Section 194IB Income Tax TDS on Rent [ TDS on Rent w.e.f 01.6.2017 ]

[ Section 194IB of Income Tax Act – Deduction of tax at source on Rent in the case of certain Individuals and Hindu undivided family]

If you are paying Rent in India , then you must have been confused whether you needs to deduct TDS , If yes than under which Section of Income Tax Act . Whether it should be under Section 194I or under Section 194ib ( w.e.f 01.06.2017) of Income Tax Act. Here is the Flow Chart below and Commentary on Section 194ib with examples which will help to solve your problem of deciding whether TDS on rent needs to be deducted, how much needs to be deducted and under which section of Income Tax Act of India.

Summary of TDS u/s 194IB of Income tax Act

- When TDS to be deducted u/s 194IB : TDS to be deducted on any income by way of rent exceeding fifty thousand rupees for a month or part of a month during the previous year

- Rate of TDS u/s 194IB is 5%

- TDS u/s 194IB is to be deducted at the time of credit of rent, for the last month of the previous year or the last month of tenancy, if the property is vacated during the year, as the case may be, to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

- by Whom tds to be deducted u/s 194IB : Any person, being an individual or a Hindu undivided family (other than those referred to in the second proviso to section 194-I),

- Whose TDS to be deducted : TDS to be deducted if payment is made to a resident

TDS on Rent Limit u/s 194I from 01.04.2019 onwards

Now TDS on rent u/s 194I is required to be deducted if rent exceeds Rs 2,40,000 from 01.04.2019 ( Earlier the limit for tds u/s 194I was Rs 180000 as shown in the flow chart below )

Flow Chart on TDS on Rent till 31.03.2019

Now TDS limit u/s 194I is Rs 2,40,000 which was Substituted for “one hundred and eighty thousand rupees” by the Finance Act, 2019, w.e.f. 1-4-2019.

Notes on Flow Chart on TDS on Rent

*Tax Audit –

For Business:-

-If Turnover exceeds Rs 1 Crore for Business in last year immediately preceding the financial year

– If Section 44AD(4) is applicable w.e.f 01.4.2017 and income exceeds maximum amount not chargeabke to income tax in last year immediately preceding the financial year

Profession :-

-If Turnover exceeds Rs 25 Lakh ( Rs 50 Lakh w.e.f 1.4.2017) in last year immediately preceding the financial year

-If Professional opt for 44ADA and Profit less than prescribed u/s 44ADA w.e.f 01.4.2017 in last year immediately preceding the financial year

**W.e.f 01.06.2017 – Rent paid/ credited Exceeds Rs 50000 Per month or part of the month during Financial year

*** Inserted by the Finance Act, 1994, w.e.f. 1-6-1994.

****Inserted by the Finance Act 2017 w.e.f 01.06.2017

Summary of TDS on Rent under Section 194IB of Income Tax Act :

Applicability of TDS on Rent u/s 194IB of Income Tax Act

- Section :- Finance Act 2017 inserted a new Section 194IB in the Income Tax Act 1961 .

- Date of Applicability: This amendment of Deduction of TDS on Rent under Section 194IB will take effect from 1st June, 2017.

Person not Covered for TDS on Rent u/s 194IB of Income Tax Act

Any person, being an individual or a Hindu undivided family (other than those referred to in the second proviso to section 194-I), responsible for paying to a resident any income by way of rent exceeding fifty thousand rupees for a month or part of a month during the previous year, shall deduct an amount equal to five per cent of such income as income-tax thereon.[ Section 194IB(1) of the Income Tax Act 1961 ]

Second proviso to section 194-I is as follow:-

Provided further that an individual or a Hindu undivided family, whose total sales, gross receipts or turnover from the business or profession carried on by him exceed the monetary limits specified under clause (a) or clause (b) of section 44AB during the financial year immediately preceding the financial year in which such income by way of rent is credited or paid, shall be liable to deduct income-tax under this section :

Comments :

1 TDS u/s 194IB is to be deducted by Individuals or a HUF who are not covered under 44AB of the Act (Tax audit) . IF Individual and HUF is liable for Tax Audit u/s 44AB then TDS is to be deducted u/s 194I and not under 194IB . Read TDS on Rent -Complete Guide-194I

2. This Section 194IB is not applicable for Company, Partnership Firm, LLP,AOP, BOI etc.

Meaning of Rent for TDS on Rent u/s 194IB of Income Tax Act

“Rent” means any payment, by whatever name called, under any lease, sub-lease, tenancy or any other agreement or arrangement for the use of any land or building or both.[ Explanation to Section 194IB of Income Tax Act 1961 ]

Comments : What is not to be included in rent :

TDS is required to be deducted only in respect of the income which is chargeable to tax and not otherwise. Thus rent Rent Paid for agricultural land may not be covered by this section 194IB as the agriculture income is exempt u/s 10(1).

As per rent definition, the payment of rent for use of land or building or both would be covered. Thus it will not cover rent paid which is not for use of land or building or both .Example :- If the amount of rent includes payment for use of furniture etc., it would not constitute rent as defined under the section 194IB.

Amount of Rent for deducting TDS on Rent u/s 194IB of Income Tax Act

Any person, being an individual or a Hindu undivided family (other than those referred to in the second proviso to section 194-I), responsible for paying to a resident any income by way of rent exceeding fifty thousand rupees for a month or part of a month during the previous year, shall deduct an amount equal to five per cent of such income as income-tax thereon.[ Section 194IB(1) of the Income Tax Act 1961 ]

Read : 194IB TDS on what portion of Rent ? if rent increased to 50000 p.m during the year; Budget 2017-18 Suggestions

Rates of TDS on Rent u/s 194IB of Income Tax Act

Any person, being an individual or a Hindu undivided family (other than those referred to in the second proviso to section 194-I), responsible for paying to a resident any income by way of rent exceeding fifty thousand rupees for a month or part of a month during the previous year, shall deduct an amount equal to five per cent of such income as income-tax thereon.[ Section 194IB(1) of the Income Tax Act 1961 ]

Maximum Amount of TDS that can be deducted :-

In a case where the tax is required to be deducted as per the provisions of section 206AA, such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be [ Section 194IB(4) of the Income Tax Act 1961 ]

Comment :

Section 206AA of Income Tax Act deals with Requirement to furnish Permanent Account Number. If payee (whose TDS is deducted ) does not furnish PAN than higher TDS is to be deducted. [Refer below : TDS rate if PAN of Payee Not Available ]

Thus if the person does not furnish PAN then TDS on rent shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

TDS rate if PAN of Payee Not Available

In a case where the tax is required to be deducted as per the provisions of section 206AA, such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be [ Section 194IB(4) of the Income Tax Act 1961 ]

As per section 206AA of Income Tax Act , any person who is entitled to receive any income, sum or amount on which tax is to be deducted at source under Chapter XVII-B of the Act, he shall furnish his Permanent Account Number (PAN) to the person responsible for deducting such tax. If he fails to furnish PAN, tax shall be deducted at the higher of the following rates, namely—

(i) at the rate specified in the relevant provision of the Act; or

(ii) at the rate or rates in force; or

(iii) at the rate of twenty per cent.

Sub-section (4) of section 194-IB provides that in a case where the tax is required to be deducted as per the provisions of section 206AA, such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

Accordingly, if the payee does not furnish his PAN, though the rate of deduction of tax would be the higher of the above but the maximum TDS liability in view of the provision of sub-section (4) of section 194-IB would be the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

Illustration : On 01.04.2018, Mr. A agreed to pay rent of Rs.80,000 per month for use of premises to Mr B. There is no payment during the year. However, it is credited to his account on 31-3-2019; Mr. B does not furnish his PAN to Mr. A.

The TDS liability of Mr. A would be as under:

Total rent for the period April, 2018 to March, 2019 (Rs.80,000 per month × 12 months) 9,60,000 Tax deductible at source in March, 2019 (Rs. 9,60,000 × 20%) 1,92,000 However, the TDS would be restricted to payment of rent for the last month of the previous year. 80,000

Section 206AB inserted by the Finance Act, 2021, w.e.f. 1-7-2021 as follow in Section 194IB(4)

“In a case where the tax is required to be deducted as per the provisions of section 206AA [206AB], such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

section 206AB omitted by the Finance Act, 2022, w.e.f. 1-4-2022 in Section 194IB(4)

In a case where the tax is required to be deducted as per the provisions of section 206AA [***], such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.”

When to Deduct TDS on Rent u/s 194IB of Income Tax Act

The income-tax referred to in sub-section (1) shall be deducted on such income at the time of credit of rent, for the last month of the previous year or the last month of tenancy, if the property is vacated during the year, as the case may be, to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.[ Section 194IB(2) of the Income Tax Act 1961 ]

Comments :-

Tax shall be deducted on such income at earliest of following :-

- Credit of rent to the account of the payee for the last month of the previous year or

- Credit of rent to the account of the payee for the last month of tenancy if the property is vacated during the year,

- At the time of payment in cash or by issue of a cheque or draft or

- At the time of payment by any other mode

If actual payment of rent is not made during the year but it is credited to the account of the payee for the last month of the previous year that is anytime during the month of March, the tax is required to be deducted in the month of March. Similarly, if the property is vacated during the year and the amount is credited to the account of the payee in the last of month of tenancy, the tax is required to be deducted in that month.

Who is to deduct TDS on Rent u/s 194IB of Income Tax Act

Any person, being an individual or a Hindu undivided family (other than those referred to in the second proviso to section 194-I), responsible for paying to a resident any income by way of rent exceeding fifty thousand rupees for a month or part of a month during the previous year, shall deduct an amount equal to five per cent of such income as income-tax thereon.[ Section 194IB(1) of the Income Tax Act 1961 ]

Comments :-

- Payer of the rent must be an individual or a HUF other than those covered under section 194-I. Thus an individual like salaried person, farmer, whose income is exempt or may be below taxable limit, etc. may have to comply with the section, if rent exceeding Rs. 50,000 is paid.

- Even non-resident in certain cases have to comply with provision of the section 194IB.

Who is Payee for TDS on Rent u/s 194IB of Income Tax Act

Any person, being an individual or a Hindu undivided family (other than those referred to in the second proviso to section 194-I), responsible for paying to a resident any income by way of rent exceeding fifty thousand rupees for a month or part of a month during the previous year, shall deduct an amount equal to five per cent of such income as income-tax thereon.[ Section 194IB(1) of the Income Tax Act 1961 ]

Comments :-

The payee (To whom rent is paid) would be any person being a resident. In other words, provision of the section would not apply to non-resident payee. Any payment of rent to the non-resident would be governed by section 195 of Income Tax Act .

TAN not required for TDS on Rent u/s 194IB of Income Tax Act

The provisions of section 203A shall not apply to a person required to deduct tax in accordance with the provisions of this section.[ Section 194IB(3) of the Income Tax Act 1961 ]

Section 203A Income Tax Act, inter alia, provides that every person deducting tax at source in accordance with the provision of the Chapter XVII should obtain ‘tax deduction account number’ (TAN).

However, section 194-IB(3) provides that the provisions of section 203A shall not apply to a person required to deduct tax in accordance with the provision of that section. In other words, the person deducting tax at source as per the section 194IB need not obtain TAN.

Tenant or Payer of the rent on property is required to quote his or her PAN and PAN of the landlord.

Time Period and Form for Deposit of TDS on Rent u/s 194IB of Income Tax Act

Any sum deducted under section 194-IB shall be paid to the credit of the Central Government within a period of thirty days from the end of the month in which the deduction is made and shall be accompanied by a challan-cum-statement in Form No. 26QC.

[As per the Notification issued on 09.06.2017 by CBDT Form No 16C & 26QC has been Notified for TDS on Rent u/s 194IB .]

Example: If a taxpayer has made payment of rent in the month of December, then corresponding TDS should be deposited on or before thirty days i.e. January 30th.

Banks Authorized for Depositing TDS on Rent u/s 194IB of Income Tax Act

Tax so deducted shall be deposited to the credit of the Central Government by remitting it electronically into the Reserve Bank of India or the State Bank of India or any authorized bank.

[As per the Notification issued on 09.06.2017 by CBDT ]

View List of Authorized Banks: Click here

Tenant may approach any of the authorized Bank Branch to facilitate in making e-payment.

How to pay TDS on Rent u/s 194IB of Income Tax Act

Form 26QC is the challan-cum-statement for reporting the transactions liable to TDS on rent under section 194-IB of the Income-tax Act, 1961. It is an online form available on the TIN website.

Pay TDS on rent online

Read the procedure and FAQs given below before paying TDS on rent and then Click on the option “Online form for furnishing TDS on Rent (Form 26QC)”.Click here

Procedure to pay TDS on Rent online :-

The Tenant of the property (deductor of tax) has to furnish information regarding the transaction, online on the TIN website i.e. www.tin-nsdl.com. After successfully providing details of transaction, deductor/tenant can:

- Either make the payment online (through e-tax payment option) immediately; Or

- Make the payment subsequently through e-tax payment option (net-banking account) or by visiting any of the authorized Bank branches. However, such bank branches will make e-payment without digitization of any challan. The bank will get the challan details from the online form filled on TIN website(www.tin-nsdl.com)

Step 1

- Log on to NSDL e-Gov-TIN website (www.tin-nsdl.com).

- Click on the option “Online form for furnishing TDS on Rent (Form 26QC)”.Click here

- Select Form 26QC (Payment of TDS on Rent of Property)

Step 2

After selecting the form you will be directed to the screen for entering certain information.

Example:-

a) Permanent Account Number of the Tenant and Landlord

b) Address of the Tenant and Landlord as well as the Property being let out

c) Financial Year will be populated on the basis of Date of Payment/Credit selected in the Form.

d) Major Head Code – Indicates the type of tax applicable viz; Corporation Tax (Companies)/ Income Tax (Other than Companies) will be populated based on Landlords PAN

e) Total Value of Rent Payable

f) Period of Tenancy

g) Date of Payment/Credit

h) Date of Deduction

i) Amount Paid/Credited

j) TDS Amount

k) Select the option for “Payment of taxes immediately”

[ Note :you can also Select the option for “Payment of taxes on Subsequent Date” in that case take printout of the Acknowledgment slip after submitting form 26QC, you may visit any of the authorized Bank branches to make the payment of TDS subsequently. The Bank will make the payment through its net banking facility and provide you the Challan counterfoil as acknowledgment for payment of taxes. Based on the information in the Acknowledgment slip, the bank will make the payment only through net-banking facility by visiting tin-nsdl.com and entering the acknowledgement number duly generated by TIN for the statement already filled by the buyer in respect of that transaction. In case you desire to make the payment through e-tax payment (net banking account) subsequently, you may access the link “E-tax on subsequent date” on the TIN website. On entering the details as per the acknowledgment slip, you will be provided an option to submit to the bank wherein you have to select the Bank through which you desire to make the payment. You will be taken to the net banking login screen wherein you can make the payment online.]

It is important to ensure that PAN of Tenant and Landlord are correctly mentioned in the form. There is no online mechanism for subsequent rectification. Deductor will have to approach the TDS – Assessing Officer or CPC-TDS for rectification of errors.

Step 3

After entering all the above detail, click on PROCEED button. The system will check the validity of PAN. In case PAN is not available in the database of the Income Tax Department then you cannot proceed with the payment of tax.

If PAN is available then TIN system will display the contents you have entered along with the “Name” appearing in the ITD database with respect the PAN entered by you.

If PAN of the landlord is not available (select PAN of landlord as PAN Not Available) TDS has to be deducted under the provisions of section 206AA of the Income-tax Act, 1961 and such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

Step 4

You can now verify the details entered by you. In case you have made a mistake in data entry, click on “EDIT” to correct the same. If all the detail and name as per ITD is correct, click on “SUBMIT” button. Ten digit alpha numeric ACK no. will be generated and you will be directed to the net-banking site provided by you.

Please be informed that the name and status of PAN is as per the ITD PAN Master. You are required to verify the name before making payment. In case any discrepancy is observed, please confirm the PAN entered by you. Any change required in the name displayed as per the PAN Master can be updated by filling up the relevant change request forms for PAN. If the name is correct, then click on “Confirm”.

Step 5

After confirmation an option will be provided for submitting to Bank. On clicking on Submit to Bank, deductor (as per the mode of payment selected while filling the form) will have to key in the debit card details or login to the net-banking site with the user ID/ password provided by the bank for net-banking purpose and enter payment details at the bank site.

On successful payment a challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made.

TIN system will direct you to net-banking/Debit card facility of your bank. You will have to log on to the net banking site of your bank using your login ID and password/PIN provided by the bank. The particulars entered by you at TIN website will be displayed again.

You will now be required to enter the amount of tax you intend to pay and also select your bank account number from where you intend to pay the tax. After verifying the correctness, you can proceed with confirming the payment.

Your bank will process the transaction online by debiting the bank account indicated by you and generate a printable acknowledgment indicating the Challan Identification Number (CIN). You can verify the status of the challan in the “Challan Status Inquiry” at NSDL e-Gov-TIN website using CIN after a week, after making payment.

You will have to check the net-banking webpage of your bank’s website for this information.

Your Bank provides facility for re-generation of electronic challan counterfoil kindly check the Bank website, if not then you should contact your bank and request them for duplicate challan counterfoil.

If any problem encountered while entering the financial details at the net-banking webpage of your bank, then you should contact your bank for assistance.

To avail this facility the taxpayer is required to have a net-banking account with any of the Authorized Banks or a debit card in case of some banks. List of Authorized Banks is available at the TIN website.View List of Authorized Banks: Click here

According to rule, Taxpayer/Tenant should furnish challan-cum-statement in Form 26QC in following scenarios:-

- At the end of the FY or in the month when the premise is vacated / termination of agreement. However, taxpayer has to mandatorily file the Form at the end of each Financial Year (in case the agreement period contains more than one FY and rent has been paid/credited during the year)

- In the month when the premise is vacated/ termination of agreement ( in case the agreement period falls in the same FY)

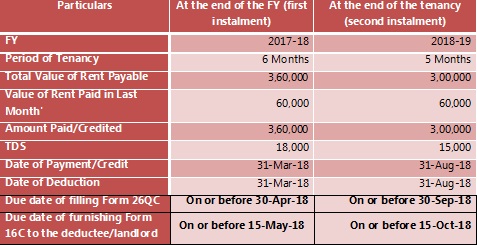

Example 1 (Rent Agreement falling across two FY):- Tenant Mr. A has entered into a tenancy agreement with Landlord Mr. X for the period of 11 months from October 1, 2017 to August 31, 2018 @ rent of Rs. 60,000.

Explanation: – In this case, Mr. A should file Form 26QC twice i.e. firstly at the end of the FY 2017-18 (on March 31, 2018) and secondly at the end of the tenancy period (on August 31, 2018). Following values will be captured in the below fields:

Example 2 (Rent Agreement falling in same FY):- Tenant Mr. B has entered into a tenancy agreement with Landlord Mr. Y for the period of 6 months from June 1, 2017 to November 30, 2017 @ rent of Rs. 80,000 for 6 months

Explanation: – In this case, Mr. B will have to file Form 26QC only once i.e. at the end of tenancy period (on November 30, 2017). Following values will be captured in the below fields:

If any problem is encountered at the NSDL e-Gov website while entering details in the online form, then contact the TIN Call Center at 020 – 27218080 or write to us at  (Please indicate the subject of the mail as Online Payment of Direct Tax_ TDS on rent of property).

(Please indicate the subject of the mail as Online Payment of Direct Tax_ TDS on rent of property).

- Acknowledgment number for the Form 26QC furnished is available in the Form 26AS (Annual Tax Statement) of the Deductor (i.e. Tenant/ Payer of property). The same can be viewed from the TRACES website (www.tdscpc.gov.in) or

- Taxpayer can also click the option ‘View Acknowledgment’ hosted on the TIN website. Taxpayer needs to enter PAN of the Tenant and Landlord, Total Payment and Financial Year (as mentioned at the time of filing the Form 26QC) to retrieve the Acknowledgment Number.

The deductor may access the link “E-tax on subsequent date” on the TIN website. On entering the details as per the acknowledgment slip, deductor will be provided options to Print the Form 26QC.

e-payment of taxes at subsequent date will be linked to the FORM 26QC based on Acknowledgement number generated at the time of filing of Form 26QC.

As per section 234E of the Income-tax Act, 1961 read with Rule 31A (4B) of Income-tax Rules, 1962, failure on part of deductor (tenant/lesse/payer) to furnish challan-cum-statement in Form No. 26QC electronically within 30 days from the end of the month in which the tax deduction is made will attract levy of fee for default in furnishing statement at the rate of Rs 200 for every day to be paid by the deductor (tenant/lessee/payer).

More than one tenant/landlord for TDS on Rent u/s 194IB of Income Tax Act

Online challan-cum-statement in Form 26QC is to be filed by each tenant for unique tenant-landlord combination for respective share. E.g. in case of one tenant and two landlords, two forms have to be filed in and for two tenants and two landlords, four forms have to be filed for respective rent shares.

TDS Certificate for TDS on Rent u/s 194IB of Income Tax Act

Every person responsible for deduction of tax under section 194-IB shall furnish the certificate of deduction of tax at source in Form No.16C to the payee within fifteen days from the due date for furnishing the challan-cum-statement in Form No.26QC under rule 31A after generating and downloading the same from the web portal specified by the Principal Director General of Income-tax (Systems)or the Director General of Income-tax (Systems) or the person authorised by him.

[As per the Notification issued on 09.06.2017 by CBDT Form No 16C & 26QC has been Notified for TDS on Rent u/s 194IB .]

Comment :-

Form 16C is the TDS certificate to be issued by the deductor (Tenant of property) to the deductee (Landlord of property) in respect of the tax deducted and deposited as TDS on rent under section 194-IB of the Income-tax Act, 1961.

Form 16C will be available for download from the website of Centralized Processing Cell of TDS (CPC-TDS), www.tdscpc.gov.in

Revision in Rent during the year

Example, suppose, during the year, rent is paid at Rs. 45,000 per month for first half of the year and subsequently, it is increased to Rs. 60,000 per month for remaining period; in such circumstances, the tax is required to be deducted in respect of rent paid at Rs. 60,000 during second half of the year. [ However Clarification is awaited from Income tax department]

Examples of TDS on Rent u/s 194IB of Income Tax Act

Examples of transactions on which TDS may be required to be deducted u/s 194IB

- Hotel Room rent : Payment made to the hotels for rooms hired may constitute a rent under the section 194IB. [ CBDT Circular No. 715, dated, 8-8-1995 point no 20 and Circular No. 5, dated 30-7-2002 ]

- Part of Land or Building : Rent paid for use of part or portion of the land or building e.g Rent paid for flat in a housing society etc (Refer Q No 5 of CBDTCircular number 718, dated 22.08.1995 )

Query No. 5 : Whether section 194-I is applicable to rent paid for the use of only a part or a portion of any land or building?

Answer : Yes, the definition of the term “any land” or “any building” would include a part or a portion of such land or building.”- Sub lease: The definition of the rent includes any payment under lease, sub-lease or tenancy.

- Lease Premium :– In case of lump sum lease payment or one time upfront lease charges. [However CBDT vide Circular No. 35, dated 13-10-2016 has also clarified that TDS under section 194-I is not required in case of lump sum lease payment or one time upfront lease payment]

- Deposit or advance Rent : If deposit is treated as advance rent then TDS is required to be deducted on adjustment of such deposit against rent.

In the context of section 194-I, the CBDT vide Circular No. 718, dated 22-8-1995 clarified as under:

“Query No. 2 : Whether tax is required to be deducted at source where a non-refundable deposit has been made by the tenant?

Answer : In cases where the tenant makes a non-refundable deposit tax would have to be deducted at source as such deposit represents the consideration for the use of the land or the building, etc., and, therefore, partakes of the nature of rent as defined in section 194-I. If, however, the deposit is refundable, no tax would be deductible at source. It is further clarified that if the deposit carries interest, the tax to be deducted on the amount of interest will be governed by section 194A of the Income-tax Act.”- Warehousing Charges : For section 194-I, the CBDT vide Circular No. 718, dated 22-8-1995 clarified that TDS is required to be deducted on warehousing charges. Therefore it may be concluded that TDS is required u/s 194IB if warehousing charges Paid exceeds Rs 50000 p.m or part of month.However if warehousing charges include payment for other facilities, then it needs to be determined on what value TDS is required to be deducted u/s 194IB on case to case basis.

- “Query No. 3 : Whether the tax is to be deducted at source from warehousing charges ?Answer : The term ‘rent’ as defined in Explanation (i) below section 194-I means any payment by whatever name called, under any lease, sub-lease, tenancy or any other agreement or arrangement for the use of any building or land. Therefore, the warehousing charges will be subject to deduction of tax under section 194-I.”

- Rent paid for use of ground, hall, etc. on occasion of functions, events, etc.

Meaning of Any other agreement or arrangement used in section 194IB

The expression “any other agreement or arrangement” is not defined in the section.In the context of the provision, the TDS would require to be deducted on payment of rent made under any other agreement or arrangement. In the context of section 194-I, the meaning of the expression “any other agreement or arrangement” is explained by High Court in case of Krishna Oberoi v. UOI [[2002] 123 Taxman 709 (AP)] as under :

“9. The expressions ‘any payment, by whatever name called’, and ‘any other agreement or arrangement’ occurring in the definition of the term ‘rent’ in Explanation to section 194-I have widest import. According to Black’s Law Dictionary, the word ‘any’ is often synonymous with either ‘every’ or ‘all’. Its generality may be restricted by the context in which that word occurs in a statute. The Supreme Court in Lucknow Development Authority v. M.K. Gupta AIR 1984 SC 787 dealing with the use of the word ‘service’, in the context it has been used in the definition of the term in Clause (o) of section 2 of the Consumer Protection Act, has opined that the word ‘any’ indicates that it has been used in wider sense extending from ‘one to all’. In G. Narsingh Das Agarwal v. Union of India [1967] 1 MLJ 197 the Court opined that the word ‘any’ means ‘all’ except where such a wide construction is limited by the subject-matter and context of the statute. The Patna High Court in Ashiq Hassan Khan v. Sub-Divisional Officer, AIR 1965 Pat. 446 (DB) and Chandi Prasad v. Rameshwar Prasad Agarwal AIR 1967 Pat. 41 has held that the word ‘any’ excludes ‘limitation or qualification’. In State of Kerala v. Shaju [1985] Ker. LJ 33 the Court held that the word ‘any’ is expressive. It indicates in the context ‘one or another’ or ‘one or more’, ‘all or every’, ‘in the given category’; it has no reference to any particular or definite individual, but to a positive but undetermined number in that category without restriction or limitation of choice. Thus, having regard to the context in which the expressions ‘any payment’ and “any other agreement or arrangement” occurring in the definition of the term “rent” (have been used) it only means each and every payment (that has been) made to the petitioner-hotel under each and every agreement or arrangement with the customers for the use and occupation of the hotel rooms.”

Comparative Analysis of TDS on Rent u/s 194I and u/s 194IB

| TDS on Rent | ||||

| Section 194I | Section 194IB | |||

| Applicability | It is Applicable to ii) Every person paying rent (Except Individual and HUF) ii) Individual and HUF if doing business and and covered in Tax Audit ( Turnover exceeds Rs 1 Crore for Business/ 25 Lakh for Profession) in Last year immediately preceding the financial year in which such income by way of rent is credited or paid | Every Individual and HUF not covered in 194I | ||

| Date of Applicability | Inserted by the Finance Act, 1994, w.e.f. 1-6-1994. | Inserted by the Finance Act 2017 w.e.f 01.06.2017 | ||

| Rate of TDS | i) 2% for the use of any machinery or plant or equipment;

| 5% | ||

| Limit | TDS to be deducted if rent paid/ credited Exceeds Rs 180000 Per annum | TDS to be deducted if rent paid/ credited Exceeds Rs 50000 Per month or part of the month during Financial year | ||

| Period | TDS to be deducted at the time of credit or payment of rent whichever earlier. | TDS to be deducted at earliest of following :-

| ||

| TAN No | Tax Deduction Account number is required to deduct tax | Tax Deduction Account number is not required to deduct tax | ||

Section – 194IB of Income-tax Act, 1961 after Finance Act 2017

[Payment of rent by certain individuals or Hindu undivided family

Inserted by the Finance Act, 2017, w.e.f. 1-6-2017

194-IB. (1) Any person, being an individual or a Hindu undivided family (other than those referred to in the second proviso to section 194-I), responsible for paying to a resident any income by way of rent exceeding fifty thousand rupees for a month or part of a month during the previous year, shall deduct an amount equal to five per cent of such income as income-tax thereon.

(2) The income-tax referred to in sub-section (1) shall be deducted on such income at the time of credit of rent, for the last month of the previous year or the last month of tenancy, if the property is vacated during the year, as the case may be, to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

(3) The provisions of section 203A shall not apply to a person required to deduct tax in accordance with the provisions of this section.

(4) In a case where the tax is required to be deducted as per the provisions of section 206AA, such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

Explanation.—For the purposes of this section, “rent” means any payment, by whatever name called, under any lease, sub-lease, tenancy or any other agreement or arrangement for the use of any land or building or both.]

Budget Speech of Arun Jaitley on 01.02.2017 – TDS on Rent under Section 194IB

Annex III to Part B of Budget Speech (para 1.5 of Direct Taxes)

” It is proposed to introduce a new provision in the Income-tax Act to provide for tax deduction at source at the rate of five per cent by an individual or HUF, other than those whose books of account are required to be audited, while making payment of rent of an amount exceeding Rs. 50,000 per month. It is also proposed to provide that such tax shall be deducted and deposited only once in a financial year through a challan-cum-statement. Further, the deductor shall not be required to obtain TAN or file any separate TDS return for this purpose. “

As per Clause 63 and Clause 64 of Finance Bill 2017

Clause 63 of Finance Act 2017

The existing provisions of section 194-I of the Act, inter alia, provide for deduction of tax at source at the time of credit or payment of rent to the account of the payee beyond a threshold limit.

It is further provide that an Individual or a Hindu undivided family who is liable for tax audit under section 44AB for any financial year immediately preceding the financial year in which such income by way of rent is credited or paid shall be required to deduction of tax at source under this section.

Therefore, under the existing provisions of the aforesaid section, an Individual and HUF, being a payer (other than those liable for tax audit) are out of the scope of section 194-I of the Act.

In order to widen the scope of tax deduction at source, it is proposed to insert a new section 194-IB in the Act to provide that Individuals or a HUF (other than those covered under 44AB of the Act), responsible for paying to a resident any income by way of rent exceeding fifty thousand rupees for a month or part of month during the previous year, shall deduct an amount equal to five per cent. of such income as income-tax thereon.

It is further proposed that tax shall be deducted on such income at the time of credit of rent, for the last month of the previous year or the last month of tenancy if the property is vacated during the year, as the case may be, to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

In order to reduce the compliance burden, it is further proposed that the deductor shall not be required to obtain tax deduction account number (TAN) as per section 203A of the Act. It is also proposed that the deductor shall be liable to deduct tax only once in a previous year.

It is also proposed to provide that where the tax is required to be deducted as per the provisions of section 206AA, such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

It is also proposed to define the term “rent” for the purposes of this section to mean any payment, by whatever name called, under any lease, sub-lease, tenancy or any other agreement or arrangement for the use of any land or building or both.

This amendment will take effect from 1st June, 2017.

Clause 64 of Finance Act 2017

Clause 64 of the Bill seeks to insert a new section 194-IC in the Income-tax Act relating to deductions in respect of

payment under specified agreement.

The proposed new section seeks to provide that notwithstanding anything contained in section 194-IA, any

person responsible for paying to resident any sum by way of consideration, not being consideration in kind, under the agreement referred to in sub-section (5A) of section 45, shall, at the time of credit of such sum to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier, deduct an amount equal to ten per cent. of such sum as income-tax thereon.

This amendment will take effect from 1st April, 2017.

Relevant Extract of Inserted new section 194IB

Payment of rent by certain individuals or Hindu undivided family.

63. After section 194-IA of the Income-tax Act, the following section shall be inserted with effect from the 1st day of June, 2017, namely:—

‘194-IB. (1) Any person, being an individual or a Hindu undivided family (other than those referred to in the second proviso to section 194-I), responsible for paying to a resident any income by way of rent exceeding fifty thousand rupees for a month or part of a month during the previous year, shall deduct an amount equal to five per cent. of such income as income-tax thereon.

(2) The income-tax referred to in sub-section (1) shall be deducted on such income at the time of credit of rent, for the last month of the previous year or the last month of tenancy, if the property is vacated during the year, as the case may be, to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

(3) The provisions of section 203A shall not apply to a person required to deduct tax in accordance with the provisions of this section.

(4) In a case where the tax is required to be deducted as per the provisions of section 206AA, such deduction shall not exceed the amount of rent payable for the last month of the previous year or the last month of the tenancy, as the case may be.

Explanation.—For the purposes of this section, “rent” means any payment, by whatever name called, under any lease, sub-lease, tenancy or any other agreement or arrangement for the use of any land or building or both.’.

Relevant Extract of Inserted new section 194-IC

Payment under specified agreement.

64. After section 194-IB of the Income-tax Act as so inserted, the following section shall be inserted, namely:—

“194-IC. Notwithstanding anything contained in section 194-IA, any person responsible for paying to a resident any sum by way of consideration, not being consideration in kind, under the agreement referred to in sub-section (5A) of section 45, shall at the time of credit of such sum to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier, deduct an amount equal to ten per cent. of such sum as income-tax thereon.”

Related Post on Budget 2017-18

Budget Speech 2017-18 -Download /Print

Finance Bill 2017 -Download /Print -Budget 2017-18

Memorandum Explaining Provisions in Finance Bill 2017

Updates on Union Budget 2017-18

Related Book on Tax

You can Bookmark This page we will update with following topics : –

sec 194ib ,form 26qc download in pdf , tds house rent , tds on rent 194ib limit ,how to deduct tds on rent, 194ib rate ,194ib for fy 2016-17, 194ib for fy 2017-18,194ib for fy 2018-19,194ib tds rate ,rent on tds, 194ib applicability,tds on rent 194ib,tds on office rent,194ib tds,section 194ib for ay 2017-18,section 194ib for ay 2018-19, online tds payment on rent,tds applicability section ,tds on rent 194ib, section 194ib notification,form 16c income tax, pay tds on rent online, 194ib for ay 2017-18, 194ia & 194ib meaning, how to calculate tds on rent, sec 194ib applicability, tds on rent, tds 194ib, difference between 194i and 194ib, tds on rent of immovable property, office rent tds rate, rent tds rate, 194i tds, section 194ib, tds under 194ib, tds section 194ib, tds on rent for fy 2018-19, tds on rent 194ib notification, sec 194 ib of income tax, tds on rent by individual budget 2017, 194ib limit,

online tds payment for rent, tds for nri on rent, 194ib for fy 2017-18, 194ib section, sec 194 ib, section 194ib of income tax act, section 194 ib, tds for rent, section 1941b,

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal