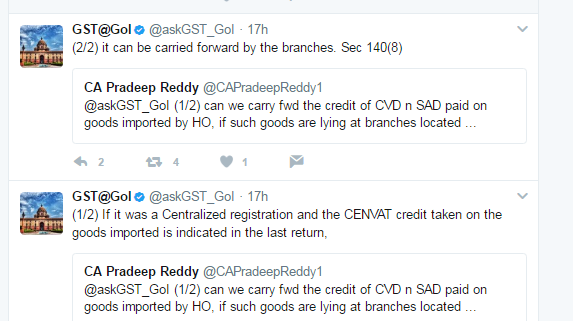

Q Can we carry forward the credit of CVD and SAD paid on goods imported by HO [ Head Office ], if such goods are lying at branches located …

If it was a Centralized registration and the CENVAT credit taken on the goods imported is indicated in the last return, it can be carried forward by the branches. Section 140(8)

[ Reply on 05.06.2017 at 2.18 am as per Twitter Account of Govt of India for GST queries of Taxpayers ]