Amendment in GST Registration Cancellation form

By Notification No. 60/2018 – Central Tax Dated 30th October, 2018 , Govt has amended GST REG-16,(Application for Cancellation of Registration)

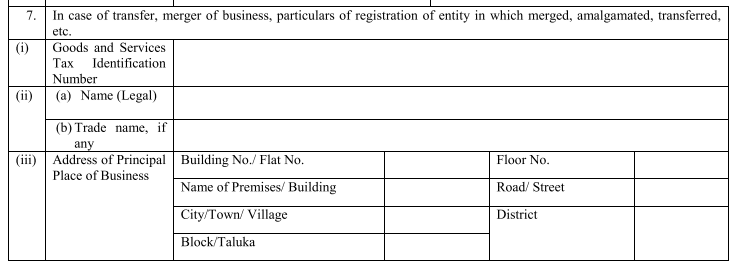

Relevant Wording of Sr No 7 GST REG 16 before Amendment

Relevant Wording of Sr No 7 GST REG 16 After Amendment

In the said rules, in FORM GST REG-16,-

(a) against serial number 7, for the heading, the following heading shall be substituted, namely:-

“In case of transfer, merger of business and change in constitution leading to change in PAN, particulars of registration of entity in which merged, amalgamated, transferred, etc.”;

Relevant Instructions of GST REG 16 Before Amendment

In case of death of sole proprietor, application shall be made by the legal heir / successor manually before the concerned tax authorities. The new entity in which the applicant proposes to amalgamate itself shall register with the tax authority before submission of the application for cancellation. This application shall be made only after that the new entity is registered.

Before applying for cancellation, please file your tax return due for the tax period in which the effective date of surrender of registration falls.

Relevant Instructions of GST REG 16 After Amendment

In the said rules, in FORM GST REG-16,-

(b) in the instruction, after the Table, for the paragraphs beginning with the words “In case of death of sole proprietor” and ending with the words “surrender of registration falls”, the following paragraphs shall be substituted, namely:-

“In case of death of sole proprietor, application shall be made by the legal heir / successor before the concerned tax authorities. The new entity in which the applicant proposes to amalgamate itself shall register with the tax authority before submission of the application for cancellation. This application shall be made

only after the new entity is registered.

Before applying for cancellation, please file your tax return due for the tax period in which the effective date of surrender of registration falls or furnish an application to the effect that no taxable supplies have been made during the intervening period (i.e. from the date of registration to the date of application for cancellation of registration).”.