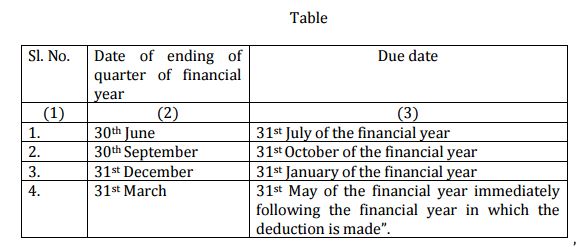

Revised due date as per Rule-31A, Income-tax Rules to file TDS Statement in Form No 24Q, 27Q, and 26Q w.e.f 01.06.2016 as per [Notification No.30/2016, F.No.142/29/2015-TPL Dated 29.04.2016]

Earlier Time Limit as per Rule-31A, Income-tax Rules to file TDS Statement in Form No 24Q, 27Q, and 26Q

i) the due date specified in the corresponding entry in column (3) of the said Table, if the deductor is an office of Government; and

ii) the due date specified in the corresponding entry in column (4) of the said Table, if the deductor is a person other than the person referred to in clause (i)

|

| Sl. No. | Date of ending of the quarter of the financial year | Due date | Due date |

| (1) | (2) | (3) | (4) | |

| 1. | 30th June | 31st July of the financial year | 15th July of the financial year | |

| 2. | 30th September | 31st October of the financial year | 15th October of the financial year | |

| 3. | 31st December | 31st January of the financial year | 15th January of the financial year | |

| 4. | 31st March | 15th May of the financial year immediately following the financial year in which deduction is made | 15th May of the financial year immediately following the financial year in which deduction is made.] |

Related Post

- e-TDS / TCS returns through e-filing portal https://incometaxindiaefiling.gov.in

- TDS Statement Upload Online -Procedure

- TDS on Property , Govt revised timeline to Deposit

- Online Correction Facility for 26QB enabled (TDS on sale of property)