expenditure reorientation to rural and housing, seemed to exonerate the Committee from the burden of skewing rates to bridge the output gap and instead allowed the Committee to focus squarely on the inflation-targeting mandate.

46. Such a time, while difficult for interest-rate setting, appears right for pushing forward on structural reforms of the banking sector: its asset quality and resolution, and its recapitalisation needs – both factors that have stunted credit growth at banks; and, the normalisation of administered small savings rates that have prevented a seamless transmission of monetary policy to bank funding and lending rates.

Statement by Dr. Urjit R. Patel

47. The short-run assessment of evolving macroeconomic conditions remains clouded.

48. On the inflation outlook, transient factors, including anecdotal evidence on fire sales of perishables, have discoloured an objective assessment of inflation pressures in recent months. Past experience suggests that the rebound in vegetable prices could be sharper than normal. Importantly, non-food non-fuel inflation has remained sticky, notwithstanding the transitory impact of demonetisation on consumption demand. Crude oil and commodity prices (including for food) have firmed up globally, thereby potentially raising risks to the headline inflation. Domestic industrial input and farm costs, including rural wages, have increased in recent months. Inter alia cost push effects of 7th pay commission allowances, and exchange rate volatility arising from possible shifts in risk premia on a full rollout of US macroeconomic policies impart uncertainty to the inflation trajectory going ahead.

49. With the remonetisation of the economy taking place at an accelerated pace over the last two months, economic activity is expected to pick up from the latter part of Q4 of 2016-17. Discretionary consumer demand, which got impacted in the immediate aftermath of demonetisation, is expected to bounce back. Limited data available on the corporate sector performance in Q3 suggests that sales growth may have improved relative to the previous quarter. According to the latest round of RBI’s consumer confidence survey, the one year ahead outlook is upbeat, with significant improvement expected relative to the situation in Q3 of 2016-17. The Union Budget for 2017-18, while being prudent, has stepped up expenditure on infrastructure and emphasised affordable housing. Global growth is projected to be higher in 2017 than 2016. These factors, along with improved monetary transmission, have markedly improved growth prospects for 2017-18 compared to the current year.

50. While pursuing 4 per cent CPI headline inflation that became effective from August 2016 as per the Gazette notification, it is necessary to adopt a calibrated approach so as to minimise the collateral costs of achieving the target as well as ensure its durability. By shifting the stance of monetary policy from accommodative to neutral, there will now be sufficient flexibility to move the policy rate in either direction, depending on future data outcomes and projections, to help ensure that inflation is brought closer to 4 per cent.

Jose J. Kattoor

Chief General Manager

Press Release : 2016-2017/2263

1 Since the introduction of the formula in April 2016, interest rates on small savings are about 65-100 basis points higher, depending on tenor, compared to what they should be if the formula is followed. If the spread between small savings rates and bond yields remains wide, the diversion of deposits to small savings would impede a full transmission to bank lending rates.