Step-by Step Guide Bank/Financial Account(s) with substantial Cash Transactions

As part of its data matching exercise, if Income Tax Department has identified bank accounts which have large value cash transactions then the details of bank account are visible under “Compliance” section of the e-filing portal of the related persons. The PAN holders are requested to submit the on-line response as under

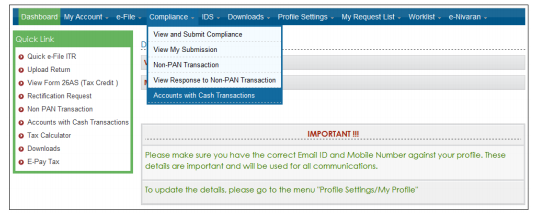

Step 1: Login to e-filing portal at https://incometaxindiaefiling.gov.in. If you are not registered with the e-filing portal, use the ‘Register Yourself’ link to register

Step 2: Click on “Accounts with Cash Transactions” link under “Quick link” or “Compliance” section and you will be directed to the “Bank/Financial Account(s) with substantial Cash Transactions” page.

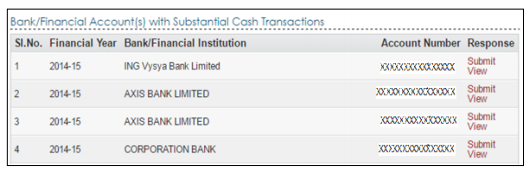

Step 3: View the details of the bank account related to you

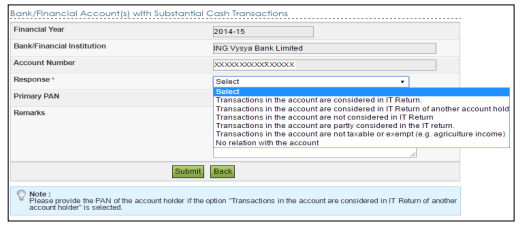

Step 4: Submit online response and keep acknowledgement for record.

In case you make a mistake in submission of response, you may further revise it by login to e-filing portal