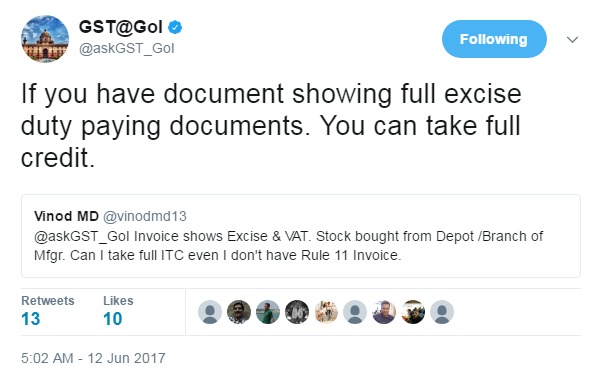

Invoice shows Excise & VAT. Stock bought from Depot /Branch of Manufacturer. Can I take full ITC even I don’t have Rule 11 Invoice.

If you have document showing full excise duty paying documents. You can take full credit. [ Read Input Tax Cedit on Closing Stock under GST ]

[ Reply as per Twitter Account of Govt of India for GST queries of Taxpayers ]