Section 269ST – Cash Receipt Rs 2 Lakh Banned w.e.f 01.04.2017

Section 269ST Income Tax Act 1961 : Finance Act 2017 of India has been inserted by Finance Act 2017 w.e.f 01.04.2017 . It provided restriction on Cash Receipt of Rs 2 Lakh or more. This provision being new, there is still a lot of confusion and curiosity among people from all walks of life. In this article an attempt has been made to analyse the provisions of section 269ST and its impact on taxpayers with Examples and Tables . The restriction is on the payee and not on the payer, so it is the payee who will invite penalty under Section 271DA of Income Tax Act for any violation of section 269ST. The section includes within its sweep all cash receipts of whatever nature such as cash sales, cash gifts, donations made in cash, compensation, encashment of securities/instruments etc . Please do write your comments and share this article if you enjoyed it.

Video Tutorial on Section 269ST of Income Tax Act

This video by CA Satbir Singh will explain Cash Receipt Limit in Income Tax w.e.f 01.04.2017 :section 269ST

Graphic Presentation of Section 269ST of Income Tax Act

Commentary on Section 269ST

- Effective date: Provision is effective from 01/04/2017 (F.Y.2017-18 onwards)

- Section 269ST applies to all persons :- As per section 2(31), the word person includes individuals, HUFs, companies, firms, AOPs, BOIs, local authorities and other artificial judicial persons. Thus, the restriction is on receipt of money by any individuals, HUFs, companies, firms, AOPs, BOIs, local authorities and other artificial judicial persons. from any other s individuals, HUFs, companies, firms, AOPs, BOIs, local authorities and other artificial judicial persons. Thus Section 269ST applies to all persons, including charitable and religious trusts.

- Threshold : Any Amount of Rs 2 Lakh or Above .

- Conditions : The section 269ST seeks to cover following three major transactions i.e Prohibition on receipt of following otherwise than by an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account.

- Receipt of Rs 2 Lakhs or more from a person in a day in the aggregate.

- Receipt of Rs 2 Lakhs or more in respect of a single transaction

- Receipt of Rs 2 Lakhs or more in relation to one event or occasion from a person

Note : Section 269ST uses the expression “receive” as against the wider expression “take” or “accept” used in section 269SS

[ Note : Finance Bill 2017 Proposed this Limit to be Rs 3 Lakh or above but the Govt of India made Amendment in Finance Bill 2017 and reduced this Limit to Rs 2 Lakh in Finance Act 2017 passed and Notified on 31.03.2017 ]

- Person to whom provisions of Section 269ST does not apply : – List of Persons who can receive Cash Payment of Rs 2 Lakh or more – 269ST : CBDT Notification No. 57 /2017/F. No. 370142/10/2017-TPL 3rd July, 2017

- Section 269st Applies on agriculture produces: any cash sale of an

amount of Rs. 2 lakh or more by a cultivator of agricultural produce is prohibited under section 269ST of the Act. Read Circular No 27/2017 Dated 03.11.2017 : Cash sale of agricultural produce by cultivators/ agriculturist - 269 ST Apply to Single one instalment of loan repayment or the whole amount of such repayment ? . : CBDT has clarified vide Circular No. 22 of 2017 [ Income Tax ] Dated 03rd July, 2017 that receipt in the nature of repayment of loan by NBFCs or HFCs, the receipt of one instalment of loan repayment in respect of a loan shall constitute a ‘single transaction’ as specified in clause (b) of section 269ST of the Act and all the instalments paid for a loan shall not be aggregated for the purposes of determining applicability of the provisions section 269ST.

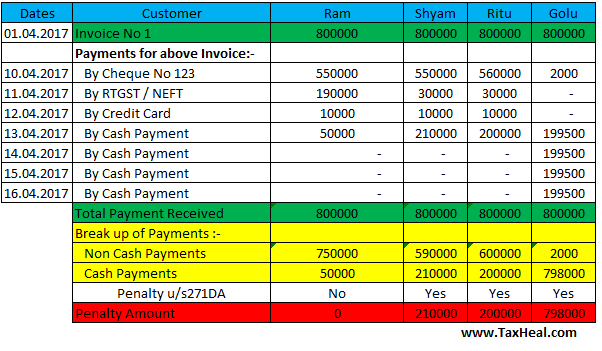

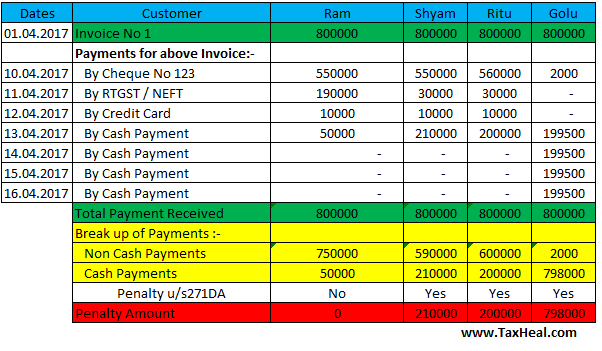

- Analysis of ” Receipt of Rs 2 Lakhs or more from a person in a day in the aggregate “

- For example, if Mr. B receives certain sum of money amounting to Rs. 2 Lakhs or more from Mr. A in a single day, this would obviously be hit by section 269ST as the cash payment exceeds the specified limit. But the mischief of section 269ST would also be attracted if payments from Mr. A are received in different installments in a single day. In such cases, whether the specified limit has been exceeded or not will be determined on the basis of aggregate. For example, if Mr. A received payments from Mr. B on a single day in 4 equal installments of Rs. 50000/- each, the aggregate will cross the specified limit of Rs. 2 Lakhs and hence, would be hit by section 269ST.

- Note : Day– A legal day commences at 12 o’clock midnight and continues until the same hour the following night [Prabhu Dayal Sesma v. State of Rajasthan, AIR 1986 SC 1948].

- The restriction is applicable even if the different receipts are in relation to distinct transactions entered into on same day or different days. To illustrate, “A” sells to “B” product “C” for Rs. 1.0 lakh and subsequently, during the same day or another day sells product “D” for Rs.2.5 lakhs. The aggregate of receipts from “B” on a single day against both transactions cannot exceed Rs. 2 lakhs.

- There will be no violation of section 269ST if payments are received from different persons in a single day and none of such payments exceed the specified limit of Rs. 2 Lakhs. For example, in a single day Mr. A received payments from four different persons namely B, C and D and all these payments are within the specified limits, then even though in aggregate total receipts exceeded the limit of Rs. 2 Lakhs, the section would not be attracted.

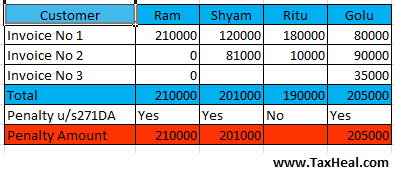

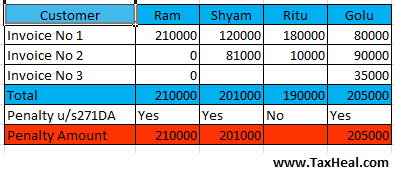

- Analysis of “ Receipt of Rs 2 Lakhs or more in respect of a single transaction “

- It envisages the receipt of Rs 2 lakhs or more in respect of a single transaction though not in aggregate on a single day. To illustrate, if Mr. A receives a sum of Rs. 6 Lakhs in respect of a single transaction( e.g Sale of Goods in cash in Single Bill) , in four installments of Rs. 1.5 Lakhs each, on different dates, then obviously it will not fall under first coverage as aggregate is out of question being payments received on different dates. But if such payments are received in respect of a single transaction say for a single sale bill, such receipts would fall under this category of prohibited transactions even though none of these receipts was of Rs. 2 Lakhs or more. This is a very important condition which prohibits the splitting of payments over several days.

- Example :

- Bill issued for any service or goods for amount of Rs.2 lacs or more may also be covered if amount received against such bill is Rs.2 lacs or more in cash in a day or days.If Hospital Bill is Rs 2 Lakh or more, Hospital can not accept payment from patient in cash.

- It appears that the restriction applies to transaction already effected before 1-4-2017. Suppose, “A” has sold goods of Rs. 3.5 lakhs to “B” in March, 2017 against which “B” has not made any payment till 31-3-2017. It appears that this transaction is covered by section 269ST and “A” cannot receive Rs. 2 lakhs or more by impermissible modes.

- suppose “B” has already paid Rs. 1.5 lakhs in cheque up to 31-3-2017. In this situation, it is not clear whether “A” can receive a sum of Rs. 50,000 or more from “B” after 31-3-2017.

- Agreement entered into for any transaction may be covered under provision if amount received in cash is Rs.2 Lacks or more in agreement period whether in a day or days or year or years.

- The said clause does not refer to “from a person”. Hence, even if the receipt is from different persons, so long as it is in respect of a single transaction, the recipient ought not receive Rs. 2 lakhs or more. To illustrate, suppose “A” has sold goods to “B”. If “C” offers to make payment to “A” on behalf of “B”, then this payment would also be covered by the restriction.

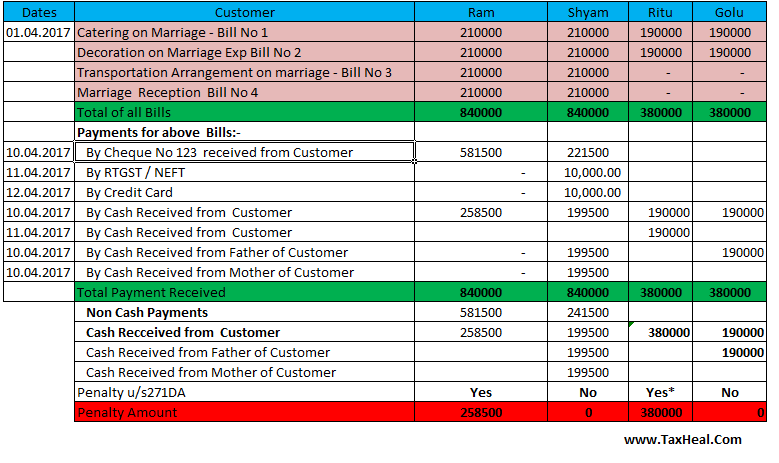

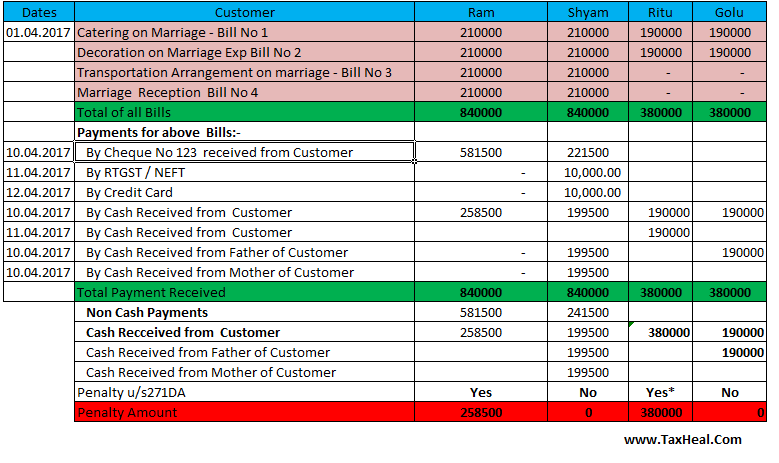

- Analysis of ” Receipt of Rs 2 Lakhs or more in relation to one event or occasion from a person “

- Note * in a Day condition is not there in Section 269ST( c ) ]

- It seeks to cover all receipts from a person in relation to transactions relating to one event or occasion.What is meant by event or occasion or what all events and occasions are covered have not been explained in the Section.It is understood that it will cover all transactions relating to one event or occasion such as reimbursement ,cash gifts on the occasion of marriage, birthday, anniversary or the like, payments made in respect of catering, decoration etc. in marriage, travel expenses, payments of rent etc to name a few. But with the introduction of section 269ST ban has been imposed on cash gifts received even from relatives to the tune of less than Rs. 2 Lakhs in respect of single event or occasion. Now the cash gifts can not be received on marriage of Rs 2 Lakh or more from relative and other persons.

- Note : EVENT:- The term “event” has been defined as follows:”Something that occurs in a certain place during a particular interval of time”(Random House Compact Unabridged Dictionary, 2nd Edn.)Occasion: The term “occasion” has been explained as follows:(a) “A special or important time, event, ceremony, celebration, etc.”(Random House Compact Unabridged Dictionary, 2nd Edn.)(b) “An opportunity; the time at which something happens; a particular time marked by some occurrence or by its special character [section 56 of Indian Contract Act] “[Legal Glossary published by the Government of India (1992 Edition)]

- Example : if marriage is one occasion then a person can not receive on his / her marriage even say Rs. 100 from 2000 people as it will amount to Rs. 2,00,000/- [100 X 2000]

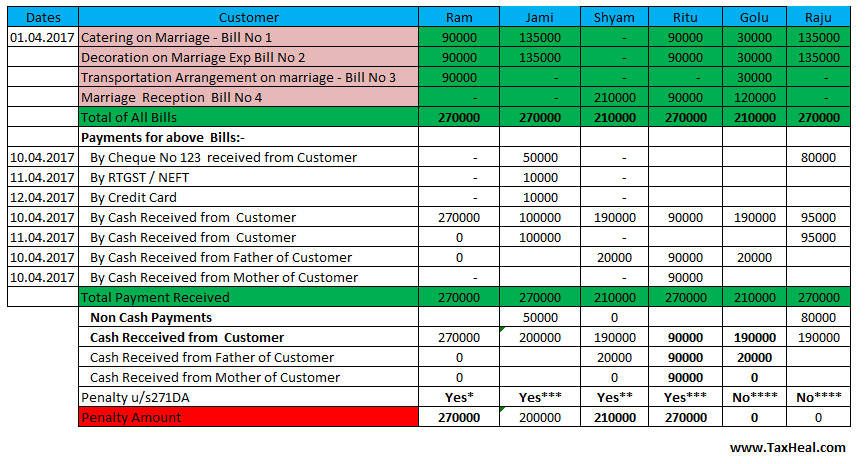

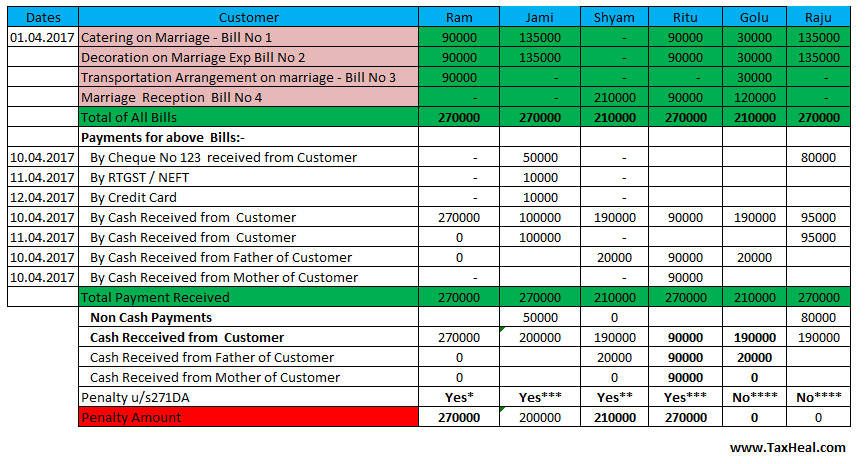

- Combined Example of all provisions of Section 269ST (a) , section 269ST(b) and section 269ST(c)

* Cash received from a person in Aggregate in a day ** Cash Received in respect of Single Transaction (Marriage Reception ) ** Cash Received in respect of event or Occassion (Marriage ) – Total of All bills of Marriage Rs 270000 ** **Cash of Rs 2 Lakh or more not Received i) From a person in a day in aggregate

ii) In respect of Single Transaction (Bills of Marriage are Separate i.e for Catering , Decoration , Transportation and Marraige Reception)iii) For a Event or occassion (Marriage ) from a person

- Nature of amount: Section 269 ST applies if any type of amount of Rs 2 Lakh or above is received in cash w.e.f 01.04.2017 whether it is capital in nature or revenue in nature .

- Allowable mode for receipt of money of Rs 2 Lakh or above :-The amount of money of Rs 2 Lakh or above can be received only through

(a) an account payee bank cheque ; or

(b) an account payee bank draft ; or

(c) use of electronic clearing system through a bank account (e.g., NEFT, RTGS, Online transfer from one bank account to another etc.).

Thus the receipt of amount of Rs 2 Lakh or above through any other mode e.g., cash, bearer cheque, crossed cheque, self cheque, transfer entry or adjustment entry in books of account etc. is not allowed.

- E-wallets/Paytm not covered :- A digital payment e.g. payment by various e-wallets or say payTM which is popular now a days is also hit by this section 269ST of Income Tax Act because these e-wallets / pay-TM are not clearing system using banks. Technically Even a payment by credit card / debit card , Rupay-card may not amount to clearing system through Bank account.

- Exemption from Section 269ST:- Restriction on cash receipt of Rs 2 Lakh or more w.e.f 01.04.2017 shall not apply to

- Government, any banking company, post office savings bank or co-operative bank. Thus, any amount of money can be deposited in cash etc. in the all type of accounts (e.g., saving account, current account, loan accounts etc.) by account holder, borrower etc. Similarly, any amount of tax, duty etc. can be paid to the Central Government, State Government etc. (other than local authority) through cash etc. other modes [ It is to be noted here that the above exemption is only for the limited purpose of receipts by the banks etc. and not for payments by the banks etc. ]

- banking company shall have the meaning assigned to it in Explanation (i) to section 269SS.

- Explanations (i) of section 269SS read as follows:” (i) banking company” means a company to which the provisions of the Banking Regulation Act, 1949 (10 of 1949) applies and includes any bank or banking institution referred to in section 51 of that Act;

- co-operative bank shall have the meaning assigned to it in Explanation (ii) to section 269SS.

- Explanations (ii) of section 269SS read as follows :”co-operative bank” shall have the same meaning as assigned to it in Part V of the Banking Regulation Act, 1949 (10 of 1949);”

- banking company shall have the meaning assigned to it in Explanation (i) to section 269SS.

- Any receipt from sale of agricultural produce by any person being an individual or Hindu Undivided family in whose hands such receipts constitutes agricultural income and [ As mentioned in Notes to Clause 83 of Finance Bill 2017 . But this transaction is not appearing in the Section 269ST ] Read Circular No 27/2017 Dated 03.11.2017 : Cash sale of agricultural produce by cultivators/ agriculturist

- Transactions of the nature referred to in section 269SS; (Note : There is limit in section 269SS for taking or accepting loans, deposits and any sum of money receivable, whether as advance or otherwise, in relation to transfer of an immovable property, whether or not the transfer takes place , of Rs 2000o or more through banking channel ]

- Such other persons or class of persons or receipts, as may be specified by the Central Government by notification in the Official Gazette.

- Cash withdrawal from Bank by any person ( withdrawal of amount in cash of Rs 2 Lakh or above etc.) Govt has clarified this through Press Release dated 05.04.2017. Read 269ST- Cash Receipt of Rs 2 Lakh or more- not apply to Receipt from Bank and Govt Notification Cash Withdrawal from Bank not covered in Section 269ST- Notification

- Government, any banking company, post office savings bank or co-operative bank. Thus, any amount of money can be deposited in cash etc. in the all type of accounts (e.g., saving account, current account, loan accounts etc.) by account holder, borrower etc. Similarly, any amount of tax, duty etc. can be paid to the Central Government, State Government etc. (other than local authority) through cash etc. other modes [ It is to be noted here that the above exemption is only for the limited purpose of receipts by the banks etc. and not for payments by the banks etc. ]

- Receives Money :– It is to be remembered that the section 269ST uses the word “receives”, it does not use the words sale consideration or debtor realization or any sort of fees etc. Accordingly, it would covers under its scope all the receipts on any account.

- Penalty for Contravention of Section 269ST:- Penalty u/s 271DA will be imposed on a person who receives a sum in contravention of the provisions of the proposed section 269ST .Penalty will be Imposed by Joint Commissioner. The penalty will be a sum equal to the amount of such receipt. The said penalty shall however not be levied if the person proves that there were good and sufficient reasons for such contravention [ Note : penalty is not for showing “ reasonable cause ” but for showing good and sufficient reasons” ] It is possible that a particular cause may very well be a reasonable cause but not a “good and sufficient reasons”

- No Penalty on Payer of money in Cash of Rs 2 Lakh or above :- The restriction U/s. 269ST is only on receipt of money and not on payment of money. Therefore, penalty U/s. 271DA on violation of these provisions shall be leviable only on the person receiving money and not on the person paying the money.

- Character of receipt irrelevant : The character of receipt is irrelevant i.e. exempt income / taxable income etc. There is no exemption even for sale of agricultural produce. Thus even if farmer sells produce for Rs 2 Lakh or above he can not receive in cash. Read Circular No 27/2017 Dated 03.11.2017 : Cash sale of agricultural produce by cultivators/ agriculturist

- Purpose of Receipt is irrelevant :The restriction of receipt of money in Cash of Rs 2 Lakh or above in cash is applicable irrespective of purpose of accepting amount i.e., whether business purpose of personal purpose or as a trustee, custodian etc.

- Consideration is not relevant :- Restriction of receipt of money in Cash of Rs 2 Lakh or above in cash is applicable irrespective of the fact that whether the receipt is with or without consideration. In case receipt of money without consideration in contravention of Section 269ST, there will be dual impact, one charge of tax U/s. 56 (in specific cases) as well as levy of penalty U/s. 271DA.

- Even Money exempt from Tax will be Covered under Section 269ST:- Section 269ST will be attracted on receipt of amount of Rs 2 Lakh or above whether that exchange of money is chargeable to tax or not. Thus even if receipt of amount of Rs 2 lakh or above in cash is exempt from tax, it will attract section 269ST.

- Meaning of Amount :- The word used in Section 269ST is receipt of an “Amount” and not “sum”. The word “Sum” means “sum of money”. The word “Amount” may includes cash and kind. However it can be logically interpreted that per the Memorandum Explaining Clauses of the Finance Bill 2017 restriction under section 269 ST is put only on receipt of money and not on anything in kind .The heading given there is “ Restriction on cash transactions ” The relevant description given is that ” Black money is generally transacted in cash and large amount of unaccounted wealth is stored and used in form of cash. In order to achieve the mission of the Government to move towards a less cash economy to reduce generation and circulation of black money, Finance Bill 2017 proposed to insert section 269ST “. Budget Speech of Finance Minister on Finance Bill 2017 also says ” It is proposed to provide that no person shall receive payment or aggregate of payments of an amount of three lakh rupees or more ( Amendment to Finance Act 2017 reduced this limit from Rs 3 Lakh to Rs 2 Lakh ) ………………” Further penalty U/s. 271DA what will be the levied for contravention of Section 269ST . Section 271DA starts with ” If a person receives any sum in contravention of the provisions of section 269ST………………….” Therefore, logically it can be inferred from those provisions that section 269ST is in respect of money only.

- PAN Not relevant : It is irrelevant that the person receiving the cash has a PAN (Permanent Account Number ) or not.

- Search & seizure : It is not necessary that the restriction of Receipt of Rs 2 Lakh or more is to be based on the entries in books of account alone.An entry or record found during search under section 132 or survey under section 133A may also show that the recipient has received more than the specified sum in non-permissible mode.

- Deposit into Bank is irrelevant : Section 269ST will be attracted even if the money received ( Rs 2 Lakh or above ) is deposited into the bank on the same day.

- Penalty on giver of Loan or Deposit in cash : Any transaction of a nature referred to in section 269SS is not covered. Section 269SS prohibits a person from taking or accepting any loan or deposit of Rs. 20,000 or more. However, no such exception is made in respect of transactions referred to in section 269T. Hence, in case of cash of repayment of loan or deposit, the borrower could be penalized under section 269T and the recipient could be penalized under section 269ST.

- Examples on Section 269 ST : Section 269ST may cover following items i.e Cash Receipt of Rs 2 Lakh or above may not be allowed in the following case :- (list is illusrative only)

- Gift in cash ( Note : Even though gift received from relative, according to provision of section 56(2)(vii) of the I.T.Act,1961, is exempted but if the amount of Gift of Rs 2 Lakh or more is received from relative in cash w.e.f 01.04.2017 assessee has to bear penalty u/s 271DA for contravention of this section 269ST )

- Gift at the time of marriage

- Amount to be received by hospitals from patients

- Sale proceeds of goods ( e.g sale of Old Car for Rs 2.10 Lakh can not be in cash w.e.f 01.04.2017)

- Sale of Depreciable Capital Assets { Note : Although amount received against sale of Depreciable capital assets is being reduced from block of assets and only reduced depreciation is allowable and still sale of this depreciable capital Assets can not happen in cash if the amount of sale proceeds is Rs 2 Lakh or more )

- Sale proceeds of movable properties

- Fees, remuneration, salary, dalali, brokerage , contract payments etc.

- Recovery of loan given and interest thereon (this is not covered presently in Section 269SS ). [CBDT has clarified vide Circular No. 22 of 2017 [ Income Tax ] Dated 03rd July, 2017 that receipt in the nature of repayment of loan by NBFCs or HFCs, the receipt of one instalment of loan repayment in respect of a loan shall constitute a ‘single transaction’ as specified in clause (b) of section 269ST of the Act and all the instalments paid for a loan shall not be aggregated for the purposes of determining applicability of the provisions section 269ST.]

- Gift received on marriage etc. occasion or otherwise

- Donation receipts by trusts etc.

- Advance taken by partner of firm, employees from employer, agents from principal etc. for personal purpose or for purpose of business itself

- withdrawal of capital / profit by a partner of firm from firm.

- Any Person receiving amount of Rs 2 Lakh or above in cash as reimbursement may also be covered under section 269st. Thus he can not accept cash f Rs 2 Lakh or above in cash

- Amount received of Rs 2 Lakh or above in cash through journal entries in books may also be covered under section 269st. Thus a person may not do transfer entries to clear balance if same person is debtor as well as creditor in books for Rs 2 Lakh or above.

Shortcomings left in section 269ST of Income Tax Act

i) when the transactions are not related with a single event or occasion, an entity may prepare many bills of less than Rs. 2 lakhs and may receive a big amount in cash (complying with per day per entity limit).

ii) In clause (c) of Section 269ST of Income Tax Act the words “from a person” have been used. Due to this now the language has became that “No person shall receive an amount of Two lakh rupees or more in respect of transactions relating to one event or occasion from a person”. In cases where there are more than one transaction and they are related with one event or occasion, the entity will fell in clause (c) and in such a situation, separate limit will became available for different persons in a joint transaction.

For example, if for a marriage there are 3 different bills of Rs. 1 lakhs each (total Rs. 3 lakhs), and all the three bills are in the name of three different persons say one bill (garden on rent for marriage reception,) of Rs. 1 lakhs is in the name of the person who is being married, second bill (given tent house services) is in the name of father of that person for Rs. 1 lakhs and the third bill (for decoration ) is in the name of the mother of that person for Rs. 1 lakhs. Then in such a situation entire Rs. 3 lakhs can be paid in cash etc. mode i.e., Rs. 1 lakh by the person being married, Rs. 1 lakhs by the father and Rs. 1 lakhs by the mother. Even if all the bills are in the joint names of three persons then also the payment can be made in the above manner.

Note : It is not possible that any of the above bill is received from two persons e.g bill of garden on rent for marriage reception say of Rs 2 Lakh can not be received in cash say Partly Rs 1 Lakh from father and partly Rs 1 lakh from son because in respect of clause (b) “in respect of a single transaction” of section 269ST the payment by multiple persons (over limit) is not possible because the word “from a person” has not been used there in Section 269ST

Extract of Section 269ST of Income Tax Act

Clause 84 of Finance Act 2017 – Notified w.e.f 1.04.2017

Insertion of new section 269ST in Income Tax Act. – Mode of undertaking transactions.

84. After section 269SS of the Income-tax Act, the following section shall be inserted, namely:—

‘269ST. No person shall receive an amount of two lakh rupees or more—

(a) in aggregate from a person in a day; or

(b) in respect of a single transaction; or

(c) in respect of transactions relating to one event or occasion from a person, otherwise than by an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account:

Provided that the provisions of this section shall not apply to—

(i) any receipt by—

(a) Government;

(b) any banking company, post office savings bank or co-operative bank;

(ii) transactions of the nature referred to in section 269SS;

(iii) such other persons or class of persons or receipts, which the Central Government may, by notification in the Official Gazette, specify.

Explanation.—For the purposes of this section,—

(a) “banking company” shall have the same meaning as assigned to it in clause (i) of the Explanation to section 269SS;

(b) “co-operative bank” shall have the same meaning as assigned to it in clause (ii) of the Explanation to section 269SS.’.

Insertion of new section 271DA by Clause 85 of Finance Act 2017

Penalty for failure to comply with provisions of section 269ST.

85. After section 271D of the Income-tax Act, the following section shall be inserted, namely:—

“271DA. (1) If a person receives any sum in contravention of the provisions of section 269ST, he shall be liable to pay, by way of penalty, a sum equal to the amount of such receipt:

Provided that no penalty shall be imposable if such person proves that there were good and sufficient reasons for the contravention.

(2) Any penalty imposable under sub-section (1) shall be imposed by the Joint Commissioner.”

Budget Speech 2017 of Finance Minister on Section 269ST

[ Para 2.13 of Annex III to Part B of Budget Speech 2017-Direct taxes ]

It is proposed to provide that no person shall receive payment or aggregate of payments of an amount of three lakh rupees or more from a person in a day, or in respect of a single transaction, or in respect of transactions relating to one event or occasion, otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account. Such restriction shall not apply to Government, banks or such other persons or class of persons or receipts notified by the Central Government. It is also proposed to provide for a penalty in case of contravention of this provision.

Objective of insertion of section 269ST of Income Tax Act

objective behind insertion of section 269ST as mentioned in Memorandum explaining the provision of the Finance Bill is as follows:

Restriction on cash transactions

In India, the quantum of domestic black money is huge which adversely affects the revenue of the Government creating a resource crunch for its various welfare programmes. Black money is generally transacted in cash and large amount of unaccounted wealth is stored and used in form of cash.

In order to achieve the mission of the Government to move towards a less cash economy to reduce generation and circulation of black money, it is proposed to insert section 269ST in the Act to provide that no person shall receive an amount of three lakh rupees or more ( this limit reduced to Rs 2 Lakh by Amendment to Finance Bill 2017) ,—

(a) in aggregate from a person in a day;

(b) in respect of a single transaction; or

(c) in respect of transactions relating to one event or occasion from a person,

The restriction is on the recipient and not on the payer.otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account.

The Notes on Clauses mention that the restriction under section 269ST shall not apply to “any receipt from sale of agricultural produce by any person being an individual or HUF in whose hands such receipts constitute agricultural income“. No such exception is found in the text of the provision.

Related Post

Section 269ST Income Tax Act 1961 : Finance Act 2017

Section 271DA Income Tax Act ; Penalty for failure to comply with section 269ST

269ST – Burning Issues on ban on Cash receipts of Rs 3 Lakh or above -Budget 2017-18 Suggestions

No Person can receive cash of Rs 3 Lakh or more w.e.f 01.04.2017 – Section 269ST

Limit & Penalty on Cash Transaction w.e.f 01.04.2017 -Income Tax ( India)

You can Bookmark this page , we will update it will following topics.

faq on section 269st , section 269st pdf, section 269st of income tax act pdf,

sec 269st of income tax act with example, section 269st in hindi ,269st notification

269sst , section 269st amendment, cash receipt more than 200000 , 269st amendment

cash receipt in excess of 2 lakhs, 269 sst ,cash receipts more than 2 lakhs ,cash payment limit

cash receipt more than 2 lakh, cash transaction limit in income tax ,cash receipt more than 2 lakhs

section 269sst, cash receipt of 2 lacs, cash received more than 2 lakhs ,section 269st pdf

2 lakh rupees ,limit of cash sale in gst ,2 lakh cash transaction ,cash transaction limit from april 2017 , 269sst of income tax act

Thanks for appreciation

Dear Sir,

in the example on marriage, i could not understand Mr. Ritu’s case, how this receipt penalised? please explain