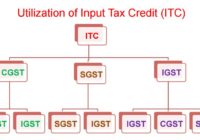

Circular No 98/18/2019 : GST ITC utilization Clarified : Rules 88A

Circular No 98/18/2019 : GST Circular No 98/18/2019 : GST Dated 23rd April 2019 Seeks to clarify the manner of utilization of input tax credit post insertion of the rule 88A of the CGST Rules.