TAX INVOICE UNDER GST OF INDIA

Tax Invoice Provision under GST is different than provision under VAT Laws. under VAT laws , for Example Invoice for supply of goods was required to be issued under existing VAT when ‘transfer of property’ takes place even though delivery has not been taken place but under GST , invoice for goods has to be issued at the time of their ‘removal’ or ‘delivery

♣ Meaning of Invoice or Tax Invoice under GST

As per Section 2(66) of CGST Act 2017

“Invoice” or “tax invoice” means the tax invoice referred to in section 31;

Note : Word ” Invoice ” as well as ” Tax Invoice ” means the same thing under GST

♣ Tax Invoice in case of Supply of goods:

Time to Issue Tax Invoice :–

As per Section 31(1) of CGST Act 2017, a registered person supplying taxable goods shall, before or at the time of,—

(a) Removal of goods for supply to the recipient, where the supply involves movement of goods; or

(b) Delivery of goods or making available thereof to the recipient, in any other case,

issue a tax invoice showing the description, quantity and value of goods, the tax charged thereon and such other particulars as prescribed in Revised Invoice Rules, 2017.

As per Section 2(96) of CGST Act 2017

“Removal” in relation to goods, means—

(a) despatch of the goods for delivery by the supplier thereof or by any other person acting on behalf of such supplier; or

(b) collection of the goods by the recipient thereof or by any other person acting on behalf of such recipient;

Example

Tax Invoice in Case of Removal of Goods

X Ltd supplies Printer to its dealer Mr A, the invoice must be issued at the time of or before removal of the Printer from X Ltd’s premises. This is because the supply involves movement of the Printers to MR A.

Tax Invoice in Other Case

X Ltd purchases a generator set, which will be assembled and installed at the factory premises by the supplier. Here, since the supply does not require movement of the generator set, the invoice must be issued at the time when the generator set is made available to X Ltd .

Commentary :-

i) Under GST , Tax Invoice to be issued only by Registered Person under GST.

ii) Provision under GST is different than provision under VAT Laws. under VAT laws , Invoice was required to be issued when ‘transfer of property’ takes place even though delivery has not been taken place. but under GST invoice has to e issued at the time of their ‘removal’ or ‘delivery

A tax invoice can be issued at or before the time of removal of the goods for making the supply . However where the supply to the recipient does not involve movement of the goods, the tax invoice would be due at the time of delivery or making the goods available to the recipient

For Example if goods are sent for sale on approval basis. Goods would be removed at a

certain time, and may be delivered to the location of the recipient. However, it is not known at the time of removal, whether the transaction results in a supply. Therefore, the time of confirmation by the recipient that he wishes to retain the goods would be the due date for issuing the tax invoice.iii) The number of digits of HSN code for goods or the Accounting Code for services, that a class of registered persons shall be required to mention as per Clause (f) (contents of Tax Invoice -below) , for such period as may be specified in the said notification, and the class of registered persons that would not be required to mention the HSN code f or goods or the Accounting Code for services, for such period as may be specified in the said notification:

Contents of Tax Invoice of Goods or Services

Tax invoice should contains the description, quantity and value of goods , the tax charged thereon ( description, value and Tax charged in case of Services )and such other particulars as prescribed in Revised Invoice Rules, 2017.

As per Rule 1 of Revised Invoice Rules, 2017, a tax invoice shall contain following particulars:

(a) Name, address and GSTIN of the supplier;

(b) a consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

(c) Date of its issue;

(d) Name, address and GSTIN or UIN, if registered, of the recipient;

(e) Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more;

(f) HSN code of goods or Accounting Code of services;

(g) Description of goods or services;

(h) Quantity in case of goods and unit or Unique Quantity Code thereof;

(i) Total value of supply of goods or services or both;

(j) Taxable value of supply of goods or services or both taking into account discount or abatement, if any;

(k) Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

(l) Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

(m) Place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce;

(n) Address of delivery where the same is different from the place of supply;

(o) Whether the tax is payable on reverse charge basis; and

(p) Signature or digital signature of the supplier or his authorized representative:

♣ Tax Invoice in case of Supply of Services:

As per Section 31(2) of CGST Act 2017, a registered person supplying taxable services shall, before or after the provision of service but within a prescribed period, issue a tax invoice, showing the description, value, tax charged thereon and such other particulars as prescribed in Rule of Revised Invoice Rules, 2017.

As per rule 2 of Revised Invoice Rules 2017, a tax invoice shall be issued within 30 days from the date of supply of services or within 45 days in case supplier of service is an Insurer or a Banking company or a Financial Institution including a NBFC.

Commentary

i) Tax Invoice for Services is to be issued by Supplier :-

before the provision of service or

After the provision of service but within a prescribed period

ii) The number of digits of Accounting Code for services, that a class of registered persons shall be required to mention as per Clause (f) (contents of Tax Invoice -above) , for such period as may be specified in the said notification, and the class of registered persons that would not be required to mention the Accounting Code for services, for such period as may be specified in the said notification:

♣ Invoice In case of Export of Goods or Services

As per Rule 1 of Revised Invoice Rules, 2017 apart from other particulars (mentioned in Contents of goods or Services above) , n case of exports of goods or services, the invoice shall carry an endorsement “SUPPLY MEANT FOR EXPORT ON PAYMENT OF IGST” or “SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF IGST”, as the case may be, and shall, in lieu of the deta is specified in clause (e), contain the following details:

(i) name and address of the recipient;

(ii) address of delivery;

(iii) name of the country of destination; and

(iv) number and date of application (ARE-1 ) for removal of goods for export:

♣ Revised Invoice under GST:

As per Section 31(3)(a) of CGST Act, 2017, a registered person may issue a revised invoice against the invoice issued during the period beginning with the effective date of registration till the date of issuance of certificate of registration but within one month from the date of issuance of certificate of registration.

Comment:

Only A registered person may issue Tax Invoice for passing the credit to the recipient.

As per the Rule 6 of Draft Invoice Rules 2017 , Revised Invoice shall contain following :-

(a) the word “Revised Invoice”, wherever applicable, indicated prominently;

(b) name, address and GST I N of the supplier;

(c) nature of the document;

(d) a consecutive serial number containing alphabets or numerals or special characters -hyphen or dash and slash symbolised as “-” and “/” respectively„ and any combination thereof, unique for a financial year;

(e) date of issue of the document;

(f) name, address and GSTIN or UIN, if registered, of the recipient;

(g) name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient i s un- registered;

(h) serial number and date of the corresponding tax invoice or, as the case may be, bill of supply;

(i) value of taxable supply of goods or services, rate of tax and the amount of the tax credited or, as the case may be, debited to the recipient; and

(j) signature or digital signature of the supplier or his authorized representative:

♣When Tax Invoice under GST not required to be issued

As per Section 31(3)(b) of CGST Act, 2017, if the value of supply of goods or services or both is less than Rs.200 , a registered person may not issue a tax invoice. if

(a) the recipient is not a registered person; and

(b) the recipient does not require such invoice,

and shall issue a consolidated tax invoice for such supplies at the close of each day in respect of all such supplies.

♣ Bill of Supply to be issued instead of Tax Invoice under GST

As per Section 31(3)(c) of CGST Act, 2017, Bill of Supply shall be issued instead of Tax Invoice if a registered person

- Supplying exempted goods or services or

- Is paying tax under composition invoice,

There is no requirement of Bill of Supply if value of goods or services or both is less than Rs.200.

As per Rule 4 of Revised Invoice Rules, 2017, Bill of Supply shall contain following particulars:

(a) Name, address and GSTIN of the supplier;

(b) a consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters -hyphen or dash and slash symbolised as “-” and “/”respectively, and any combination thereof, unique for a financial year;

(c) Date of its issue;

(d) Name, address and GSTIN or UIN, if registered, of the recipient;

(e) HSN Code of goods or Accounting Code for services;

(f) Description of goods or services or both;

(g) Value of supply of goods or services or both taking into account discount or abatement, if any; and

(h) Signature or digital signature of the supplier or his authorized representative

♣ Receipt Voucher to be issued for Advances

As per Section 31(3)(d) of CGST Act 2017, receipt voucher shall be issued on receipt of advance payments with respect to any supply of goods or services or both.

As per Rule 5 of Revised Invoice Rules 2017, Receipt Voucher shall contain following particulars:

(a) Name, address and GSTIN of the supplier;

(b) A consecutive serial number containing alphabets or numerals or special characters –hyphen or dash and slash symbolised as “-” and “/”respectively, and any combination thereof, unique for afinancial year

(c) Date of its issue;

(d) Name, address and GSTIN or UIN, if registered, of the recipient;

(e) Description of goods or services;

(f) Amount of advance taken;

(g) Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

(h) Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

(i) place of supply along with the name of State and its code, in case of a supply in the course of inter-State trade or commerce;

(j) Whether the tax is payable on reverse charge basis; and

(k) Signature or digital signature of the supplier or his authorized representative.

♣ Refund voucher if no supply made against Advances

As per Section 31(3)(e) of CGST Act 2017, where a receipt voucher is issued on advance payment and subsequently no supply is made and no tax invoice is issued , the registered person may issue a refund voucher to the person who had made the payment.

♣ Invoice on Reverse charge

As per Section 9(4) of CGST Act 2017, if an unregistered person is supplying goods or services or both to a registered person under GST or if registered person is taking supply of notified goods (To be notified by Govt on which tax to be paid by recipient under reverse charge) or services or both than registered person shall pay tax under reverse charge mechanism.

As per Section 31(3)(f) of CGST Act 2017, A registered person who is liable to pay tax under reverse charge mechanism shall issue an invoice in respect of goods or services received by him from the supplier who is not registered on the date of receipt of goods or services or both;

As per Section 31(3)(g) of CGST Act 2017, a registered person who is paying tax under reverse charge mechanism shall a payment voucher at the time of making payment to the supplier.

♣ Invoice in case of continuous supply of goods

As per Section 31(4) of CGST Act 2017, the invoice shall be issued before or at the time of receiving each successive payments or issuing each successive statement of accounts.

♣ Invoice in case of continuous supply of services

As per Section 31(5) of CGST Act 2017

- Due date of payment is ascertainable- Invoice on or before due date of payment

- Due date of payment is not ascertainable- Invoice on or before receipt of payment by supplier.

- Payment linked to completion of an event- Invoice on or before the date of completion of that event.

♣ Invoice in case of cessation of supply of services

As per Section 31(6) of CGST Act 2017, if supply of services ceases before the completion of supply, the invoice shall be issued at the time of cessation of supply, to the extent supply made before such cessation.

♣ Invoice in case of Goods sent on approval

As per Section 31(7) of CGST Act 2017, if goods are sent on approval basis, invoice shall be issued before or at the time it is known that supply has taken place or 6 months from the date of removal whichever is earlier

♣ Amount of tax to be indicated in tax invoice and other documents.

As per Section 33 of CGST Act 2017, every person who is liable to pay tax for such supply shall prominently indicate in all documents relating to assessment, tax invoice and other like documents, the amount of tax which shall form part of the price at which such supply is made.

♣ Credit Note

As per Section 34(1) of CGST Act 2017, a Credit note may be issued by the registered person who has supplied goods or services to the recipient where:

- Taxable value in the tax invoice issued is found to exceed the taxable value of supply .

- tax charged in the tax invoice issued is found to exceed the tax payable on supply

- Goods supplied are returned by the recipient

- Goods or services or both supplied are found to be deficient

Commentary

A credit note has to be issued by the supplier and not by Recipient

As per Section 34(2) of CGST Act 2017 The detail of credit note shall be declared in the return for the month during which credit note is issued.

However , if not declared in that month, credit note can be declared in any return prior to September following the end of financial year or date of furnishing of annual return i.e 31stDecember following the end of such financial year. whichever is earlier

As per the Rule 6 of Draft Invoice Rules 2017 , Credit Note shall contain followings

(a) the word “Revised Invoice”, wherever applicable, indicated prominently;

(b) name, address and GSTI N of the supplier;

(c) nature of the document;

(d) a consecutive serial number containing alphabets or numerals or special characters -hyphen or dash and slash symbolised as “-” and “/” respectively„ and any combination thereof, unique for a financial year;

(e) date of issue of the document;

(f) name, address and GSTIN or UIN, if registered, of the recipient;

(g) name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient i s un- registered;

(h) serial number and date of the corresponding tax invoice or, as the case may be, bill of supply;

(i) value of taxable supply of goods or services, rate of tax and the amount of the tax credited or, as the case may be, debited to the recipient; and

(j) signature or digital signature of the supplier or his authorized representative:

♣ Debit Note or Supplementary Invoice

As per Section 34(3) of CGST Act 2017,The debit note shall include a supplementary invoice.

A Debit note / Supplementary Invoice may be issued by the registered person who has supplied goods or services or both to the recipient where:

- Taxable value in the tax invoice issued is found to be less than the taxable value of Supply or

- Tax charged in the tax invoice issued is found to be less than tax payable on the supply

Commentary :-

-A debit note has to be issued by the supplier and not by a recipient

As per Section 34(4) of CGST Act 2017 : The detail of Debit note shall be declared in the return for the month during which debit note is issued and tax liability shall be adjusted accordingly.[

As per the Rule 6 of Draft Invoice Rules 2017 , Debit Note or Supplementary Invoice shall contain followings

(a) the word “Revised Invoice”, wherever applicable, indicated prominently;

(b) name, address and GSTI N of the supplier;

(c) nature of the document;

(d) a consecutive serial number containing alphabets or numerals or special characters -hyphen or dash and slash symbolised as “-” and “/” respectively„ and any combination thereof, unique for a financial year;

(e) date of issue of the document;

(f) name, address and GSTIN or UIN, if registered, of the recipient;

(g) name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient i s un- registered;

(h) serial number and date of the corresponding tax invoice or, as the case may be, bill of supply;

(i) value of taxable supply of goods or services, rate of tax and the amount of the tax credited or, as the case may be, debited to the recipient; and

(j) signature or digital signature of the supplier or his authorized representative:

♣ Invoice by Input Servie Distributors

As per Rule 7 (1) of Invoice Rules 2017 :-

An ISD invoice or, as the case may be, an ISD credit note issued by an Input Service Distributor shall contain the following details:‑

(a) name, address and GSTIN of the Input Service Distributor;

(b) a consecutive serial number containing alphabets or numerals or special characters hyphen or dash and slash symbolised as , “-“, “/”, respectively, and any combination thereof, unique for a financial year;

(c) date of its issue;

(d) name, address and GSTIN of the recipient to whom the credit is distributed;

(e) amount of the credit distributed; and

(f) signature or digital signature of the Input Service Distributor or his authorized representative:

However where the Input Service Distributor is an office of a banking company or a financial institution, including a non-banking financial company, a tax invoice shall include any document in lieu thereof, by whatever name called, whether or not serially numbered but containing the information as prescribed above.

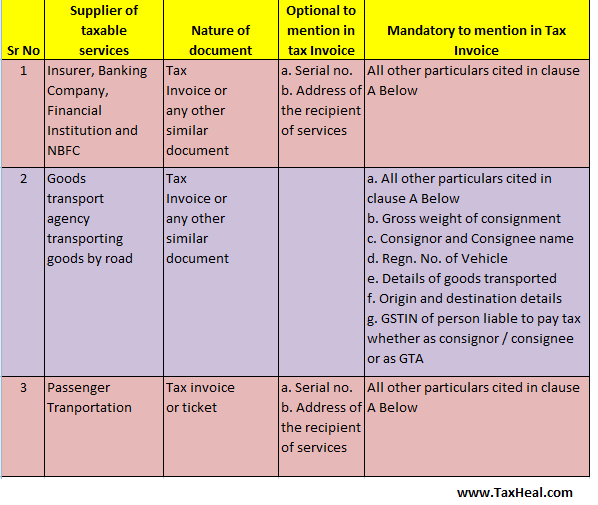

♣ Tax Invoice in special cases

As per Rule 7 (2) to (4) of Invoice Rules 2017 :

Clause A :-

Tax invoice issued by the registered person containing the following particulars:-

(a) name, address and GSTIN of the supplier;

(b) a consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

(c) date of its issue;

(d) name, address and GSTIN or UIN, if registered, of the recipient;

(e) name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more;

(f) HSN code of goods or Accounting Code of services;

(g) description of goods or services;

(h) quantity in case of goods and unit or Unique Quantity Code thereof;

(i) total value of supply of goods or services or both;

(j) taxable value of supply of goods or services or both taking into account discount or abatement, if any;

(k) rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

(l) amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

(m) place of supply along with the name of State, in case of a supply i n the course of inter-State trade or commerce;

(n) address of delivery where the same is different from the place of supply;

(o) whether the tax is payable on reverse charge basis; and

(p) signature or digital signature of the supplier or his authorized representative:

However that the Commissioner may, on the recommendations of the Council, by notification, specify ‑

(i) the number of digits of HSN code f or goods or the Accounting Code for services, that a cl ass of registered persons shall be required to mention, for such period as may be specified in the said notification, and

(ii) the class of registered persons that would not be required to mention the HSN code f or goods or the Accounting Code for services, for such period as may be specified in the said notification:

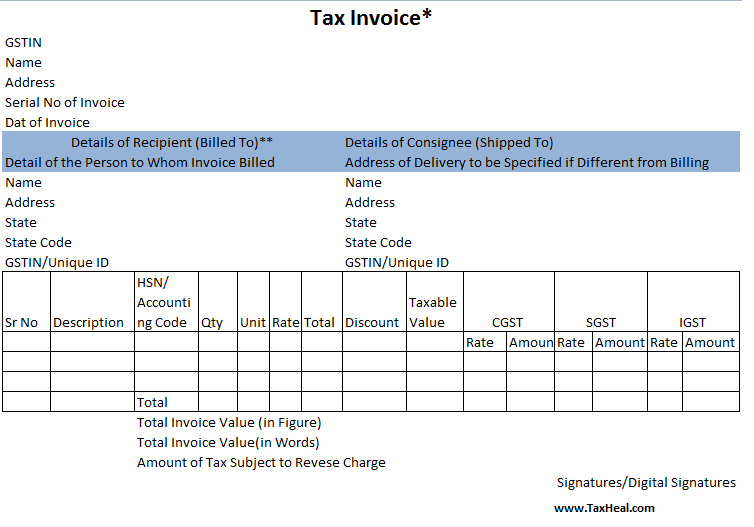

♣ Tax Invoice Sample Format

* This is Indicate Format based on Invoice Rules

**Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more;

♣ Three Copies of Tax Invoice Needs to be issued :

For supply of goods, three copies of the invoice are required – Original, Duplicate, and Triplicate.

Original invoice: The original invoice is issued to the receiver, and is marked as ‘Original for recipient’.

Duplicate copy: The duplicate copy is issued to the transporter, and is marked as ‘Duplicate for transporter’. This is not required if the supplier has obtained an invoice reference number. The Invoice reference number is given to a supplier when he uploads a tax invoice issued by him in the GST portal. It is valid for 30 days from the date of upload of invoice.

Triplicate copy: This copy is retained by the supplier, and is marked as ‘Triplicate for supplier’.

For supply of services, two copies of the invoice are required:

- Original Invoice: The original copy of the invoice is to be given to receiver, and is marked as ‘Original for recipient’.

- Duplicate Copy: The duplicate copy is for the supplier, and is marked as ‘Duplicate for supplier’.

GST Tax Invoice : Free Study Material