ADVISORY ON VEHICLE NUMBER IN E-WAYBILL SYSTEM OF GST

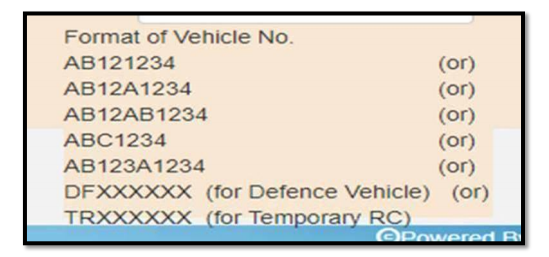

In the EWB system, for the movement of goods via roads, vehicle number is to be updated mandatorily in Part B of EWB, either by the generator of EWB or by the transporter. In the EWB system, following format of vehicle number are accepted:-

The current format of the registration of vehicles in India consists of 3 parts. They are

The first two letters indicate the state to which the vehicle is registered.

The next two digit numbers are the sequential number of a district. Due to heavy volume of vehicle registration, the numbers were given to the RTO offices of registration as well.

The third part is a 4 digit number unique to each plate. A letter(s) is prefixed when the 4 digit number runs out and then two letters and so on

However, in some states, such as in the state of Delhi, the initial 0 of the district code is omitted in the vehicle number. Thus for vehicle number in Delhi district in 3 and 4th place, there may be only one number instead of two. Hence the number in the 3rd and 4th place for the district 2 of Delhi may appear as DL 2 and not DL 02.

This format where 0 is omitted cannot be entered in the EWB system. In these cases, 0 need to be prefixed after the state code for entry of vehicle number in EWB system. Therefore, all inspecting officials as well as taxpayers/ transporters are directed to accept this format as valid one.

Thus for example, vehicle with the registration number DL29183 carrying goods will be entered in EWB system as DL029138.