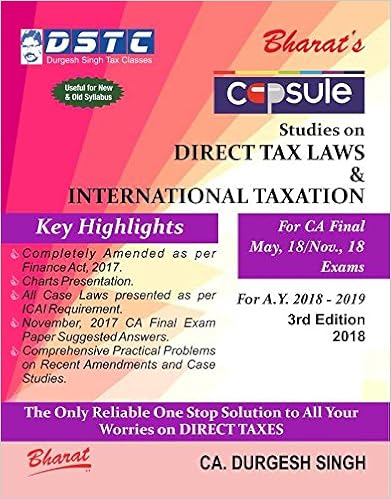

Capsule Studies on DIRECT TAX LAWS & International Taxation (A.Y. 2018-19)

by

Price Rs 710 Click to buy online

| About Capsule Studies on DIRECT TAX LAWS & International Taxation (A.Y. 2018-19) |

| PART A Chapter 1 Income Tax Rates for A.Y. 2018-19 Chapter 2 Income from House Property Chapter 3 Profits and Gains from Business or Profession Chapter 4 Business Deductions under Chapter VIA & 10AA Chapter 5 Income Computation and Disclosure Standards (ICDS) Chapter 6 Alternate Minimum Tax (AMT) Chapter 7 Assessment of Partnership Firm PART B Chapter 8 Surrogate Taxation Chapter 9 Capital Gains Chapter 10 Income from Other Sources Chapter 11 Set Off and Carry Forward of Losses PART C Chapter 12 Trust, Institutions and Political Parties Chapter 13 Association of Persons (AOP) & Body of Individuals (BOI) Chapter 14 Special Tax Rates of Companies PART D Chapter 15 International Taxation Chapter 16 Transfer Pricing & Other Provisions to Check Avoidance of Tax Chapter 17 General Anti Avoidance (GAAR) PART E Chapter 18 Tax Deducted at Source (TDS) Chapter 19 Tax Collected at Source (TCS) Chapter 20 Advance Tax & Interest Chapter 21 Assessment Procedures, Appeals, Revision, Settlement Commission & AAR Chapter 22 Penalties & Prosecution PART F Chapter 23 Clubbing Provisions Chapter 24 Hindu Undivided Family Chapter 25 Liability in Special Cases Chapter 26 Chapter VIA Deductions Chapter 27 Case Laws APPENDIX Appendix 1 Chart on Scope of DDT u/s 115-O Appendix 2 Tax Rates for LTCG & STCG on Specified Securities in case of Resident & Non-resident Appendix 3 Solved Answers for CA Final November, 2017 Examination Question Corrigendum for Chapter 9: Capital Gains, page 248 WHY GROW OLD?

|