Upload Form 15CA

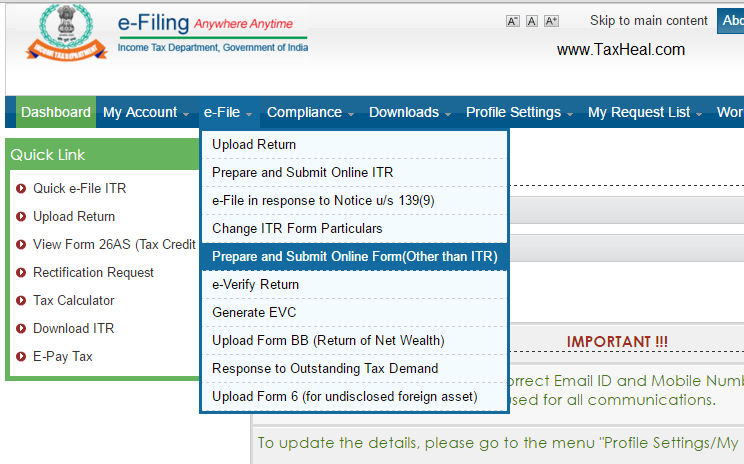

STEP 1 : To upload Form 15CA login to www.incometaxindiaefiling.gov.in with your username and password . Go to e-file => Prepare and submit form (other than ITR )

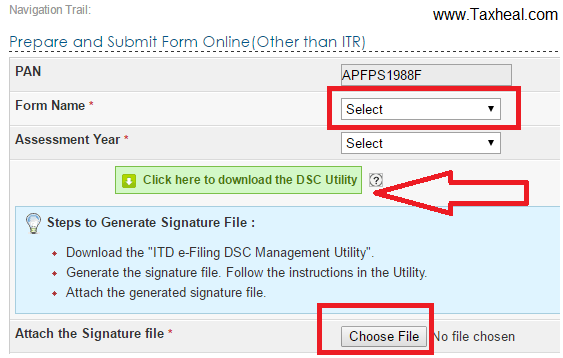

STEP -2 : Select the Form Name form No 15CA and attach the signatures (You need to download the Digital signature utility -DSC to generate signatures and save them on your desktop)

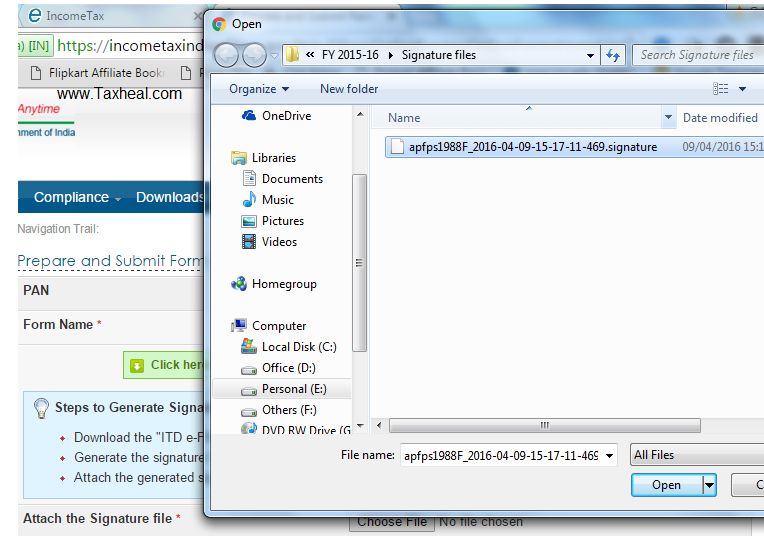

STEP -3 : Upload the digital signatures you have generated using DSC utility as downloaded in Step -2

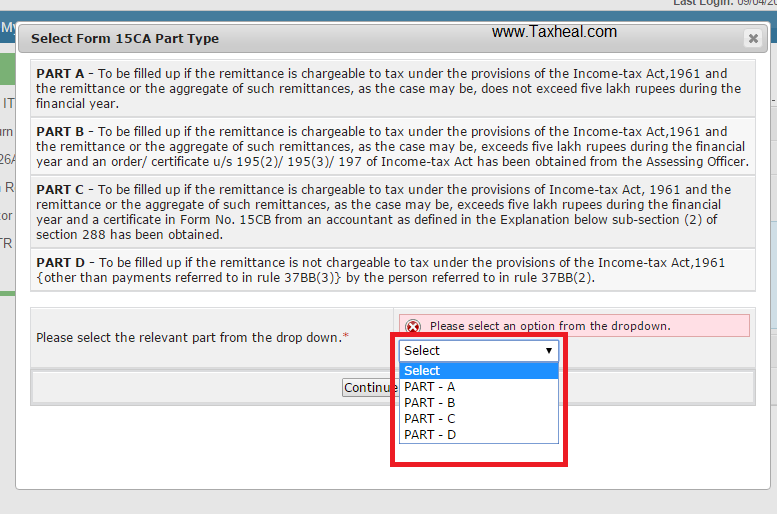

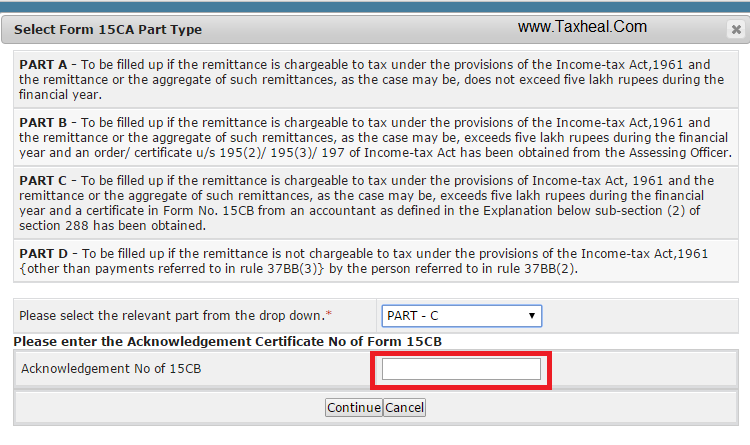

STEP -4 : Select which part is applicable for uploading form No 15CA i.e Part A, Part B , Part C or Part D

Note :

1 For Part C , Chartered Accountant has to first upload Form No 15CB in XML Format, then only use can Fill PartC as it will ask Acknolwedgement No of Form No 15CB filed by Chartered Accountant online .

2. To enable Chartered Accountant to file Form No 15CB , Assessee has to Add CA by going on My Account => Add CA

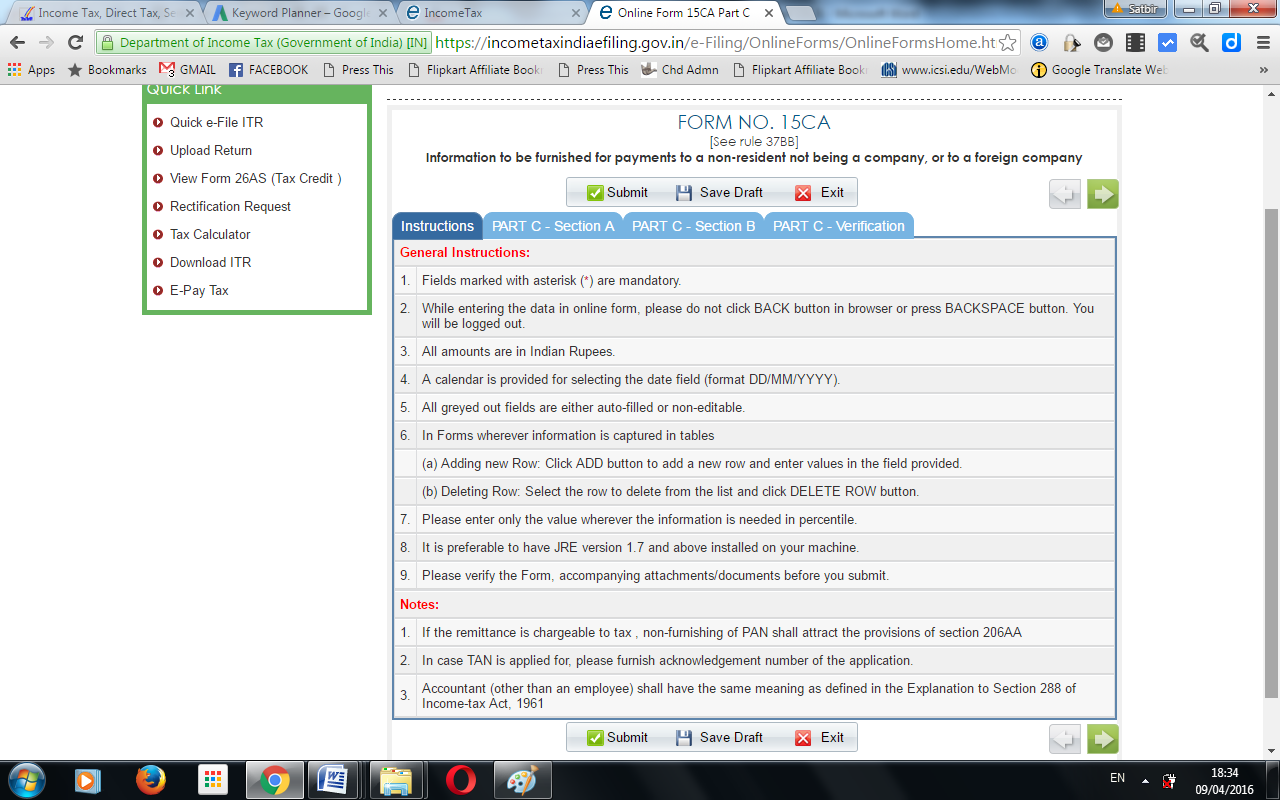

STEP-5 : If you select Part C then Acknowledgement No of Form No 15CB filed by CA is required before you can proceed further.

STEP-6 : If you select the Part C and filled the Form No 15CB acknowledgement No given by CA , then following screen will open with Section A, B and C. It will automatically capture the details from the CA certificate i.e Form No 15CB filed by CA. Some fields you have to Fill like TAN of remitter, Beneficiary place of Business etc

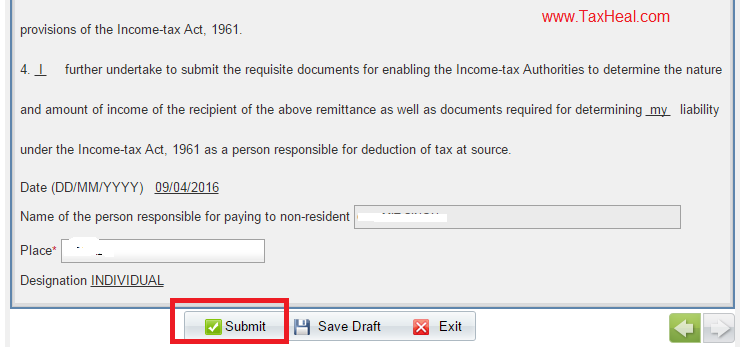

STEP -7 Then you have to Submit the Form No 15CA by clicking on submit Button

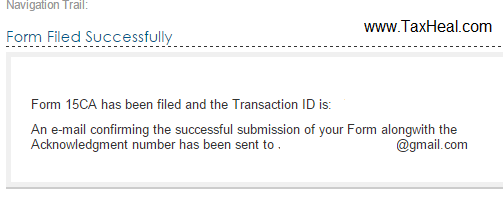

STEP-8 : Following success message will display after successful upload of Form No 15CA

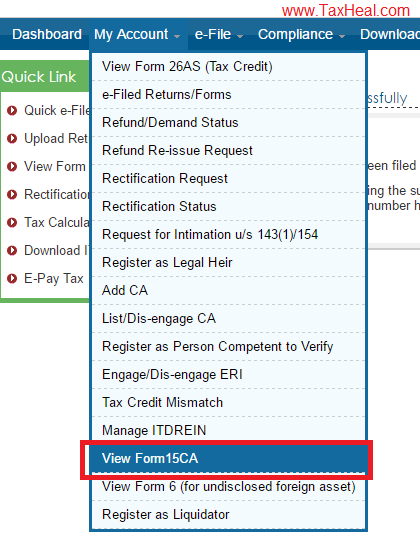

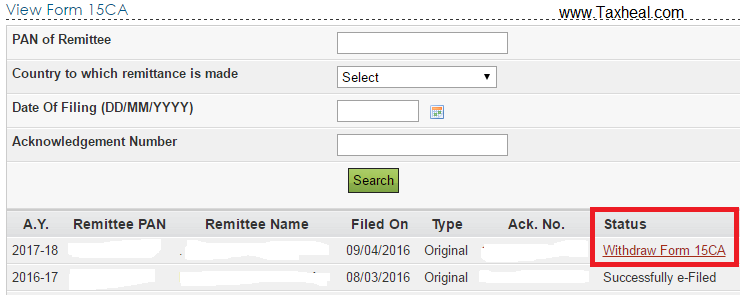

STEP -9 : Now you can check the Form No 15CA by going to My account => View Form No 15CA

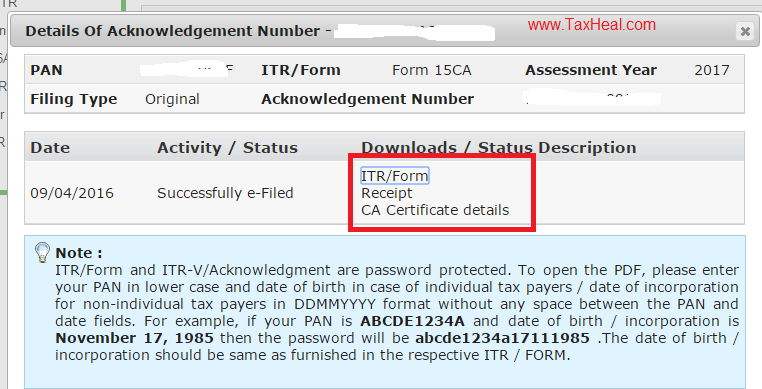

STEP 10 : By clicking on ACK No , following screen will display . Now you can download the ITR / Form (Form No 15CA) as well as CA certificate details (Form No 15CB filed by CA if part C is applicable to you)

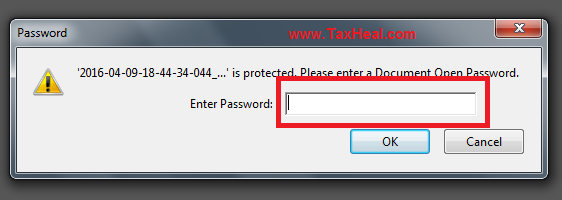

STEP 11 : When you download the Form No 15CA it will ask password which is PAN of the Assessee /remitter followed by his date of Birth

STEP 11 : You can also withdraw Form no 15CA filed by going to My account => view Form No 15CA => Status => Withdraw Form No 15CA

Buy Latest Income Tax Ready Reckoner