Circular No 26/26/2017 GST

F. No. 349/164/2017/-GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise and Customs

GST Policy Wing

Circular No 26/26/2017 GST

New Delhi, Dated the 29th December , 2017

Clarifications for Filing of returns under GST vide Circular No 26/26/2017 GST Dated 29th December , 2017

[Clarifications on exports related refund issues Circular No 37/11/2018 GST Dated the 15th March, 2018 ]

To,

The Principal Chief Commissioners/Chief Commissioners/Principal Commissioners/

Commissioners of Central Tax (All)

The Principal Director Generals/ Director Generals (All)

Subject: Filing of Returns under GST- regarding

The GST Council, in its 23rd meeting held at Guwahati on 10th November 2017, has taken certain decisions in regard to filing of returns by taxpayers. Subsequently, various representations have been received seeking clarifications on various aspects of return filing such as return filing dates, applicability and quantum of late fee, amendment of errors in submitting / filing of FORM GSTR-3B and other related queries. In order to consolidate the information in various notifications and circulars regarding return filing and to ensure uniformity in implementation across field formations, the Board, in exercise of its powers conferred under section 168 (1) of the Central Goods and Services Tax Act, 2017 hereby clarifies the following issues:

Complete Circular No 26/26/2017 GST

1. Return Filing Calendar:

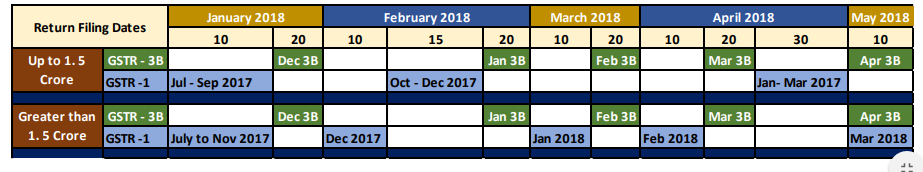

1.1 Dates for filing of FORM GSTR-1 and FORM GSTR-3B have been put in a calendar format for ease of understanding as under:

1.2 It may be noted that all registered persons are required to file their FORM GSTR-3B on a monthly basis in terms of Notification No. 35/2017-Central Tax (referred to as “CT‟ hereinafter) dated 15th September, 2017 and 56/2017-CT dated 15th November 2017. Further, Notification No. 71/2017-CT and Notification No. 72/2017 – CT both dated 29th December 2017 (superseding Notification No. 57/2017-CT and 58/2017-CT both dated 15th November 2017) have been issued to notify the due dates for filing of outward supply statement in FORM GSTR-1 for various months / quarters (as depicted in the calendar above) by registered persons having aggregate turnover in the previous financial year or current financial year of upto1.5 Crores rupees and above 1.5 Crores rupees respectively. Since, the

option of quarterly filing was not available earlier, many taxpayers have already filed their FORM GSTR-1 for the month of July, such taxpayers shall not file these details again and shall only file details for the month of August and September, 2017. For those, who have not filed their FORM GSTR-1 for the month of July, they shall also file their FORM GSTR-1 for the month of July separately and then file their FORM GSTR-1 on quarterly basis for the

month of August and September, 2017.

1.3 It has been further decided that the time period of filing of FORM GSTR-2 and FORM GSTR -3 for the months of July 2017 to March 2018 would be worked out by a Committee of officers and communicated later.

1.4 Registered persons opting for Composition scheme are required to file their returns quarterly in FORM GSTR-4. The due date for filing of FORM GSTR-4 for the quarter ending September 2017 has been extended to 24th December 2017 vide Notification No. 59/2017-CT dated 15th November 2017. For the remaining quarters, the last date for filing of FORM GSTR-4 is within eighteen days after the end of such quarter.

1.5 It is also clarified that the registered person will self-assess his aggregate turnover in terms of Section 2(6) of the CGST Act, 2017 for the previous financial year or the current financial year (in case of new registrants). Based on this self-assessed turnover, the registered person with turnover up to Rs. 1.5 Crore will be required to file FORM GSTR-1 on quarterly basis instead of on monthly basis. It is also clarified that the registered person may opt to file FORM GSTR-1 on monthly basis if he so wishes even though his aggregate turnover is up to Rs. 1.5 Crore. Once he falls in this bracket or if he chooses to file return on monthly basis, the registered person will not have the option to change the return filing periodicity for the entire financial year. In cases, where the registered person wrongly reports his aggregate turnover and opts to file FORM GSTR-1 on quarterly basis, he may be liable for punitive action under the CGST Act, 2017.

2. Applicability and quantum of late fee:

2.1 The late fee for the months of July, August and September for late filing of FORM GSTR – 3B has already been waived off vide Notification No. 28/2017-CT dated 1 st September 2017 and 50/2017-CT dated 24th October 2017.

2.2 It has been decided that for subsequent months, i.e. October 2017 onwards, the amount of late fee payable, by a taxpayer whose tax liability for that month was “NIL”, will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts). For other taxpayers, whose tax liability for that month was not “NIL”, late fee payable will be Rs. 50/- per day (Rs. 25/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts). Notification No. 64/2017-CT dated 15th November 2017 has already been issued in this regard.

3. Amendment / corrections / rectification of errors:

3.1 Various representations have been received wherein registered persons have requested for clarification on the procedure for rectification of errors made while filing their FORM GSTR-3B. In this regard, Circular No. 7/7/2017-GST dated 1st September 2017 was issued which clarified that errors committed while filing FORM GSTR – 3B may be rectified while filing FORM GSTR-1 and FORM GSTR-2 of the same month. Further, in the said circular,

it was clarified that the system will automatically reconcile the data submitted in FORM GSTR-3B with FORM GSTR-1 and FORM GSTR-2, and the variations if any will either be offset against output tax liability or added to the output tax liability of the subsequent months of the registered person.

3.2 Since, the GST Council has decided that the time period of filing of FORM GSTR-2 and FORM GSTR -3 for the month of July 2017 to March 2018 would be worked out by a Committee of officers, the system based reconciliation prescribed under Circular No. 7/7/2017-GST dated 1st September 2017 can only be operationalized after the relevant

notification is issued. The said circular is therefore kept in abeyance till such time.

3.3 The common errors while submitting FORM GSTR-3B and the steps needed to be taken to rectify the same are provided in the table annexed herewith. The registered person needs to decide at which stage of filing of FORM GSTR-3B he is currently at and also the error committed by him. The corresponding column in the table provides the steps to be followed by him to rectify such error.

4. It is clarified that as return in FORM GSTR-3B do not contain provisions for reporting of differential figures for past month(s), the said figures may be reported on net basis alongwith the values for current month itself in appropriate tables i.e. Table No. 3.1, 3.2, 4 and 5, as the case may be. It may be noted that while making adjustment in the output tax liability or input tax credit, there can be no negative entries in the FORM GSTR-3B. The

amount remaining for adjustment, if any, may be adjusted in the return(s) in FORM GSTR3B of subsequent month(s) and, in cases where such adjustment is not feasible, refund may be claimed. Where adjustments have been made in FORM GSTR-3B of multiple months, corresponding adjustments in FORM GSTR-1 should also preferably be made in the corresponding months.

5. Where the taxpayer has committed an error in submitting (before offsetting and filing) the information in FORM GSTR-3B, a provision for editing the same has been provided. The facility to edit the information can be used only before offsetting the liability and editing will not be permitted after offsetting the liability. Hence, every care should be taken to ensure the accuracy of the figures before proceeding to offset the liabilities.

6. It is further clarified that the information furnished by the registered person in the return in FORM GSTR-3B would be reconciled by the department’s system with the information furnished in FORM GSTR-1 and discrepancies, if any, shall be dealt with in accordance with the relevant provisions of the CGST Act, 2017 and rules made thereunder. Detailed instructions regarding reconciliation of information furnished in FORM GSTR-3B

with that contained in FORM GSTR-2 and FORM GSTR-3 will be issued in due course of time

7. It is requested that suitable trade notices may be issued to publicize the contents of this circular.

8. Difficulty, if any, in implementation of the above instructions may please be brought to the notice of the Board. Hindi version would follow.

(Upender Gupta)

Commissioner (GST)

Stage of Return Filing (GSTR – 3B)

Circular No 26/26/2017 GST Download

For latest Notification Refer Govt Website Click Here

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |