Key Changes in ITR 1 of FY 2017-18 / AY 2018-19

The most popular one pager Income Tax return (ITR-1 Sahaj) is continued by the CBDT this year also vide notification no. 16/2016 dated 03rd April 2018. But there are certain changes regarding eligibility to file this return as well contents of this return which are as under.

[ Download/print ITR 1 SAHAJ for AY 2018-19 / FY 2017-18 ]

1. Changes in ITR 1 of FY 2017-18 / AY 2018-19 : Residential Status removed

This year (AY 2018-19 FY 2017-18), only the individual who is “resident andordinary resident” can file this return, so three categories of residential status are removed from the content of this return.

2. Changes in ITR 1 of FY 2017-18 / AY 2018-19 : Changes in Schedule of TDS

Resident Individual who has income to be apportioned in accordance with provisions of Section 5A (governed by Portuguese Civil Code) are no more eligible to file this return. Therefore in schedule-TDS of this ITR, column no. 7 is removed this year.

3. Changes in ITR 1 of FY 2017-18 / AY 2018-19 : No carry forward of House property Loss

Individual who want to carry forward the loss under the head income from house property is not eligible to file this return

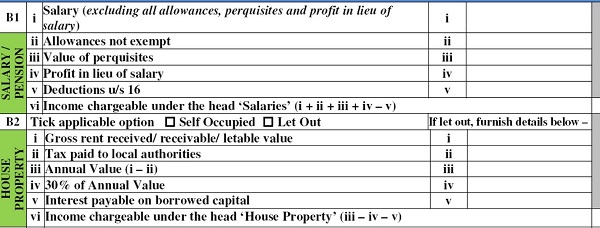

4. Changes in ITR 1 of FY 2017-18 / AY 2018-19 : details of Salary and House property income

Income under the head salary and house property are to be shown in detail as under instead of writing only net figure of income/loss under the head.

5. Changes in ITR 1 of FY 2017-18 / AY 2018-19 : Late Fees for delayed filing of ITR

. Amount of late fees under newly introduced section 234F which is payable in case of late filing of ITR.

Related Post

CBDT notifies Income Tax Return Forms for AY 2018-19