TDS on Property Sale : Section 194IA Income Tax

TDS on Property Sale in India is deducted as per Section 194IA Income Tax . (Article written by CA Satbir Singh .contact on Taxheal@gmail.com )

Deduction of tax at source from payment on transfer of certain immovable property

Relevant provision regarding TDS on Property sale is covered in Section 194IA Income Tax

Conditions to be satisfied for applicability of section 194-IA : TDS on Property Sale

For applicability of section 194-IA following conditions need to be satisfied :

♦ The payer (i.e.purchaser) must be any person referred to in Para 1.3 below

♦ The payee (i.e. seller) must be a resident transferor of an immovable property (other than agricultural land).

♦ The payment must be by way of consideration for transfer of any immovable property (other than agricultural land).

♦ TDS was to be dedufted @ 1% on sale consideration till 31.03.2022 . However w.e.f 01.04.2022 ,as per Finance Bill 2022 , TDS will apply @ 1% of such sum of consideration or the stamp duty value of such property, whichever is higher . [Refer Change for TDS on Sale of Immovable Property in India from FY 2022-23: Section 194IA Income Tax]

1.1 TDS on Property Sale : Scope of section 194IA Income tax

Section 194-IA, as inserted with effect from 1-6-2013 provides that any person, being a transferee, responsible for paying (other than the person referred to in section 194LA) to a resident transferor any sum by way of consideration for transfer of any immovable property (other than agricultural land) shall deduct an amount equal to one per cent of such sum as income-tax at the time of credit of such sum to the account of the transferor or at the time of payment of such sum in cash or by issue of cheque or draft or by any other mode, whichever is earlier.

No deduction shall be made where consideration for the transfer of an immovable property is less than fifty lakh rupees.

1.2 What payment is covered under section 194IA Income tax

Any sum paid by way of consideration for transfer of any immovable property (other than agricultural land) is covered under section 194-IA, provided the consideration for transfer of an immovable property is not less than Rs. 50 lakhs.

However w.e.f 01.04.2022 ,as per Finance Bill 2022 ,TDS will be deducted provided the consideration for transfer of an immovable property and Stamp duty value is not less than Rs. 50 lakhs.

TDS will apply @ 1% of such sum of consideration or the stamp duty value of such property, whichever is higher . [Refer Change for TDS on Sale of Immovable Property in India from FY 2022-23: Section 194IA Income Tax]

Agricultural land means agricultural lands in India, not being a land situate in any area referred to in section 2(14)(iii)(a)/(b) of Income Tax Act.

Example 1

Consideration as per Builder Buyer Agreement/Agreement to Sell:Rs.47 Lakhs

Stamp Duty value: Rs.50 Lakhs

| Liability of buyer to deduct TDS under till 31.03.2022 | Liability of buyer to deduct TDS under provisions after proposed amendments w.e.f 01.04.2022 |

| No TDS u/s 194IA if consideration as per BBA/ATS is less than 50 Lakhs[Sub-section (2)] Stamp Duty Valuation is irrelevant In view of consideration being less than Rs. 50 lakhs, no TDS is deductible under existing provisions of section 194-IA | No TDS only if both consideration as per BBA/ATS and stamp duty value are less than Rs.50 Lakhs. Here, stamp duty value is Rs.50 lakhs though consideration is less than Rs.50 lakhs. Therefore, TDS is deductible from the consideration . TDS amount will be 1% of higher of consideration and SDV. From payment of Rs.47 lakhs, TDS to be deducted will be Rs 50,000,not Rs.47,000 |

Example 2

Consideration as per Builder Buyer Agreement(BBS)/Agreement to Sell(ATS):Rs.49 Lakhs

Stamp Duty value: Rs.53 Lakhs

| Liability of buyer to deduct TDS under existing provisions till 31.03.2022 | Liability of buyer to deduct TDS under provisions after proposed amendments w.e.f 01.04.2022 |

| No TDS if consideration as per BBA/ATS is less than 50 Lakhs [Sub-section (2)] Stamp Duty Valuation is irrelevant In view of consideration being less than Rs. 50 lakhs, no TDS is deductible under existing provisions of section 194-IA | No TDS only if both consideration as per BBA/ATS and stamp duty value are less than Rs.50 Lakhs. Here, stamp duty value is Rs.53 lakhs though consideration is less than Rs.50 lakhs. It can be seen that SDV does not exceed the safe harbour limit under section 43CA/Section 50C of 110% of the consideration is Rs.53.90 lakhs. Though section 43CA and section 50C are not attracted, TDS under section 194-IA is attracted as SDV is Rs.50 lakhs or more. Though consideration as per ATS/BBA, and not SDV, will be adopted for section 43CA/Section 50C purposes, TDS will be deductible on higher of SDV and consideration i.e. @ 1% of 53 lakhs.TDS to be deducted=Rs.53,000. TDS to be deducted from consideration of Rs.49 lakhs will be Rs 53,000, not Rs.49,000. |

1.3 Who is the payer (i.e purchaser) for deduction of TDS on Property Sale

The payer is any person, being a transferee, responsible for paying (other than the person referred to in section 194-IA) to a resident transferor any sum by way of consideration for transfer of any immovable property (other than agricultural land).

1.4 Who is the payee (i.e Seller) for deduction of TDS on Property Sale

The payee is resident transferor of any immovable property (other than agricultural land).

1.5 Time of deduction of TDS on Property Sale

Tax shall be deducted at the time of credit of such sum to the account of the transferor or at the time of payment of such sum in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

Illustration :-

An asset is being purchased in Delhi and is valued at INR 80 Lacs. A part payment for this purchase INR 30 Lacs was made 0n 1st June 2016 and balance 50 Lakh on 01st July 2016

1. TDS on this 30 Lakh has to be deducted on 1st june 2016 @ 1% and to be deposited with the government in Form No. 26QB. within thirty days from the end of the month in which the deduction is made i.e on or before 3oth july 2016).

2. TDS on this 50 Lakh has to be deducted on 1st July 2016 @ 1% and to be deposited with the government in Form No. 26QB. within thirty days from the end of the month in which the deduction is made i.e on or before 3oth Aug 2016).

1.6 Rate of TDS

TDS was to be dedufted @ 1% on sale consideration till 31.03.2022 . However w.e.f 01.04.2022 ,as per Finance Bill 2022 , TDS will apply @ 1% of such sum of consideration or the stamp duty value of such property, whichever is higher . [Refer Change for TDS on Sale of Immovable Property in India from FY 2022-23: Section 194IA Income Tax]

1.7 Who is to deduct tax at source

The payer (i.e., the purchaser) is to deduct tax at source.

Effect of private arrangement where under the payer has to bear the tax liability of the payee

Section 195A of the Act provides that where, under an agreement or other arrangement, the tax chargeable on any income is to be borne by the person by whom the income is payable, then, for the purposes of deduction of tax such income shall be increased to such amount as would, after deduction of tax thereon at the rates in force for the financial year in which such income is payable, be equal to the net amount payable under such agreement or arrangement

1.8 Where no tax need to be deducted or tax be deducted at lower rate

No such provision exists unde this section 194IA

1.9 Effect of non-furnishing of PAN on rate of tax

Section 206AA, as inserted with effect from 1-4-2010, provides as under :

♦ Every person whose receipts are subject to deduction of tax at source (i.e., the deductee) shall furnish his PAN to the deductor. It will be compulsory from 1-4-2010.

♦ If such person does not furnish PAN to the deductor, the deductor will deduct tax at source at higher of the following rates—

(a) the rate prescribed in the Act;

(b) at the rate in force, i.e., the rate mentioned in the Finance Act; or

(c) at the rate of 20 per cent.

♦ It is mandatory for quoting of PAN of the deductee by both the deductor and the deductee in all correspondence, bills and vouchers exchanged between them.

♦ Where the PAN provided to the deductor is invalid or does not belong to the deductee, it shall be deemed that the deductee has not furnished his PAN to the deductor and above provisions shall apply accordingly.

1.20 Deposit of TDS on Property Sale to the credit of the Central Government

w.e.f. 1-6-2016. Any sum deducted under section 194-IA shall be paid to the credit of the Central Government within a period of thirty days from the end of the month in which the deduction is made and shall be accompanied by a challan-cum-statement in Form No. 26QB.

The sum so deducted shall be deposited to the credit of the Central Government by remitting it electronically into the Reserve Bank of India or the State Bank of India or any authorised bank.

For list of authorized banks, please refer https://onlineservices.tin.nsdl.com/etaxnew/Authorizedbanks.html

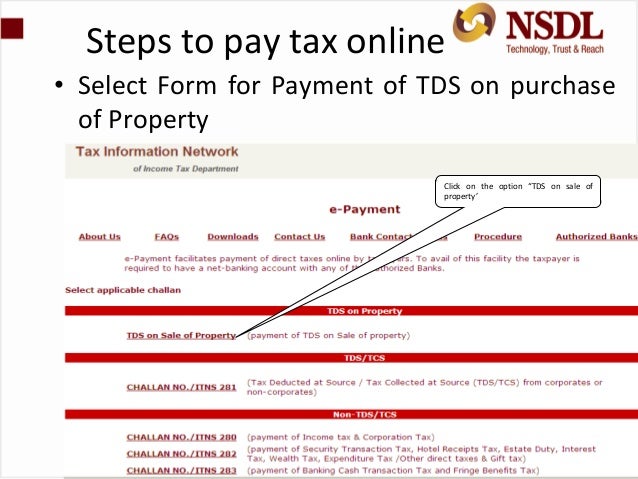

Steps to fill form 26QB :

- Log on to TIN NSDL website ( www.tin-nsdl.com ).

- Under ‘TDS on sale of property’, click on “Online form for furnishing TDS on property (Form 26QB)”.

- Select the applicable challan as “TDS on Sale of Property”.

- Fill the complete form as applicable.(User should be ready with the following information while filling the form 26QB :

- PAN of the seller & buyer

- Communication details of seller & buyer

- Property details

- Amount paid/credited & tax deposit details

- Submit the duly filled form to proceed. A confirmation screen appears. After confirming, a screen appears showing two buttons as “Print Form 26QB” and “Submit to the bank”. A unique acknowledgement number is also displayed on the screen. It is advisable to save this acknowledgment number for future use.Click on “Print Form 26QB” to print the form. Then click on “Submit to the bank” to make the required payment online through internet banking. Then proceed to the payment page through internet banking facility of various banks.

- On successful payment a challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made.

1.21 Certificate/statement for TDS on Property Sale

Every person responsible for deduction of tax under section 194-IA shall furnish the certificate of deduction of tax at source in Form No. 16B to the payee within fifteen days from the due date for furnishing the Challan-cum-statement in Form No. 26QB under rule 31A after generating and downloading the same from the web portal specified by the Director General of Income-tax (System) or the person authorised by him

Steps to Download Form 16B:{Proceed to TRACES portal( www.tdscpc.gov.in) after 5 days to download Form 16B.}

- Register & login on TRACES portal ( www.tdscpc.gov.in) as taxpayer using your PAN.

- Select “Form 16B (For Buyer)” under “Downloads” menu.

- Enter the details pertaining to the property transaction for which Form 16B is to be requested. Enter the Assessment Year, Acknowledgment Number, PAN of Seller and click on “Proceed”.

- A confirmation screen will appear. Click on “Submit Request” to proceed.

- A success message on submission of download request will appear. Please note the request number to search for the download request.

- Click on “Requested Downloads” to download the requested files.

- Search for the request with request number. Select the request row and click on “HTTP download” button.

1.22 Annual statements to payees by Income Tax Department

With effect from 1-4-2008, the Director General of Income-tax (Systems) or the person authorised by him (i.e. NSDL) shall deliver to every payee from whose income tax has been deducted, a statement in Form No. 26AS by the 31st July every year following the financial year during which taxes were deducted.

This statement of 26AS regarding TDS on property sale can be seen by the payee (Seller) after loggining into www.Incometaxindiaefiling.gov.in

1.23 Credit for tax deducted at source on sale of property

The payee (seller) can claim credit for the tax deducted at source as furnished in such certificate in his return of income in which the relevant income is disclosed.

1.24 Claim for refund (in case of Wrong TDS deposit)

Rule 31A(3A) provides that a claim for refund, for sum paid to the credit of the Central Government under Chapter XVII-B, shall be furnished by the deductor in Form 26B electronically under digital signature in accordance with the procedures, formats and standards prescribed by the Director General of Income-tax (Systems).

1.25 Consequences of failure to deduct or pay tax, etc.

Read Post TDS not Deducted ? -Consequences

1.26 Disallowance under section 40(a)

Section 40(a) provides that in the case of any assessee following amounts shall not be deducted in computing the income chargeable to tax

‘Thirty per cent of any sum payable to a resident, on which tax is deductible at source and such tax has not been deducted or, after deduction, has not been paid on or before the due date specified in sub-section (1) of section 139.’

Read More Disallowance under section 40(a)(i)/(ia)/(iii) for non Deduction of TDS

1.27 Information to be furnished by payer in case of payment to non-resident

Read Complete Post Payment to Non resident ?- Statement by Tax Deductor to Income Tax deptt.

1.28 FAQs on TDS on Purchase of Property

Read Post TDS on Purchase of Property : FAQ’s

26QB -Challan cum Statement for TDS on Property Sale

Form 26QB filing and Correction procedure (TDS on Property)

Online Correction Facility for 26QB enabled (TDS on sale of property)

Procedure to generate Form 16B?